Iowa’s repeal to leave Nebraska with region’s only inheritance tax

Thanks to a comprehensive tax reform bill (SF 619), Iowa has successfully set a date for repealing its inheritance tax.

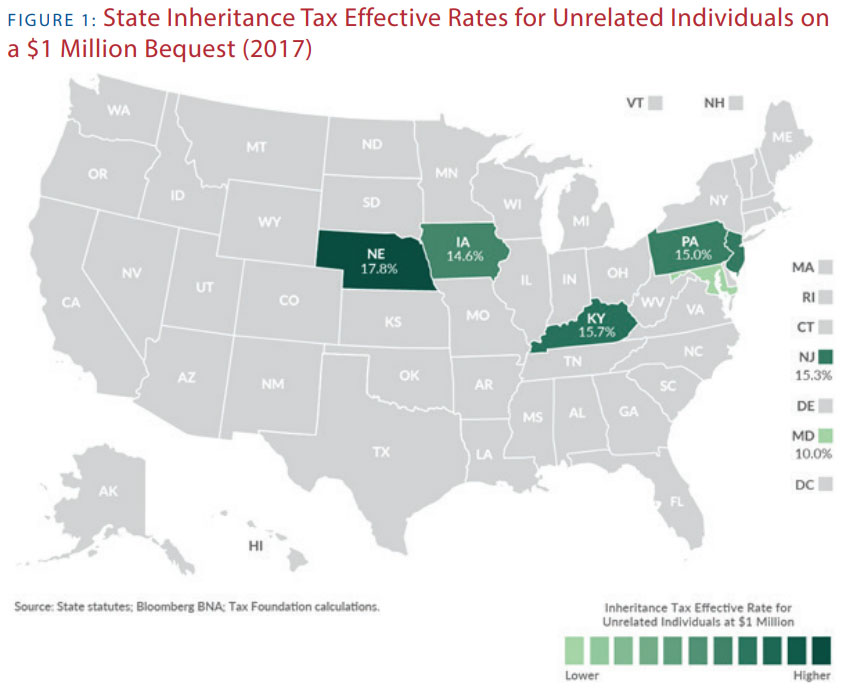

Iowa will phase down the tax by 20% each year until it is repealed in 2025, leaving only 5 states in the nation left with an inheritance tax. Among them, Nebraska has the highest rate nationwide, at 18% for inheritors not related to the decedent. Aside from Kentucky, all the other states with an inheritance tax will now be situated in the Mid-Atlantic region, making Nebraska a clear geographic outlier.

In 2021, two bills were introduced in the Nebraska Legislature to modernize and reduce the inheritance tax, LB310 and LB377. While neither of these bills proposed to completely repeal the inheritance tax, both would make the tax less burdensome and help modernize it from its 19th century roots.

The inheritance tax, which is levied on the beneficiary of an estate and not on the estate itself, has been shown to have a particularly negative impact on family farms and businesses in Nebraska. While most states do not make the transfer of property after death a taxable event for property of any value, Nebraska can impose inheritance taxes and compliance costs even on taxpayers receiving relatively modest inheritances.

Historically, some believed the inheritance tax was a necessity to break up large fortunes or to redistribute accumulated wealth. But studies have found the tax to be hostile to economic growth because of its destructive impact on capital formation and investment, as well as having high compliance costs.

In addition, a study released in April 2021 found that most present-day millionaires are made, not born.

The overwhelming majority (79%) of millionaires in the U.S. did not receive any inheritance at all from their parents or other family members. While one in five millionaires (21%) received some inheritance, only 3% received an inheritance of $1 million or more.

According to the survey, 8 out of 10 millionaires come from families at or below middle-income level. Only 2% of millionaires surveyed said they came from an upper-income family.

Which means, in Nebraska, we are primarily levying this arcane tax on hardworking Nebraskans that have saved their entire lives and just happen to pass along something to their children or other family members.

Tax modernization is a focus of the current Nebraska Legislature, and reforms to the 19th century-inspired inheritance tax need to be at the top of the list. Iowa’s planned repeal of the inheritance tax just highlights how uncompetitive Nebraska is by being the only state west of the Mississippi with this tax. Nebraska has not made a substantial change to its inheritance tax law since 2007. As a byproduct of standing still, Nebraska has fallen behind as other states continue to update their tax code for a 21st century economy.

Are you one of the 78% of Nebraskans who agree it’s time to lay the county inheritance tax to rest? Sign the petition to tell the Unicameral to eliminate this outdated and inequitable tax on Nebraska families.

Sign The Petition

End Nebraska's Inheritance Tax

Simply fill out the form below to sign the petition.

Learn More >