Get Real About Property Taxes

Table of Contents

Click a link to advance to a section.

History

Nebraska Property Tax Reform Timeline

Nebraskans’ Views on Property Tax Reform

Nebraskans’ Views on Expanding the Sales Tax Base or Increasing Sales Taxes

Economic Development and Business Incentives

Nebraskans’ Views on Property Tax Limitations

Property Tax Reform Options in Summary

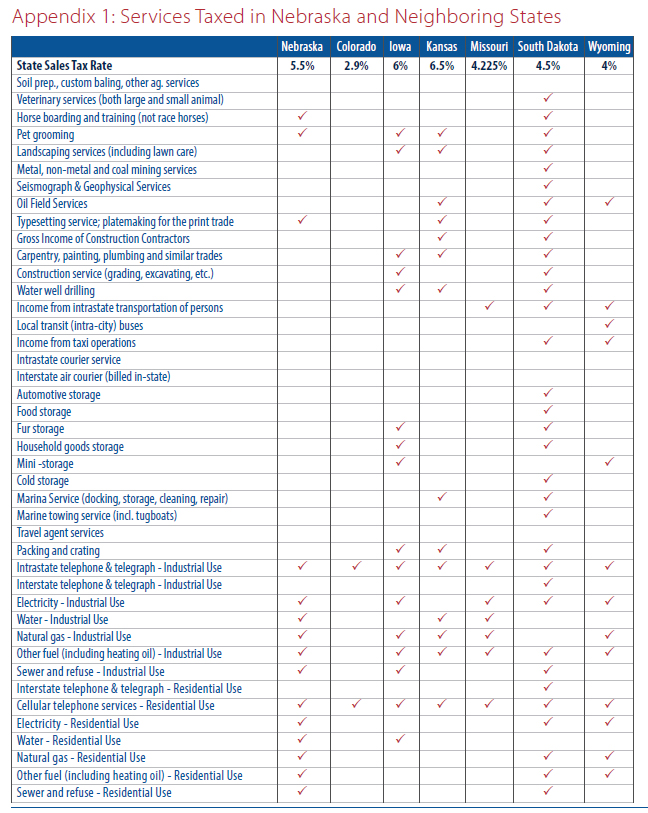

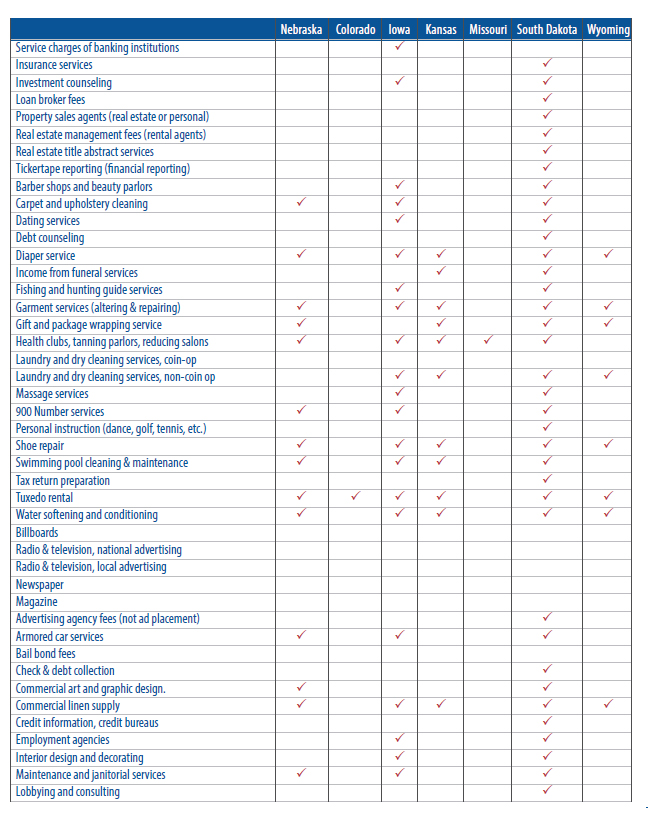

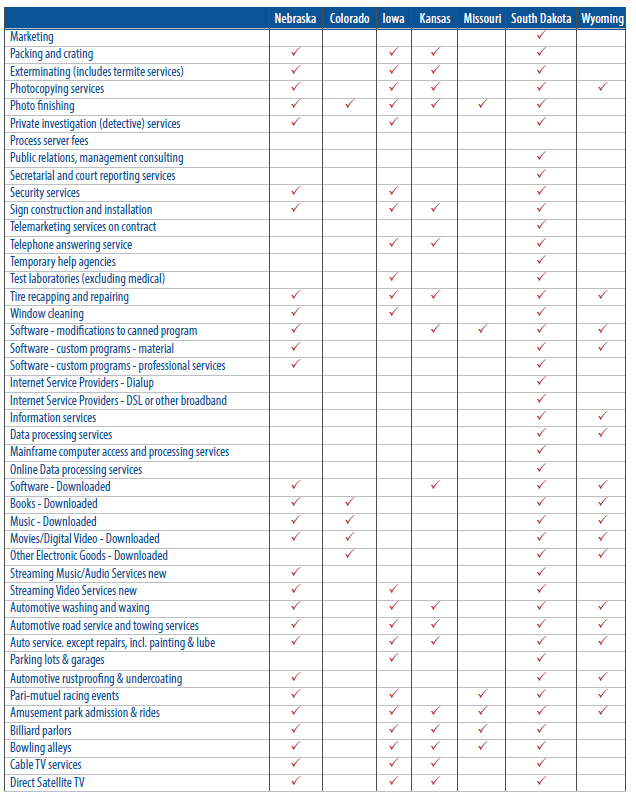

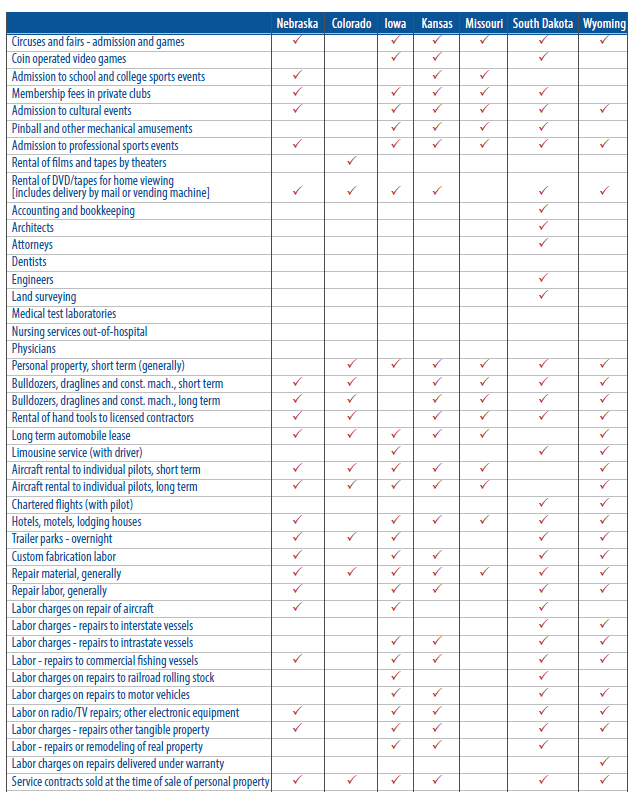

Appendix 1: Services Taxed in Nebraska and Neighboring States

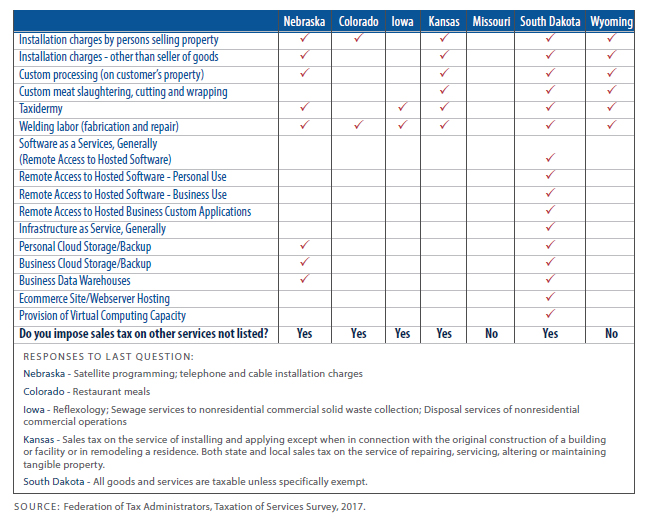

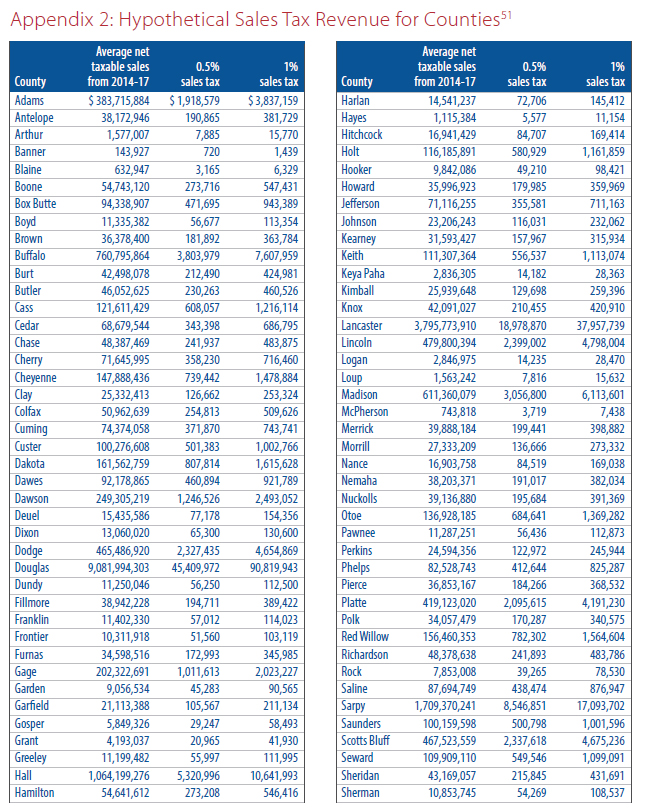

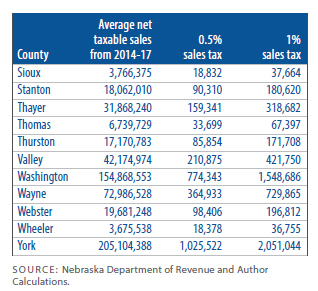

Appendix 2: Hypothetical Sales Tax Revenue for Counties

Appendix 3: Property Tax Reform Survey Responses

Introduction

It’s time to get real about property taxes in Nebraska.

Though property taxes are undoubtedly the best-known and most hated tax in the state, Nebraskans are affected by property taxes and possible changes to them in many different ways, creating several barriers to reform that policymakers must address to arrive at any solution. One of the more obvious barriers is the Nebraska Legislature itself.

Though high property taxes have dominated the discussion in the Unicameral, a simple majority vote from state senators is not sufficient to pass property tax reform legislation. Without a 33-vote consensus that can overcome a legislative filibuster, no major reforms will be enacted into state law. But state senators or legislative procedure don’t deserve all of the blame. After all, senators rely on the input of their constituents, who often make contradictory demands for lower taxes and more spending on government services.

Another barrier facing lawmakers is that while the state itself does not collect the property tax, which is a local tax in Nebraska, they are expected to solve the problem to the satisfaction of property taxpayers, the local taxing subdivisions that collect property taxes, and those who desire the state to fund other programs or state tax policy changes. It is difficult to do anything that will make all of these groups happy. While it may seem obvious that one way to lower property taxes would be to require local property taxing subdivisions to cut spending and do with less, many of their responsibilities are mandated by the state and federal government.

School districts must provide all children in their community access to an education. Counties and other local governments must provide for a justice system, roads, and services such as police, fire, and emergency medical services.

In recent years, the state has increased spending on the property tax problem, subsidizing property taxes with state sales and income tax dollars. But the fundamental tax structure has not changed, and as property tax valuations increase, the effectiveness of these programs has been diminished.

Anything the state does to address property tax comes with a cost to someone. If the state mandates a lower property tax levy rate, a cap on assessment growth, or makes a change to property valuations, that will come at a cost to local subdivisions, who will lose revenue needed to provide local services.

If the state replaces the revenues from property taxes with other funds from sales and income taxes, that will come from the taxes Nebraskans would otherwise pay for services provided by the state. It also means that same revenue cannot be used to improve the state tax system, which many would agree also needs work.

As discussed in previous reports, the state’s flexibility has been limited by slower revenue growth resulting from a downturn in agriculture. The Legislature has to balance spending on programs supported by the state, such as Medicaid, corrections, and higher education, with funding for services that are otherwise funded by property taxes, such as public schools.

This paper intends to report on which tax policy changes have the best chance of working to achieve lasting property tax reform. Policy studies tend to gloss over the difficulty involved in making such big changes. This report will not. This study also asks whether Nebraskans themselves are ready for changes that could realistically address the current property tax burden. We will investigate that question and look at responses to possible alternatives through a non-scientific survey of Nebraskans.

This report will also make a choice that will undoubtedly upset some readers. We are going to assume, as experience shows, that the 33-vote filibuster requirement in the Legislature makes achieving property tax reform through major reductions in state or local spending a political impossibility. This doesn’t mean there aren’t many policy approaches that can scrutinize and rein in spending or prevent the departure of government from its core functions. It simply means that major spending cuts could only come with a much longer discussion of reforming many government programs, and there are too many roadblocks to that being the primary way the state would afford paying down the local property tax burden in the near term.

Necessarily, that means the state will have to find more revenues. But this policy change is still fraught with danger for the state and for taxpayers. Without needed reforms to the structure of property taxes, the state could put itself on the hook for significant increases in spending and taxes, with no positive change to the local property tax burden. After all, even though the state is spending over $200 million more on direct property tax relief annually than it did a decade ago, property taxes are still higher than they’ve ever been.

Getting real about property taxes means acknowledging that difficult, and even initially unpopular choices, may be needed if lawmakers truly want to make the property tax less of a worry for Nebraskans.

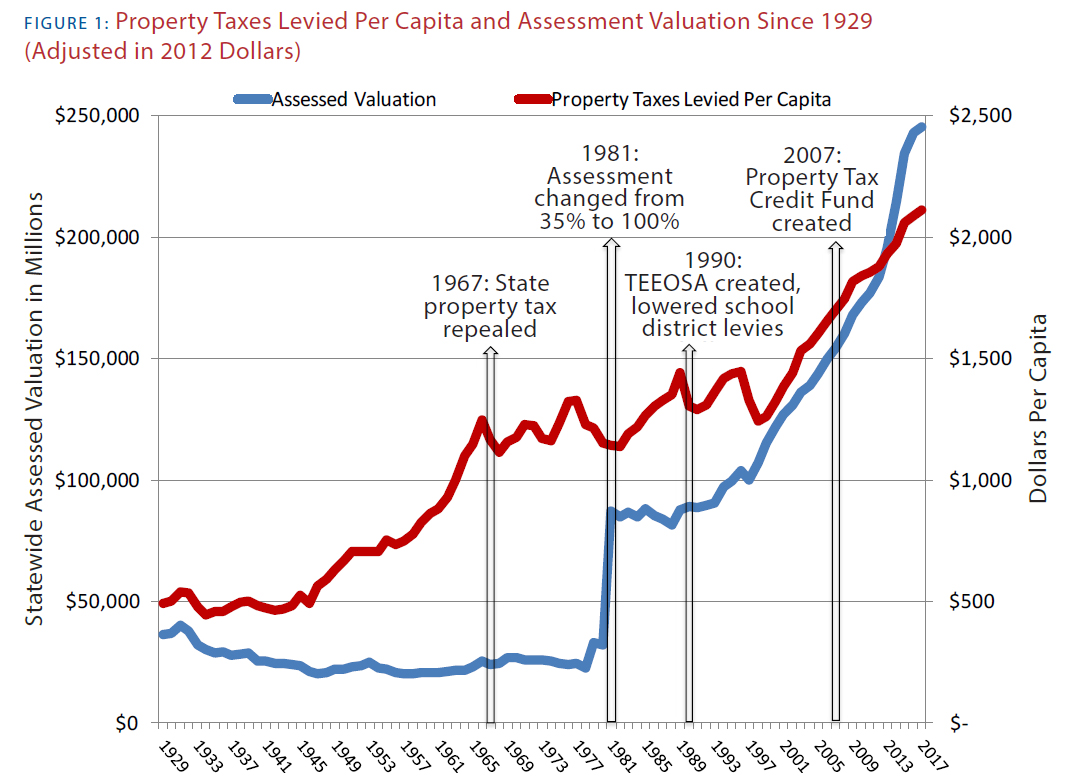

Despite current dissatisfaction with property taxes, there have been multiple reforms to the tax in Nebraska’s history. Originally, Nebraska levied a state property tax. That changed in 1967, when the state’s property tax was abolished via constitutional amendment.

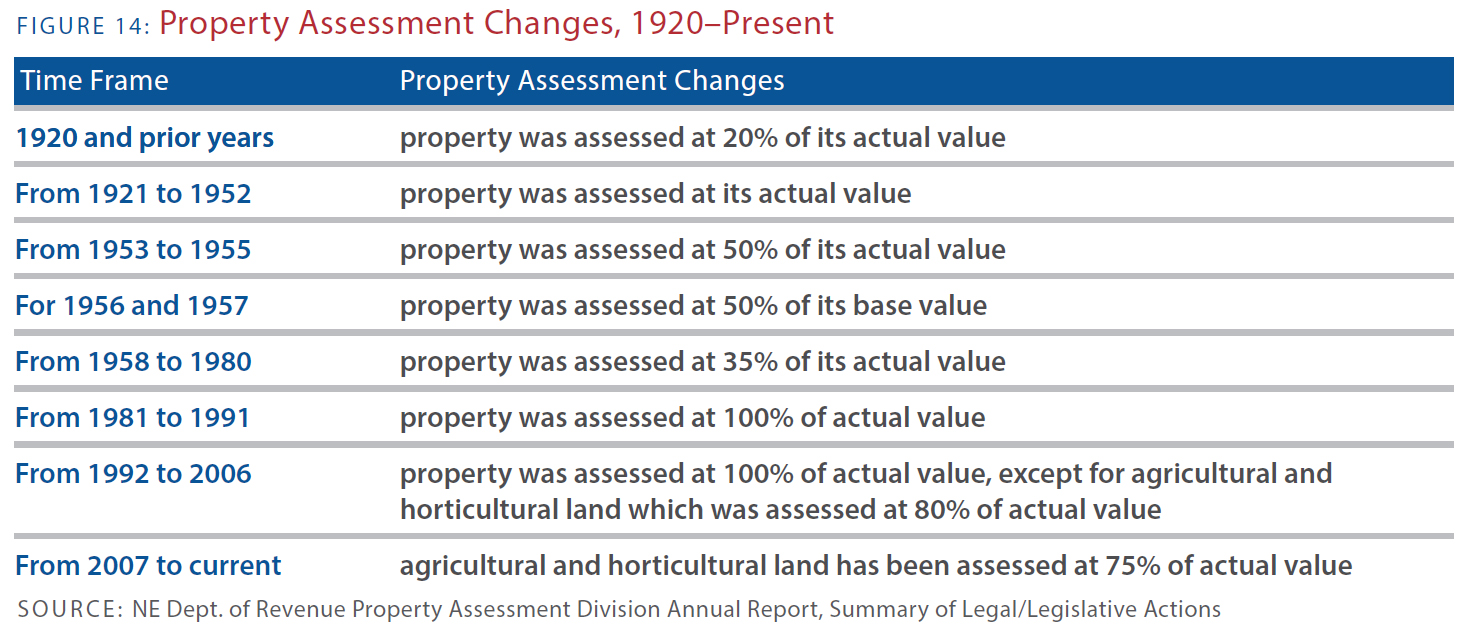

Instead, the state created the income and sales tax to fund state government. Local governments were still allowed to levy a property tax to fund their operations, but with time, those property taxes became a problem as well. The first major change to the local property tax was in 1979, when the assessment level changed from 35 percent of actual value to 100 percent of actual value.1

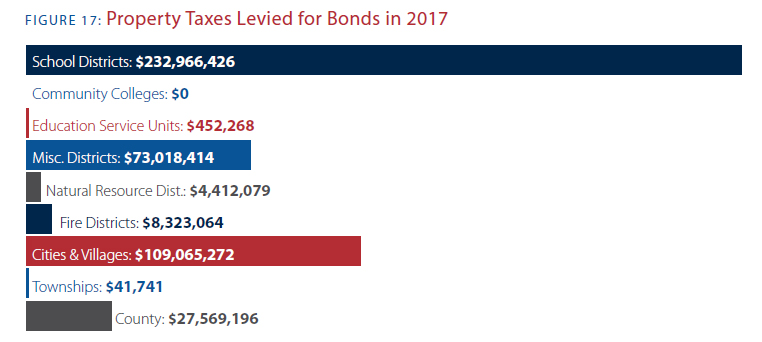

This means the entire market value of the property was subject to the property tax rate, instead of only a fraction. The next big change to the property tax was addressing how to fund K–12 education. This became an issue because schools are the most expensive function of local governments, and today, the school district levy makes up 60 percent of the total property tax levied.2

In the 1980s, school district levies ranged from less than $0.45 to over $3.40, and over 70 percent of the cost of operating public schools was from the property tax.3 The state’s current school funding formula, also known as LB1059 or TEEOSA, was signed into law in 1990. The debate around TEEOSA focused on the question of “how we fund education and how we tax property.”4

As one senator put it, “the first goal (of TEEOSA) was to try and shift the burden of taxes in this state from property to sales and income [and] do away with the overreliance on property taxes.”5

One of the key points of opposition to the bill was that school districts that were currently receiving funds from the state would lose that revenue, because the new formula still viewed property ownership as the “only indicator of wealth.”6 This argument still holds today.

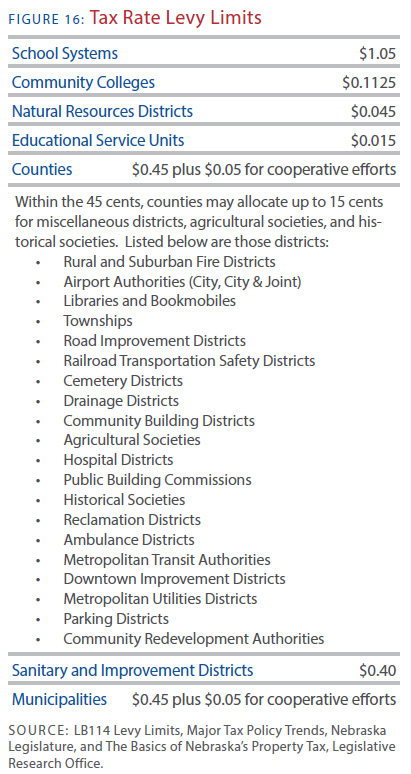

Critics of the formula note that most school districts do not receive equalization aid (one of several sources of state aid) due to their higher agricultural land values, while a smaller group of mostly urban school districts receive most of the equalization aid. Initially, however, the enactment of TEEOSA led to additional state funding being directed to schools, and the state dropped the maximum school district levy limit to $1.10. Another significant property tax relief effort was LB1114 in 1996. This law placed a limit on local government expenditures7 and levy limits on the total property tax rate. The rate decreases took effect in 1998 and again in 2001.8

County consolidation or the consolidation of local governments was also discussed in 1996 as a property tax relief measure. The result was a constitutional amendment ballot initiative to provide the Legislature the authority to establish methods for counties to merge with other counties or cities. The question was placed on the 1996 general election ballot, and it failed to pass by a margin of 47 percent (for) to 53 percent (against).9

Targeting relief towards agricultural land has also been a method used to reduce property taxes. In 1992, the assessment of agricultural land was lowered to 80 percent of its actual value, and then reduced again to 75 percent in 2007. The Property Tax Credit Fund was created in 2007. Under this program, state money is sent to local taxing subdivisions, which appears as a credit on local property tax bills. The program started at a state cost of $105 million and has grown to $224 million10 in the last fiscal year.11

What history has shown us is that while property taxes are locally levied, there is significant state involvement with the amount of tax local political subdivisions can levy, how property assessments are conducted, and what services local taxing subdivisions must provide for their residents. Many of the changes the state has made in the past to lower the local property tax required a shift in financial responsibility from the local governments to the state. This comes at a cost to state taxpayers, because the state has obligations it must fund as well, with a limited amount of state tax dollars.

The state’s ability to address the property tax problem is not only limited by tax revenues and the state’s economic circumstances. Crafting a policy that actually restrains the growth of property taxes also appears to be a historical problem. On a per capita, inflation-adjusted basis, property tax collections in Nebraska have never been higher than they are today.

The growth of these taxes has not been reined in, either with higher state taxes and more spending, or previous attempts at reductions in levy rates or the agricultural assessment ratio. Some would argue that’s because the state has not yet spent enough to offset the property tax. However, even in parts of Nebraska where taxing subdivisions receive the largest amounts of financial support from the state, property taxes are well above the national average. This means a proper combination of both spending and limitations on property taxing authority will be needed to secure lasting property tax reform.

1857 Property tax adopted by the Territorial Legislature.

1867 Nebraska gains statehood. State and political subdivisions begin levying property taxes.

1920 New revenue law passes to assess real property at actual value instead of 20% of actual value.

1953 Property assessment changes to 50% of actual value.

1954 Voters approve constitutional amendments on property values, methods of determining uniform value, and prohibiting a state property tax if the state ever adopts a sales or income tax.

1956 Property assessment changes to 50% of base value.

1958 Voter approve constitutional amendment to cancel property taxes and assessment charges unpaid for 15 years.

1966 Ballot initiative to limit state property tax fails, while voters approve a constitutional amendment to terminate the state property tax.

1967 State property tax is abolished. Legislature creates state income taxes and sales tax as replacement revenue sources for state government.

1968 Ballot initiative to classify or exempt personal property from taxation fails.

1969 Homestead exemption program created.

1972 Voters pass constitutional amendment allowing agricultural and horticultural land to be valued based on its current use, rather than potential use.

1978 Voters approve constitutional amendment for the state board of equalization to equalize assessments of property among counties.

1980 Voters reject constitutional amendment to require “a system of financing public education that imposes no unfair and excessive property tax burden.”

1981 Property tax assessment changes from 35% to 100% of actual value.

1984 Nebraska Supreme Court case, Kearney Convention Center Inc. v. Board of Equalization, holds the State Constitution’s uniformity requirement demands agricultural land be assessed similarly to other classes of property, at full market value. The State Constitution is then amended to make agricultural and horticultural land a distinct class of property.

1988 The U.S. Court of Appeals case, Trailer Train v. Leuenberger, prohibits personal property tax collections from railroads.

1989 The Nebraska Supreme Court rules, in Northern Gas v. State Board of Equalization, that pipelines, telephone companies, and other centrally assessed entities should be treated the same as railroads.

1990 TEEOSA (LB1059) caps school district levy rates to $1.10 and increases state income and sales tax rates.

Voters approve constitutional amendment to remove agricultural and horticultural land from the uniformity clause, requiring this land to be assessed uniformly only within its own class of property.

1991 The Nebraska Supreme Court rules, in MAPCO Ammonia Pipeline v. State Board of Equalization, that all prior personal property exemptions were unconstitutional, thus reversing earlier cases.

1992 Agricultural and horticultural land is assessed at 80% of actual value.

Voters approve constitutional amendment establishing separate and uniform tax valuation of tangible personal property.

1995 Tax Equalization and Review Commission (TERC) formed. Body hears valuation appeals and exemption disputes instead of district courts.

1996 LB1114 places a limit on local government expenditures and reduces levy rates in phases.

Ballot initiative providing for the Legislature to consolidate counties fails.

1997 LB271 changes the taxation of motor vehicles to be different than taxation of other property.

1998 1996 property tax limitations fully implemented, limiting local governments to tax levy rates of no more than $2.19 per $100 of property value.

Voters approve constitutional amendment to exempt government property used for public purposes from taxation.

1999 Department of Property Assessment and Taxation created as a separate state agency, distinct from the Department of Revenue. Administrator appointed by the governor for a six-year term.

2003 LB540 lowers school district levy limit to $1.05, the current amount.

2004 Voters approve constitutional amendment exempting certain improvements of historically significant real property from property taxation.

2005 Nebraska Advantage Act is created, offering property tax exemptions to companies in the state that meet certain employee and capital investment goals.

2006 LB968 prevents reduction of school district levy lid to $1.00.

Maximum exempt amount and maximum value for homestead exemption increased.

Assessment of agricultural and horticultural land reduced to 75% of actual value, and changes from income valuation to market valuation. This policy is still in use today.

LB 808 eliminates agricultural zoning requirements, but clarifies that the entire parcel must be used for agricultural or horticultural purposes in order to receive special valuation.

Legislature authorizes Learning Community taxing subdivision for Douglas and Sarpy Counties with a common school levy rate of $.95.

2007 LB367 creates the Property Tax Credit Act at a state cost of $105 million.

The Department of Property Assessment and Taxation is returned to the Department of Revenue, and the Property Tax Administrator functions within the Department of Revenue.

2008 An exemption for tangible personal property is established in Nebraska’s Beginning Farmer Tax Credit Act.

LB 777 excludes land associated with buildings from the parcel of agricultural and horticultural land and clarifies the rest of the parcel can qualify for the special valuation if it meets other requirements.

Property Tax Credit Act increased to $115 million.

2009 Legislature passes LB121, requiring all counties to resume assessments before June 2013. Previously, some counties turned over assessment responsibilities to the state.

2010 Tax exemptions for property used in wind generation enacted.

2012 Tax exemptions for data center property enacted.

Community College levy lid increases to $0.1025, its current rate.

2014 Income limitation amounts for homestead exemption increased.

Property Tax Credit Act increased to $140 million.

2015 Property Tax Credit Act increased to $204 million.

2016 LB958 increases the Property Tax Credit Act to $224 million and directs the additional $20 million towards agriculture.

LB1067 eliminates common school levy in Learning Community school districts.

Nebraskans’ Views on Property Tax Reform

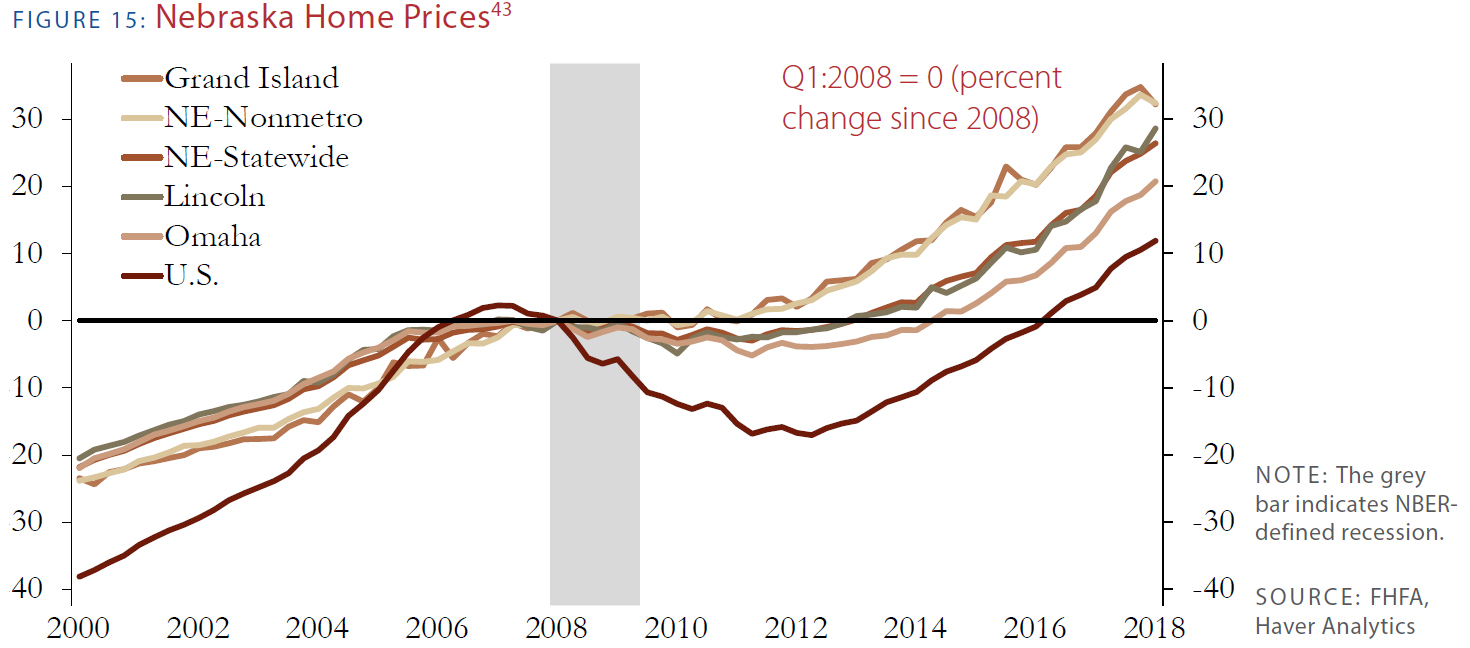

Despite all the reform attempts made by the state over the last 50 years, Nebraskans remain concerned about property taxes. Nonetheless, synthesizing these concerns into an understandable consensus can be difficult. Agricultural land values increased substantially over the last decade as commodity prices reached record highs. Though the pace of growth for residential property owners may have been far less by comparison, a report from the Federal Reserve Bank of Kansas City finds that home values in Nebraska have grown the sixth fastest nationally in the same period of time.

That means farmers, ranchers, and landowners are disproportionately impacted by even modest increases in property tax rates. But property tax rate hikes that may seem small to homeowners now may not seem so manageable as more updated assessed valuations arrive. Local school districts also lose or gain state aid in different ways under the current system, and taxpayers who may be concerned about their property taxes may have issues with other types of taxes they pay to state or local government as well. For example, some taxpayers may feel overburdened by state income taxes, or feel that taxes they pay to the state will not find their way back to the local community.

In addition, some parts of the state may not have the needed mix of different kinds of taxpayers to collect revenues needed to offset high property taxes. And, undoubtedly, some Nebraskans are accustomed to the state’s high property taxes and feel the levies are vindicated by the amenities, services, and public employment opportunities their revenues make available in our communities.

In an effort to collect these various views and understand what Nebraskans across our state may be envisioning when they think of potential property tax reforms, the Platte Institute took a survey, which received over 300 responses. This was not a scientific poll, but an online survey promoted through email, social media, and local newspapers.12 The answers may give us a better sense of what Nebraskans mean when they say “property tax relief.”

The complete set of survey responses can be found in the appendix.

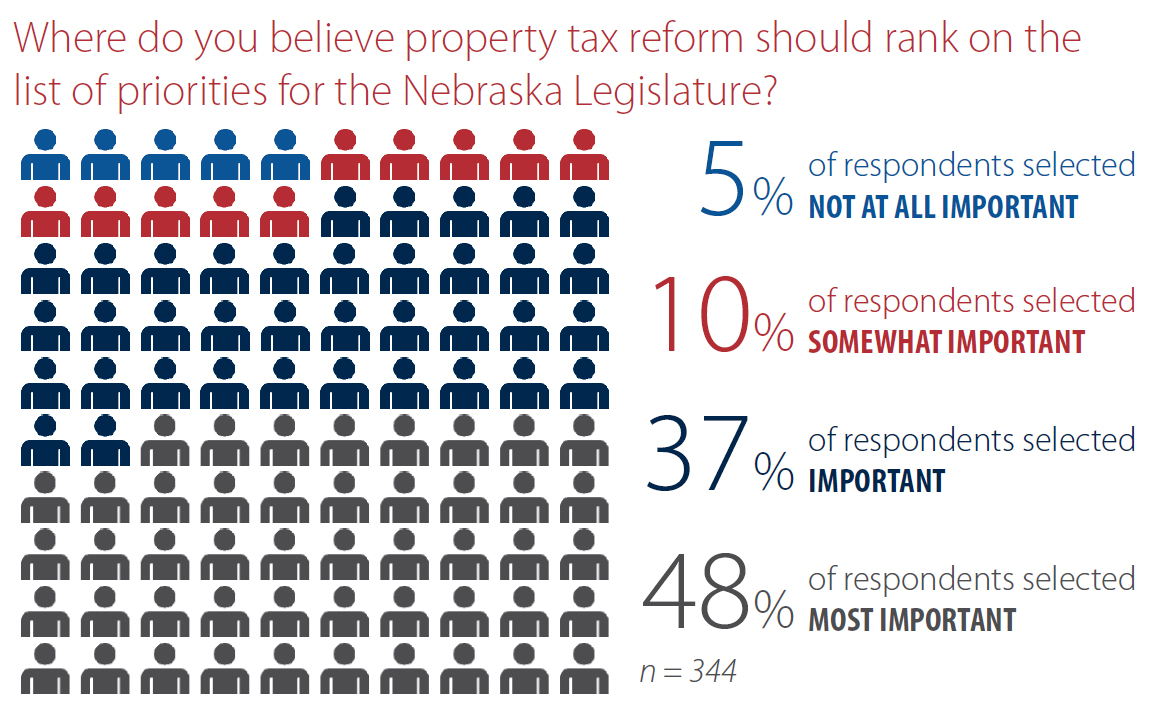

2018 is an election year in Nebraska, and many legislative candidates and incumbents are running with a focus on property taxes. For this reason we opened our online survey with the question, “Where do you believe property tax reform should rank on the list of priorities for the Nebraska Legislature?” Forty-eight percent of respondents said that property tax reform should be the most important priority of the Unicameral. An additional 37 percent said it should be an important priority, while 10 percent said it was somewhat important, and 5 percent said it was not at all important.

Figure 3: Survey Results

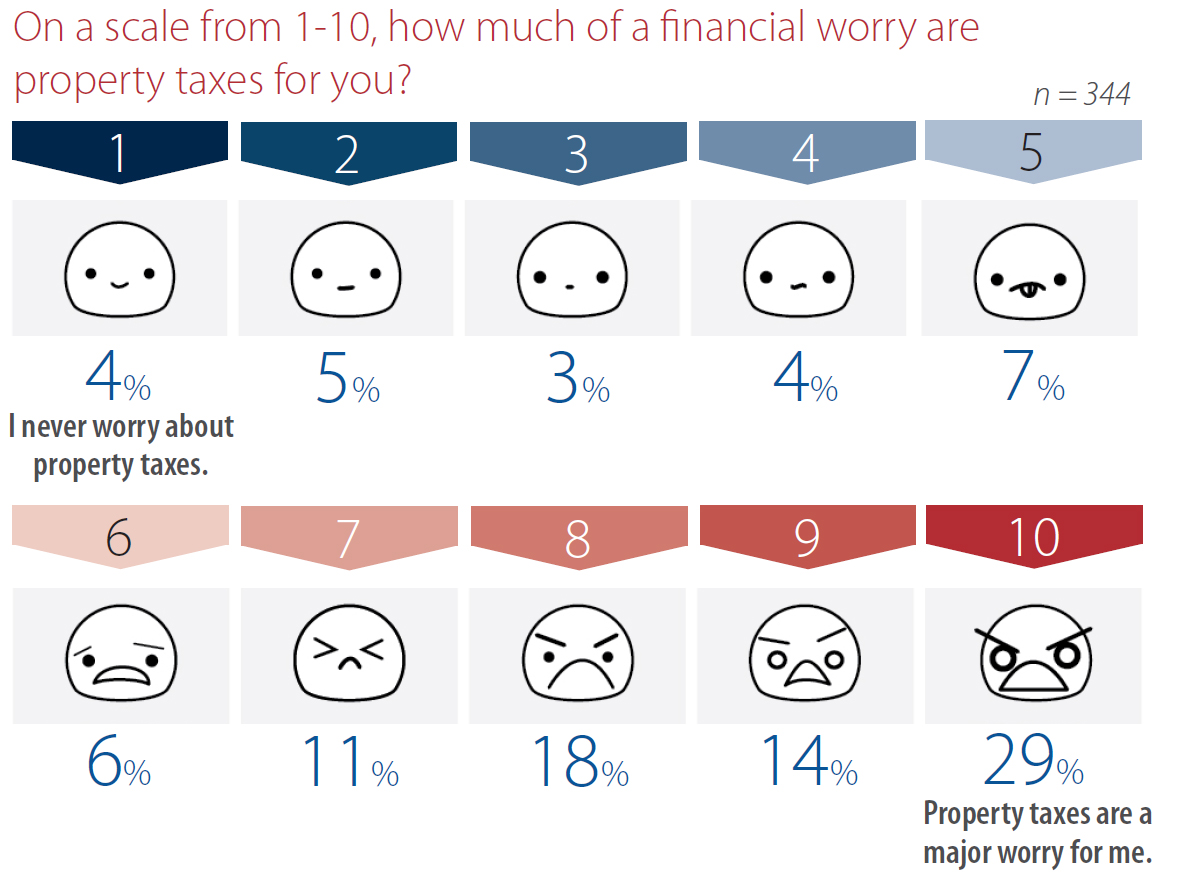

The respondents were also asked how much of a financial worry property taxes are for them.13 Twenty-nine percent of respondents said property taxes are a major financial worry for them, ranking their concern as a 10. More than 60 percent ranked their financial concern between 8 and 10, while 23 percent ranked their worries about property taxes between 1 and 5. On average, taxpayers ranked their financial worry at 7.4. Unsurprisingly, those who rank the property tax issue as a higher priority for the Legislature also express more financial worry with property taxes.

Respondents who believe property tax is the most important issue average 8.7. Those who call property tax somewhat important average 4.5 and respondents who don’t think property tax is important at all rank 4.1 on average.

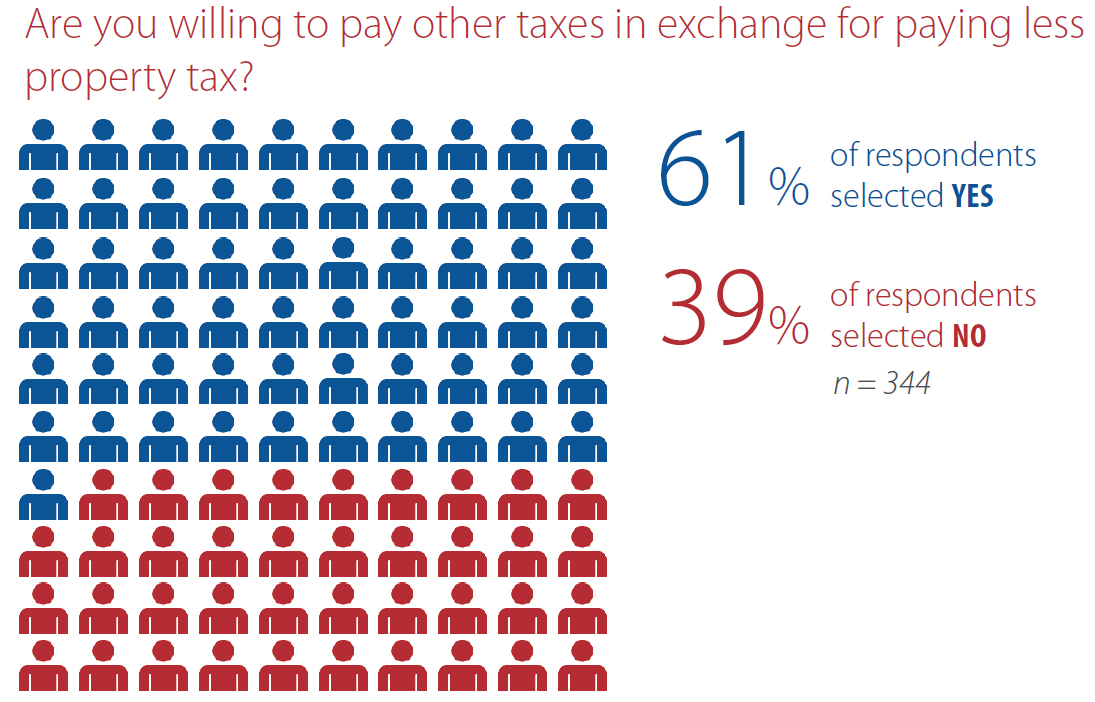

Of course, these answers tell us what we already know: taxpayers consider property tax to be a problem. But what we really need to know is what Nebraskans are willing to do about it. Do Nebraskans think property tax is a serious enough problem to justify changing other policies that have been around a very long time? In the next survey question, we asked respondents if they would be willing to pay other taxes in exchange for paying less property tax.

Perhaps surprisingly, 61 percent of respondents said they would be willing to pay other taxes for property tax reform. Thirty-nine percent said they were unwilling to pay other taxes. This is a strong majority by any standard, and particularly for a question geared toward the respondent personally having to pay additional taxes. This response tells us that Nebraskans may be willing to put up with significant tax policy changes to enable property tax reform. It is noteworthy, however, that to reach a 33-vote consensus in the Legislature, state senators must build a coalition of even more than 61 percent of the body.

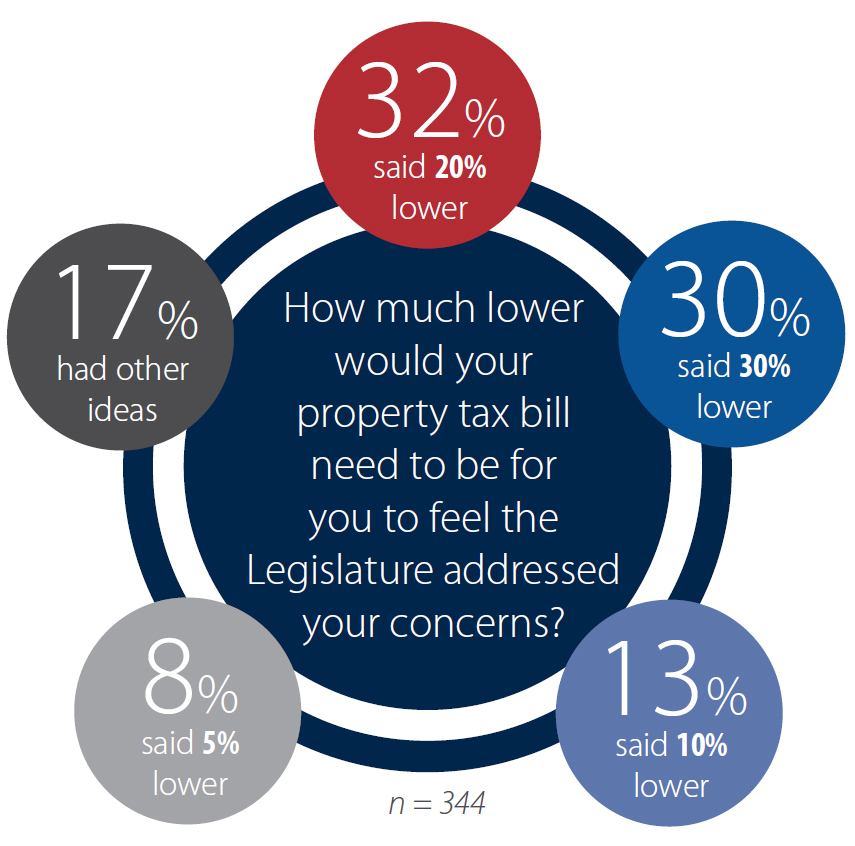

The premise that Nebraskans are willing to pay other taxes for less property tax needs to be tested against some other propositions, though. When Nebraskans say they are willing to pay more taxes if it means their property taxes are reduced, how much lower are they envisioning? We asked what amount of property tax reduction would satisfy the respondents.

Thirty-two percent said that a 20 percent cut in property tax would address their concerns. Another 30 percent wanted an even bigger cut, coincidentally, a 30 percent reduction. Twenty-one percent said they could be content with 5 or 10 percent less property tax. In short, these Nebraskans have very high expectations for how much property tax relief they want their elected officials to deliver. One recent Legislative Fiscal Office assessment found a tax credit to offset roughly 30 percent of property taxes could cost the state over $1.3 billion a year. Much smaller reductions in taxes have faced an uphill climb in the Nebraska Legislature.

And, as previous reports have shown, the state is not generating enough new revenue on its own to provide this much money, particularly as new demands for spending arise every year. This stark reality demands for taxpayers to get more specific: if they want very significant property tax reductions, and if they are willing to pay other taxes to do it, which alternative taxes would they accept?

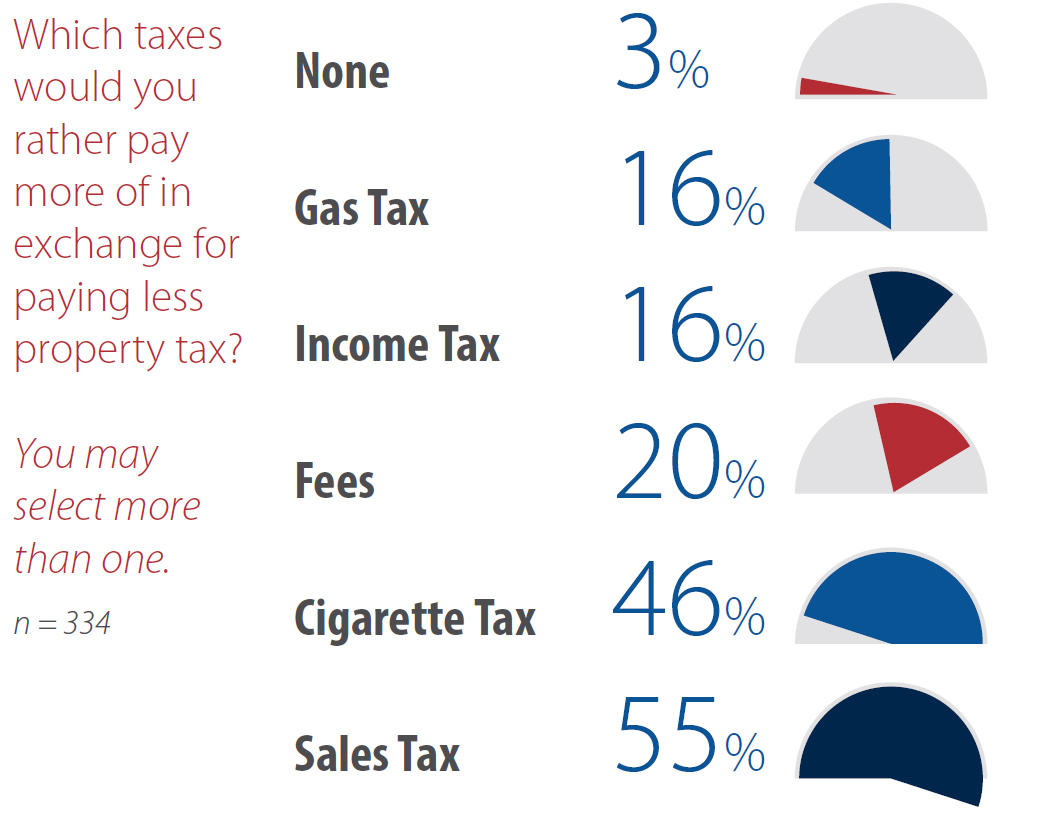

In our property tax reform survey, we provided a list of taxes that taxpayers could pay more of in exchange for lower property taxes. More than one option could be selected. The offered taxes were Cigarette Tax, Fees, Gas Tax, Income Tax, and Sales Tax, as well as a space for other ideas they may have.

The clear winner as the alternative source of revenue was sales tax. Fifty-five percent said they would rather pay more sales tax in exchange for lower property taxes. No other tax type received a majority. Second was cigarette tax at 46 percent, followed by fees at 20 percent, income tax at 16 percent, and gas tax at 16 percent. The desirability of the sales tax may relate to a feeling that sales tax is more voluntary or within the control of the taxpayer than property or income tax. Income is taxed as it is earned, and property tax is levied with assessments that may change over time, while sales tax is only owed on the amount a taxpayer chooses to spend.

The strong showing for the cigarette tax may represent a bit of wishful thinking, since far fewer than 46 percent of Nebraskans are smokers who would actually pay the tax. Regardless of policy considerations, there’s clearly an audience for changes to that revenue source.

Now we know that there may be interest in changes to the sales tax to enable property tax reform. Before we dive deeper into that possibility, though, let’s discuss how Nebraska’s sales tax works currently and how it could potentially function under property tax reform.

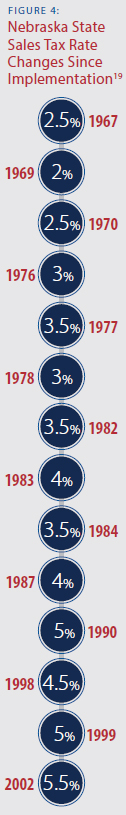

A major replacement of property tax collections with sales tax revenue has already happened once before in Nebraska’s history. When the state abolished its property tax in the 1960s, one of the two new taxes implemented was the state sales tax.

The tax was structured to focus on the final sale at retail of any item of tangible personal property or goods. At the time, Nebraska was primarily a goods-based economy. Prior to the passage of the 1967 Sales Tax Act, the Legislature commissioned a study to focus on the design of a retail sales tax. This study recommended that business-to-business sales or business inputs be exempt, a structural principle that still exists in today’s law that is supported by economists as a sound tax policy.14

The original state sales tax rate was 2.5 percent. It has changed 13 times since then and is now 5.5 percent. Many Nebraska cities levy local sales taxes in addition to the state’s, placing the average combined sales tax rate in Nebraska at around 7 percent, though some cities are higher. As a rule of thumb, all goods or tangible products are automatically subject to sales tax unless exempted by law. However, according to Nebraska’s tax expenditure report, there are 117 sales tax exemptions currently in state law, including many goods.15

Some of these exemptions date back to 1967 when the tax was created to exclude business inputs, while some were enacted as late as 2016, like the exemption for the purchase of fine art.16 Unlike most goods, which are subject to the sales tax, services sold to the final consumer are not taxed unless specifically mentioned in the sales tax law.17 This has become a problem because Nebraska has an increasingly service-based economy. Because services are mostly exempt from the sales tax, only one-third of what is purchased in Nebraska is now subject to the state and local sales tax.18

The exclusion of most services means that as the service sector grows, the amount of revenue the sales tax can bring in is being eroded. This narrow tax base is one reason why the sales tax rate has increased over time. As more of the economy is made up of nontaxable purchases, the rate must increase to collect the same amount of revenue.

One question Nebraskans and lawmakers have is whether the collection of sales tax from online transactions can broaden the tax base enough to enable significant property tax reform. This conversation accelerated in June of 2018, when the U.S. Supreme Court ruled in the South Dakota v. Wayfair decision, allowing states to collect sales tax on out-of-state internet retailers. A previous ruling in the 1990s, dealing with catalog-based retailers, prohibited such collections.

Many Nebraska elected officials have been publicly stating20 that this additional revenue will be used to help reduce property taxes. However, while the state Department of Revenue intends to comply with the Supreme Court ruling, the state itself has not yet passed legislation enabling all of the policy changes needed to comply with the Supreme Court ruling. This would include a minimum threshold for the amount of sales in Nebraska which would require sales tax collection, known as a de minimis threshold, and a ban on retroactive tax collections. Until such legislation is passed by the Unicameral and signed into law by the governor, only voluntary collections may begin, starting in 2019.21

While some revenue will come to the state from the remittance of internet sales, it is hard to estimate the total impact to the state budget, since some retailers have already started collecting voluntarily. State estimates of how much new revenue will come in have varied greatly, but range in the tens of millions of dollars. Such a sum would not last long once split among Nebraska’s many property taxpayers. That means a broader source of sales tax revenue would be needed if fundamental property tax reform is the goal. The best solution to collect more sales tax is to broaden the sales tax base by including more services, and ending unnecessary exemptions on final consumer goods where possible.

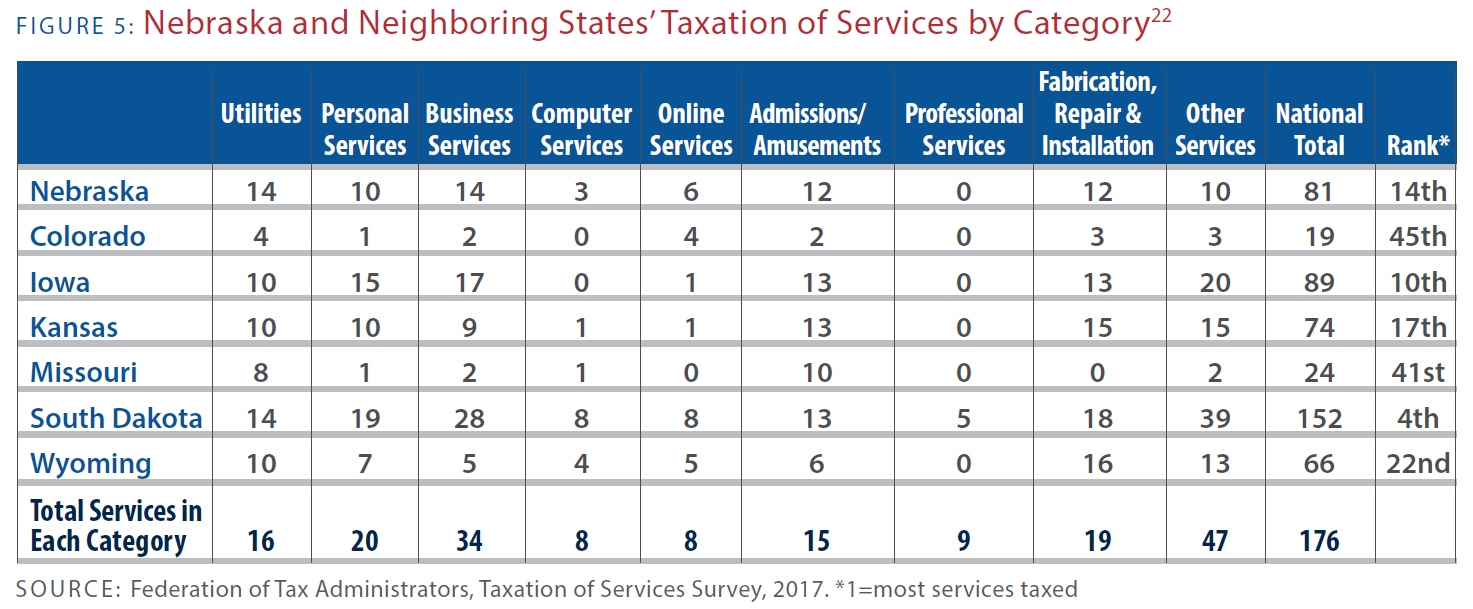

Besides increasing state and local revenue without increasing tax rates, there is an added benefit for government budgets as well. A broader sales tax will make tax collections more reliable during economic swings, which will help the state to sustainably fund its commitment to property tax reform, and help local political subdivisions replace more of their property tax revenues with sales taxes if their taxpayers desire. One potential solution to enable this reform is highlighted in Figure 5.

Nebraska currently taxes 81 services and is ranked 14th nationally in the number of services taxed. While Nebraska is ahead of many states in this area, there is still plenty of room to improve. The top two states in the nation, Washington and Hawaii, tax 167 services, compared to Nebraska’s 81. These two states are noteworthy examples, since their heavier reliance on sales tax is used in different ways to reduce their reliance on income or property tax. Hawaii also uses their broad sales tax base to maintain a lower sales tax rate.

A full list of services that are taxed in Nebraska and neighboring states can be found in Appendix 1.

Nebraskans’ Views on Expanding the Sales Tax Base or Increasing Sales Taxes

Are Nebraskans open to the possibility of paying sales taxes on goods or services that are currently exempt? Or what would they think of forgoing these reforms and just paying a higher sales tax rate instead?

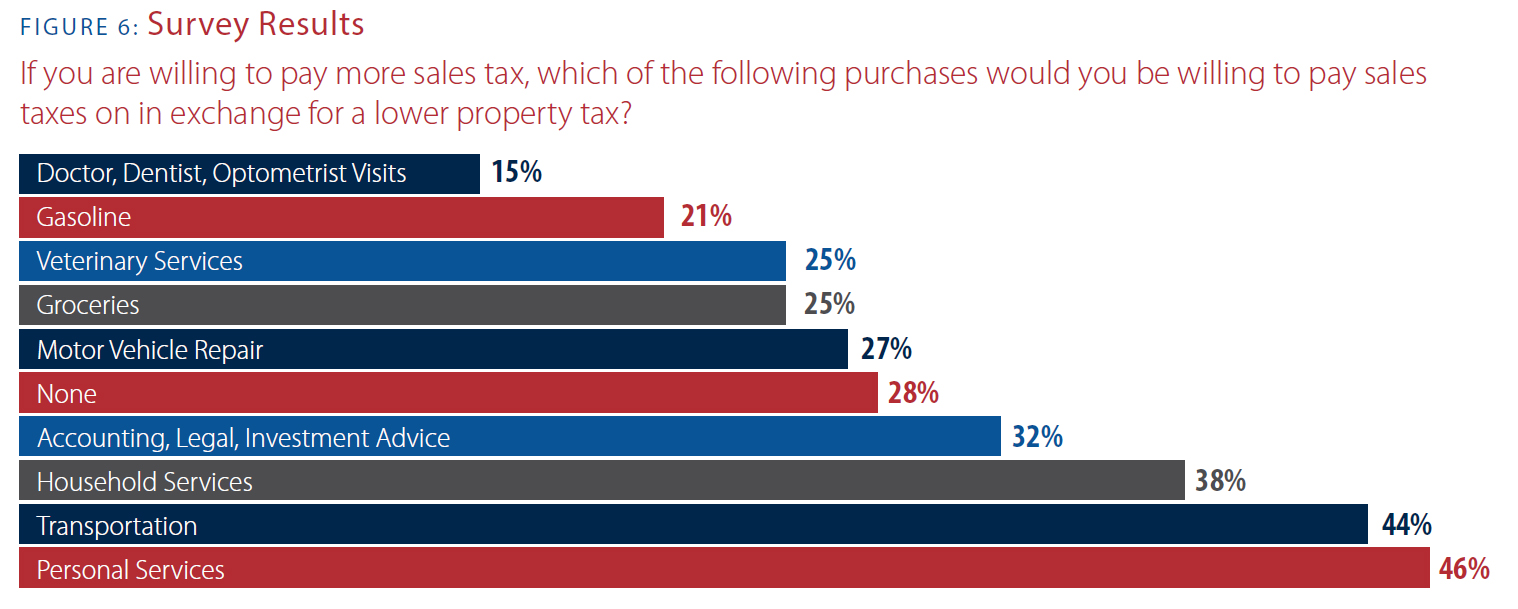

Proposals for either of these policies have been discussed in the Nebraska Legislature in previous years, and appear to be gaining support among candidates and legislators. In our survey, though, we found that getting specific on this issue may present a challenge with taxpayers. We provided categories of goods and services that were currently exempt from state and local sales taxes in Nebraska and asked which the respondents would be willing to pay sales tax on, if it meant reduced property taxes. While 55 percent of respondents in the property tax reform survey said they were willing to pay more sales tax to have reduced property taxes, at most only 46 percent could agree on a specific exempt purchase on which they’d be willing to pay sales taxes.

The largest number of respondents agreed with paying sales tax on personal care (46 percent), taxi, limousine or ridesharing transportation (44 percent), and household services (38 percent). Thirty-two percent also favored collecting sales taxes on accounting, legal, or investment advice services. About 28 percent of the respondents rejected all of the possible additions to the sales tax base.

Only a minority of respondents expressed willingness to pay tax on some purchases that might be considered traditional third rails: 27 percent favored sales taxes on motor vehicle repair services, 25 percent would accept a sales tax on groceries or veterinary services, and 21 percent said they would accept paying sales tax on gasoline. The lowest ranking option listed was visits to the doctor, dentist, or optometrist, which received only 15 percent support.

This result deserves careful analysis. There is a wide gulf between tax researchers, who broadly support the idea of collecting sales taxes on all final sales of goods and services, and taxpayers, who find these types of taxes intolerable, just like property taxes.

Everyone likely realizes they will be impacted if the tax is imposed. It is easier and more comfortable to suggest someone else pay taxes on something you never expect to buy for yourself. It is much harder for Nebraskans to accept that the cost of the state paying for their lower property taxes will likely fall on them to some significant degree.

Property tax collections are a large sum paid by Nebraskans all across the state. To replace those revenues, lawmakers will need to look for sources that have a similarly broad base. Getting real about property taxes means coming to grips with the reality that there are very few palatable choices at the disposal of policymakers if they want to collect enough new, stable revenue to pay for significant and immediate property tax reforms.

Sales taxes are not meant to only be collected on luxuries or novelties, yet many policymakers inadvertently buy into this notion. For example, many states that exempt groceries from sales taxes still choose to include candy and soft drinks in the sales tax base, in some cases on the grounds that no one really needs to buy these products. While taxing these sales is a sensible policy choice for Nebraska, by itself, it makes a minimal difference in revenue.

Nebraskans will never be able to eat enough candy bars, chew enough bubble gum, or drink enough pop in any given year to pay for over $1 billion of property taxes. Policymakers should instead look at the sales tax as a tax meant to collect a share of the total consumer spending in the state economy. In fact, the sales tax already applies to many goods and services that may be considered necessities, including utilities, over the counter medication, sanitary products, and many prepared foods that Nebraskans buy at the grocery store.

It is also worth noting that even if Nebraska taxed sales of groceries again in some way (as the state once did when the sales tax was first introduced), federal law prohibits sales of groceries purchased with SNAP, or food stamps benefits, from being subject to tax. Whatever senators choose to do, if only the easiest policy choices are included in the tax base—those which impact the fewest number of people—then lawmakers will continue to lack the financial flexibility to address the state’s most pressing tax concern, which is the property tax.

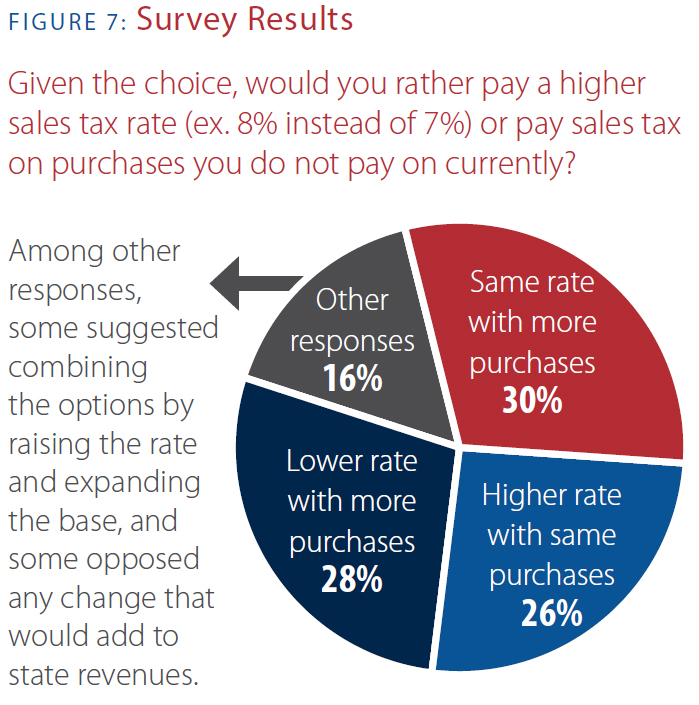

While tax economists and the Platte Institute would not be quick to recommend it, there is another alternative, if expanding the sales tax base seems impossible. The Legislature could choose to simply increase the state sales tax rate. This would mean the amount of tax paid on goods and services that are currently subject to sales tax would increase. In general, raising tax rates is a less preferable policy because it creates a greater financial burden on those who are currently paying the tax, while not raising any additional revenue from those who do not. This means the tax can also be less stable in times of economic uncertainty, or place Nebraska in a less competitive position with nearby states that have lower tax rates on the same goods and services. Nonetheless, we asked survey respondents whether there is a greater desire to pay more sales tax through expanding the base, or increasing the rate. We also offered an option for reducing the sales tax rate.23

Respondents were closely split between each option. Thirty percent said they would rather pay the same rate with additional purchases. Twenty-eight percent would accept expanding the base to add more purchases but prefer a lower sales tax rate. Twenty-six percent said they would rather raise the sales tax rate instead of expanding the sales tax base. Among other responses, some suggested combining the options by raising the rate and expanding the base, and some opposed any change that would add to state revenues.

These responses may show that while there is a general idea that sales taxes can be used to enable property tax reform, there are still challenges with getting Nebraskans to agree on what that means. It will likely take significant political will for senators to offer any proposal that involves new revenues, since it could face boisterous opposition, regardless of the reforms that may be included.

Another merit to expanding the sales tax base is its direct impact on locally-collected taxes. Currently, cities and counties can levy their own sales tax with voter approval, and it can be set at ½, 1, or 1½ percent.24 Any city, except a metropolitan class city (Omaha), may impose a local sales tax rate up to 1¾, or 2 percent of the retail sales within the boundaries of the city.25 Currently, Dakota County is the only county to have a sales tax.26 In Nebraska, there are many cities that already levy a sales tax.

Twenty cities levy a 2 percent tax, for a total state and local combined rate of 7.5 percent. A 1½ percent rate is levied by 111 cities, 94 cities have a local rate of 1 percent, and only three jurisdictions, Dakota County, Dakota City, and Upland, have a local rate of ½ percent.27

If the state were to expand its sales tax base, local taxing subdivisions with sales tax authority would then receive additional revenue on each transaction that was newly subject to sales tax. Let’s use the previous example of a candy bar and say it was purchased in York, Nebraska. This item is currently exempt from sales tax in York or anywhere else in the state. But if included in the base today, the state of Nebraska would tax the sale of the candy bar at 5.5 percent, and the City of York would additionally impose its own 2 percent local option sales tax.

These local policies were enacted, in part, to enable cities and counties to provide services while swapping the necessary revenue from property taxes to sales taxes. Considering whether these policies can be restructured to better meet the needs of local taxing subdivisions may also allow a lowering of local property taxes without putting a larger financial burden on the state. Additionally, if a policy such as a sales tax rate increase to replace property taxes is desired in Scotts Bluff County, but not Sarpy County, local policymakers would be able to better respond to those differences of opinion than the Legislature.

There are some complications with local sales taxes that prevent them from being fully utilized as an alternative to property tax. One is that cities and counties cannot both collect a sales tax in the same jurisdiction. In May of 2018, Dakota City voters approved a separate city-wide sales tax from their previous county tax. Per the Nebraska Department of Revenue, since Dakota City is within Dakota County, the county sales tax will no longer be effective for taxable sales made within the Dakota City boundaries.28

Currently, a county sales tax can only be imposed on taxable sales within the county, but not within the boundaries of any city that also imposes a city sales tax.29 This small ½ cent city sales tax was intended to supplement infrastructure improvements without increasing property taxes, but an unintended consequence was that the county will no longer be allowed to apply sales tax to items sold within the city limits. Importantly, the city leadership was unaware of this guideline when it put the city-wide sales tax to a vote. “It was an unintended consequence,” Dakota City administrator Alyssa Silhacek said. “We were not aware of this until after everything had happened, after the infrastructure tax passed.”30

One possible reform could be to change state law to allow counties to collect sales tax within city limits, in addition to city taxes, if the county sales tax is approved by voters. Appendix 2 shows hypothetical revenue generated from a countywide sales tax, if counties were to enact one. This additional revenue could be used to offset the property tax, or eliminate other taxes harmful to economic growth. It should be noted, however, that some counties have very little taxable sales within their jurisdiction, such as Banner, Blaine, and Hayes counties. This illustrates the point that a locally levied sales tax could bring some relief for certain counties, but is not a solution for every county.

Economic Development and Business Incentives

A common question is whether Nebraska could significantly reduce its property tax burden by eliminating business incentives and economic development programs.

The answer is about as complicated as the many programs that exist under that umbrella. “Economic development” is a catch-all term used by many to mean activities that promote migration, jobs, and investment in a specific area, but really, it is most applicable to government policies that direct economic activities for specific businesses or industries. A more appropriate term for the general improvement of business, wages, and other measurements of prosperity that arise from free enterprise and a government providing core services would be “economic growth.”

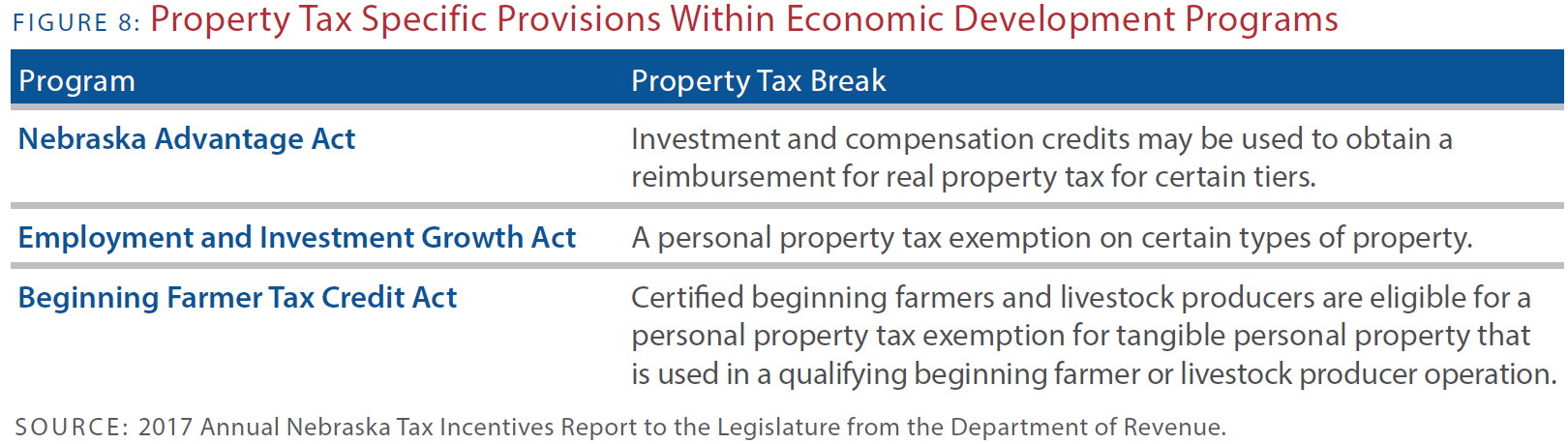

In 2007, the state made one of its largest investments in economic development programs when the Legislature adopted the Nebraska Advantage Act incentives program. Tax incentives are abatements or tax credits that are designed to provide tax cuts for businesses that make certain types of investments in Nebraska. These programs do not only offset state taxes like the corporate and personal income tax, or the sales tax, but may also reimburse or abate local personal or real property taxes as detailed in Figure 8.

These incentives are supposed to help the state overcome its many tax policy disadvantages and increase the number and quality of enterprises and jobs that would make Nebraska a more attractive place to live and work. In practice, incentives are pursued for the same reason as sales tax exemptions: in any given legislative session, it is more politically expedient to give a smaller group of market participants a carve-out in the tax code than it is to craft an overarching tax policy with a broad base and low rates.

However, a recent study31 by the Mercatus Center at George Mason University found that Nebraska could make a significant positive impact on its overall tax burden if it moved away from using tax incentives and instead initiated tax reforms. Mercatus found the revenue lost to incentives was enough to completely eliminate the state’s corporate tax and still have money left over for additional tax cuts.

At the 2018 Platte Institute Legislative Summit in Lincoln, Nebraska state Sen. Curt Friesen of Henderson, who has previously served as Vice Chair of the Revenue Committee, made mention of this overall policy goal. “Forget about the incentives, we’re picking winners and losers, let’s take the corporate rate to zero. Politically, I don’t know if we can go there, but let’s put it on the table, let’s have that discussion,” Friesen said.32

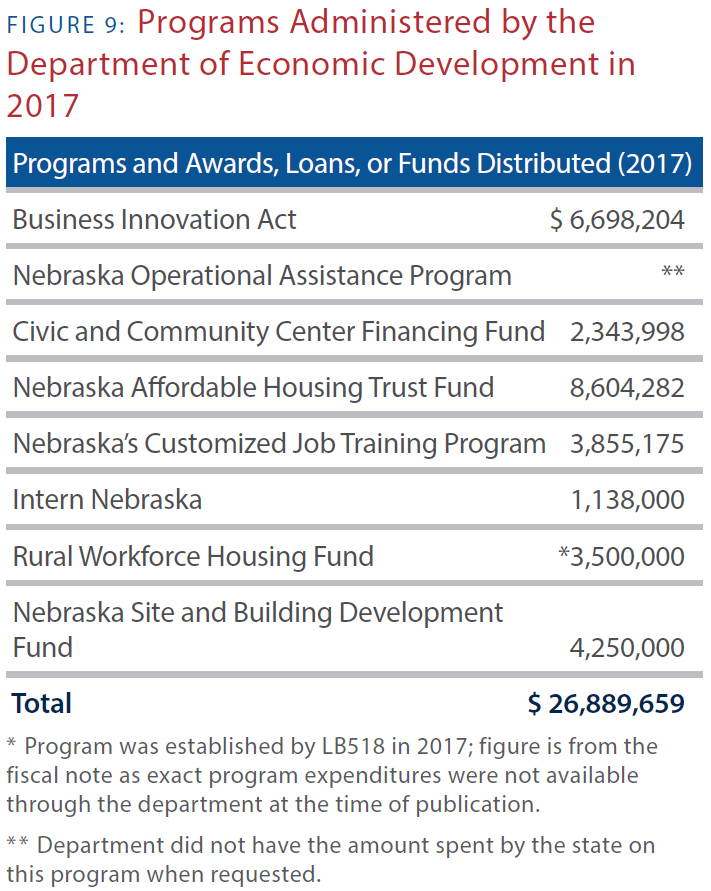

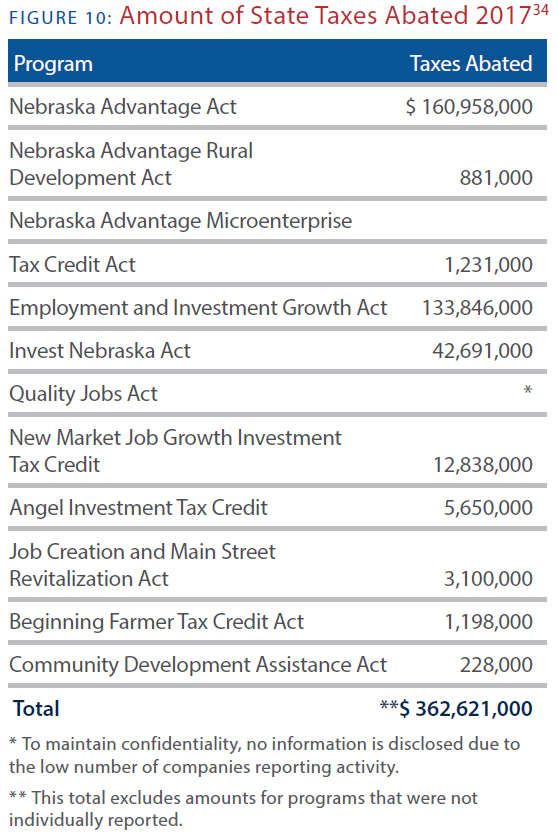

But just as with the sales tax, achieving an economically ideal outcome of a better tax system for everyone is much easier said than done, mainly because Nebraska has a wide variety of economic development programs. In addition to state tax dollars being spent by the department, there are multiple tax incentive programs that are continuously making agreements with businesses for their participation. According to the State of Nebraska’s Certified Annual Financial Report33,

“As of June 30, 2017 the State administered eleven separate tax abatement programs—the Nebraska Advantage Act, the Nebraska Advantage Rural Development Act, the Nebraska Advantage, Microenterprise Tax Credit Act, the Employee and Investment Growth Act, the Invest Nebraska Act, the Quality Jobs Act, the New Market Job Growth Investment Tax Credit, the Angel Investment Tax Credit, the Nebraska Job Creation and Main street Revitalization Act, the Beginning Farmer Tax Credit, and the Community Development Assistance Act.”

The Legislature will likely debate at least one of these programs by 2020, when the Nebraska Advantage Act is set to expire. As shown in Figure 10, though, that is not likely to be the last word in Lincoln on tax incentive programs. Even if corporate incentives were curtailed, if all of the revenues were used for property tax reform, that would result in significant tax increases on some businesses, and significant reductions for others. If Nebraska wants to consider reforming its state incentive programs, it should be tied to comprehensive tax reforms that create a more neutral tax policy for all business taxpayers in the state.

Retrace Your Steps

Almost every legislative session, a new economic development program, tax incentive, or tax carve-out is approved by the Legislature. In deciding how to begin reforming these policies with the least disruption, the Legislature may want to look at the most recent history, identify the newest incentives and carve-outs, and work in reverse order to scale them back or eliminate them.

One suggestion is to look for incentives and programs that are redundant to existing federal or local policies. As one example, the Nebraska Historic Tax Credit (NHTC), which is under the Nebraska Job Creation and Main Street Redevelopment Act, costs the state $15 million annually. The program currently sunsets on December 31, 2022.35 This credit for the restoration of historic buildings, which is also available at the federal level, was only created in 2015, when the state faced a very different budget picture.

In addition, property owners can take part in the Valuation Incentive Program (VIP), which freezes the assessed property valuation for eight years after the rehabilitation, and subsequently property taxes can only increase by 25 percent each year for the next four years for a total of 12 years of property tax relief.36

By removing or capping entry to this relatively new credit, the state will free up millions of dollars per year over time to spend on property tax reforms. In addition, if the Valuation Incentive Program were to be suspended, that would give local governments a broader tax base and possibly lead to lower property taxes in some jurisdictions. Because virtually all of the potential benefits of a renovation project accrue to those who live, work or sell goods and services in that community, it makes sense for any support for such a project to flow from local sources, whether private or public. This is just one example of many that can be implemented to help reduce the state’s expenditures on incentive and economic development and free up valuable tax dollars for property tax reform.

No discussion of property tax reform would be complete without discussing what appropriate restraints will be placed on property taxing subdivisions in exchange for any new revenues they receive. History shows that more spending alone doesn’t work to reduce the property tax burden for very long.

Taxes kept climbing in 2007 after the creation of the Property Tax Credit Fund, and in 1967, with the elimination of the state property tax. Property taxes will tend to be higher if local taxing jurisdictions have (1) high property tax reliance, (2) low property values, or (3) high local government expenditures.37 In some parts of Nebraska, combinations of all three exist.

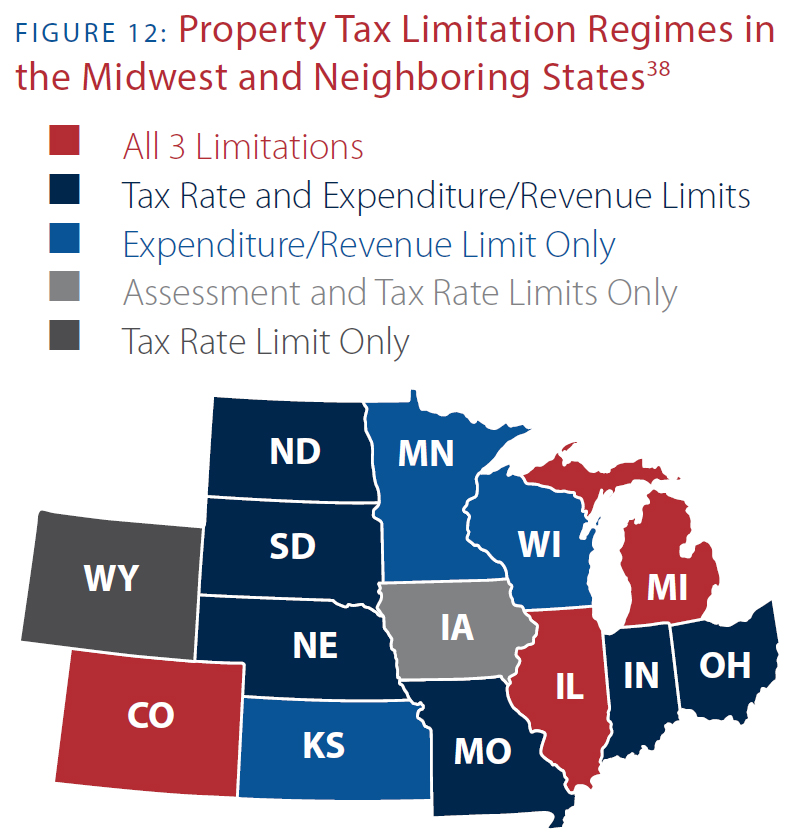

It is important to note that Nebraska, like 45 other states and the District of Columbia, already has some limitations in place for property taxes. Another barrier in solving the property tax problem is that even with these limitations, property taxes range widely across the United States, and there is no proven combination to keep property taxes low that works for every state. Each state that has implemented limitations serves as a case study where Nebraska can learn from their limitations to see which would best suit Nebraska’s needs. To truly reform the state’s property tax system, all property taxing subdivisions must come to the table, along with state lawmakers, and be willing to compromise on a solution that exchanges greater property tax limitations with a broadening of Nebraska’s state and local tax bases.

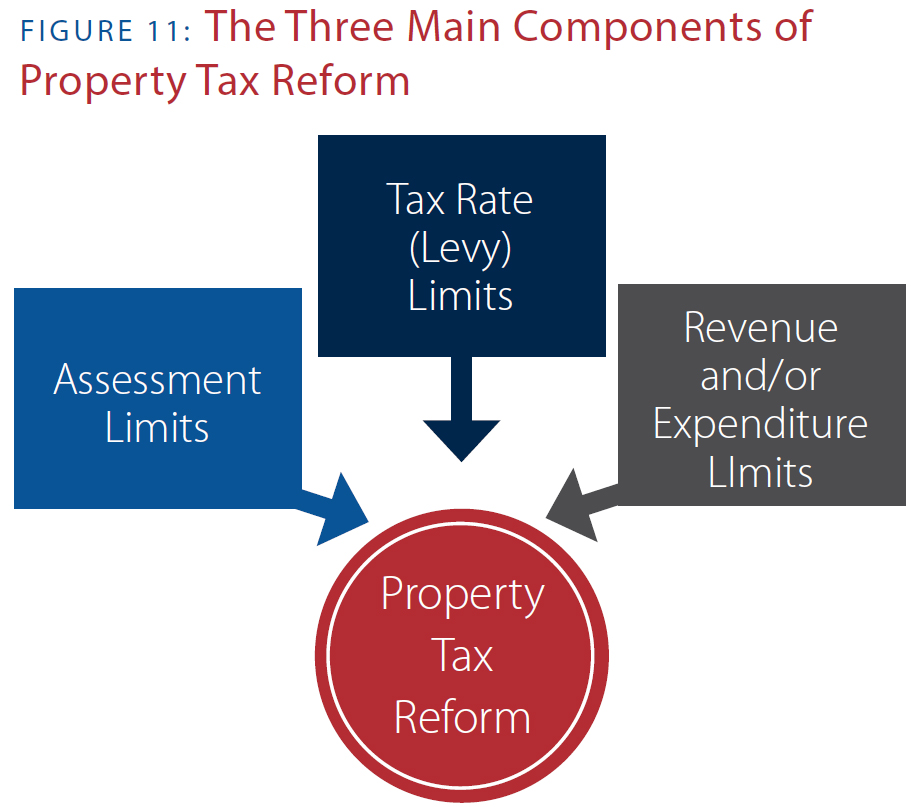

Overall, property tax limitations are broken into three broad categories: assessment limits, tax rate levy limits, and revenue/expenditure limits. Under current law, Nebraska’s property tax system has revenue/expenditure and tax levy rate limitations, and no assessment limitations. A combination of these three limitation types can result in significant property tax relief for Nebraskans. However, each of these limitations work in very different ways, and any reform must have a clear understanding of how they all work together, to achieve the goal of lessening the property tax burden in Nebraska.

Nebraskans’ Views on Property Tax Limitations

Limitations are the key to property tax reform, and potentially for any changes to earn support from Nebraskans. Lawmakers have heard from constituents that property taxes are their number one concern, and the Platte Institute survey confirms that sentiment. We also found that a significant number of Nebraskans may entertain paying additional sales taxes if their property taxes are meaningfully reduced.

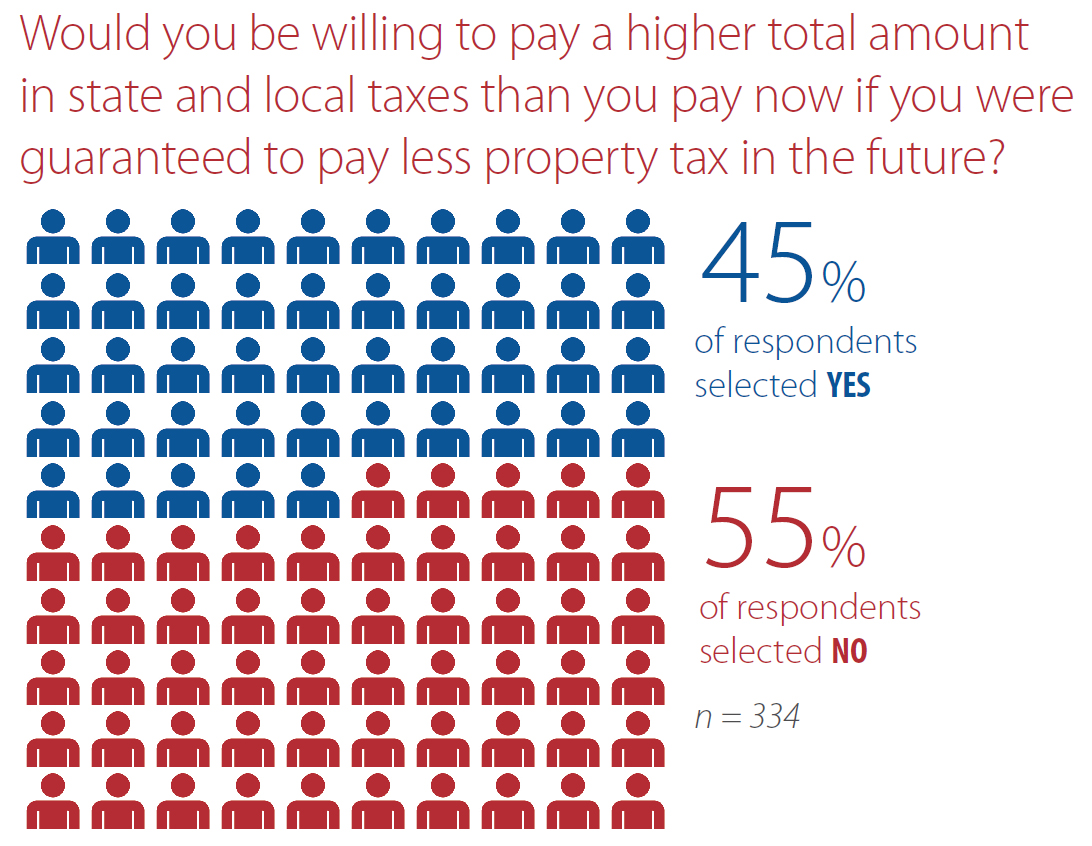

But would Nebraskans accept a net tax increase if it staved off future increases in property taxes? Most of our respondents said no, although the margin was not very large. Fifty-five percent of respondents do not want to pay more in total taxes as a result of property tax reform, while 45 percent would be willing to do so if they had a guarantee that they would pay less property tax going forward.

While it is difficult to say, without specifics, who would pay more in any tax reform, and who would pay less, in general the spirit is as important as the letter. Nebraskans may be willing to pay other taxes to reform the property tax system, but if they sense that policymakers instead only have brazen tax increases in mind, they may get cold feet. On the other hand, a significant number of taxpayers may feel enough of a burden or uncertainty about the future of property taxes that they could be upsold into a net increase through paying another tax, particularly the sales tax.

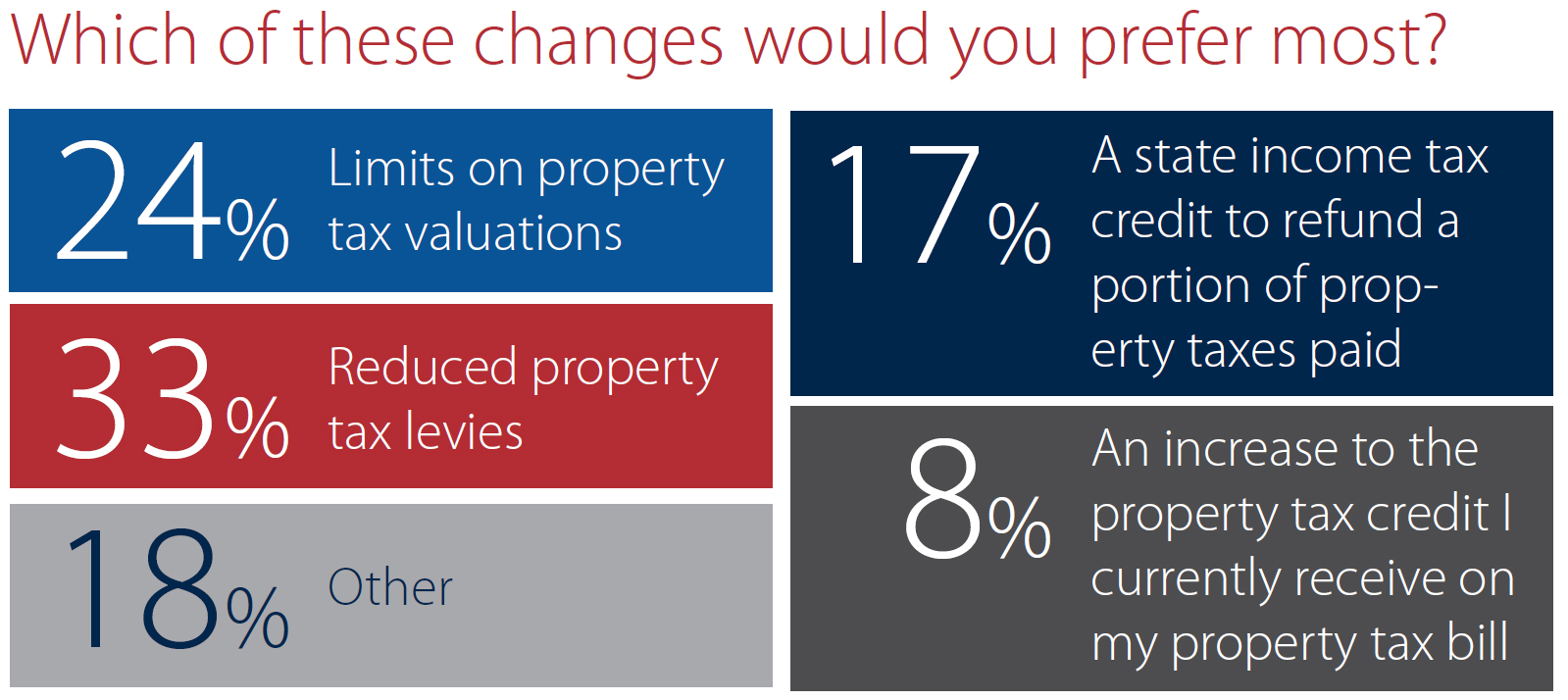

These respondents also seem to be open to moving away from the current approach to tax relief in Nebraska, which is the Property Tax Credit Fund and tax credit proposals, and looking toward a more fundamental type of tax reform. Thirty-three percent say their preferred policy for limiting property taxes would be reducing property tax levies. Limits of property tax valuations were chosen by 24 percent. Income tax credits to offset a portion of property tax paid garnered 17 percent support, while an increase to the current property tax credit that appears on property tax bills earned 8 percent support.

Let’s look at each property tax limitation in more detail:

Assessment Limits, Ratios, and Valuations

An assessment limit is a way to avoid inadvertently pricing someone out of their home or land when their assessed value and associated tax burden rises. Nebraska does not currently have an assessment limit statewide.

Assessment ratios, as discussed previously, are the percent of property value subject to the tax rate. Residential and commercial properties are taxed on 100 percent of the property’s actual value, while agricultural and horticultural land is taxed at 75 percent of actual value.

One policy option to help curb the growth of property tax liabilities in Nebraska is to set an aggregate assessment cap to keep assessments from growing too fast. Another option is to reduce assessment ratios in Nebraska, as was the case in many years for Nebraska’s history. Assessment limits are advantageous for a property owner that may appear wealthier on paper due to the appreciation of their property value, yet their income and ability to pay higher taxes may not have risen proportionately.

An example of this is would be an elderly homeowner who has paid off their home, yet is on a fixed income, or a farmer who has low income, yet has a very high property tax bill due to the large amount of land on their farm. However, experience from other states suggests an aggregate assessment limitation, which takes the whole state into account, may have fewer unintended consequences that an assessment limit on an individual property. Otherwise, a restriction on assessment growth for a single property can create large inequities.

California decided to limit assessments in 1978,39 freezing the assessments to 1976 values. The law only allowed property tax assessments to increase a maximum of 2 percent per year as long as the property was not sold.40 Once a property was sold, it was reassessed. This means two homes on the same street can have drastically different property taxes based upon the year of purchase. This has created a disincentive for homeowners to relocate and also increases the cost of new construction. Two of Nebraska’s neighboring states have a form of a statewide aggregate assessment limit. According to Tax Foundation research:

“Colorado caps residential property at no more than 45 percent of statewide assessed value. Iowa, meanwhile, combines a statewide assessment limit with an “ag tie” which implements an assessment rollback if residential property values in aggregate rise faster than agricultural assessments, or vice versa.”41

If an assessment limit were to be enacted in Nebraska, a full review of other states’ assessment limits and the impact on the property market should be evaluated so a detrimental policy like California’s does not result. A well-designed tax limitation will keep taxes in check across the board, not shift the tax burden from one class of property owner to another. Assessment limits alone will not safeguard against tax increases, and would need to be part of a bigger reform package including the other two aspects of property tax limitations, if Nebraska lawmakers chose to implement them.42

Changing property assessment ratios also has similar drawbacks. Agricultural property, which is assessed at 75 percent of market value while all other classes of property are assessed at full market value, is a good example. A constitutional amendment was approved by voters in 1990 that distinguishes agricultural land as a separate class of property which must be assessed uniformly and proportionately within that class, but not in comparison with other classes of property. A reduced assessment ratio on agricultural property may have made property tax increases less costly than they otherwise would have been, but valuation increases have outpaced any difference the ratio change would have made.

Further reductions in agricultural assessment ratios may also be of limited use on their own. In an area where most property is agricultural, there is little other property to tax. That means absent other funds, local taxing subdivisions may only increase property tax rates in response. In areas where residential and commercial property are well represented, such a change would shift property taxes higher on these taxpayers.

There have been recent suggestions and proposals to adjust the agricultural land property tax valuation from market valuation to income potential in an effort to reduce agricultural property taxes. If this were to occur, it would be reversing a law passed in 2006 by the Nebraska Legislature that changed the valuation from income to market. This leads policymakers to question which is the best approach.

According to tax economists, the income potential valuation adds complexity to the tax code, and ultimately does not make much of a difference for agricultural property tax bills. Switching to income potential is based on the idea that crop prices and yields are volatile, and that paying property taxes is more painful in bad years. But it leads to questions such as how county assessors will consider productivity, soil quality, irrigation, and other factors that speak to income potential. Or, if these factors are not considered, will it be done on a statewide scale only looking at the income potential of agricultural property in aggregate, and then making some sort of adjustment? Ultimately, good tax policy should strive for greater simplicity than the income potential method involves.

Tax Rate ‘Levy’ Limit

A rate limit, commonly referred to as the levy limit, is the most straightforward limitation, and imposes a cap on property tax rates. Nebraska has overall levy caps intended to provide absolute maximum property tax levies. Starting in 1998, property tax levy limits were implemented, limiting local governments to property tax levies of no more than $2.19 per $100 of property value.

Caps have varied over time, especially with regard to school districts, as there have been changes in the state school aid formula and funding. Currently, school systems are limited to $1.05 per $100 of property value. Cities, counties, community colleges, natural resource districts, and sanitary improvement districts are also subject to levy limits. The levy limits do not apply to levies for bond issues of any of these local government units which is why many taxpayers pay more than $2.19.44

Voters may approve an override of the levy limit. If a taxing subdivision, other than a class I school district, wants to levy an additional property tax amount in excess of its cap, they may do so if approved by a majority of the voting electorate, upon a resolution of the governing body voted in favor by 66 percent or more, or by petition signed by 5 percent or more of the voters. Only one resolution and one election for excess levy is allowed per calendar year and if approved is only applicable for a period up to five years.45

In addition to the traditional levy rate limit, Nebraska also has a levy limit that can be adopted in any jurisdiction using the property tax. If a petition is signed by 10 percent of the registered voters of the political subdivision to put a limitation on the budget of the jurisdiction and subsequently approved by a majority of the electorate, then the limitation will take effect for up to two fiscal years.46 This ultimately means that any local government in Nebraska relying on the property tax may be limited by this process.

The most practical way to approach levies in Nebraska would be to tighten or lower levy rate limits for school districts or other taxing subdivisions in concert with a reimbursement of the difference in revenue from state funds. In the late 1990s, cities and counties had their levy limits reduced. Today, school districts levy the most, and are also typically the subdivisions that levy overrides for school bonds. This is one reason why school districts are the single largest source of the property tax in Nebraska. Schools are also funded through a funding formula established by the state, as well as multiple other revenue sources, such as court fines, vehicle taxes, and alcohol and tobacco license fees.47 If a change occurred in how education was funded at the state level, then an appropriate accompanying policy would be a reduction in the school district levy rate.

Revenue or Expenditure Limit

These types of limitations impose a hard constraint on revenue growth, and have the same revenue effect as imposing both a rate and an assessment limit combined, without the inequities and distortions associated with assessment limits.48

However, revenue or expenditure limits do not protect individual taxpayers from substantial tax increases. State lawmakers still have the ability to adjust levy rates and assessment rates within the overall revenue cap. Cities, counties, and taxing subdivisions across Nebraska must maintain a base limitation rate on the growth of restricted funds to 2.5 percent. A governmental unit may exceed the limit for one fiscal year by up to an additional one percent if approved by at least 75 percent of the governing body. A higher percentage may be approved by a majority vote, by the recommendation of the governing body, or by petition signed by at least five percent of voters. Further, a higher percentage may be approved by majority vote at a meeting of residents of the governmental unit after notice is published in a newspaper of general circulation. At least 10 percent of voters in the governmental unit constitute the quorum necessary to exceed the allowable growth percentage.49

A re-evaluation needs to occur as to how these spending and budget caps are working. Again, other states have imposed these with varied success, and a full review of these outcomes should be made. If any other form of property tax limitation is reformed, it is suggested this area also be reformed, as it is an integral tool to ensure local governments are not driving an increase in property tax with excessive spending.

One suggestion is also placing a cap on the maximum override any specific district can enact, which will provide some relief from local communities spending in excess of their limit for bonds.50

Tax Credits

As should be evident from Figure 1, the Property Tax Credit Fund, which is technically a type of tax credit all property owners receive on their property tax bills, has not significantly changed the course of property taxes over the last decade. More recently, proposals and initiatives to beef up this approach have revolved around creating a state income tax credit that a property taxpayer could claim each year when they file their state income tax return. Typically, these credits are proposed to be refundable, meaning a taxpayer who owes more property tax than they owe in income tax could receive a check from the state for the amount of property tax credit they are still owed.

The strategy behind such a policy is to make the state financially responsible for reimbursing taxpayers for a share of property taxes that are paid at the local level. One major problem that arises from such a policy is that it has no corresponding property tax limitations. For example, if a percentage of property tax is reimbursed by the state, but no limitations are enacted on how much that amount could be, the state could be put on the hook for an indefinite amount of funding. This policy could require significant increases in state taxes, while providing no incentive for local taxing subdivisions to reduce property taxes on their own. In the end, this policy has all of the costs of a potentially massive tax cut with none of the benefits of improving the state’s overall tax structure.

Property Tax Reform Options in Summary

Assessments

• Study adoption of statewide aggregate cap on assessment growth;

• Avoid individual property assessment caps;

• Do not reduce assessment ratios without significant tax rate reductions and state reimbursements.

Economic Development and Business Incentives

• If reformed, replace or reduce incentives with comprehensive tax reforms for all businesses;

• Eliminate incentive programs for which another incentive or tax credit performs the same function (i.e. historic preservation credit), and review incentives and carve-outs that have been recently created.

Education Funding

• Provide a base amount of state aid for students enrolled in public schools;

• Reduce or tighten levy rates for school districts in concert with additional aid.

Property Tax Rate Limits

• Reduce total allowed levy rate below $2.00, including bonded indebtedness and overrides.

Property Tax Relief Programs

• Consolidate revenues from the Property Tax Credit Fund into overall property tax reforms, such as an increase in TEEOSA, with additional property tax limitations.

Sales Tax

• Enact statutory language to take full advantage of the online sales tax collections;

• Broaden the base to include services;

• Eliminate unnecessary exemptions that are not business inputs;

• As a compromise, consider lower state tax rates or local sales taxes;

• Do not increase current state sales tax rate;

• Expand the sales taxing authority of local subdivisions, including for tax rate increases, with voter approval;

• Allow counties to collect sales tax within city boundaries if approved by voters.

Conclusion

Nebraska currently has the 7th highest property tax in the nation and is in need of property tax reform that addresses the underlying problem of a local tax system that imposes too great a burden on the state’s economic growth.

However, property taxes have been an issue in Nebraska for over 100 years, and there is no perfect solution to solving the state’s property tax problem. The historical tax changes enacted in 1967 were the result of property taxes, and they are still the number one public policy issue in Nebraska today. Each of the policy proposals offered in this paper have its own set of advantages and disadvantages, and each address a different set of priorities.

What is certain is that more state spending alone will not address the problem. Instead, lawmakers must reform the overall state and local tax structure in order to reduce the financial and compliance costs associated with local property taxes. Achieving a structural reform is particularly important in the face of statewide economic challenges that have been compounded by the downturn in agriculture.

In most recent years, Nebraska has lagged behind the national average in both employment growth and attracting migration from other states. Nebraska’s reputation for high taxes does it no favors in overcoming these challenges. States which gain the most people and jobs at Nebraska’s expense levy significantly lower taxes on average, but do share the commonality of relying more heavily on their sales tax base to fund government services.

During any discussion of tax reform, the Legislature will also need to be aware of the impact a change in tax revenue will have on the state’s budget. Ideally, Nebraska should look to enact revenue-neutral tax reform that results in greater limitations on property taxing authority. Broadening the sales tax base to include select services that are currently exempt, and eliminating some of the state’s many tax exemptions, will allow a reduction in tax rates on working and investing in Nebraska while maintaining the current level of state revenue.

None of this will be easy, but with courage, compromise, and a willingness to change, property tax reform can make a valuable difference for Nebraskans.

Appendix 3: Property Tax Reform Survey Responses

All figures are rounded to the nearest number. Totals may not equal 100%.

1. Where do you believe property tax reform should rank on the list of priorities for the Nebraska Legislature?

• An increase to the property tax credit I currently receive on my property tax bill – 8%

• Other – 18%

Erratum: In the original publication, the results for survey question 2 were printed in reverse. The numbers have been corrected to reflect that 74% of respondents indicated that local governments are responsible for levying property taxes.

Endnotes

1. LB187 passed in 1979 and took effect in 1981.

2. Nebraska Department of Revenue, Property Assessment Division, 2017 Value & Taxes Levied by Taxing Subdivision & by Property Type, accessed July 26, 2018, http://www.revenue.nebraska.gov/PAD/ research/valuation/annual_taxchg/currentvt_piecharts_state.pdf.

3. Legislative Fiscal Office, Brief History of School Finance Formulas, TEEOSA Tax Force meeting handout, July 13, 2018.

4. Legislative Records Historian, Floor transcripts, LB 1059 (1990), prepared by the Legislative Transcribers’ Office, Nebraska Legislature, 91st Leg., 2nd Sess., 6 March 1990, 10477. http://schoolfinance. ncsa.org/teeosa#anchor67

5. Floor Transcripts, LB 1059 (1990), 6 March 1990, 10513. Senator Scott Moor quote.

6. http://schoolfinance.ncsa.org/teeosa#anchordebate, citations 39, 40, 41, and 42.

7. LB299-1996, “Imposed a limit on local government expenditures of “restricted funds” generally property taxes, local sales taxes, and state aid to local governments. The limit was 2% for FY1996-97 and 0% for FY1997-98. Growth equal to the percentage growth in population was allowed, as was an additional 1% with a three-fourths vote of the governing body. Exceptions were for capital improvements, judgments, except for CIR judgments, and expenditures in support of a jointly provided public service.” Go to Chronology of Changes in Tax Policy since 1982 at https://nebraskalegislature.gov/app_rev/source/chrono_ taxpolicy.htm for more information.

8. LB1114 – 1996, “Imposed levy limits on all local governments to limit the total property tax rate (excluding exceptions) to $2.24 per $100 of taxable value beginning in 1998 and $2.13 when fully implemented in 2001. Exceptions were for bonded debt, grandfathered building fund projects for schools, grandfathered capital lease purchases, and voter-approved overrides. Another crucial change was the concept of allocated levies, wherein counties were responsible for allocating levy authority to dozens of small, miscellaneous governments within the 45-cent limit of the county.” Go to Chronology of Changes in Tax Policy since 1982 at https://nebraskalegislature.gov/app_rev/source/chrono_taxpolicy.htm for more information.

9. Nebraska State Government, Statistics on Constitutional Amendments, Initiated and Referred Measures, 1996 General Election, page 15.

10. The legislation states $224 million, but it was only funded $221 million.

11. State of Nebraska Biennial Budget FY2017-19, Property Tax Credit Fund Table 34. Revised Biennial Budget General Fund Transfers-out Table 12.

12. Survey results were collected between June 27, 2018 and July 13, 2018. This was not a scientific survey. Duplicates and those that commented from other states were deleted from the results.

13. The specific question asked was, “On a scale from 1-10 how much of a financial worry are property taxes for you? One indicates you never worry about property taxes, while 10 means property taxes are a major worry for you.”

14. McClelland, Harold, F. page 429, State and Local Finance, A Report of the Nebraska Legislative Council Committee on Taxation, November, 1962.

15. Nebraska Department of Revenue (2016, October 14). 2016 Tax Expenditure Report (Section A – Nebraska and Local Sales and Use Taxes), accessed September 7, 2018, http://www.revenue.nebraska. gov/research/tax_expenditure_rep/2016/2016_Tax_Expend_ Report_1.pdf. There are more recent reports, yet this is the last report that gives a comprehensive list of all exemptions, the 2017 report only lists the most recent 21 exemptions added to state law and none of those were enacted in 2017. The 2018 report has not been published as of the access date, thus there might be some exemptions not counted that were enacted in Spring of 2018.

16. Fine art and other property purchased by museums, enacted in 2016, located in Nebraska Revised Statutes §77-2704.56.

17. Lock, B. (2009, December 1). Response to LR161, LR166, LR97 [Letter to Members of the Committee on Revenue], http://govdocs. nebraska.gov/epubs/L3770/B042-2009.pdf. Published in response to LR 161 introduced by Senator Abbie Cornett, Chair, and the members of the Revenue Committee. The report is also intended to address issues raised by LR 166, introduced by Senator Cap Dierks, the Revenue Committee Vice Chair, and the sales tax issues raised in LR 97, introduced by Senator Richard Pahls.

18. Henchman-Bishop, J., & Drenkard, S. (2013). Building on Success: A Guide to Fair, Simple, Pro-Growth Tax Reform for Nebraska (pp. 29-33, Publication). Washington, D.C.: Tax Foundation. https://files. taxfoundation.org/legacy/docs/building_on_success_nebraska.pdf.

19. Nebraska Department of Revenue, Chronological History of Nebraska Tax Rates, History of Nebraska Income Tax and Sales Tax Rates Through 1992 and Nebraska Tax Rate Chronologies Table 1-Income Tax and Sales Tax Rates, http://www.revenue.nebraska.gov/ research/chronology/history.pdf and http://www.revenue.nebraska. gov/research/chronology/4-607table1.pdf.

20. Walton, D., & Olberding, M. (2018, June 21). Ricketts says online sales taxes should go to property tax relief if Nebraska takes advantage of ruling. Lincoln Journal Star. Retrieved September 4, 2018, from https://journalstar.com/business/local/ricketts-says-online-sales-taxes-should-go-to-property-tax/article_1f7f8188-e007-57bf-a4ad- 5a1c99b5bd30.html

21. Nebraska Department of Revenue (July 27, 2018). Statement from the Nebraska Department of Revenue Regarding the South Dakota v. Wayfair United States Supreme Court Decision, accessed September 4, 2018, http://www.revenue.nebraska.gov/news_rel/jul_18/wayfair. pdf.

22. Federation of Tax Administrators (August 2017). Sales Taxation of Services: Summary Table [xlsx spreadsheet]-Number of Services Taxes by State & Category, accessed August 30, 2018, https://www. taxadmin.org/sales-taxation-of-services.

23. The specific question asked was, “Once again, if you wouldn’t mind paying more sales tax for property tax reform: Given the choice, would you rather pay a higher sales tax rate (ex. 8% instead of 7%) or pay sales tax on purchases you do not pay on currently?”

24. Title 316 – Nebraska Department of Revenue, Chapter 9-Local Sales and Use Tax, REG-9-004 AUTHORIZATION FOR COUNTIES, accessed August 27, 2018, http://www.revenue.nebraska.gov/legal/ regs/localopt.html#004.

25. Title 316 – Nebraska Department of Revenue, Chapter 9-Local Sales and Use Tax, REG-9-002 AUTHORIZATION FOR CITIES – UP TO 1½%, accessed August 27, 2018, http://www.revenue.nebraska. gov/legal/regs/localopt.html#003.

26. Nebraska Department of Revenue, Frequently Asked Questions about Nebraska Sales and Use Tax, Rates and Returns, accessed August 27, 2018, http://www.revenue.nebraska.gov/question/slstax_faq.html.

27. Nebraska Department of Revenue, New Local Sales and Use Tax Rates Sorted by Rate effective January 1, 2019, accessed September 7, 2018, http://www.revenue.nebraska.gov/question/newsales_ratesort. html#per1-5.

28. Richardson, I. (2018, July 12). Dakota City asking voters to re-approve sales tax for fire station. Sioux City Journal. Retrieved September 7, 2018, from https://siouxcityjournal.com/news/local/ govt-and-politics/dakota-city-asking-voters-to-re-approve-sales-tax-for/article_8b24cc58-0f1a-575b-8512-3968080c22ef.html

29. Nebraska Department of Revenue, Bulletin, received via email on August 31, 2018, “NOTE: Since Dakota City is within Dakota County, which imposes a 0.5% COUNTY sales and use tax rate, the Dakota County sales and use tax rate will no longer be effective for taxable deliveries made within the Dakota City boundaries as of January 1, 2019. A county sales and use tax is only imposed on taxable sales within the county, but outside the city boundaries of any city that imposes a city sales tax.”

30. Richardson, I. (2018, July 12). Dakota City asking voters to re-approve sales tax for fire station. Sioux City Journal. Retrieved September 7, 2018, ¶6 and ¶7, from https://siouxcityjournal.com/ news/local/govt-and-politics/dakota-city-asking-voters-to-re-approve-sales-tax-for/article_8b24cc58-0f1a-575b-8512-3968080c22ef.html.

31. Mitchell, M., & Winter, T. (2018, June 04). The Opportunity Cost of Corporate Welfare. Retrieved September 14, 2018, from https://www. mercatus.org/publications/opportunity-cost-corporate-welfare.

32. Platte Institute Legislative Summit, September 13, 2018, Property Tax Reform Panel, Lincoln, Nebraska.

33. State of Nebraska. (2017). Comprehensive Annual Financial Report Year Ended June 30. Lincoln, NE: Department of Administrative Services, p 79, http://das.nebraska.gov/accounting/cafr/cafr2017.pdf.

34. State of Nebraska. (2017). Comprehensive Annual Financial Report Year Ended June 30. Lincoln, NE: Department of Administrative Services, p 83, http://das.nebraska.gov/accounting/cafr/cafr2017.pdf.

35. Nebraska Department of Revenue. (2017, April 20). Retrieved September 10, 2018, from http://www.revenue.nebraska.gov/ incentiv/historic_tax_credit/hist_tax_cred_gen_info.html.

36. Historic Tax Incentive Programs. (n.d.). Retrieved September 10, 2018, from https://history.nebraska.gov/historic-preservation/ historic-tax-incentive-programs.

37. Lincoln Institute of Land Policy, & Minnesota Center for Fiscal Excellence. (2017, June). 50-State Property Tax Comparison Study for Taxes Paid in 2016, p5. Retrieved September 17, 2018, from https:// www.lincolninst.edu/sites/default/files/pubfiles/50-state-property-tax-comparison-for-2016-full.pdf.

38. Walczak, Jared. (2018, April 23). Property Tax Limitation Regimes: A Primer. Table 1, retrieved September 17, 2018, from https:// taxfoundation.org/property-tax-limitation-regimes-primer/.

39. California Proposition 13 in 1978; this rolled back and froze property tax values at 1976 assessed value level.

40. What is Proposition 13? California Property Tax Information by the California Tax Data, https://www.californiataxdata.com/pdf/Prop13.pdf

41. Walczak, Jared. (2018, April 23). Property Tax Limitation Regimes: A Primer. Page 8, retrieved September 17, 2018, from https://taxfoundation.org/property-tax-limitation-regimes-primer/.

42. Walczak, Jared. (2018, April 23). Property Tax Limitation Regimes: A Primer. Page 9, retrieved September 17, 2018, from https://taxfoundation.org/property-tax-limitation-regimes-primer/.

43. Kauffman, Nathan. (2018, June 28). Nebraska’s Housing Market Heating Up. Federal Reserve Bank of Kansas City. Chart 2, retrieved October 2, 2018, from https://www.kansascityfed.org/en/publications/research/ne/articles/2018/2q2018/nebraskas-housing-market-heating-up.

44. Anderson, J. E., & Thompson, E. C. (2014). Property Taxes in Nebraska: Past, Present, and Future. Omaha, NE: Platte Institute. https://files.platteinstitute.org/uploads/2020/05/Property-Taxes-in-Nebraska-Past-Present-and-Future.pdf.

45. Anderson, J. E., & Thompson, E. C. (2014). Property Taxes in Nebraska: Past, Present, and Future. Omaha, NE: Platte Institute. https://files.platteinstitute.org/uploads/2020/05/Property-Taxes-in-Nebraska-Past-Present-and-Future.pdf.

46. Neb. Rev. Stat. § 77-3402

47. Overview of Nebraska Public School Funding Sources (2015-16 School Year), http://news.legislature.ne.gov/dist42/2017/12/04/table-overview-of-nebraska-public-school-funding-sources/.

48. Walczak, Jared. (2018, April 23). Property Tax Limitation Regimes: A Primer. Page 11, retrieved September 17, 2018, from https://taxfoundation.org/property-tax-limitation-regimes-primer/.

49. Neb. Rev. Stat. § 13-518; Neb. Rev. Stat. § 77-3446; Neb. Rev. Stat. § 79-1025; Neb. Rev. Stat. § 79-1029 ~ § 79-1030