Iowa advances bill to repeal inheritance tax while Nebraska focuses on reform

Bill introduction has ended for the 2021 Nebraska Legislature, and two bills were filed to reform Nebraska’s antiquated, and increasingly uncommon, inheritance tax. In fact, yet another neighboring state might soon ditch its own inheritance tax.

SSB 1026, which would repeal Iowa’s inheritance tax if approved, was advanced unanimously from an Iowa Senate subcommittee. It now moves on for consideration by the Senate Ways and Means Committee.

Iowa State Sen. Dan Dawson (R-Council Bluffs), who chaired the subcommittee, said, “It’s been a priority for ours for a few years, and I’m hoping this year is the year to get this thing across the finish line.”

Nebraska and Iowa are two of only six states that currently tax inheritances. Nebraska has two bills related to inheritance tax in the current Legislature, LB377 by Sen. Wendy DeBoer and LB310 by Sen. Robert Clements. Neither proposes a complete repeal, but DeBoer’s bill would change the individuals who are considered relatives of a decedent (the person that dies), potentially making more people eligible for a lower tax rate. Clements’ bill would lower the inheritance tax rates and increase the amount of property value that is exempt from the tax.

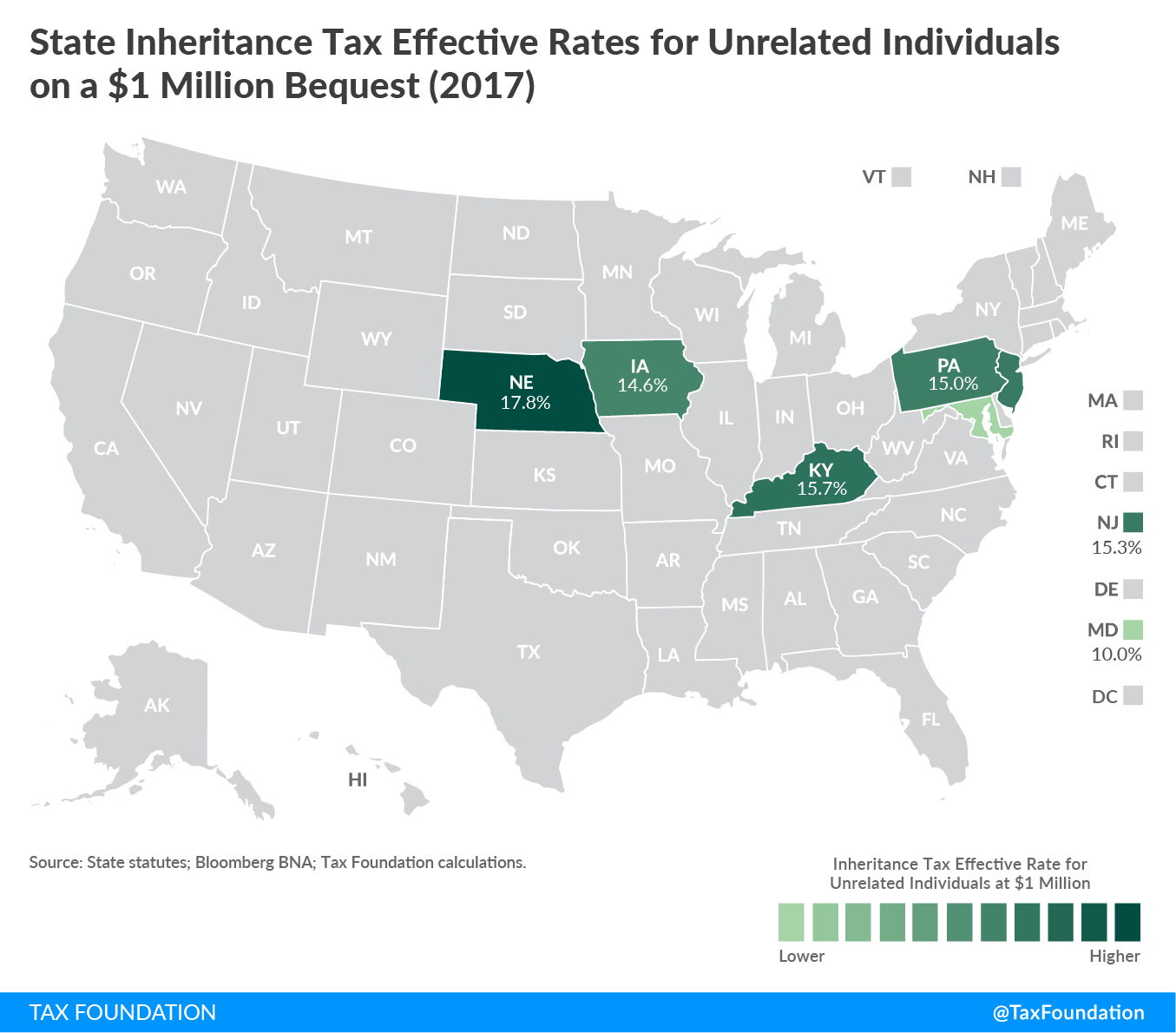

If Iowa repeals its tax, the closest state to Nebraska with an inheritance tax would be Kentucky, with the other three remaining states located in the Mid-Atlantic. The map below shows the effective inheritance tax rate once exemptions are included in each state. As you can see, with a nation’s-highest 18% tax on unrelated inheritors of property, Nebraska’s current exemption level shaves very little off the tax burden.

The inheritance tax has been a complicated issue for the Legislature for decades because Nebraska’s tax is a revenue source for county governments, whereas Iowa’s tax is a state revenue source.

According to the Taxpayers Education Foundation in Iowa,

Previous Iowa legislatures ended the inheritance tax for spouses and lineal ascendants and descendants, but the tax remains for non-lineal beneficiaries. Bills have been introduced in past legislative sessions to either abolish or gradually phase-out the inheritance tax but to no avail.

During the 2018 legislative session, the legislature enacted a comprehensive tax reform that began the process of lowering Iowa’s individual and corporate tax rates. Abolishing the inheritance tax will not only end this obsolete tax and instill more fairness in the tax code, but it will strengthen Iowa’s tax reform. States have either abolished the inheritance tax either as a part of a comprehensive tax reform, eliminated it at once, or phased the tax out. Iowa should follow the many states who have eliminated the inheritance tax.

At a time when Nebraska is concerned about preventing outmigration of its aging population, a significant reform or repeal of the inheritance tax would help with that problem.

However, we must not forget the impact a change would have on the counties. Counties are primarily funded through property tax, and if they lose this revenue some might choose to increase their property tax to offset the difference.

Reform ideas to minimize the direct impact to counties would be to create a higher minimum threshold while reducing the top rate. Another option would be to replace the inheritance tax and offer counties a local-option sales tax to provide for a more reliable alternative revenue source.

The Platte Institute will be watching Iowa’s SSB1026 as well as testifying in support of LB377 and LB310 this session.

Are you one of the 78% of Nebraskans who agree it’s time to lay the county inheritance tax to rest? Sign the petition to tell the Unicameral to eliminate this outdated and inequitable tax on Nebraska families.

Sign The Petition

End Nebraska's Inheritance Tax

Simply fill out the form below to sign the petition.

Learn More >