Nebraska community college property tax repeal: simplifying the tax code to deliver property tax relief

High Resolution Downloadable Study Here.

Introduction

Nebraska’s property tax burden is the central issue in the state’s tax debate. Property taxes are high and unevenly distributed, making it hard to develop clean solutions for direct tax reduction. Indeed, legislative action in the last several sessions shows that Nebraska lawmakers are working to tame the state’s property tax burden through several different approaches, and more solutions are likely to come.

Nebraska’s community college property tax is a unique component of the total property tax burden in that it can be entirely eliminated by the state. It is also large enough that complete elimination would provide meaningful property tax relief. Not only is it possible for Nebraska to eliminate community college property taxes, previous legislatures have taken meaningful steps to make full repeal more feasible.

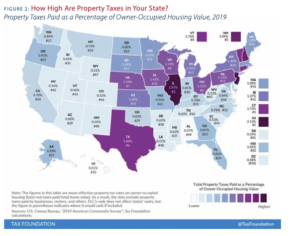

Nebraska property owners pay the 7th-highest property taxes in the country. Recent changes to Nebraska’s Property Tax Incentive Act have created credits for property tax relief while changes to Nebraska’s Property Tax Request Act have created greater transparency and accountability in the property tax system. While these efforts have provided a form of indirect tax relief, what has been missing is a direct reduction in property taxes for property owners across the state.

Nebraska lawmakers enacted indirect community college property tax relief in 2022 by passing LB 873, which creates a refundable income tax credit for community college property taxes paid. This tax credit mirrors one Nebraska provides for school district property taxes paid. In short, property owners can claim a refundable tax credit on their income tax returns for community college property taxes paid.1

In 2023, Governor-elect Jim Pillen and Nebraska’s newly-elected Unicameral should build upon LB 873 by eliminating Nebraska’s community college property taxes altogether. This solution will provide direct, permanent property tax relief. Current revenue conditions combined with the community college tax credit created in LB 873 make community college property tax elimination the next logical step. Eliminating community college property taxes will achieve three important goals:

- Directly reduce property taxes by more than 5% statewide

- Eliminate the administrative burden of tax credits to achieve property tax relief

- Simplify Nebraska’s property tax system

Community Colleges as a Slice of Nebraska’s Total Property Tax Burden

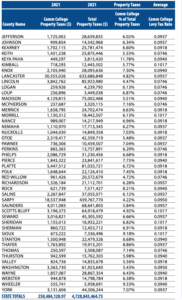

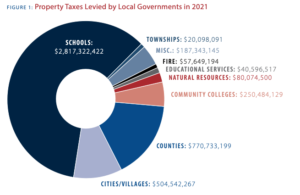

Nebraska’s property tax generates significantly more revenue than any other tax in the state. Nebraskans paid $4.73 billion in property taxes in 2021, according to the state’s Department of Revenue. In comparison, $3.1 billion was paid in state and local sales taxes, $3.0 billion was paid in net individual income taxes, and $644 million was paid in net corporate income taxes.2

Schools account for 60% of the property tax burden, followed by 16% from counties, 11% from cities and villages, and just over 5% from community colleges. The remaining 8% of property taxes are collected by Natural Resource Districts, Educational Service Units, Fire Districts, Townships, and other Miscellaneous Districts.

Nebraska property owners pay the 7th-highest property taxes in the country as a percentage of housing value, according to an analysis by Tax Foundation.3 Property taxes equal 1.54% of housing value in Nebraska, a higher rate than all bordering states. Iowa’s is the neighbor with the next highest property tax rate at 1.43%.

All else being equal, if Nebraska had repealed its community college property tax before Tax Foundation’s calculations were made, Nebraska’s property tax burden would have been reduced from 1.54% to approximately 1.46% of housing value. This would have put Nebraska at the 9th-highest property tax burden rather than the 7th-highest, dropping the Cornhusker State below Wisconsin and Ohio and landing not far from #10 Iowa (1.43%) and #11 Pennsylvania (1.43%).

Nebraska’s Community College Funding

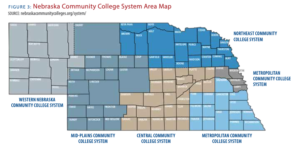

Nebraska’s community college system is comprised of 5 regional member colleges across the state along with one metropolitan region consisting of the four counties surrounding Omaha. Western Nebraska covers the 12 westernmost counties, Mid-Plains covers 18 counties, Central covers 25 counties, Northeast covers 20 counties, Southeast covers 15 counties and Metropolitan covers four counties. Each college is governed by a locally-elected eleven-member board, and the colleges focus on occupational education to link local industry to a skilled workforce.

The original financial plan for Nebraska’s community colleges included 40% funding from the state, 40% from local property taxes, and 20% from tuition. However, the state-local balance broke down over time, with local property taxes providing more than double the resources that the state appropriates. State funding has historically faded during tough economic times, which creates a challenge for any proposal to eliminate the community college property tax.

For every dollar in resources community colleges get from property taxes, the state provides only 44 cents of resources to community colleges. Community college property taxes are levied in all 92 of Nebraska’s counties, and total state-wide collections were approximately $250 million in tax year 2021. Countywide collections range from $180,000 in Arthur County to $51 million in Douglas County.4 By contrast, Nebraska’s 2022-23 general fund appropriation for community colleges was $110 million.

LB 342, enacted in 2007, created a state funding formula to fill in the difference between community college needs and locally available resources. Needs are based upon enrollment (FTEs) and the cost of education (REUs). Local resources are derived from property taxation. The formula allows for a 3% automatic growth upon the most recent years of expenditures, plus any additional growth experienced by the colleges.

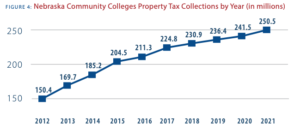

In the last decade, community college property tax collections have outpaced inflation, growing at a 5.8% annual clip. However, much of the accelerated growth occurred from 2012-2017. Since 2017, collections have grown at a 2.7% annual rate.5

The community college property tax was $250.5 million in calendar year 2021. Adjusted forward at a 3.0% growth rate, the community college property tax would be expected to collect just over $265 million in 2023.

The local effort rate (LER) for community colleges property taxes covers both operations and capital levies. Rates range from 7.46 cents to 10.17 cents per $100 of property value across the member colleges. The LER adjusts depending upon the amount of money appropriated by the legislature into the state funding formula.6

Local property taxation provides a stable source of revenue for the community colleges that is not dependent upon legislative appropriation. Given the inconsistency of state funds for community colleges, repeal of community college property taxes should be coupled with a safe harbor for community colleges that would allow them to reimpose a property tax if the state lapses in fulfilling its funding formula.

Nebraska’s Recent Property Tax Relief and Reform

Nebraska lawmakers have confronted the state’s high property tax burden in recent legislative sessions by creating and expanding tax credits, and by creating transparency measures that redefine tax increases in terms of revenues raised rather than tax levy rates. The tax credits are designed to offset the cost of property taxes. In addition, the transparency measures will increase public engagement in local property tax decisions.

Tax credits

Nebraska enacted the Property Tax Credit Act in 2007 to provide property tax relief through the administration of state funds. The law created the Property Tax Credit Fund to deliver relief dollars to each county. The fund was initially provided $105 million. The Fund divides the money between counties based upon the real property value within each county as a portion of real property value across the state. At the county level, property tax relief is delivered to each individual property parcel based upon the parcel’s valuation as a portion of total countywide property valuation.7

The appropriation to the Property Tax Credit Fund has been regularly increased over the years.8 LB 1107, which was enacted in 2020, increased the appropriation to the Property Tax Credit Fund to $375 million beginning in calendar year 2024.9

In addition, LB 1107 established the Nebraska Property Tax Incentive Act, which created a new income tax credit for school district property taxes paid. Each property taxpayer is provided a refundable tax credit against the Nebraska income tax. The value of the refundable credit is calculated as a percentage of the taxpayer’s school district property taxes paid. LB 1107 allocated $125 million for the credit in calendar year 2020 with scheduled increases in future years.

Lawmakers updated the Property Tax Incentive Act again with LB 873, which was enacted in 2022. The value of the income tax credit for school property taxes paid was expanded to:

- $548 million for calendar year 2022

- $560.7 million for calendar year 2023

- Prior year amount plus an allowable growth percentage going forward

In addition, LB 873 created a new refundable income tax credit for community college property taxes paid. The value of the new credit is:

- $50 million for calendar year 2022

- $100 million for calendar year 2023

- $125 million for calendar year 2024

- $150 million for calendar year 2025

- $195 million for calendar year 2026

- Prior year plus an allowable growth percentage going forward

Community colleges levied $250 million in property taxes in 2021, and should be expected to levy approximately $265 million in 2023. A $195 million credit, if accelerated and implemented in 2023, would offset 74 percent of the entire community college property tax burden.

Levy limits and Truth in Taxation

Nebraska created a modified tax levy limit to provide additional taxpayer transparency with LB 103, passed in 2019. LB 103 required political subdivisions to hold a public hearing if they wished to request more in property taxes than they had in the prior year. The intent of the law was to prevent tax bills from automatically going up as a result of property valuations rising. Due to a lack of direct taxpayer notification about the hearings and limited compliance with the law, public awareness as to how rising valuations impacted tax collections continued to be insufficient after the law took effect.

LB644, known as Nebraska’s Property Tax Request Act, was passed in 2021 with the goal of improving transparency as to the impact of rising property valuations on rising revenue collections. The law requires direct notification to property owners when political subdivisions choose to increase revenue collections rather than lower levy rates to offset rising property valuations. It was designed to bring a new level of transparency and public engagement to local property tax decisions.10 Modeled on laws in Utah and Kansas, it is also known as Nebraska’s “Postcard Bill” or its “Truth in Taxation” law.

The Truth in Taxation law sets a levy limit that triggers a public transparency process. Levies can increase by an “allowable growth percentage,” which is 2% plus a “real property growth percentage.” Any levy increase beyond this allowable growth must go through the Truth in Taxation process. The process involves notification for a public hearing about the property tax increase along with the public hearing itself. The notification for the meeting is sent out on a postcard, and the postcard indicates an estimated tax increase upon the property owner’s property, along with information about the public hearing.

The joint public hearings are held at one central location within a county and include each taxing authority which seeks to raise property taxes in excess of the levy limit. However, for taxing authorities that span multiple counties, the public hearing is held in only one county. From the Truth in Taxation law 11:

Each political subdivision within a county that seeks to increase its property tax request by more than the allowable growth percentage shall participate in a joint public hearing. Each such political subdivision shall designate one representative to attend the joint public hearing on behalf of the political subdivision. If a political subdivision includes area in more than one county, the political subdivision shall be deemed to be within the county in which the political subdivision’s principal headquarters are located. At such hearing, there shall be no items on the agenda other than discussion on each political subdivision’s intent to increase its property tax request by more than the allowable growth percentage.

Joint public hearings are held in only one county across each community college regional area. Thus, the Truth in Taxation law is only partially effective for providing transparency aimed towards public engagement related to community college property taxes.

The case for community college property tax repeal

The community college property tax should be repealed under the condition that the state provides stable and consistent funding to meet college needs under the state aid formula. Strong state revenue along with recent federal support for community colleges provides an opportunity for community college property tax repeal. State revenues have been repeatedly adjusted upwards over the post-pandemic era, and Nebraska community colleges received approximately $69 million in federal aid from the federal American Rescue Plan Act.12 These extra revenues provide a buffer to allow state lawmakers and community college leaders to carefully phase in financial changes.

The LB 873 tax credit for community colleges taxes will be worth $195 million per year once it is fully phased in. Given Nebraska’s strong tax revenues and large surplus, lawmakers are considering accelerating the LB 873 tax relief to take full effect in 2023.13 This would provide the majority of the dollars needed to replace community college property taxes. In addition, state revenue surpluses are large enough that the state can afford the additional $70 million per year necessary to fully eliminate the community college property tax in 2023 and fund community colleges going forward. Policymakers should reallocate the tax credit money to the community college formula over the 2023-2024 legislative session, along with an additional $70 million per year to completely eliminate the community college property tax.

Community college property tax repeal would be a significant legislative achievement. All else being equal, property taxes would be directly reduced by 5.3% statewide.

Furthermore, full repeal makes sense because refundable income tax credits to offset property taxes are not a perfectly efficient way to deliver tax relief in comparison to direct tax repeal.

The community college tax credit is structured identically to the tax credit for K-12 property taxes, and only 60% of eligible Nebraska property taxpayers have claimed their income tax credits for K-12 property taxes paid credit, leaving hundreds of millions of dollars unclaimed in state coffers.14

If the $195 million community college property tax credit is only taken up by 60% of property taxpayers, then only $117 million of annual tax relief would be claimed while $78 million would be left unclaimed. Furthermore, the problem of unclaimed income tax credits could worsen given that LB 873 also removed a portion of Nebraska retirees from the income tax rolls entirely. The new law exempts social security income from taxation, making it less likely that retirees will file a state income tax return at all, and thus less likely that they will receive an income tax credit for community college property taxes paid. State lawmakers can simplify this process and provide taxpayers with direct tax relief by fully repealing community college property taxes.

Community college property taxes are also less completely subject to taxpayer oversight under Nebraska’s Truth in Taxation law. Truth in Taxation hearings are carried out each year, but only in the county that hosts each community college’s headquarters. Central Community College covers 25 counties while Northeast covers 20. It is impractical for taxpayers across all of these counties to show up in one location on one night to make their voices heard. Thus, repeal of the community college property tax eliminates the problem of community colleges being less than completely subject to Truth in Taxation transparency requirements.

Community college administrators will rightfully be concerned that state lawmakers might eliminate their ability to levy property taxes, and then become inconsistent in providing resources for community colleges. A proposal to repeal community colleges should include a safe harbor that provides community colleges with the ability to reintroduce a property tax under the condition that the state fails to fully fund the community college formula.

Conclusion

Nebraska lawmakers have a unique opportunity to directly reduce property tax bills across the state by repealing community college property taxes. Full repeal would result in property tax bills falling by more than 5% statewide, and it would mean that property owners would see one less line item on their property tax bills.

Three-fourths of the funds needed to repeal community college property taxes have already been dedicated to community property tax relief through tax credits. Nebraska policymakers can supplement these funds with additional state support to pay for full repeal of community college property taxes.

Nebraska has made several successful property tax reforms over recent legislative sessions, and lawmakers should continue to advance and strengthen such solutions. However, direct reduction of property taxes has been the missing piece to Nebraska’s broader property tax relief package. The upcoming legislative sessions are the ideal time to achieve community college property tax repeal, providing direct property tax relief to complement Nebraska’s suite of ongoing property tax reforms.