This Time, It’s Personal: Nebraska’s Personal Property Tax

Note: This report addresses Nebraska’s personal property tax on business equipment. To read our latest report on Nebraska’s property tax on real estate, click here.

Quick Access to:

- How Personal Property Taxes Impact Each County

- Examples of Nebraska Businesses Impacted by Personal Property Tax

- An In-Depth Look at Nebraska’s Personal Property Tax

Introduction

Property tax in Nebraska is perhaps the most important and discussed issue in state government. The property tax in Nebraska is older than the state itself, instituted in 1857 by the territorial legislature and levied at the state level until the 1966 constitutional amendment abolished the state property tax.1 However, local taxing governments began levying property tax in Nebraska in 1867 and have been the only levying entities since 1967.2

When most people think of property tax, they immediately think of their real property. Real property is stationary and includes land, buildings, improvements, fixtures, mobile homes, minerals, and wells. Nebraska also taxes another type of property, known as tangible personal property (tangible personal property will be called personal property throughout this paper).

This is property that is able to be touched and moved which generally consists of machinery and equipment that is not permanently affixed to the real property. The third type of property is intangible property, which includes stocks, contract rights, bonds, bank accounts, and other similar items.

After the constitutional amendment in 1966, both intangible property and personal property taxes on household goods were abolished.3 Today, the taxes that remain are on real property and business personal property. Many in Nebraska are unaware of the personal property tax because it is only levied on businesses.

Total amount of tax collected in Nebraska

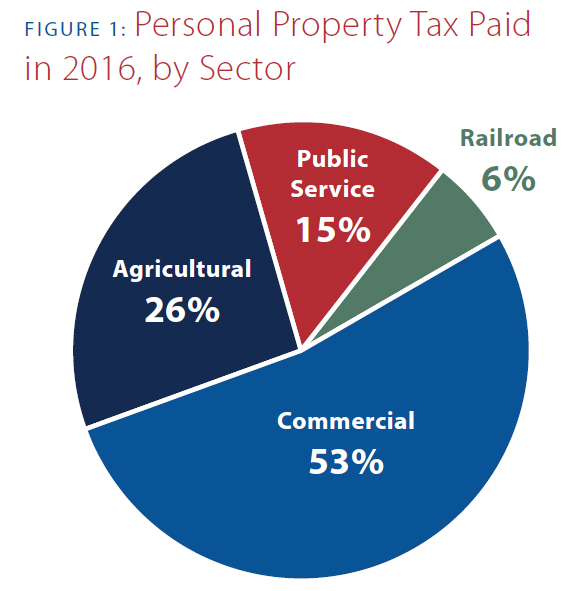

In 2016, personal property accounted for 5.6 percent of total property taxes levied in Nebraska. Of that amount, commercial personal property was the largest category at 53 percent, and agricultural personal property was the second largest category at 26 percent. Public Service Commission personal property was the third highest and accounted for 15 percent of total personal property taxes levied statewide. Finally, railroad personal property made up the remaining 6 percent.

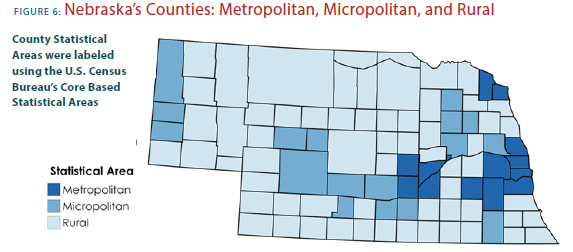

While collected at the political subdivision levels, when we look at collections by county,** these figures vary greatly from one category to the next. For example, in Douglas County over 80 percent of the personal property tax comes from the commercial category, while less than half of a percent comes from agriculture. However, in Logan County, over 90 percent of the tax is from agriculture and less than 4 percent comes from commercial. There are 16 counties that don’t have any railroads located in them, so they do not collect any personal property tax in that category. Other counties are more diversified in their personal property tax such as Lincoln County, where each category is approximately 25 percent of their total personal property taxes collected.

National Snapshot

Eight states do not levy a personal property tax (Delaware, Hawaii, Illinois, Iowa, New Hampshire, New York, Ohio, and Pennsylvania) and four additional states (Minnesota, New Jersey, North Dakota, and South Dakota) tax very little.4 However, many states have recognized the detrimental nature of this tax and have enacted significant exemptions, making the impact of the tax vary greatly amongst states. When looking at a regional snapshot, six Midwestern states—Iowa, Illinois, Minnesota, North Dakota, Ohio, and South Dakota— currently exempt all or nearly all personal property from taxation, while others, like Indiana and Michigan, have recently adopted reforms to reduce their personal property tax burdens.5

History and Key Developments

In the early 1990s, Nebraska experienced a personal property crisis. The crisis began when the railroads questioned whether Nebraska was complying with the federal Railroad Revitalization and Regulatory Reform Act of 1976 (the so-called 4-R Act). That Act was intended to save railroads from financial collapse and contained a provision (in Section 306(1)(d)) that prohibited imposition of any discriminatory tax on railroads. In 1988, the U.S. Court of Appeals in the Trailer Train v. Leuenberger case held that Nebraska discriminated against railroads because the state provided exemptions for agricultural and business inventories, livestock, and farm machinery that were not available to railroads with no such property. The state was prevented from collecting personal property tax from the railroads. Further complicating the situation, the Nebraska Supreme Court ruled in the Northern Gas v. State Board of Equalization case that the state constitution required pipelines, telephone companies and other centrally assessed entities to be treated equally and have their property equalized to that of the railroads, which were paying no tax. Later, in the 1991 case of MAPCO Ammonia Pipeline v. State Board of Equalization, the Supreme Court ruled that all prior personal property exemptions were unconstitutional, thus reversing earlier cases.

As a result of this situation, the Legislature passed a constitutional amendment in 1992 which separated real and personal property in the uniformity clause of the state constitution, allowed personal property exemptions, allowed legislation to revise assessment methods applied to personal property, and created a distinct class of railroad personal property. In order to settle litigation with the centrally assessed entities, the Legislature added farm equipment back into the property tax base, valuing it at net book value. It also changed the assessment of business equipment from market value to net book value (cost minus depreciation).6

Since these developments, there have been many changes to the structure of the state’s personal property tax as the Legislature has addressed multiple concerns. The most notable of these changes are exemptions that have been enacted in the last decade. One of the larger changes was the Beginning Farmer Tax Credit Act, which had a component added in 2008 that authorized several exemptions for personal property. This legislation was expanded upon when personal property used in wind generation was exempted in 2010 and data center property was exempted in 2012.

The most recent was the enactment of the Personal Property Tax Relief Act that was signed into law in 2015 and took effect in 2016, which exempts the first $10,000 of assessed value from personal property tax.7

Economics of the Personal Property Tax

When discussing taxes, one should always look at the economic implications of the tax to assess the true impact on economic growth. In the case of Nebraska’s personal property tax, the economic impact reaches far beyond those Nebraska businesses that are required to file each year.

Personal property taxes distort or interfere with markets by discouraging capital investment, expansion, and replacement.8 Residents and businesses may choose to delay or forego investments in new technology or other capital to avoid the tax consequences or compliance cost of the personal property tax, hurting the state’s economy over time. When a business wishes to invest in new technology or some other form of capital to enhance operations, they may choose to delay or forego such investments to avoid the tax consequences or the compliance cost of the personal property tax.

According to research by Creighton University economist Ernie Gross, the capital per worker in Nebraska is $78,371, which is substantially lower than the $105,605 average of neighboring states and $122,736 nationwide.9 What this means is that acquiring new or additional capital in Nebraska is more expensive relative to other business costs.10 This tax has clearly altered the decision-making process of Nebraska businesses because they are choosing to reduce their tax burden instead of investing in new equipment. Companies choosing to forego capital investment to avoid the tax are operating at a competitive disadvantage when compared to those in other states where the tax is not levied or significantly reduced.

Along with altering business decisions, personal property taxes may be more harmful than real property taxes due to the fluidity of personal property and how it responds to changes in the tax base more readily than immobile real property. Businesses will tend to gravitate to areas of the state where the personal property tax is lower. Counties and municipalities use this to their advantage when attracting new investment, which can undercut nearby counties and cities.11

Four Principles of Sound Tax Policy

There are four main principles of sound tax policy economists use to evaluate the impact of a tax: simplicity, transparency, economic neutrality, and stability.12 When applying these principles to the personal property tax, it is clear that Nebraska’s tax does not align with the majority of these principles.

SIMPLICITY. The state’s various assessment ratios, tax rates, and depreciation schedules make it difficult for business owners to estimate how much tax they will owe on different types of personal property. Substantial compliance and administration costs exist because the tax is considered “taxpayer active,” meaning that businesses must fill out forms listing all of their taxable personal property. Businesses in Nebraska must use valuable resources filling out forms and identifying their property that is subject to taxation and then explain the required information, which includes, but is not limited to, a physical description, the year of purchase, the purchase price, and any identifying information such as a serial number.13

TRANSPARENCY. Many consumers in Nebraska have no idea this tax exists on businesses. When a business must allocate part of its financing to pay for the tax, they must find some way to offset that cost with revenues. Thus, this tax is partly passed onto consumers in Nebraska because they are paying higher prices to offset the business expense of the personal property tax. Part of the reason consumers are unaware of this tax is because it is hidden and it cannot be shown on receipts such as the retail sales tax.

NEUTRALITY. When a tax is applied differently to different products, the principle of neutrality is violated, which is the case with some of Nebraska’s exemptions, such as exempting certain businesses or items over others.

STABILITY. The last principle is perhaps the only one that may apply to the personal property tax. Many will argue that personal property tax is a relatively stable source of government revenue, as the proceeds from the tax are somewhat constant from year to year. However, there has been no research done to date that examines the stability of the personal property tax separately from the stability of the real property tax, so the true stability of the tax is unknown.

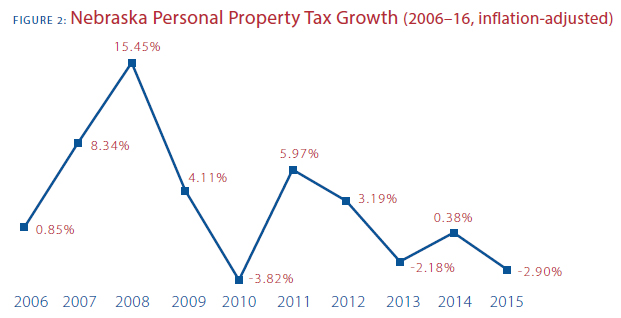

An evaluation of Nebraska’s personal property tax collections over the last ten years shows that Nebraska’s statewide personal property tax collections have increased on an inflation-adjusted measure, yet the tax has been far from stable.

In 2006, statewide collections were $164.9 million and in 2016 they were $217.1 million, for a ten year inflation-adjusted increase of 32 percent.14 During this time, the state experienced many ups and downs in the collections of the tax, with three of the ten years returning negative growth; therefore, it can be concluded that while Nebraska’s personal property will collect a certain amount of tax revenue, it should not be considered a stable revenue source for political subdivisions. Since many subdivisions budget on revenue projections, it is difficult to rely on tax revenue when there are wide fluctuations from year to year.

Personal Property Tax related to the share of the overall Property Tax burden in Nebraska

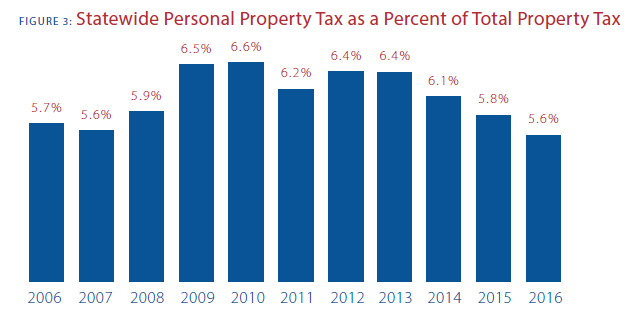

In 2016, the State of Nebraska collected almost $4 billion in total property tax, which equates to $2,048 per person. From the total tax figure, personal property taxes amounted to $217 million, or $114 per person. Over the past ten years, the amount of statewide personal property tax collected as a percent of total property taxes has ranged between 5.6 percent and 6.6 percent, averaging 6.1 percent.15

Features of Nebraska’s Personal Property Tax

While the personal property tax is considered part of the overall property tax base in Nebraska, it is treated much differently than the real property tax. It is assessed differently, mainly because some of the personal property can be depreciated. Depreciable taxable property is used in a trade or business or for the production of income with a determinable life of more than one year. It is depreciated on a scale ranging from three to twenty years, depending on the type of property.

Valuation

When businesses assess their property, they must prepare a separate form for personal property to determine its value. Once the exempted items are removed from the assessment, the remaining value must be determined.

Assessment Ratio

An assessment ratio is a method of valuing personal property where an established percentage of the property’s value is actually taxed. For example, an assessment ratio of 50% means that only half of the value of the property is taxable. Nebraska calculates personal property value by its net book value through a Depreciation Factor Table.16 As property ages, its assessed value also decreases at a set rate. Below is an example from the Nebraska Personal Property Return form:

“Example 3: A farmer incorporates his farming operation and transfers a tractor to the corporation. The tractor was placed in service three years earlier with a Nebraska adjusted basis of $40,000 and has a recovery period of seven years. For property tax purposes, the corporation will be taxed on a three-year-old tractor with a Nebraska adjusted basis of $40,000, a depreciation factor of 55.13% (from Table 1), and a net book value (taxable value) of $22,052” [$40,000 x 55.13% = $22,052].17

As the tractor ages each year, the depreciation factor will decrease, meaning the taxable value will decrease as well. However, if a new tractor is bought to replace the old one, the process starts over.

Tax Rates and Classes of Property

After the assessment, political subdivisions determine the tax rate to be applied on the property’s assessed value. Political subdivisions take numerous approaches to their tax rates, but all taxing entities apply the same rate across all property, regardless of whether it is real or personal property.

When reporting on assessed and levied personal property, Nebraska divides it into four categories: commercial, agricultural, public service (utilities), and railroads. Commercial and agricultural property is assessed and levied by the local political subdivision. However, public service18 and railroad property is assessed by the state, then levied by the subdivision. The state also assesses car line and air carriers. The reason the state assesses public service and railroad property is due to the limited jurisdiction of subdivisions. Since political subdivisions are only allowed to assess property within their own borders, the state must assess property that crosses county and state lines, such as railroad tracks and gas pipelines. This public service property includes telephone lines, cellular/wireless communication infrastructure, and fiber-optic lines. The state then gives each subdivision an assessed value they use to levy the tax.

Refunds

If a taxpayer files an amended tax return or their tax return is changed or corrected in a way that it affects the Nebraska adjusted basis of the personal property, then a recalculation of the personal property tax is conducted. If the change results in personal property becoming exempt or reduces the net book value of the property for a tax year, then the taxpayer must request a refund of the property tax paid. If a refund is warranted, it will be issued by the county treasurer.19

Examples of Nebraska Businesses Impacted by Personal Property Tax

Breweries

Brewers pay plenty of personal property tax. Brewing tanks are taxable business equipment, as are tools used to store and transport beer once it is placed into containers, including pallets, pallet jacks, and hand trucks.

Beauty salons

The more services a salon provides for its clients, the more personal property tax they may have to pay. Business items like shampoo basins, facial steamers and magnifying lights, and even the styling chair the client sits in are taxable equipment.

Clothing stores

The clothing customers try on is not taxed because is it considered business inventory, which is exempt. However, the rack that the clothing is hanging on is taxed because it is considered a trade fixture that assists with business. Other items that are taxed are the computerized cash register, the software used on the computer, and even the desk it is sitting on.

Farms

As with commercial businesses more often based in urban areas, agricultural producers are also burdened by the personal property tax. A wide range of equipment for farming is taxable in Nebraska, including pivots, combine harvesters, and tractors. Upgrades made to these pieces of equipment, whether to modernize their functions or improve efficiency, are also considered personal property. Farmers can face significant increases in their personal property tax bill just for making these investments.

An In-Depth Look at Nebraska’s Personal Property Tax

- The personal property tax in Nebraska makes up 5.6 percent, or $217.1 million, of the total property taxes collected statewide.

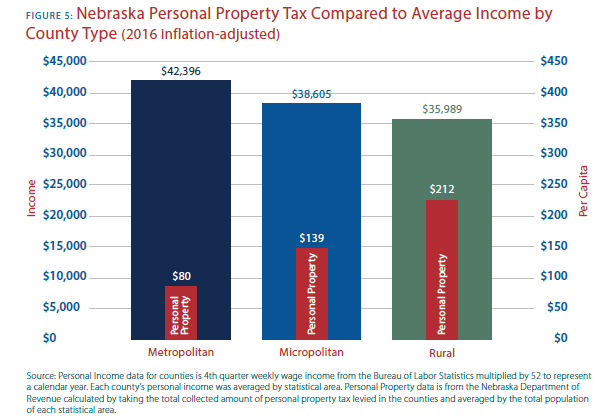

- Rural Nebraskans pay the most on a per person basis at $211.87.

- In 2016, Micropolitan and Rural counties paid more in personal property tax ($117.5) than Metropolitan counties ($99.6 million).

- Rural counties have the lowest average personal income, yet pay the most personal property tax per capita.

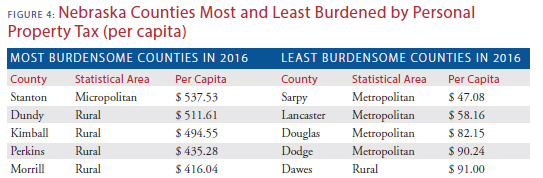

- Stanton County residents paid the most statewide in 2016, amounting to $537.53 per person.

- Sarpy County residents paid the least statewide in 2016, at $47.08 per person.

- Sixteen counties do not contain any railroads, thus do not collect any railroad personal property tax.

- Rural and Micropolitan counties have almost identical populations; yet rural counties collect more than $25 million more than Micropolitan counties.

- Stanton County collects the most per capita in commercial personal property tax, $306.87 per person.

- The counties collecting the most in commercial personal property are Sarpy County at 86% of their total personal property and Stanton County at $306.87 per capita. The county collecting the least is Blaine County at 0.8% or $2.49 per capita.

- The counties collecting the most in agricultural personal property are Logan County at 91% of their total personal property and Hayes County at $273.10 per capita. The county collecting the least is Douglas County at 0.6% or $0.45 per capita.

- The county collecting the most in public service personal property is Dundy County at 50% of their total personal property, or $253.96 per capita. The county collecting the least is Boyd County at 1.4%, or $2.91 per capita.

- Of the counties that collect railroad personal property, Hooker County collects the most as a percent of their total personal property at 67% and Hayes County collects the most per capita at $273.10. Collecting the least is Franklin County at 0.02% or $0.04 per capita.

Reform Ideas

Each year, lawmakers ask how they can reduce their constituents’ property tax burden. There are many states that have reformed their personal property tax, and many research organizations that have studied the effects of these reforms.

Taking lessons from other states is imperative in order to avoid pitfalls and pursue policies that are successful. Organizations such as the National Conference of State Legislatures, the Tax Foundation, the American Legislative Exchange Council, as well as multiple state-based organizations support these reform ideas.20

While not comprehensive, a cursory overview of state legislation focused on personal property showed there have been more than 35 pieces of legislation in more than 25 states over the last ten years. Specifically, between 2000 and 2009, there were 28 states that decreased their reliance on personal property revenues, while four states increased their reliance on the tax.21 In 2017 alone, there were more than a dozen states that introduced some sort of legislation amending their personal property tax in some way. This included neighboring states Colorado and Kansas, as well as Alaska, Connecticut, Arizona, Massachusetts, Nevada, New Mexico, Oregon, Rhode Island, West Virginia and Wisconsin.

While there are many reforms being proposed and implemented in states, this publication focuses on the reforms that would apply directly to Nebraska.

De Minimis Exemption

De minimis is a Latin term that means trivial or minor. The de minimis exemption is a reform process where a trivial or very small amount of personal property value under a specific dollar threshold is exempted over a period of time. Nebraska has already introduced this sort of exemption with the passage of the Personal Property Tax Relief Act. Under current law, the first $10,000 of personal property is exempt from the tax. A de minimis exemption would slowly increase the dollar amount of the exemption incrementally each year until the threshold is so high it essentially exempts all personal property tax, at which point the tax can be repealed.

One of the major benefits to this exemption is that it provides the biggest relief to small businesses.22 As the exemption amount increases, the number of small businesses falling under the exemption grows as well.

What would need to change in Nebraska’s law is the reimbursement to local subdivisions for the lost tax revenue, as this provision is not in alignment with the true intent of a de minimis exemption. The legislation that enacted the $10,000 exemption also indicated that, “The state shall reimburse each county from the General Fund for funds lost due to the exemption for both the locally-assessed taxes and the centrally assessed companies.”23 This reimbursement directly counters the intent of this reform option. De minimis exemptions are used to slowly reduce the tax burden without there being a large impact from the lost revenue with the hope of eventual phase out of the tax.

There are multiple states that use de minimis exemptions including Colorado, Idaho, Kansas, Montana, Oregon, Texas, Utah, and Washington, among others. Recent reforms have taken place in states that focused on this type of exemption. Michigan raised the cap on their exemption in 2014 to $80,000 through a public vote,24 and specifically stated in the legislation that the state would not reimburse revenue lost from the exemption.25

Florida took the same approach and will hold a ballot initiative in 2018,26 which will raise their current $25,000 exemption to $50,000, again with no mention of a reimbursement for lost revenue. Arizona has also chosen to use the de minimis reform and has an automatic increase each year; their current exemption totals $159,498.27

Exempt New Property

Because the personal property tax is assessed and levied every year, all new property acquired by businesses is added to the tax rolls on an annual basis. One reform option is to exempt new property from being added to the tax rolls.

This reform has the advantage of limiting the immediate impact on local governments, because all existing property would continue to be subject to the tax. Over time, the older taxable equipment is replaced with new equipment that is exempt from the tax. Local governments avoid steep and sudden reductions in tax revenue, and instead rely on gradual reductions. It also benefits Nebraska businesses because it encourages economic growth by not penalizing a business for upgrading or replacing old or inefficient equipment.

While not enacted on a comprehensive approach, Maine decided to exempt all personal property of retail businesses acquired after April 1, 200828 and Kansas exempted most machinery and equipment acquired after June 30, 2006.29 Indiana passed legislation in 2014 that allows local governments to exempt new property from the personal property tax.30

Nebraska has also done something similar when it decided to exempt property used in wind generation in 2010 and data centers in 2012. While Nebraska’s industry specific exemptions are beneficial to these specific business interests, it erodes the tax base and doesn’t solve the problem of how detrimental the tax is across the state. The exemption of all new property acquired, regardless of business type, would be a more beneficial example of comprehensive reform.

Local Option for Exemption

Another option for reform would be if Nebraska gave the local political subdivisions the option to reduce or eliminate their personal property tax. This would promote greater tax competition within the state by allowing political subdivisions to choose any of the previously-mentioned reforms within their jurisdiction. In the absence of a move toward statewide change, a local option, either standing alone or coupled with other reforms, would help reduce reliance on this tax without statutorily restricting local property tax bases.31 This has become a popular option for many states, including Alaska, Florida, Maryland, and Virginia.

Each political subdivision within Nebraska has a different economic make-up and their reliance on the personal property tax differs greatly, which will affect how they want to approach reform. When looking at the percentage of personal property tax collected out of total property taxes, Loup County is the lowest at 2.4 percent while the highest is Stanton County at 15.7 percent. Seven counties have a reliance greater than 10 percent, and the average county rate is 6.4 percent. Allowing counties to approach reform would allow Loup County to remove the tax without too much interference with their revenue, while Stanton County may choose to keep it due to their higher reliance on the tax.

Eliminate Personal Property Tax

When many approach an unpopular and economically detrimental tax, their initial reaction is to repeal the tax in its entirety. However, immediate elimination of the tax can create unforeseen consequences. The aforementioned reforms will eventually eliminate the personal property tax, yet it will happen gradually over a long period of time. What research and experience have shown is that states choosing to eliminate the tax in one broad sweep ultimately replace it with other sources of revenue.

For example, Ohio repealed its personal property tax in 2005, using three steps implemented over a six-year time frame with the intent to smooth the impact of the lost tax revenues. These steps included the exemption of new manufacturing equipment, reducing the assessment ratio for general business personal property over four years with complete elimination in 2009, and a slow phase-out of telecommunications property that ended in 2011. In addition to the phase-out, a new property tax replacement payment program was established to reimburse local governments and school districts for the lost revenue, as well as a new gross receipts tax. The reimbursement put stress on the state’s budget, and ten years later, Governor Kasich had to manage a budget deficit and make changes in state government to counter how these reform packages were executed32 in an attempt to put the state’s fiscal house back in order.

Illinois has a similar story. In 1979, the Illinois legislature passed legislation to abolish the personal property tax, and replace it with a surcharge on the corporate income tax and a tax on the invested capital of public utilities.33 These replacement taxes are collected by the Illinois Department of Revenue and then allocated back to the local governments and school districts. Today, Illinois has one of the highest corporate income taxes in the country and a severe state budget deficit.

Vermont repealed its personal property taxes, replacing them with a statewide property tax for education in 1997. Maine reduced its personal property taxes, but its constitution requires the state to reimburse municipalities for half of property tax revenue lost as a result of property tax exemptions or credits enacted after 1978.

It is clear from these state examples that an outright repeal is not a wise policy decision for Nebraska. There is a strong likelihood the state would take on additional financial responsibilities through a reimbursement program or local taxing subdivisions may respond by suddenly raising the tax rate on real property to offset lost revenue. If outright repeal is the end goal of the Nebraska Legislature, other incremental reform options should be used.

Conclusion

Nebraska has been grappling with solutions to its property tax since statehood, but there is an opportunity to make a difference. Reforming the personal property tax will give citizens much needed tax relief while also helping to remove barriers to businesses located within the state. The personal property tax is clearly of economic concern. Scott Drenkard of the Tax Foundation, the country’s leading tax research organization, has said that Nebraska’s most economically harmful taxes are those levied on capital, including the personal property tax. When compared to the real property tax, the personal property tax has many unfavorable aspects including more complexity and higher compliance costs than the real property tax.

Many states are making a change and enacting reform. Reducing reliance on a detrimental tax is necessary in the mobile and highly competitive economy America has developed into over the last century. Nebraska can do more, and needs to increase its competitiveness amongst the other Midwestern states that either have no personal property tax or very little. This is an opportunity for Nebraska to enact meaningful reform that will positively impact both rural and urban areas of the state.

APPENDIX – Personal Property Tax in Each Nebraska County