Nebraska PPP loan data show CARES Act tax policies are essential

The Paycheck Protection Program (PPP) is one of the largest parts of the federal government’s CARES Act relief legislation. The PPP provides loans intended to help small businesses—those with 500 or fewer employees—maintain their payroll, hire back any employees who were laid off, and cover applicable overhead expenses such as rent and utilities.

Detailed data on the loan program was released on July 6 by the Small Business Administration (SBA) and the U.S. Treasury Department.[1] Treasury Secretary Steven Mnuchin said in a news release, “Today’s release of loan data strikes the appropriate balance of providing the American people with transparency, while protecting sensitive payroll and personal income information of small businesses, sole proprietors, and independent contractors.”[2]

To legally qualify for a PPP loan, businesses had to self-certify a good-faith determination of need stating that “current economic uncertainty makes this loan request necessary to support the ongoing operations of the applicant.”[3] While there have been stories of multi-million dollar businesses being granted taxpayer-funded PPP loans,[4] analysis of the data show that 90% of Nebraska’s PPP loans were for less than $100,000, and were primarily used by small businesses, not large corporations. Thus, it is safe to assume that the data for Nebraska loan recipients is an accurate representation of business and industry financial need during the pandemic.

Not only is this data important for analysis on the industries and jobs most negatively impacted by the pandemic, but it is also supporting evidence for why Nebraska needs to conform to accompanying tax changes in the federal CARES Act relief legislation.

Withdrawing from federal tax provisions under state law is known as “decoupling,” while retaining the changes is called “conforming.” Nebraska is considered a rolling conformity state, which means the state automatically incorporates federal tax changes into its own tax code as they happen unless excluded by state legislation.

Nebraska lawmakers have discussed not accepting tax changes in the federal CARES Act relief legislation. Nebraska state Sen. Lou Ann Linehan is quoted[5] saying, “I think we need to look at decoupling…but I want to hear if companies are hurting and need this (CARES Act) money.” These sentiments are echoed by her fellow Revenue Committee members, Sens. Tom Briese[6] and Sen. Mike Groene.[7]

The tax relief provisions in the CARES Act are intended to ensure jobs and small businesses are not needlessly lost as the crisis continues into the latter half of 2020. If the state decouples from the CARES Act’s tax policies, it will put an additional burden on small businesses and agriculture producers that are already hurting by subjecting them to a tax increase.

In addition, depending on how the legislation is written, there is a chance that the PPP loans may be taxed if the state decouples because under normal circumstances debt forgiveness constitutes taxable income. While not the intention to raise taxes on businesses, the decision to decouple could result in a burdensome tax increase that could drive some businesses to bankruptcy. If the state decouples, more income will be subject to state income tax, including the PPP loan amount, which will hinder the state’s economic recovery. Data on the PPP loans helps identify some of the metrics of those negatively impacted by the crisis and should show policymakers that tax conformity is the best option for Nebraska.

Details on Nebraska PPP Loans

Since the program was approved in late March, Nebraska businesses have received 42,497 loans amounting to more than $3.4 billion. This money has helped to retain 327,536 jobs across the state during a time when Nebraska experienced its highest unemployment rate in recorded history, 8.3%. PPP loans range from $80 to $10 million and have been used by all types of businesses, ranging from nonprofits to corporations. Seventy-five percent of the loans approved are for amounts under $50,000 and loans were received in all 93 Nebraska counties.

The cities with the greatest number of businesses receiving loans were Omaha, Lincoln, Norfolk, Columbus, Hastings, and Elkhorn. When viewed by dollar amount, we can see that Elkhorn, Fremont, Winnebago, Omaha, La Vista, Lincoln, Aurora, Kearney, Hastings, Holdrege, Sidney, and Scottsbluff-based employers all received at least one loan in the highest dollar range, $5-$10 million.

The data keeps certain aspects of business data from being made public to avoid disclosing competitive advantages or payroll information. For example, if the loan amount was above $150,000, the name and address of the recipient was released, but the exact amount was not. Instead, it was reported in a dollar range. If the amount was for less than $150,000, then the exact loan amount was given, but the name and address of the business was not.

Looking at Nebraska’s PPP loans in aggregate, we can see that businesses in the 3rd congressional district received the greatest number of loans in the state. This is partly due to the agriculture sector being one of the hardest-hit industries, amounting for 18.6% of the state’s loans and 7,905 jobs. Specifically, corn farming and beef cattle ranching and farming had the most jobs affected.

When considering the debate over conforming to the CARES Act tax policies, it is important to know what types of businesses needed PPP loans the most. The primary focus of the tax changes are targeted at the individual income tax, which affect pass-through businesses. Pass-through businesses are not subject to the corporate income tax, but instead report their income to the individual income tax returns of the owners.[8] Out of all the businesses that took PPP loans in Nebraska, 72% of those are considered pass-throughs. Specifically, limited liability companies (LLCs) used the most loans (10,249), followed by sole proprietorships (9,331), and subchapter S corporations (7,352).

Many of the federal relief plan’s tax provisions are designed to help businesses increase their cash flow during the recession, including expanding the net operating loss deduction (NOL), which will allow businesses suffering financial losses to amend past tax returns and receive immediate refunds on some of their taxes paid instead of having to wait to deduct those losses in future years.

This is especially important for pass-through businesses. According to SBA data, 72% of the loans went to pass-through entities supporting 181,778 jobs, with the two largest sectors being agriculture and construction. Loans issued under $150,000 make up 90% of all the loans issued in Nebraska, which indicates that businesses needing help amid the pandemic are not multi-million dollar corporations, but relatively small firms that would greatly benefit from a tax break. For example, agriculture is primarily made up of the self-employed and sole proprietorships, amounting to more than 4,500 of the loans in that sector alone.

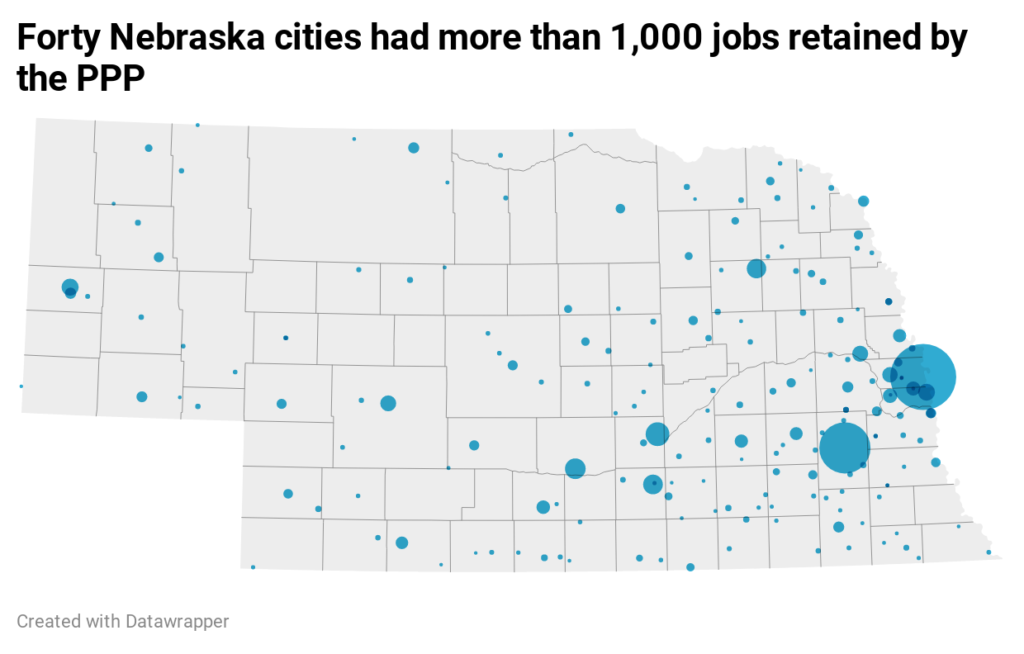

The other major statistic to review in the SBA data are the number of jobs PPP loans supported during the pandemic. All 93 counties received loans. Omaha and Lincoln ZIP codes saw the greatest number of jobs supported at 98,580 and 57,068, respectively. Grand Island businesses needed support for nearly 10,500 jobs while Kearney, Hastings, Norfolk, Scottsbluff, Bellevue, Fremont, Columbus, and North Platte all supported over 4,000 jobs with PPP loans.

In total, 40 cities across the state supported more than 1,000 jobs each with PPP loans. Nine counties saw job retention rates of less than 100, which is significant in some rural parts of Nebraska, where that is a noticeable amount of the workforce. For example, Arthur County is the least populous county in the state, yet they supported 45 jobs, or 19% of county’s workforce, with PPP loans.[9]

Another major concern is the industry breakdown for the businesses that needed PPP financial assistance. We have seen the unemployment reports, but now we can see with even greater detail what industries and jobs were directly affected by the pandemic in Nebraska. The industry breakdown by jobs indicates that the largest percent of jobs retained was in the health care field (16%), followed by accommodation and food services (11.3%), and construction (10.8%). The industries that received the greatest number of loans were agriculture (18.6%), construction (11.6%), and other services (11.1%), which includes religious organizations, beauty salons, general automotive repair, and personal care services. The sectors which used PPP loans the least were mining, utilities, government, and management companies.

It is safe to say that Nebraska has experienced significant economic turmoil amid the pandemic, and it is not over yet. Congress approved an extension of the PPP loan program through August 8 to continue helping those businesses most impacted from the crisis. Nebraska’s unemployment rate is recovering, but still posting rates comparable to the 1980s farm crisis.

The state of Nebraska is also taking an economic blow. When business is not being productive or prohibited from operating at full capacity, tax revenues fall. This compounds the problem of wanting to allow tax relief provisions that reduce tax revenues further. However, all the data point to the same conclusion; Nebraska’s business community has been negatively impacted and needs relief to rebound.

Key Takeaways

- Nebraska has received 42,497 loans amounting to more than $3.4 billion and helped retain 327,536 jobs.

- All 93 counties have demonstrated financial need through recipients of PPP loans.

- Seventy-two percent of all businesses that took PPP loans are pass-through entities that will benefit most from conformity to CARES Act tax changes.

- PPP loans are supporting 327,536 jobs, all of which could be at stake if the state decouples.

- Agriculture accounts for nearly 1 out of 5 loans received in the state supporting 22,000 jobs.

[1] SBA Paycheck Protection Program Loan Level Data. (2020, July 6). U.S. Department of the Treasury. https://home.treasury.gov/policy-issues/cares-act/assistance-for-small-businesses/sba-paycheck-protection-program-loan-level-data.

[2] The U.S. Small Business Administration. (2020, July 6). SBA and Treasury Announce Release of Paycheck Protection Program Loan Data [Press release]. https://www.sba.gov/about-sba/sba-newsroom/press-releases-media-advisories/sba-and-treasury-announce-release-paycheck-protection-program-loan-data.

[3] Hobson, M. (2020, May 15). Good-Faith Determinations under the CARES Act Paycheck Protection Program. American Bar Association. https://www.americanbar.org/groups/business_law/publications/blt/2020/05/cares-act/.

[4] Herzog, K. (2020, May 26). Which Public Companies Have Returned Their SBA PPP Loans? (Updated). Entrepreneur. https://www.entrepreneur.com/article/349848

[5] Hammel, P. (2020, July 7). Lincoln think tank questions $230 million tax break for Nebraska businesses. Omaha World-Herald. https://www.omaha.com/news/state-and-regional/lincoln-think-tank-questions-230-million-tax-break-for-nebraska-businesses/article_6dbdf5ab-434c-5e2a-8a68-10b8d0dbac86.html.

[6] Walton, D. (2020, June 9). Briese says state may need to decouple from federal income tax code. Lincoln Journal Star. https://journalstar.com/legislature/briese-says-state-may-need-to-decouple-from-federal-income-tax-code/article_07024ee4-d856-517b-b8ca-3f73f66fc06d.html.

[7] Young, J. (2020, June 16). Senators consider loss of state revenue because of income tax changes. Fremont Tribune. https://fremonttribune.com/legislature/senators-consider-loss-of-state-revenue-because-of-income-tax-changes/article_7e78e15c-d912-5f46-931b-377421ede9d6.html.

[8] York, E. (2020, July 9). Pass-Through Businesses Q&A. Tax Foundation. https://taxfoundation.org/pass-through-businesses/.

[9] According to the Federal Reserve Bank in St. Louis the civilian labor force in Arthur County, NE was 234 in January 2020, https://fred.stlouisfed.org/series/NEARTH5LFN.