Disruptions from COVID-19 on Nebraska’s Agriculture

Government and industry responses to the COVID-19 pandemic created a variety of unique situations for agriculture. The “stay-at-home” orders forced consumers to be homebound, which increased the demand for food in grocery stores while simultaneously reducing the demand for food in restaurants. Reduced consumer travel caused the demand for ethanol to fall, impacting distillers’ grains, which impacted livestock producers. Agricultural exports have also been affected with labor shortages, disruptions in logistics, and reduced foreign demand.1 It is clear agriculture has been deeply impacted by this crisis both at home and abroad with no easy remedy or end in sight.

Nebraska Farm Bureau and the Platte Institute have partnered to review the disruptions from the pandemic on Nebraska’s agriculture to share this information with leaders across the state. Nebraska is in a unique situation given its strong reliance on agriculture. We will set the stage with the current status of Nebraska agriculture, evaluate the impact of COVID-19, look at the federal relief legislation that was enacted, and briefly discuss the regulatory structure of two activities directly affected in Nebraska. It is important policy leaders across the state understand what happened to agriculture so policies moving forward can focus on re-establishing supply chains and markets, reducing regulatory barriers, and promoting economic growth.

Nebraska Agriculture

Nebraska agriculture is diverse and can be found in every corner of the state. Family-owned farms and ranches produce corn, soybeans, pork, and poultry predominantly in the east, sunflowers, millet, wheat, dry beans, sorghum, and sugar beets in the west, and beef is produced across the state.

Each year Nebraska crop producers plant 19 million acres to crops. Corn and soybeans are the most prominent, accounting for 70-75% of total acres, or 13-15 million acres, followed by wheat, with 850,000 acres. Nebraska typically numbers among the top three states in corn production and the top six in soybean production. Nebraska producers raise countless other crops like sugar beets, millet, dry beans, and sorghum. Hay production is often overlooked in the state and Nebraska producers will harvest roughly 2.6 million acres of some form of hay or alfalfa this year.

On the livestock side, there’s a reason Nebraska vehicle license plates once carried the moniker, “The Beef State.” Total head of cattle in Nebraska as of January 1 of this year numbered 6.8 million head, almost 3.6 times the number of people in the state. Nebraska ranks fourth among states in the number of beef cows, with 1.92 million head. Nebraska ranked second in the number of cattle on feed as of January 1, 2.6 million head. The density and geographical breadth of cattle feeding in the state is unmatched. While not as prominent statewide as cattle production, in certain regions, pork, poultry, and dairy production are important. Hogs in Nebraska number around 3.0 million and Nebraska has a growing poultry sector with Smart Chicken in Tecumseh and Lincoln and the Costco project in and around Fremont. Established egg and dairy sectors are located primarily in the Northeast region.

Agriculture in Nebraska, though, comprises more than the production sector. It also includes processing, transportation, storage, input suppliers, and more. Nebraska has significant animal processing, grain processing, ethanol, and feed/pet food manufacturers. The animal processing sector alone accounts for $18 billion in output and nearly 28,000 jobs. Nebraska is the second-largest producer of ethanol employing over 1,900 Nebraskans. Taken together, a University of Nebraska-Lincoln (UNL) Department of Agricultural Economics report in 2012 estimated the agricultural production complex in Nebraska accounted for 41% of the state’s production output, 27% of its gross state product, and 24% of total employment.

Farm Finances Entering 2020

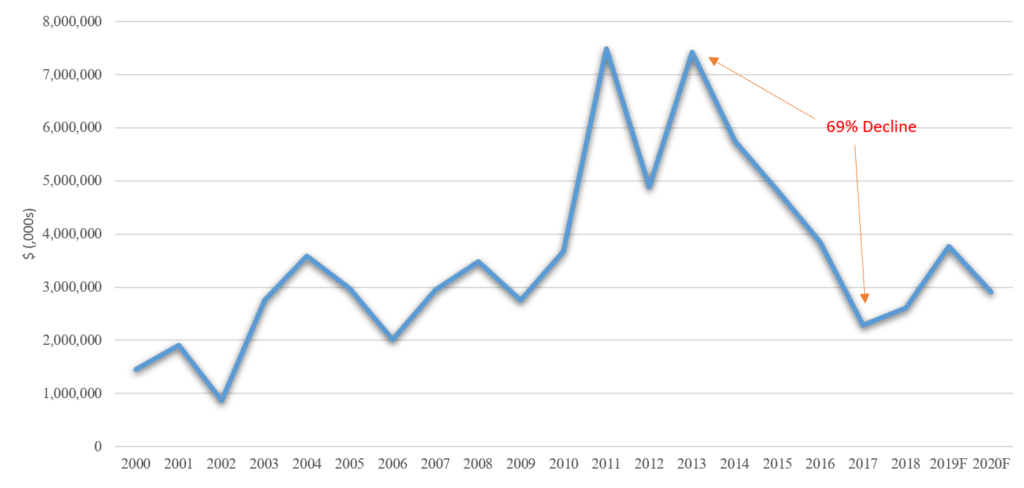

Crop and livestock producers have been on a roller coaster ride over the past decade regarding net farm income (Figure 1). Prior to 2010, net farm income was slowly trending upwards, hitting just short of $4 billion in 2010. From 2011-2013, drought, export demand, and ethanol production led to surging commodity prices and soaring net farm incomes. Nebraska’s net farm income exceeded $7 billion in 2011, and again in 2013, and was just under $5 billion in 2012. Record production, souring trade relations, and stabilizing ethanol demand quickly turned the tide, and after 2013, net income rapidly plunged. Over a four-year period, net farm income fell 69% to $2.3 billion. Since 2017, it has trended upwards, but largely due to trade assistance payments provided by the federal government to mitigate lost exports due to trade disputes. The latest projections from the Bureau of Business Research (BBR) at UNL show net farm income in Nebraska for 2020 will decline 23% compared to last year. Federal government assistance could comprise 50% of net farm income this year.

Figure 1: Nebraska Net Farm Income, 2000-2020 Source: USDA, Economic Research Service, 2000-18; UNL Bureau of Business Research, 2019-20

Source: USDA, Economic Research Service, 2000-18; UNL Bureau of Business Research, 2019-20

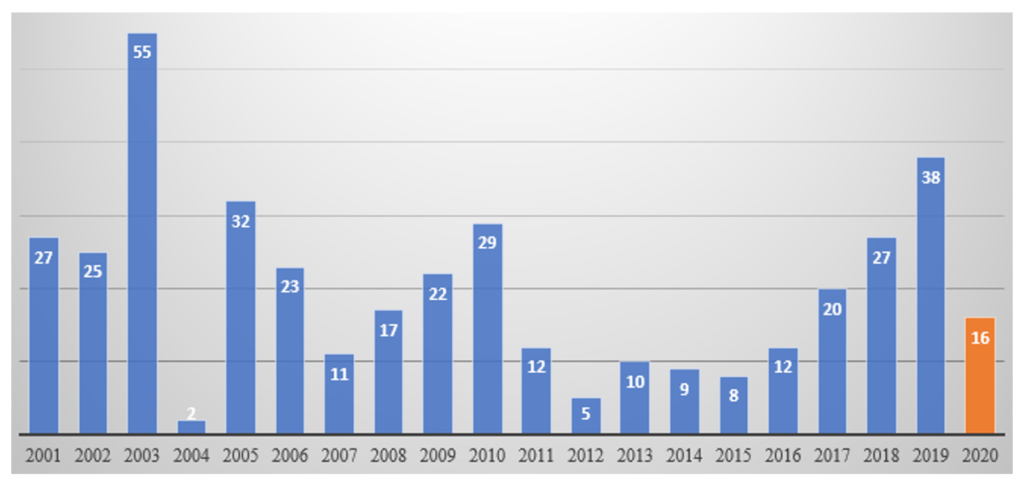

With the turn in income in the last few years, Nebraska producers entered 2020 already experiencing the financial pinch. Figure 2 plots the number of Chapter 12 farm bankruptcies filed in Nebraska each year since 2001, including filings through June 30 of this year. The number of filings hit a low in 2012 with five, and were below 10 through 2015, roughly the same period of surging farm incomes. After 2015, the number of Chapter 12 bankruptcies turned higher, reaching 38 last year, the most filed since 2003. Through the first half of this year, the number filed equaled 16, on pace to equal last year.

For the past 12 months ending June 30, Nebraska was second only to Wisconsin in the number of Chapter 12 bankruptcies filed with 38, an increase of 13 over the previous 12-month period. The farm economy in the Midwest appears to be suffering more financial stress relative to the rest of the country—five states exceeded 32 filings between July 2019-June 2020. In fact, the 13-state Midwest region accounted for more than 50% of the Chapter 12 filings over the previous 12 months. All these states have large corn, soybean, beef, and pork production sectors.

Like bankruptcy filings, farm loan delinquency rates have been creeping higher since 2014, more evidence of a financial squeeze on producers. According to Kansas City Federal Reserve Bank farm loan performance data, the delinquency rate in the fourth quarter of 2019 for non-real estate loans was 2.12%, up from 1.77% for the same quarter the prior year. The delinquency rate on farm real estate loans for the fourth quarter of 2019 was 2.20%, also higher than recent years. As a silver lining though, both measures are below the 30-year average rate.

Figure 2: Chapter 12 Farm Bankruptcy Filings in Nebraska, 2001-2020 Source: U.S. Bankruptcy Court

Source: U.S. Bankruptcy Court

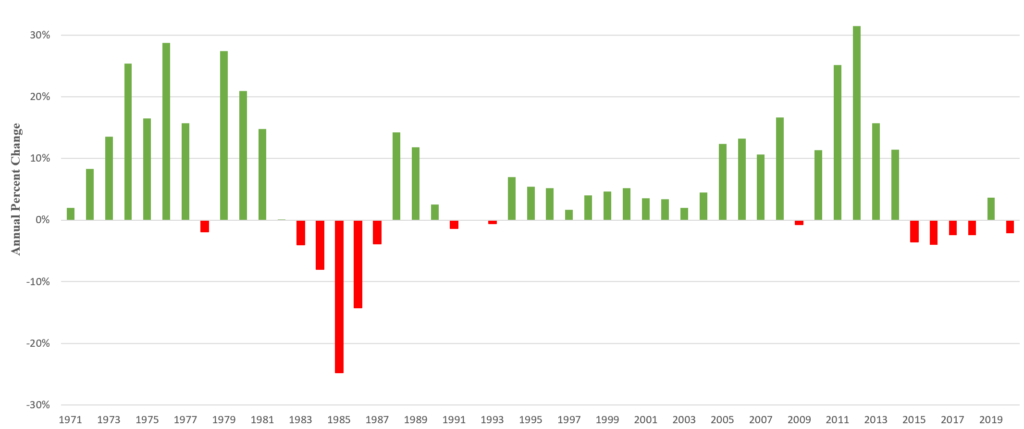

Thus, net farm income, bankruptcy filings, and loan delinquency rates all show increasing financial stress for Nebraska producers. One bright spot has been the resiliency of farmland values despite the drop in farm incomes. Figure 3 plots the percentage changes in average statewide land values since 1971. History shows in any given year land values are more likely to increase—in only 14 years over the 49-year period did average values decline. However, in five of the last six years, farmland values have fallen, but the declines have been minimal compared to the drop in net farm income. Sticky land values have propped up producer balance sheets and allow for greater borrowing capacity to withstand the current financial difficulties.

Figure 3: Percentage Change in Nebraska Average Land Values, 1971-2020

Source: USDA, National Agricultural Statistics Service

Source: USDA, National Agricultural Statistics Service

Role of International Trade

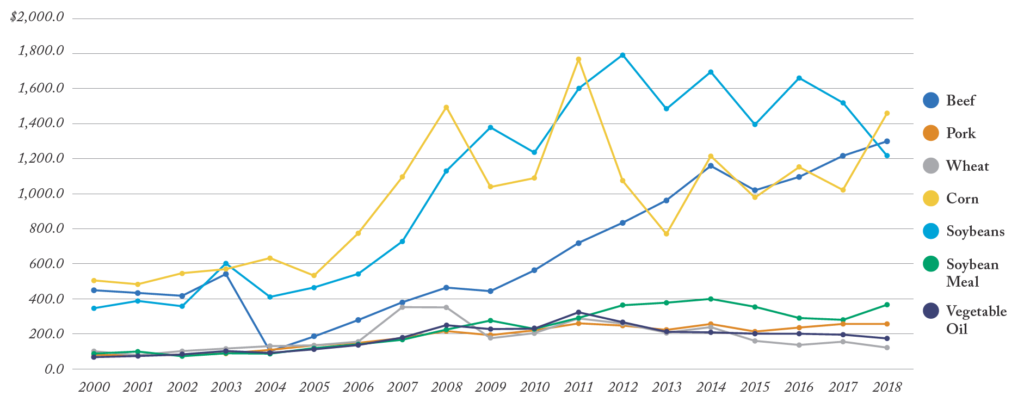

International markets are becoming increasingly important to Nebraska producers’ bottom line. Exports are a growing part of Nebraska’s agricultural sales, increasing nearly three-fold since 2000. The value of exports now consistently accounts for 30% of the state’s total agricultural receipts. Nebraska exported agricultural commodities worth $6.802 billion in 2018, the last year data is available, according to the United States Department of Agriculture’s (USDA) Economic Research Service. Nebraska was the sixth-largest agricultural exporting state following California, Iowa, Illinois, Minnesota, and Texas. It topped the nation in exports of beef, was the second-largest exporter of hides and skins, the third-largest exporter of corn, feed, and processed grain products, and the fifth-largest exporter of soybeans, soybean meal, and vegetable oil. Other Nebraska products exported included ethanol, popcorn, wheat, pork, dry edible beans, and a host of other commodities and processed products.

Figure 4 tracks Nebraska export values of several of the same commodities between 2000–2018. The value of Nebraska agricultural exports in 2018 grew more than $450 million compared to 2017. Remarkedly, the value of Nebraska exports grew in 2018 despite trade disputes with many U.S. agricultural trading partners. Tariffs on steel and aluminum imposed by the U.S. prompted several trading partners to impose retaliatory tariffs on U.S. agricultural goods. Fortunately for Nebraska producers, the U.S. maintained cordial trade relations with its two leading beef markets, Japan and South Korea. Growing purchases by these two countries helped boost the value of Nebraska’s beef exports to record setting levels in 2018. Positive relations with Japan helped boost corn exports as well. Nebraska was also fortunate Mexico chose not to impose tariffs on U.S. corn in retaliation for U.S. tariffs on steel and aluminum.

Figure 4: Nebraska Commodity Exports, 2000-2018 (Million $)

Source: USDA Economic Research Service

Source: USDA Economic Research Service

Impact of COVID-19 to Nebraska Agriculture

With Nebraska agriculture entering 2020 financially weakened, COVID-19 landed two major punches to its midsection. The first came in mid-March with the shutdown of the hospitality, restaurant, and institutional food service sector (HRI), and the stay-at-home orders. Almost overnight, demand for food in the HRI sector, which accounted for 54% of the food consumed pre-COVID-19, went missing. At the same time, consumers sprinted to grocery stores for their food purchases. Since the HRI and retail grocery segments have completely different supply chains, supply chains were ill-equipped to deal with the shutdown of one demand segment and meet the onslaught of demand in the other segment.

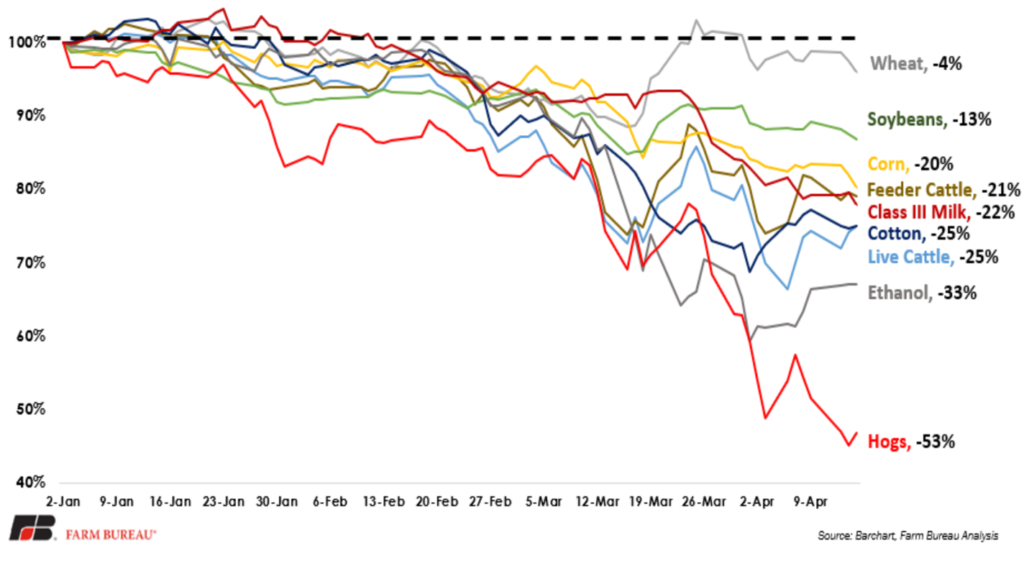

The stay-at-home orders meant less travel and less fuel consumed. Estimates suggested that at one point, gasoline consumption was off 36% in 2020 compared to the same period last year. The immediate impact for Nebraska agriculture was the idling and slowdown of ethanol production as less ethanol was needed for blending into gasoline. Nebraska corn producers lost a key market for their corn while livestock producers lost a key feed source in distillers dried grains. The first punch, with its demand destruction and uncertainty, caused commodity prices to spiral downward (Figure 5).

Figure 5: Declines in Ag Futures Prices, January-April 2020

The second punch, delivered in April, were the disruptions in operations of meat processing facilities due to employee health concerns. Between complete shutdowns, reduced operations, and slower speeds, the processing facilities were operating between 60-70% of capacity at one point. Livestock prices plunged. The situation was exacerbated by large cattle and hog inventories coming into the year. Even under perfect conditions, processing facilities needed to operate at peak capacities to avoid backlogs. Prices for beef and pork skyrocketed at the retail level as concerns over shortages led to a run on meat by consumers. Livestock producers were forced to pay additional feed costs to keep animals on feed, scramble to find alternative processing facilities, or in some instances, euthanize animals. The situation has greatly improved, and processing has returned to near pre-COVID-19 levels with facilities operating extra hours. However, it will take some time for the clogged supply chains to clear.

No doubt, like other economic sectors, the COVID-19 pandemic had several repercussions for Nebraska agriculture. An analysis released in June by Nebraska Farm Bureau suggested Nebraska’s agricultural economy could face nearly $3.7 billion in losses in 2020 due to COVID-19 if economic conditions did not improve. The estimate was based on a “snapshot” of revenue losses on 2019 and 2020 production sold in 2020. Commodities including corn, soybeans, wheat, beef cattle, and pork production, as well as dairy and ethanol were part of the analysis. The analysis does not account for financial assistance farmers and ranchers could receive through state and federal COVID-19 relief programs.

The potential estimated losses for corn and soybean producers alone could reach $1.17 billion, with beef producer losses adding another $971 million. The analysis further pegged potential losses in the pork sector at $166 million, with dairy losses near $66 million, and $8.7 million in losses related to COVID-19 for wheat growers. The estimates assumed prices wouldn’t improve for the remainder of the year. With the time remaining in 2020, price improvements can change these figures markedly to the better. Yet, the results still demonstrate the potential magnitude of the financial challenges facing farm and ranch families.

Pandemic-Related Financial Assistance

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), passed in March of 2020, provided many changes that directly impacted farmers. It created both the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL). For agriculture, this legislation was unprecedented, because agricultural enterprises had never previously been eligible for disaster assistance from the EIDL. In addition, there were other relief packages enacted specifically targeting agriculture such as the USDA’s many programs providing relief and flexibility to farmers and ranchers during the pandemic. All of these sources of financial assistance have benefited Nebraska agriculture producers and helped bring stability to our nation’s food supply chains.

Paycheck Protection Program (PPP)

The PPP was one of the largest parts of the federal government’s CARES Act relief legislation. The PPP provides loans intended to help small businesses—those with 500 or fewer employees—maintain their payroll, hire back any employees who were laid off, and cover applicable overhead expenses such as rent and utilities. Since the program was approved in late March, Nebraska businesses have received 42,497 loans amounting to more than $3.4 billion.

To legally qualify for a PPP loan, businesses had to self-certify a good-faith determination of need stating that “current economic uncertainty makes this loan request necessary to support the ongoing operations of the applicant.” Analysis of the data show that 90% of Nebraska’s PPP loans were for less than $150,000 and were primarily used by businesses that file under the individual income tax, not the corporate tax. Seventy-five percent of the loans approved are for amounts under $50,000 and loans were received in all 93 Nebraska counties.

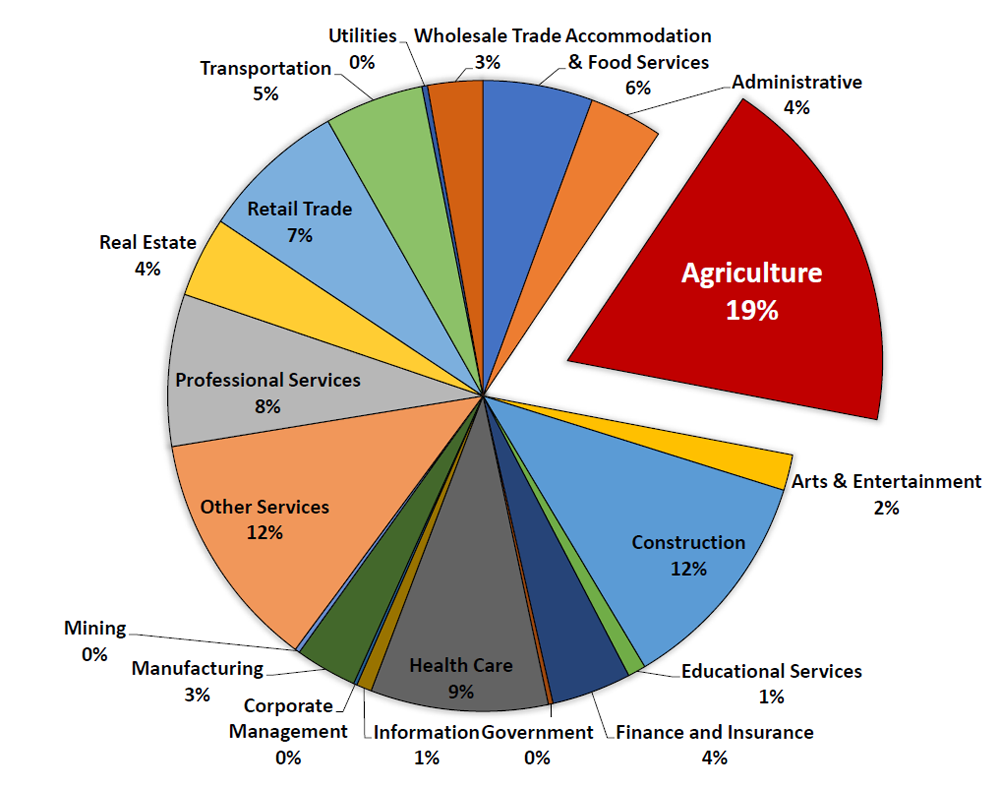

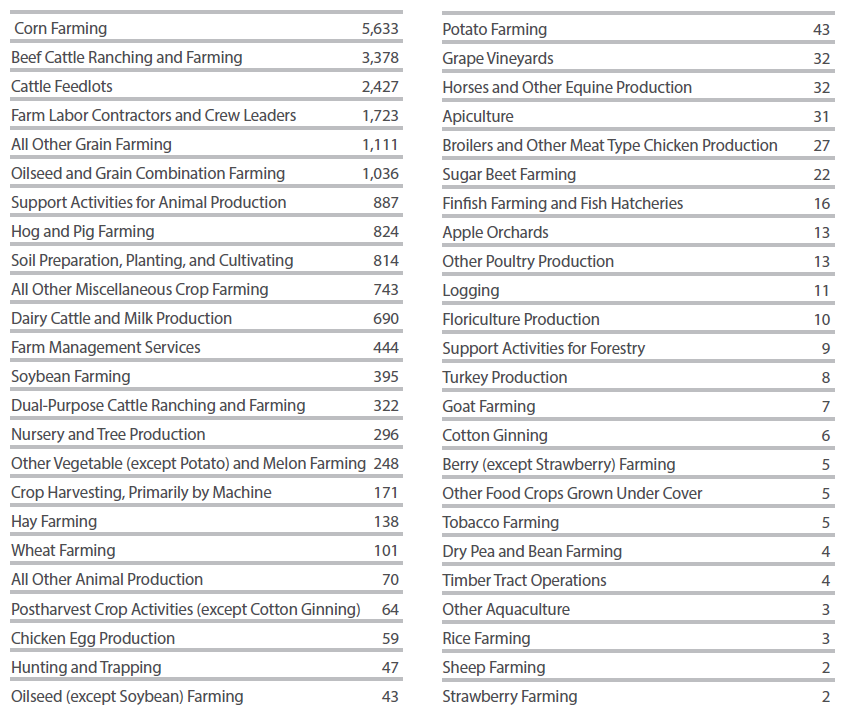

Looking at Nebraska’s PPP loans in aggregate, the 3rd congressional district received the greatest number of loans in the state which is partly due to the agriculture sector being one of the hardest hit industries, accounting for 19% of the state’s loans (See Figure 6) and 21,977 jobs (See Table 1). Specifically, corn farming and cattle ranching/farming and feedlots had the most jobs affected.

Figure 6: Portion of Nebraska PPP Loans in Agriculture

Source: SBA Paycheck Protection Program Loan Level Data. (2020, July 6). U.S. Department of the Treasury. https://home.treasury.gov/

Source: SBA Paycheck Protection Program Loan Level Data. (2020, July 6). U.S. Department of the Treasury. https://home.treasury.gov/

policy-issues/cares-act/ assistance-for-small-businesses/sba-paycheck-protec¬tion-program-loan-level-data.

Table 1: Breakdown of Agricultural Jobs Retained by PPP Loans Issued in Nebraska

Other Relief Programs

One of the major relief packages aimed specifically at agriculture because of the pandemic is the USDA Coronavirus Food Assistance Program, or CFAP. This program set aside $16 billion for direct support related to the pandemic, allowing agricultural commodity and livestock producers who suffered a 5% or greater price decline, or who had market supply chain disruptions, to apply through their local Farm Service Agency. In Nebraska, producers of most major commodities and livestock received financial assistance under the program. As of September 8, Nebraska producers were allocated $679 million through CFAP, with 60% of the aid flowing to livestock producers.

Producers can also receive assistance through traditional farm programs. Producers typically choose to enroll in one of three programs. The two most used programs are the Agriculture County Risk Coverage (ARC-CO) program and the Price Loss Coverage (PLC) program. Under the ARC-CO program, producers receive payments when actual revenue falls below a five-year average benchmark revenue. The PLC program provides payments when the average price for a commodity over the marketing year falls below a set reference price. For example, the reference price for corn is $3.70 per bushel. Payments are based on a portion of the acres enrolled in the programs. Payments received by producers in 2020 would be based on 2019 production and average prices from September 2019 to August 2020. Most of Nebraska’s corn acres are enrolled in the PLC program, while soybean acres are more evenly split between the two programs.

The federal crop insurance program is also used by crop producers to provide risk management against price or revenue declines. Crop insurance can be used to provide coverage against natural disasters (i.e. hail; wind damage; etc.), but depending on the type and level of coverage, can also be used to protect a portion of the expected revenue from a crop. Producers pay premiums which are subsidized by the federal government. The USDA’s Risk Management Agency is working with insurance providers to allow additional flexibilities in response to the pandemic.

Other programs and flexibilities the USDA is providing for farmers and agricultural producers during the pandemic include: adjustments on dumped milk, flexibilities for farm and commodity loans, flexibility for crop acreage reporting, and assistance for livestock producers that had to depopulate livestock due to impacts from the pandemic.2

Regulatory Structure of Related Industries

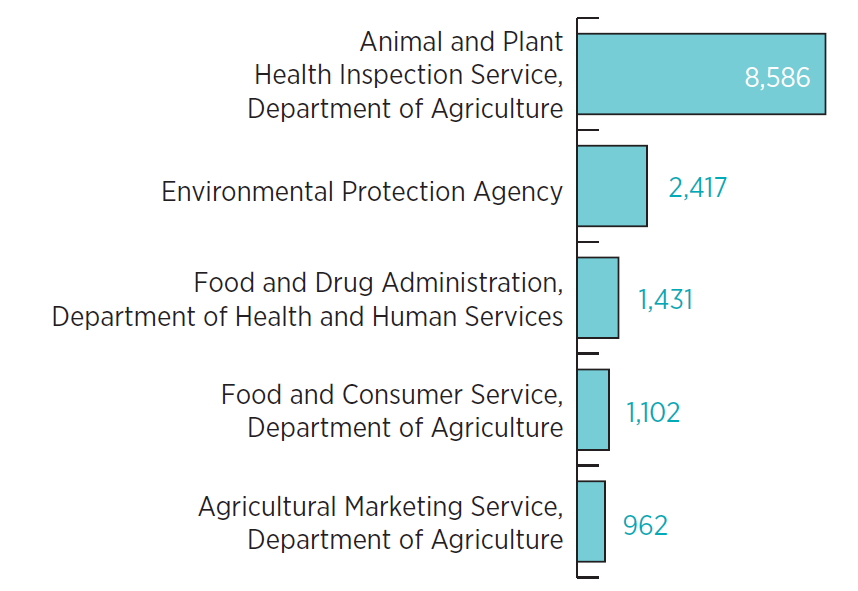

Regulation is a necessity in our society, but farming and agriculture is one of Nebraska’s top industries, and between federal and state regulations, it is no surprise our agricultural producers had a hard time reworking their business models to adapt to the pandemic. Federal regulations impact Nebraska 26% more than the nation overall, and regulations on farms make up a significant amount of that, with more than 20,000 restrictions imposed at the federal level.3 Figure 7 shows the agencies and the number of regulatory restrictions for each.

Figure 7: Top Regulators for Farming, Number of Industry-Relevant Regulatory Restrictions

Source: Mercatus Center at George Mason University

Source: Mercatus Center at George Mason University

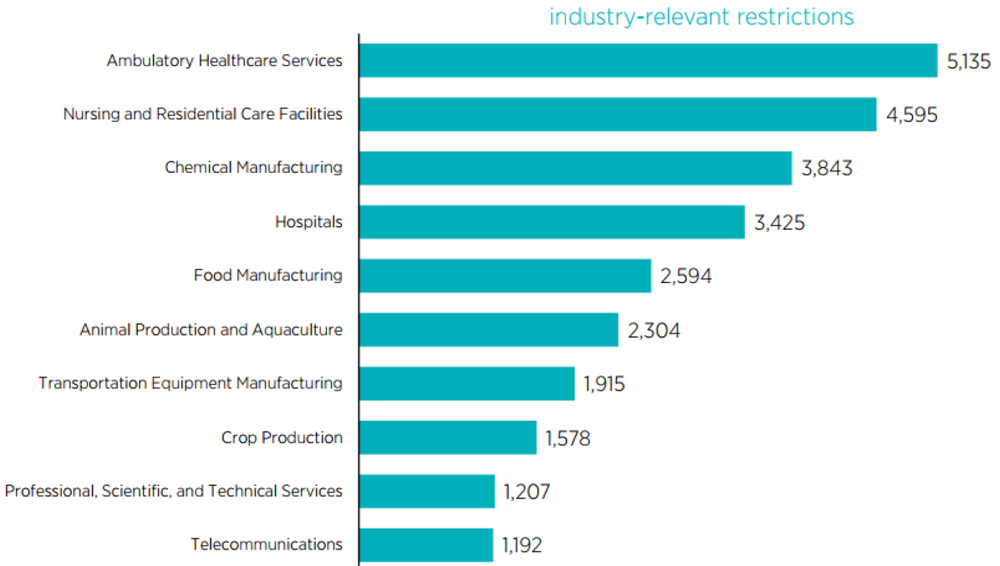

On top of federal regulations, there are also state regulations on agriculture. The Department of Environmental Quality, now part of the new Department of Environment and Energy (NDEE), is the second largest regulator in Nebraska with 8,565 restrictions, while the Nebraska Department of Agriculture is the fifth largest with 3,442 restrictions. When these restrictions are broken out by industry, it is easy to see the impact these regulations had on agriculture during the pandemic-related closures. Figure 8 shows that food manufacturing is the fifth top regulated industry in the state, followed by animal production and aquaculture, and crop production.

Figure 8: Top Ten Industries Targeted by Nebraska State Regulation in 2017 Source: “State Administrative Codes-Nebraska,” QuantGov, http://www.quantgov.org/data

Source: “State Administrative Codes-Nebraska,” QuantGov, http://www.quantgov.org/data

Some of these regulations are necessary for public health and safety, however, over the years, more and more regulations have been added at both the state and federal level, which has increased the complexity of doing business, and is one of the major reasons Nebraska’s agricultural producers could not adjust quickly to the pandemic-related market.

However, there were some positive and proactive changes made at the state level to help reduce the regulatory burden on agriculture from the governor’s office, the Nebraska Department of Environment and Energy, and the Nebraska Department of Agriculture. These included waiving certain hauling requirements,4 allowing for a new online program to certify or recertify pesticide applicators,5 allowance for more livestock at packing plant sites,6 permitting the disposal of excess milk and milk products in Livestock Waste Control Facilities,7 and many more.

Some of the regulatory burden was lifted when federal agencies issued waivers, such as the U.S. Environmental Protection Agency allowing the sale, distribution, and use of reformulated gasoline to address fuel concerns.8 Other regulations within Nebraska’s Pure Food Act were loosened when the U.S. Food and Drug Administration allowed more flexibility regarding nutrition labeling and packaging.9

Overall, agriculture is heavily regulated in Nebraska, both by federal and state entities. The flexibility and waiver of some of these regulations provides a perfect case study for the possibility of future permanent reforms to help lessen the regulatory barriers for Nebraska agriculture producers.

Animal Processing

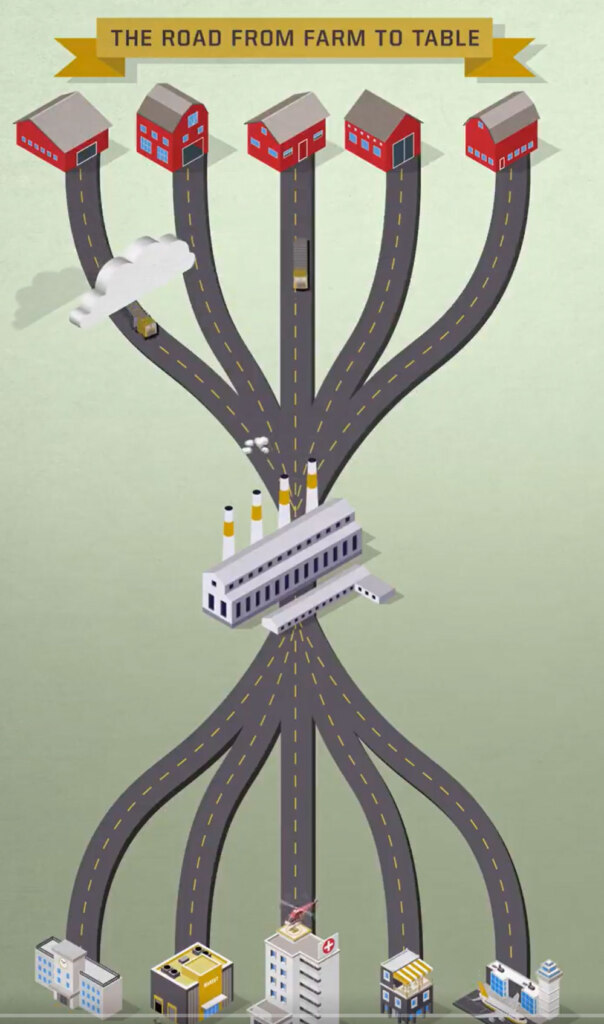

Probably one of the most well-known disruptions from the pandemic is the impact on the food supply chain. Over half of the nation’s food spending occurs in restaurants and cafeterias. When those sectors of the economy shut down at the same time, there was a dramatic spike for demand at grocery stores, and the industry was not prepared to repackage much of the food into retail products.

A simple example of this can be illustrated in the dairy industry. Many dairies package small cartons of milk for schools, and when schools closed, they were unable to change their manufacturing processes, or did not have the equipment to package the milk in gallon jugs to meet the demand at the grocery stores. However, cows continued to produce the same amount of milk. In some cases, products can be stored in warehouses, but this is not the case for perishable products like milk. Food banks do not have the equipment or volunteers to take bulk quantities of milk and convert it into a product someone can use in their home. As a result, the excess milk was dumped.

There are numerous farms and livestock producers in America, yet there are a limited number of meat packing plants. A Perdue University report stated there are more than 60,000 pork producers in the U.S., but roughly 60% of hogs are processed in just 15 large pork-packing plants.10 When the pandemic hit and workers in these plants were diagnosed with COVID-19, several of these plants were shut down, and as a result, the plants were not able to take as many cattle, hogs, chicken, etc. Consequently, the price for livestock fell, and farmers had nowhere to take their animals, while grocery stores were left with no meat to fill the shelves.

Figure 9: Disruption of Slaughter Creates a Bottleneck

Source: Purdue University

Source: Purdue University

The good news is that our nation is not without sufficient food, but rather the difficulty with the COVID disruptions is in processing and distribution. Processing livestock, such as cattle, sheep, swine, and goats, is administered by the Federal Meat Inspection Act, and poultry processing is regulated through Poultry Products Inspection Act. Both acts and additional USDA regulations require livestock meat processing to be subject to continuous inspection by government officials along with labeling, sanitation, and building regulations.11

In addition to the federal regulations, Nebraska law also has some stipulations related to animal/food processing. State law requires that farm businesses processing food must be licensed as a food processing plant and must comply with the Nebraska Food Processing Plant Requirements.12 These regulations cover aspects of the processing such as the water supply, plumbing and sewage systems, hand washing stations, refrigeration, special storage, and record keeping to avoid raw food product contamination. Some processors must also comply with additional requirements that are specific to the type of food processed.

In general, the Nebraska Department of Agriculture is responsible for the licensing of these facilities, and the regulations imposed are primarily for the health and safety risks of food production. The enforcement of these regulations, however, is executed by local health departments, and their individual inspectors make decisions as to how general regulations are applied. This means that an individual inspector or local health department’s interpretation of the rules may differ and could result in some processing facilities being subject to more stringent practices than others.

Ethanol Facilities

Nebraska is the second largest producer of ethanol nationwide and home to 25 ethanol plants with the capacity to produce 2.6 billion gallons of ethanol.13

Figure 10: Map of Nebraska’s 25 Ethanol Plants

Source: Nebraska Ethanol Board

Source: Nebraska Ethanol Board

When “stay-at-home” orders went into effect, automobile traffic drastically declined, along with the need for fuel. However, the main byproduct of ethanol production is distilled grain, which is a high protein and nutrient-rich food for livestock. To meet the demand for distilled grain, the ethanol plants continued to operate until they ran out of storage facilities across the nation. If it were not for the lack of storage, ethanol plants would have continued to operate.

The height of the slowdown for the ethanol industry hit in early May when 11 of Nebraska’s ethanol plants were shut down, and two operated at reduced capacity. While the operating costs of the plants fell due to reduced production, the decrease was not enough to offset the price reduction. Overall, Nebraska ethanol plants’ production fell to 55% of capacity in May due to lower demand and limited storage facilities.14

Storage facilities for ethanol are highly regulated since ethanol fuel is classified as a Class IB flammable liquid. The Occupational Safety and Health Administration (OSHA) sets these requirements. When the pandemic hit, and demand for ethanol dropped, there was no way to quickly store the excess production or change existing processes. Nearly every aspect of the ethanol business is influenced by federal and state regulations. For example, the regulations that influence the ethanol industry on a daily basis are from the Environmental Protection Agency, Department of Transportation, Alcohol Tobacco Tax and Trade Bureau, Food and Drug Administration, OSHA, and the Federal Trade Commission, to name a few.

While ethanol is a highly regulated commodity for safety reasons, there are issues that need to be addressed to hedge against another “pandemic-like” event. For example, Nebraska could produce 2.6 billion gallons per year, but federal regulations only allow the state to produce 2.1 billion gallons.15 This sheds light on the fact that even in a highly and necessarily regulated industry, like ethanol, there are opportunities for reform.

Conclusion: Future Implications from the Pandemic

Given the present economic circumstances, there is a great deal of uncertainty surrounding Nebraska’s agricultural sector and what the future holds. Both livestock and commodity prices have improved since June, but are still below pre-COVID-19 levels. A large variable will be the duration and magnitude of the effects of COVID-19 on the economy. Exports are another key variable. How much will the shrinkage in world economic growth affect world trade? And, will China abide by its purchase agreements signed earlier this year? The Costco project in Fremont is one positive factor, as it should provide additional economic activity. Farm program payments and other forms of federal financial assistance will also play a role in the ultimate 2020 outcome.

Beyond 2020, the effects of COVID-19 will be felt by Nebraska agriculture for many years and raises several important questions for the state for the long term. Estimates suggest that as much as 35-50% of the state’s net farm income this year could come from federal financial assistance due to COVID-19. It’s unlikely this level of financial assistance can be sustained. Will markets regain their strength to offset a drop in federal assistance? The world economy, trade policies, and political differences have cast a dark cloud over future growth in international trade. The value of exports equal 30% of Nebraska farm receipts. Will economic growth, trade policies, and politics post-COVID-19 allow for continued growth in trade needed by Nebraska’s agricultural producers? Finding and securing skilled labor was a problem for agriculture pre-COVID-19 and COVID-19 only exacerbated the problem. Will this change? COVID-19 and the subsequent supply chain problems provided direct marketing opportunities for Nebraska producers to sell directly to consumers. Will these opportunities materialize into permanent changes in how products are marketed? The questions are many.

Chancellor of the University of Nebraska-Lincoln Ronnie Green has said that Nebraska should strive to be at the epicenter of global food production—a notable goal. Nebraska agriculture has many advantages from its natural resources, infrastructure, educational system, people, and heritage to achieve this goal. But growing Nebraska agriculture and becoming the epicenter of global food production won’t just happen. Nebraska producers, agricultural businesses, elected officials, and educational leaders should think strategically on how Nebraska can marshal these advantages in a post-COVID-19 world. This should include a thorough examination of policies regarding regulations, infrastructure, tax policy, innovation, and others to assure the state’s agricultural sector is on the proper path for growth.

The authors would like to thank Platte Institute Policy Intern Jaliya Nagahawatte for his contributions to this paper.

Endnotes

- Beghin, John, “Some Economic Implications of the COVID-19 Pandemic in Nebraska” (2020). Cornhusker Economics. 1052. https://digitalcommons.unl.edu/agecon_cornhusker/1052

- US Department of Agriculture, “Coronavirus and USDA Assistance for Farmers” (2020). https://www.farmers.gov/coronavirus#:~:text=USDA’s%20Coronavirus%20Food%20Assistance%20Program,face%20additional%20significant%20market%20costs.

- Patrick A. McLaughlin and Oliver Sherouse, The Impact of Federal Regulation on the 50 States, 2016 ed. (Arlington, VA: Mercatus Center at George Mason University, 2016).

- State of Nebraska Executive Order No. 20-21 “Coronavirus – Continued waiver of motor carriers safety regulations”, https://nda.nebraska.gov/COVID-19/ContinuedWaiverMotorCarrierSafetyRegs.pdf.

- Press Release (April 13, 2020), “NDA order eases restrictions on pesticide applicator license holders”

- Press Release (May 27, 2020), https://nda.nebraska.gov/COVID-19/LivestockTemporaryIncreaseGuidance.pdf.

- Memorandum (April 3, 2020), “Guidance for Dairies Unable to Ship Milk to Processors Due to COVID-19 Pandemic”, https://nda.nebraska.gov/COVID-19/MilKExceptionGuidance.pdf.

- NE Department of Agriculture, (March 31, 2020), https://nda.nebraska.gov/COVID-19/FuelWaiver_033120.pdf.

- Nebraska Department of Agriculture (April 14, 2020), “Order No. 04142020), https://nda.nebraska.gov/COVID-19/FuelWaiver_033120.pdf.

- Croney, Candace and Lusk, Jayson, “The Road from Farm to Table” (April 28, 2020). Perdue University College of Agriculture, https://ag.purdue.edu/stories/the-road-from-farm-to-table/.

- Rumley, Elizabeth and Wilkerson, James, “Meat Processing Laws in the United States – A State Compliation”. The National Agricultural Law Center, https://nationalaglawcenter.org/state-compilations/meatprocessing/.

- Endres, Bryan A., Armstrong, Rachel H. “Nebraska Direct Farm Business – A Legal Guide to Market Access” (2013). University of Illinois at Urbana-Champaign, https://nationalaglawcenter.org/wp-content/uploads/assets/articles/NEdirectfarm.pdf.

- Nebraska Ethanol Board, https://ethanol.nebraska.gov/.

- Beghin, John, Timalsina, Sushant,“The Impact of the COVID-19 Crisis on Nebraska’s Ethanol Industry” (May 27, 2020). Cornhusker Economics, https://agecon.unl.edu/cornhusker-economics/2020/The-Impact-of-COVID19-Crisis-on-Nebraskas-Ethanol-Industry.pdf.

- Berry, Roger (2020), phone conversation in July 2020.