States should compete within America’s highly progressive tax and redistribution system

State and local governments are on the front lines of providing core government services. They are also on the front lines of competing for jobs and economic growth. Therefore, state fiscal policy should produce revenue for core government services by applying low, competitive tax rates to a broad tax base with limited exemptions. That is the way to fund services and maintain a competitive business environment.

For generations, Nebraska’s progressive income tax has been one of the least competitive in the region with high top rates and a progressive rate structure. A competitive state tax code is more important now than it has been for generations, which is why lawmakers and Governor Pillen are focused on a generational opportunity to reform Nebraska’s income tax with LB 754. The recently passed bill will lower Nebraska’s income tax rate for both individuals and businesses to a competitive 3.99%.

Yet arguments are being rolled out against these tax cuts with a focus on the harm they cause to “equity.” These arguments are divorced from fiscal reality. For example, a recent Route Fifty article opines:

They will worsen inequality by making state tax codes less equitable and enriching those at the very top of the income scale.

The article furthermore argues that state tax cuts put democracy itself at stake.

The debate over tax cuts that’s happening in statehouses across the country is about much more than revenues and spending. It’s a fight over whether we will have an inclusive democracy where everyone—all races in all places—can thrive, or a system rigged for the rich and powerful, a group that, because of our long history of racial discrimination and oppression, is disproportionately white and male.

This hyperbolic rhetoric, which has also been heard within Nebraska’s tax debate, is completely devoid of facts about how America’s tax and redistribution system actually works. The fact-free rhetoric should be firmly rejected. In fact, across federal, state, and local governments, the United States has one of the most progressive fiscal regimes in the world. It is arguably the world’s single most progressive tax and redistribution system, all things considered.

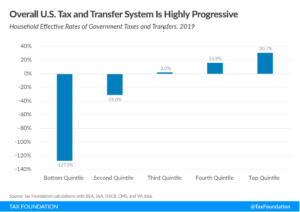

A landmark new analysis from Tax Foundation makes the facts clear. Their study is called America’s Progressive Tax and Transfer System: Federal, State, and Local Tax and Transfer Distributions. It looks at the combined impact of taxation and social welfare benefit redistributions across the federal, state, and local governments. The study finds that only the top 40% of income earners make meaningful net tax payments.

Lower-income Americans receive more in transfer benefits than they earn in market income. These benefit transfers are funded by levying high net taxation on higher earners. As Tax Foundation explains:

Households in the bottom quintile received an effective net tax-and-transfer benefit of $1.27 for every dollar they earned in income—in other words, a tax-and-transfer rate of -127.0 percent. Households in the top quintile, on the other hand, experienced an effective reduction of $0.31 for every dollar they earned in income. Due to the highly progressive tax and transfer system, a household in the bottom quintile earned an average of $22,491 in pre-tax and transfer income but had approximately $54,900 in post-tax and transfer income, since they received an estimated $32,409 in net government transfers.

The study explains that America’s tax and redistribution system is highly progressive at the federal level, and it is also progressive at the state level. The reality is the opposite of what the Route Fifty authors argue.

State tax cuts, like Nebraska’s LB 754, will make the tax and redistribution system slightly less progressive. But it will still be highly progressive. Indeed, even Nebraska’s income tax will remain progressive under LB 754. Any argument to the contrary is simply ignoring the fiscal facts.

On the other hand, states must compete with one another, and that competition is heating up. Remote work has untethered higher earners – who are the primary net tax payers – from a specific geographic location. And those same higher earners can no longer deduct high state and local taxes from their federal taxable income. In short, taxpayers are feeling a greater impact from state and local taxes, and they have greater ability to move away from high-tax jurisdictions.

Nebraska lawmakers should reject the overheated rhetoric. Claims that common sense tax reform will endanger an “inclusive democracy” and “rig the system for the rich” are the opposite of reality.

The facts are crystal clear. America’s tax and redistribution system is highly progressive, and Nebraska’s is also progressive. Tax reform will not make the system unfair. It will simply allow Nebraska to compete.