Nebraska should join the responsible state budget revolution

Nebraska’s Revenue Committee is advancing a broad overhaul of the state’s tax code. These reforms, if enacted, would bring the Cornhusker State in line with the ongoing state tax revolution.

During the post-pandemic era, states are turning away from progressive tax structures and creating lower, flatter income taxes. And mobile workers are moving towards states with flat income taxes, or no income tax at all, rewarding those states that adopt competitive tax codes. The legislature’s work this year could make Nebraska a national leader in the state tax revolution.

Another revolution in state fiscal policy is beginning to sweep across many of the same states that have reformed their taxes. The so-called “conservative budget” or “sustainable budget plan” calls for limiting state spending growth to no more than inflation plus population. This reform was pioneered by the Texas Public Policy Foundation in 2015, and consistently enacted by Governor Greg Abbott across his three terms as Texas’ leader.

The idea is to keep government spending growth at or below the taxpayer’s ability to pay. When the population grows, there are more taxpayers and thus more ability to pay. And when inflation goes up, spending can rise equally. But that is the limit to state spending growth. Economists with the Texas Public Policy Foundation explain how it works:

If Texas, for example, saw a population growth of 3.2 percent in 2018, and the inflation rate was 4.8 percent, passing a conservative budget the following year would mean lawmakers kept spending below 8 percent (3.2+4.8=8). In other words, if the state government spends more than 8 percent, it is spending money that taxpayers don’t have and can’t afford.

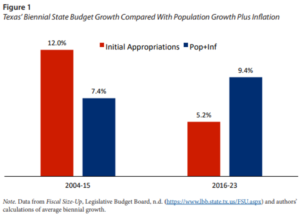

Prior to adopting the spending limit, Texas’ spending significantly outpaced the growth in inflation plus population. The biennial budget grew an average of 12%, while biennial inflation plus population grew an average of 7.4%. In contrast, from 2016-2023 the biennial budget has grown an average of 5.2% compared to an average inflation + population growth of 9.4%.

Texas policymakers have been strong stewards of state resources since adopting sustainable budget practices. But that’s not the only benefit. Upon adopting a spending limit of inflation plus population, states should expect to achieve a structural surplus which will allow for ongoing tax cuts.

Economic growth outpaces inflation over the long-run, and so revenues should naturally grow faster than the inflation + population spending restraint. The surplus represents a good governance dividend which should be returned to the taxpayers in the form of lower tax rates. Indeed, Texas lawmakers have consistently used surpluses to buy down property taxes, with the largest property tax cut in state history likely to be enacted in 2023. And other states like Iowa are considering the sustainable budget model to secure the tax reforms they achieved.

Texas’ legislature codified the budgeting practice with S.B. 1336 in 2021, which lowered the state’s spending limit for all general revenue to a combination of inflation plus population. In the meantime, states such as Tennessee, Kansas, Iowa, and Montana are considering a similar fiscal rule.

Colorado was the original standard-bearer before the Texas model. The Centennial State adopted the Taxpayer Bill of Rights (TABOR) by constitutional amendment in 1992. This amendment limits the growth in Colorado’s tax revenue to inflation plus population. Revenues in excess of the TABOR limit are returned to taxpayers via tax rebates. But the rule is not an iron-clad restraint. Voters can approve new taxes, excess revenues can be retained with voter approval, and revenues can be raised via fees. TABOR does not limit state spending as such, but rather restricts revenues from taxes unless voters approve an increase.

While the Texas model applies to a broader classification of state revenues and restricts all general spending, Colorado’s TABOR was the original gold standard for state fiscal rules. Both of these state models should be considered by Nebraska lawmakers.

Upon his exit interview, Governor Pete Ricketts touted his administration’s 2.8% annual spending growth as one of his administration’s top accomplishments. That spending restraint is one of the reasons Nebraska has large surpluses today. Governor Jim Pillen and the new legislature should consider options for formalizing a spending rule to constrain state spending growth in Nebraska. Like in Texas and Colorado, such stewardship will pay dividends for generations to come.