Sales tax receipts hit harder in most populated Nebraska counties

Despite COVID-19, Nebraska saw an increase in taxable sales revenue for March of 2020. However, urban areas in Nebraska appear to have taken a heavy hit as buyers react to COVID-19 restrictions.

Nebraska’s sales tax usually operates as one of the more stable sources of state revenue. That fact is significant when social distancing policy is created on the basis of lowering contact and limiting face to face sales.

At first glance, the taxable sales for Nebraska seem positive with an increase in March of 1.1% compared to March the previous year. However, the growth rate of taxable sales revenue over the past three years has started to slow down.

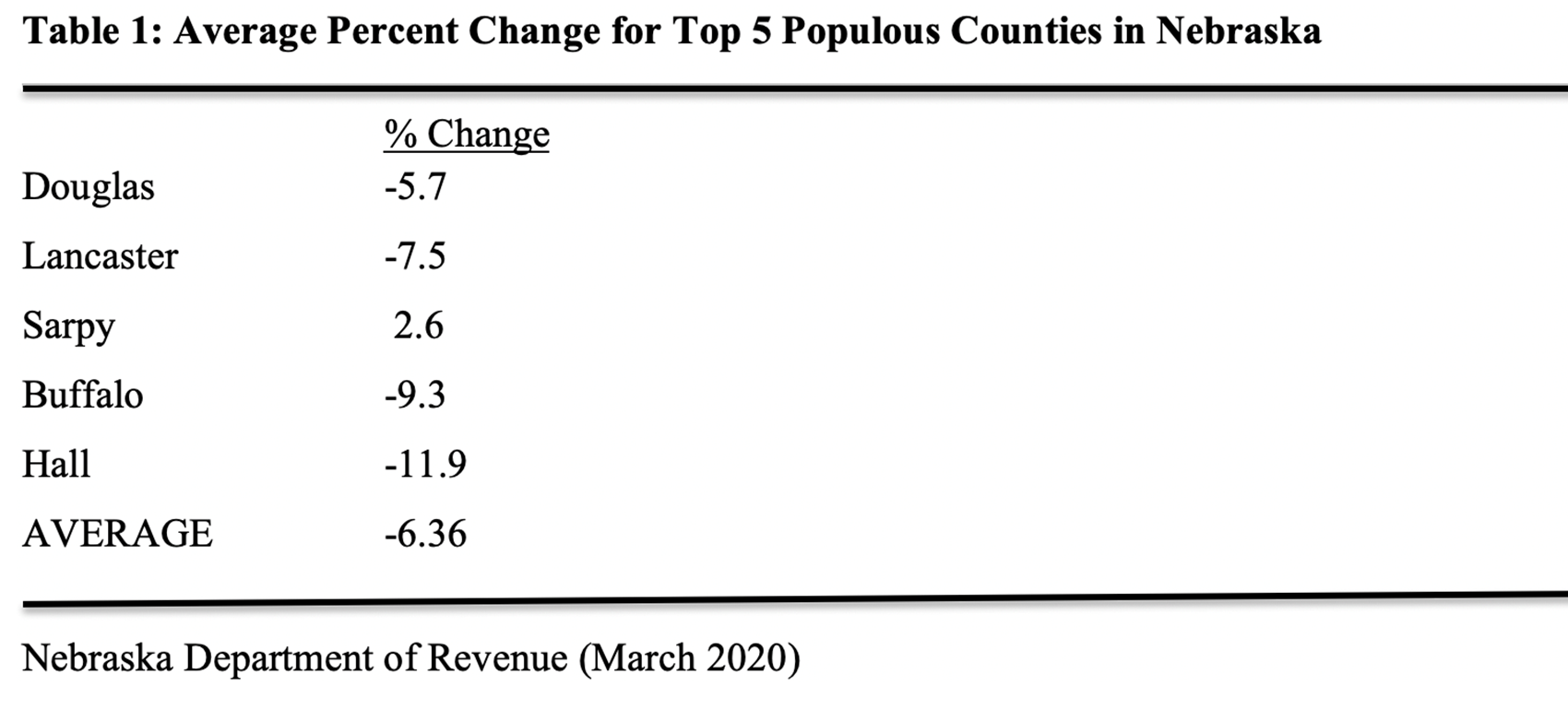

Urban areas, including both Douglas and Lancaster counties, saw a significant drop in taxable sales revenue compared to the previous year. In March of 2019, Douglas County’s taxable sales had only decreased by 0.1%, but in 2020 they saw a decrease of 5.7% in taxable sales. Lancaster County had a similar situation, where they saw a drop of 1.9% in 2019 and a drop of 7.5% in 2020.

The top five most populous counties in Nebraska saw an average drop in taxable sales revenue of 6.36% compared to the previous year. That statistic is worrisome since those counties usually bring in a sizable portion of the taxable sales revenue for Nebraska.

As Nebraska begins to reopen it is natural to expect that the urban areas see the most activity. It will be interesting to see what insight April’s data will provide to that extent. While Nebraska’s urban areas suffered losses, overall state sales tax revenue has held steady so far, even during the pandemic crisis.