Ranking shows no improvements to Nebraska’s business tax climate

In any organization, maintaining the status quo can create an opening for competitors to gain on you and even surpass you. That is exactly what’s happening to Nebraska with our latest ranking in the Tax Foundation’s 2021 State Business Tax Climate Index. In 2020, despite passing major tax legislation, Nebraska lawmakers did nothing to structurally reform our state’s tax code, and the state’s overall tax ranking is the same as last year.

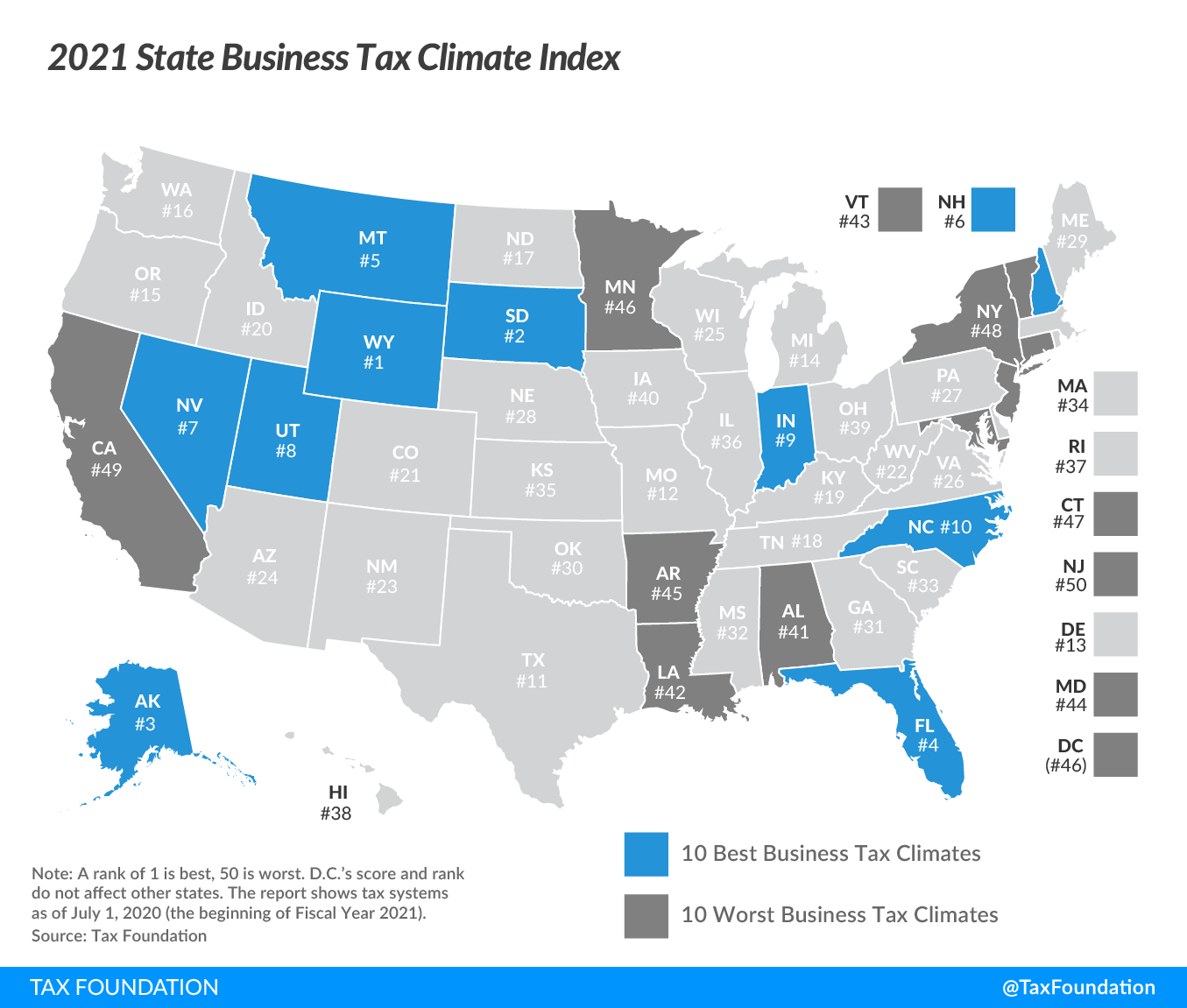

According to the newest edition of the Index, Nebraska remains ranked 28th best in the nation. This measure is comprised of rankings based on the structure of corporate income tax (32nd), personal income tax (21st), sales tax (15th), property tax (41st), and an unemployment insurance ranking (11th).

Even though Nebraska stayed the same with our overall ranking, we dropped 1 ranking spot in corporate income taxes and dropped 5 with sales tax. This is because other states enacted their own reforms.

In comparison, while Nebraska conformed to the federal CARES Act tax changes, almost every state did that, so the impact was negligible. And as the Tax Foundation noted at our Virtual Legislative Summit, the major compromise legislation in LB1107 also had no impact on our overall ranking.

Meanwhile, among our neighboring states, Kansas dropped one ranking overall but saw a 4-position increase on their corporate income taxes and one position increase for both unemployment insurance and sales taxes. Missouri increased their overall ranking by 2 spots to become 12th best tax climate in the nation with the help of positive changes to their corporate and individual income taxes and unemployment insurance taxes. And one of the biggest changes in the country was seen in neighboring Iowa where they increased their ranking from 45th to 40th overall. This was thanks to their tax reform efforts being implemented which increased their ranking on corporate and individual income tax by two positions each and sales tax by one position.