Tax Foundation calculations prompt explicit response from rapper 50 Cent

Many of us focus on the most hated tax in Nebraska, which is the property tax, but did you know the income tax can change some people’s minds about business decisions and even who they vote for?

A tweet from rapper-turned-actor and entrepreneur 50 Cent implies he’d prefer the Trump tax policy based on analysis of the Biden plan done by the Tax Foundation. Biden’s tax plan would increase tax rates, but not for those who make $400,000 or less, which includes most Americans. However, an increase in the top marginal income tax rate would negatively impact many businesses. At the request of a reporter at the financial network CNBC, Tax Foundation Vice President for State Projects Jared Walczak provided the calculations below, which drew 50’s ire:

Here’s 50 Cent explaining his economic rationale in a follow-up tweet:

👀Yeah, i don’t want to be 20cent. 62% is a very, very,bad idea. 😟i don’t like it ! #abcforlife nov 18 #starzgettheapp pic.twitter.com/y9TsSs0o6Q

— 50cent (@50cent) October 20, 2020

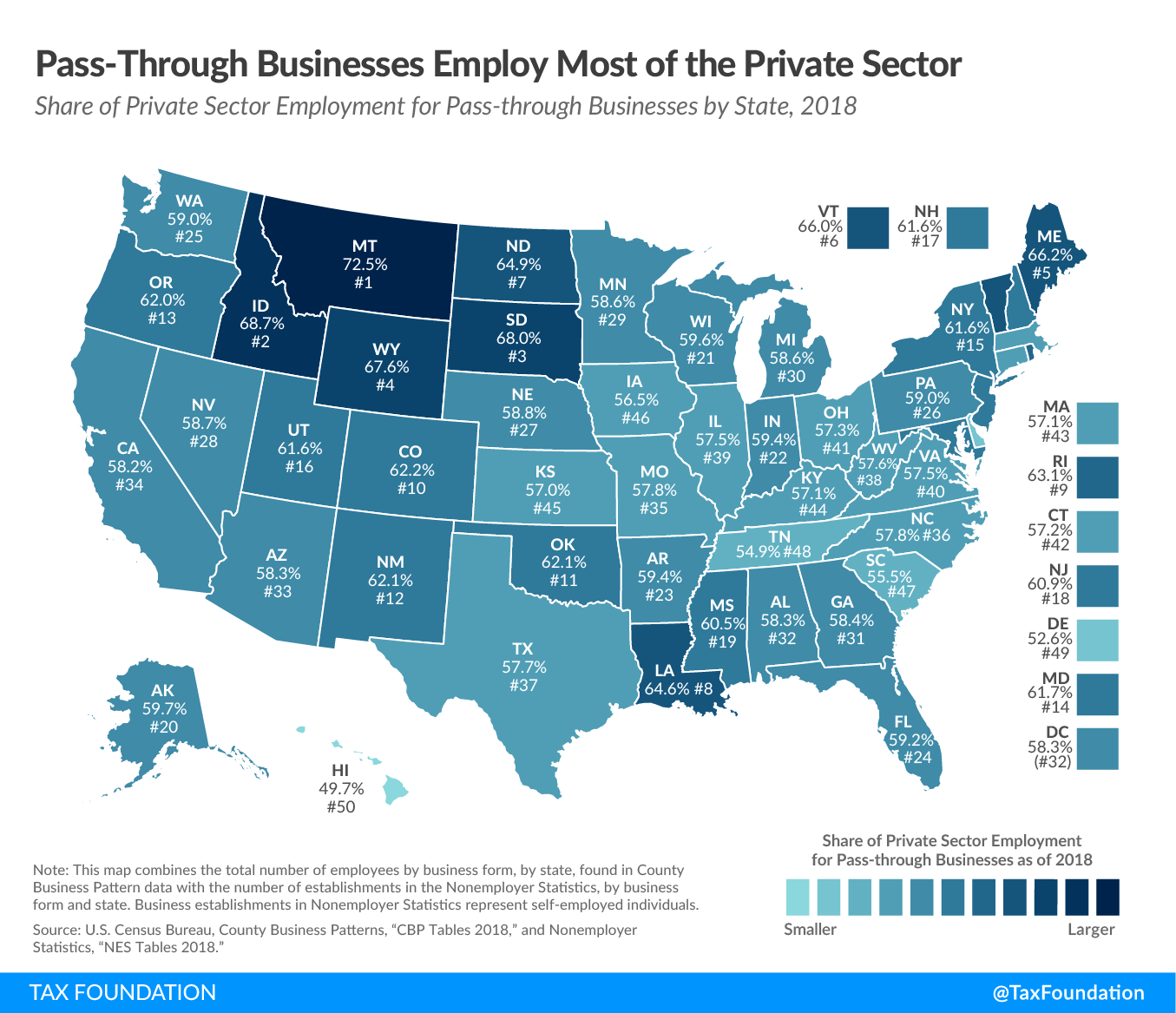

Remember, high personal income tax rates make the state less attractive to businesses that are organized as partnerships, sole proprietorships, limited liability companies, S corporations, and other pass-through entities. Most businesses in the United States (and Nebraska) and new businesses are organized as pass-through entities instead of traditional C corporations. Pass-through entities are taxed at the shareholder level, and as a result, they are reluctant to expand or relocate to states with high personal income tax burdens. Academic studies have found that individual income taxes are among the most detrimental to economic growth.

This map shows that nearly 60% of Nebraska’s employment comes from pass-through businesses. While our rates are nowhere as high as California, New Jersey, or New York City – it is still something to be aware of.

Taxes make an impact. Even if you make less than $400,000 a year, a business certainly can make more than that. If your employer has to pay more in taxes, that means they have to cut somewhere else, which means less pay raises, hiring of new employees, or investment.

On a personal note – I’ve never listened to 50 Cent’s music. However, I thought it was interesting that a high-profile music industry personality took the time to read something from the Tax Foundation and that taxes are influencing his decisions.