What is Nebraska’s likelihood of enacting a tax increase next year?

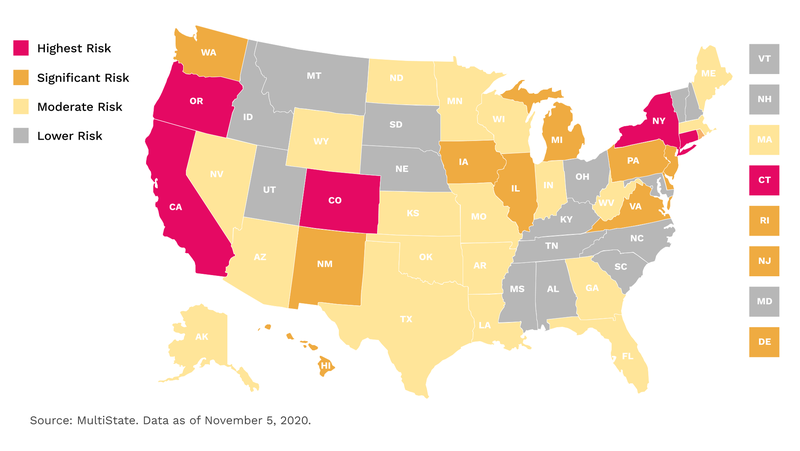

That is the focus of a most recent white paper from a private sector consulting firm, MultiState. They conducted an analysis of the 50 states and their likelihood of enacting a tax increase next year.

Nebraska is in the “lower risk” category thanks to not having a large budget deficit, having an accepted amount in the rainy-day fund (cash reserve) and having a governor that opposes tax increases.

Our neighbors, however, and not so lucky. Colorado is in the “highest risk” category while Iowa is considered “significant risk”. One of the similarities between Iowa and Colorado, according to the report, is that they both had a 5-10% revenue decline, and this deficit exceeded their rainy-day fund signaling they need revenue and are more likely to enact a tax increase.

Nebraska is on the path to continued recovery and it is important we remember that tax increases stifle economic growth, not enhance it.