Nebraska drops to 35th in national tax ranking

Nebraska has fallen in the ranks of the Tax Foundation’s annual State Business Tax Climate Index.

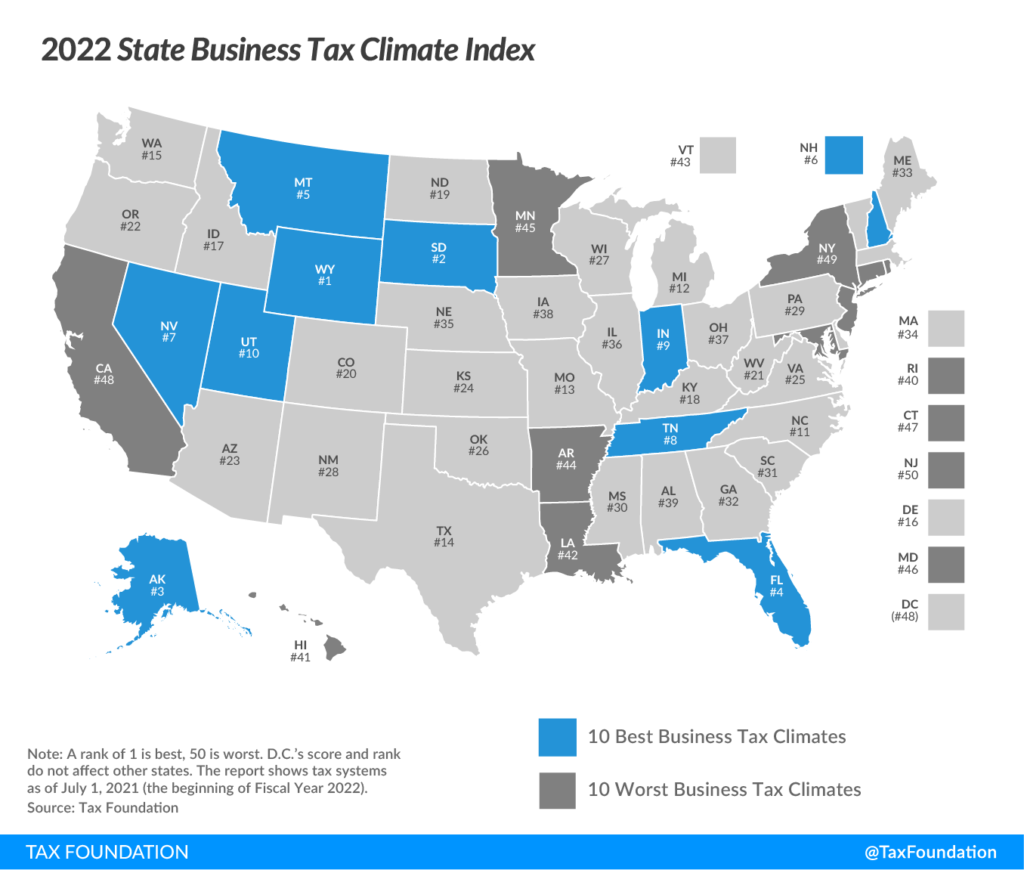

In the 2022 Index, Nebraska dropped 2 places in the overall ranking, landing at 35th out of 50, with 1st being the best.

Looking at the breakdown, the state ranks best for unemployment insurance tax and sales tax. These tax rates are competitive, and Nebraska does much better than many states at avoiding sales taxes on business inputs. The taxes where the state is behind most of the country are personal income tax, corporate income tax, and property tax.

When you look at the timeline of the index, it is notable that Nebraska was much better positioned nationally in 2019 then today. The main reason for that is not necessarily what Nebraska did, but what Nebraska didn’t do.

For example, Kansas exempted GILTI income for corporations, which improved their corporate score to surpass Nebraska. Iowa is phasing out its inheritance tax, which improves its property tax ranking, and exempted GILTI, which increased its corporate rank. Indiana and Missouri, while both ahead of Nebraska, both reduced rates for their income taxes, which helped improve their rankings even more.

Many states have been using record-breaking revenue surpluses to reform their tax codes and become more competitive. As a result, their ranking on this index has improved, despite the pandemic. Unfortunately, while other states have adopted significantly more business-friendly tax codes, Nebraska has dropped in the rankings because it has mostly maintained the status quo over the same period of time.

See the map below for all the state's rankings for 2022.

However, the Nebraska Legislature has made some promising commitments to improve the tax system, specifically on the corporate side. The Tax Foundation says this new ranking doesn’t include recently passed legislation (LB432) to gradually reduce Nebraska’s corporate income tax rate to the same rate as the personal income tax.

But they also note that the Legislature still needs to pass additional legislation to fully phase in that plan. If lawmakers continue to prioritize making Nebraska’s business tax system simpler and more competitive, it will improve the state’s ranking, and enhance the many other efforts underway to strengthen Nebraska’s economy and quality of life.