Omaha and Lincoln’s Growing Challenge in Pension Funding

Executive Summary

Public pension debts from three major municipal plans in Nebraska are approaching $1 billion, and an analysis of Omaha’s two municipal systems and Lincoln’s public safety plan suggest that this shortfall is likely to continue to expand unless policymakers make meaningful changes to how the city funds and manages the retirement plans. In 2015, Omaha city officials took important first steps in addressing funding challenges by establishing a cash balance plan for all new members of their civilian plan. The city’s plan for public safety employees—with roughly three times the unfunded liabilities as the civilian employee plan—remains unchanged and still exposed to significant risks of underfunding, undervalued liabilities, and underperforming investments. In 2017, Lincoln took a prudent step of its own by requiring that city budgets fully pay the actuarially determined cost of providing pension benefits to its public safety workers. Although, like Omaha, risks to financial sustainability remain for Lincoln’s public safety plan.

Omaha and Lincoln plans will need to address accrued pension debts, and this challenge will require exploring potential reforms to contributions, assumptions, amortization policies, plan design and more. Nebraska’s municipal plans currently face the challenge of pension promises for which they only hold about half of the necessary funding to afford. But well-informed comprehensive reform can help manage long-term costs for taxpayers, as well as improve retirement security for public workers.

Introduction: The Pension Problem in Omaha and Lincoln

Like many other municipal governments around the country, Omaha and Lincoln strive to offer a competitive and secure retirement benefit to its public servants. Historically, the most common type of public retirement plan was a defined benefit pension, which places annual contributions from employees and employers into a fund that accrues investment returns over a worker’s career, the combination of which is meant to be sufficient to provide guaranteed lifetime benefits to the city’s retirees.

Promised retirement benefits to public workers are generally guaranteed under federal and state contract law, thus it is the responsibility of government policymakers—the pension system sponsors, as employers—to maintain a properly funded plan. Any funding shortfall will ultimately be the taxpayers’ burden, so it is also the responsibility of lawmakers to oversee and manage the costs associated with pension funding.

Pensions depend on a variety of long-term market and demographic assumptions, which lawmakers and plan managers use to ensure annual contributions going into the fund are enough to guarantee the agreed-upon benefits for the rest of an employee’s life. If actual experience differs from these assumptions, or if policymakers take too long to adjust expectations, pension funds can see their asset growth fall behind the amount needed to pay promised benefits, leading to what is called pension debt, or more formally, unfunded pension liabilities.

Unfortunately, many state and local governments have experienced alarming levels of growth in unfunded liabilities over the past two decades. Omaha’s two public pension plans, the Employees’ Retirement System (ERS) and the Police and Fire Retirement System (PFRS), and Lincoln’s public safety plan, Police and Fire Pension Fund (PFPF), are certainly no exception to national funding trends.

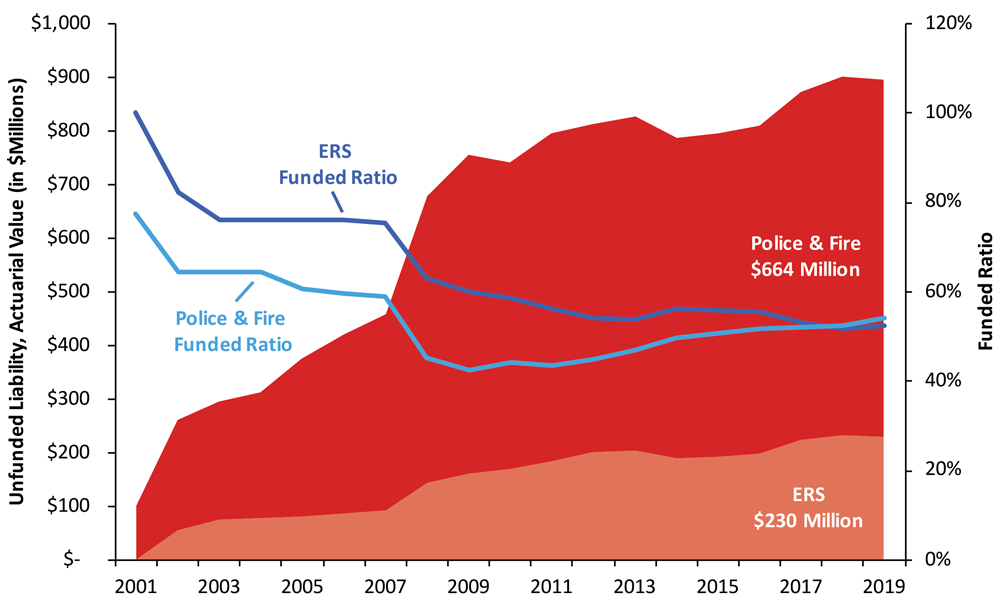

Both Omaha plans combined saw their funding go from being short by about $100 million in 2001 to nearly $900 million short on pension promises by 2020 (see Figure 1). Omaha’s ERS was last fully funded in 2001, but has since descended into significant underfunding with only 52% of the assets needed to fulfill retirement promises made to current and retired public servants. The police and fire plan was not fully funded in the early 2000s, but had a 92% funded ratio in 1998. After the 2008 recession, Omaha PFRS dipped to below 50% funded, and has recovered very little since then despite a record-long Wall Street streak of market growth.

Figure 1: Omaha ERS and Omaha PFRS Unfunded Liability Growth and Declining Funding (2001-2018)

SOURCE: Pension Integrity Project analysis of Omaha PFRS & ERS actuarial valuation reports.

SOURCE: Pension Integrity Project analysis of Omaha PFRS & ERS actuarial valuation reports.

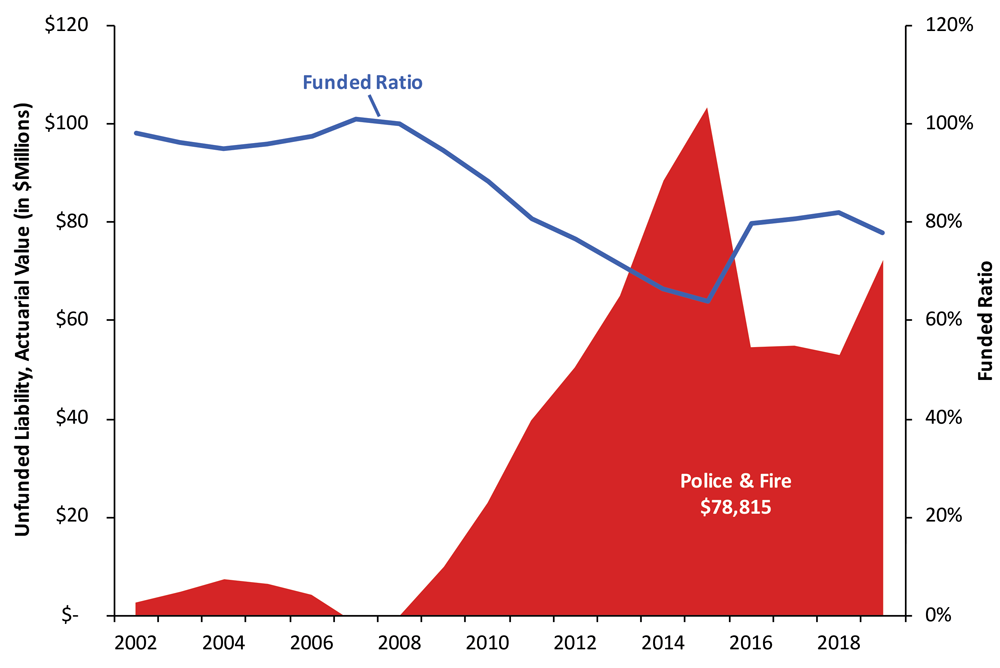

Prior to the financial crisis, Lincoln PFPF reported that it was fully funded with assets exceeding or keeping close pace with promised benefits. However, since the financial crisis, the Lincoln public safety pension fund saw funding ratios below 70%. The last four years PFPF has seen a funded ratio around 80%. In 2019, PFPF reported a 78% funded ratio with $72.4 million in unfunded liabilities.

Figure 2: Lincoln PFPF Unfunded Liability Growth and Declining Funding (2002-2019)

SOURCE: Pension Integrity Project analysis of Lincoln PFPF actuarial valuation reports.

SOURCE: Pension Integrity Project analysis of Lincoln PFPF actuarial valuation reports.

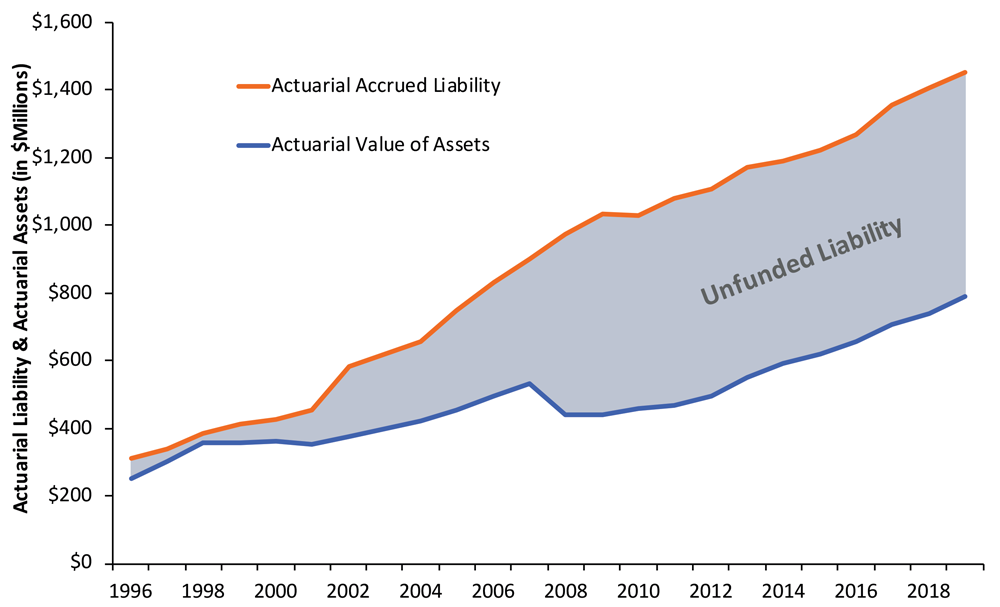

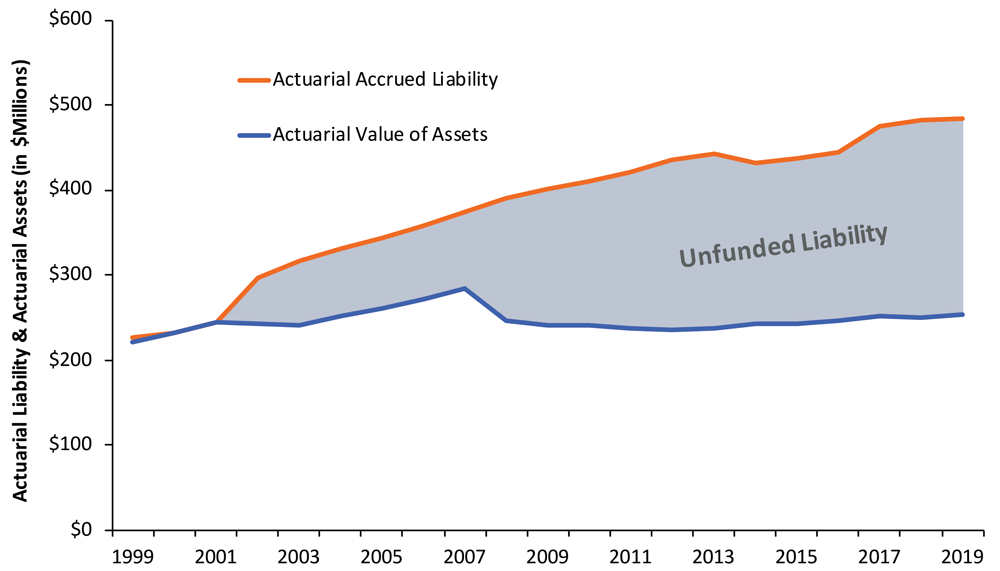

Another way to evaluate a system’s growth in pension debt is to look at the historical progress of the benefits promised to members (the actuarial accrued liability) and the growth of assets on hand as reported by the plan (the actuarial value of assets). Such an analysis shows that Omaha ERS and PFRS were already showing signs of long-term underfunding even before the fallout of the 2008 recession. Once the funds experienced significant asset losses in the latter part of the 2000s, the funding gap never closed and even widened. These results demonstrate the systems’ struggles in being able to recover from major market volatility, an increasingly prevalent challenge during and beyond the 2020 pandemic.

Figure 3: Omaha PFRS Assets and Liabilities (2001-2018)

SOURCE: Pension Integrity Project analysis of Omaha PFRS actuarial valuation reports through FY2019.

SOURCE: Pension Integrity Project analysis of Omaha PFRS actuarial valuation reports through FY2019.

Figure 4: Omaha ERS Assets and Liabilities (1999-2018)

SOURCE: Pension Integrity Project analysis of Omaha ERS actuarial valuation reports through FY2019.

SOURCE: Pension Integrity Project analysis of Omaha ERS actuarial valuation reports through FY2019.

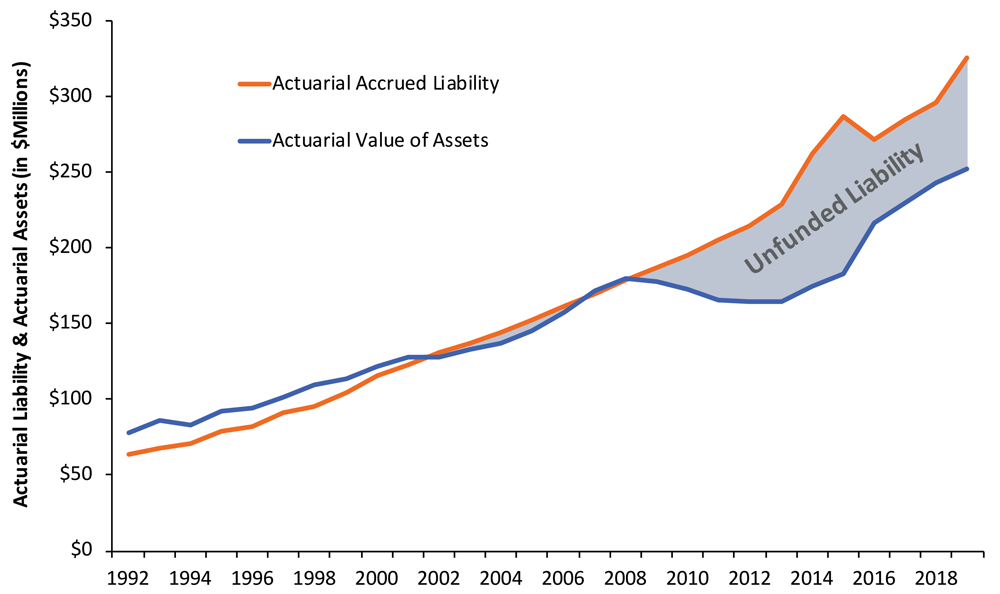

For Lincoln PFPF, unfunded liability was minimal, or non-existent, in plan reporting prior to the financial crisis. However, the sharp losses incurred during the financial crisis exposed a series of underlying weaknesses in the pension plan. Years of underfunding actuarially recommended rates were papered over by strong investment returns during the housing and dot-com bubbles. Leading up to 2008, the city increased pension asset allocation to high-yield, high-risk investments which resulted in -6.6% and -16.4% market returns in 2008 and 2009, respectively.

Figure 5: Lincoln PFPF Assets and Liabilities (1992-2019)

SOURCE: Pension Integrity Project analysis of Lincoln PFPF actuarial valuation reports through FY2019.

SOURCE: Pension Integrity Project analysis of Lincoln PFPF actuarial valuation reports through FY2019.

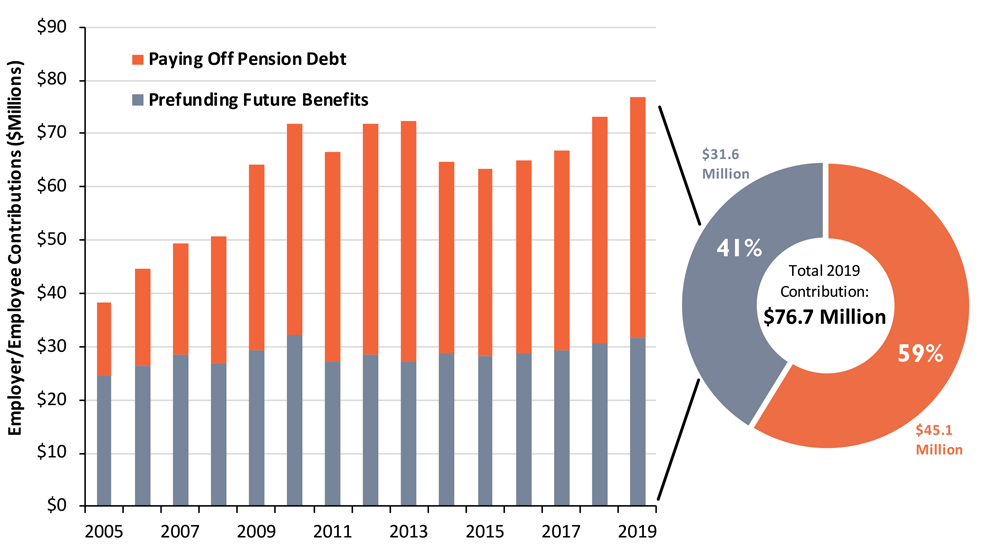

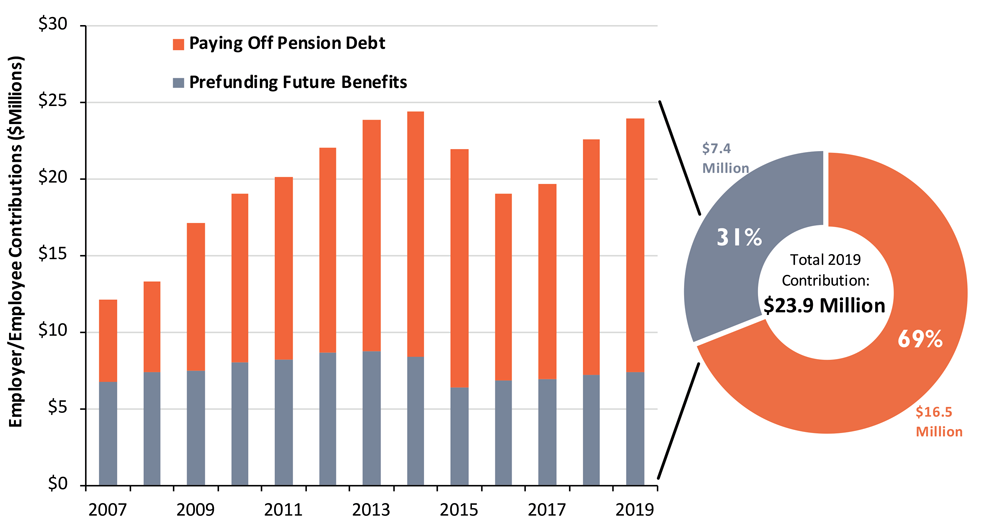

Significant—and long-lasting—shortfalls in both Omaha and Lincoln’s pension funding are driving up annual contributions, which puts city policymakers in a difficult position of having to appropriate more funding and/or reallocating funding from other local needs (for example infrastructure or parks). Calculated as a percentage of total payroll, annual costs for Omaha PFRS are now more than twice of what they were just two decades ago. Yearly contributions for Omaha ERS have multiplied by more than four times since 2001. Most of this increase results from ballooning pension debt, which requires higher annual payments to eventually pay off unfunded liabilities (see figures 6 and 7).

Figure 6: Pension Debt Payments Driving Up Costs for Omaha PFRS

SOURCE: Pension Integrity Project analysis of Omaha PFRS actuarial valuations.

SOURCE: Pension Integrity Project analysis of Omaha PFRS actuarial valuations.

Figure 7: Pension Debt Payments Driving Up Costs for Omaha ERS

SOURCE: Pension Integrity Project analysis of Omaha ERS actuarial valuations.

SOURCE: Pension Integrity Project analysis of Omaha ERS actuarial valuations.

Some recent efforts have attempted to start addressing Omaha’s growing pension challenge. In 2015, Omaha Mayor Jean Stothert signed a collective bargaining agreement with civilian labor unions that, in part, created a new “cash balance” retirement plan for new members of ERS. This cash balance plan guarantees a 4% rate of return on contributions to members’ retirement accounts and shares 75% of investment returns above 7% with plan members. Thus, every member hired after March 1, 2015, when this cash balance plan was adopted, is an employee whose pension liabilities are not exposed to the same actuarial assumptions of the civilian defined benefit plan. On this reform, Mayor Stothert stated “The cash balance plan is the key to solving our pension liabilities…It better protects the City against market volatility, provides a fair pension that our employees can depend on and offers greater protection against future unfunded pension liability than the current plan.”1

The city has also committed to significantly higher contributions into both systems, which has at the very least slowed the growth of pension debt over the past five years. In 2015, Omaha policymakers agreed to a 7% contribution increase (calculated as a percentage of payroll) into ERS. In 2018, the city negotiated a 0.75% increase in contributions from both employees and employers in PFRS.

While the adoption of a risk-managed cash balance plan for new civilian hires and the commitment of higher annual contributions were positive steps toward more affordable and secure pensions in Omaha, structural issues still exist in the city’s plans. These challenges must be addressed in order to prevent more decades of continued underfunding. Thus, there are several other steps that should be taken in order to protect Omaha’s taxpayers from seeing their tax dollars consumed by unfunded liability amortization payments.

For Lincoln, as mentioned previously, prior to the 2008 financial crisis, the city underfunded the plan relative to recommended rates. Since the crisis, with the exception of 2015, the plan has seen funding much closer to the actuarial determined employer contribution rate. An important step towards reform was taken in May of 2017. Lincoln passed an ordinance requiring the city to pay 100% of the actuarially determined employer contribution rate.

Additionally, in 2019 Lincoln PFPF took a small step to reform by decreasing the investment return assumption from 7.5% to 7.45%. The plan is scheduled to reach a return assumption of 7.25% over the next four years. However, the plan’s annualized geometric return was 5% over the past five years, 7.1% over ten years. Given the current status of Lincoln’s Police and Fire Pension Fund, additional reforms are needed to ensure the long-term stability of the plan.

The Sources of Omaha’s Pension Underfunding

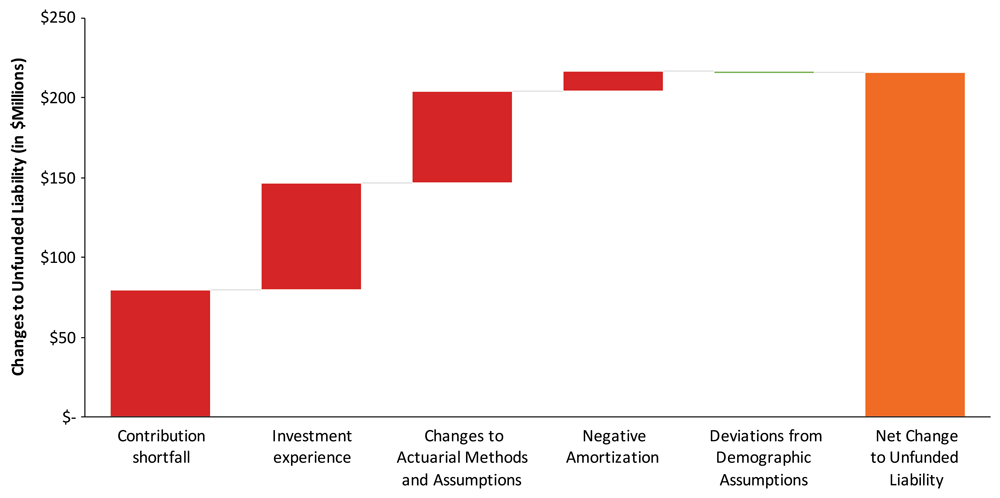

Analysis of annual actuarial reports from Omaha’s PFRS and ERS along with Lincoln’s PFPF can be valuable in identifying the causes of their current funding shortfalls over the past two decades. Figures 8 and 9 provide a visual of these numbers for Omaha PFRS and Omaha ERS respectively.

Figure 8: The Cause of PFRS Pension Debt (Actuarial Experience 2003-2018)

SOURCE: Pension Integrity Project analysis of Omaha PFRS actuarial valuations. Data represents cumulative unfunded liability by gain/loss category.

SOURCE: Pension Integrity Project analysis of Omaha PFRS actuarial valuations. Data represents cumulative unfunded liability by gain/loss category.

Figure 9: The Causes of ERS Pension Debt (Actuarial Experience 2000-2018)

SOURCE: Pension Integrity Project analysis of Omaha ERS actuarial valuations. Data represents cumulative unfunded liability by gain/loss category.

SOURCE: Pension Integrity Project analysis of Omaha ERS actuarial valuations. Data represents cumulative unfunded liability by gain/loss category.

As shown in this analysis, the two most prominent causes of growth in the unfunded liability were shortfalls in the city’s contributions to the pension systems and investment returns below expectations. The third largest contributor to the growth in pension debt has been the systems’ changes to actuarial assumptions to become more realistic. These additions to the unfunded liability represent prudent adjustments in assumptions, which uncovered costs that always existed but were previously not recognized. These additions to the pension debt show that PFRS and ERS underestimated liabilities in the past, and that there are likely more hidden costs remaining for Omaha’s pension plans.

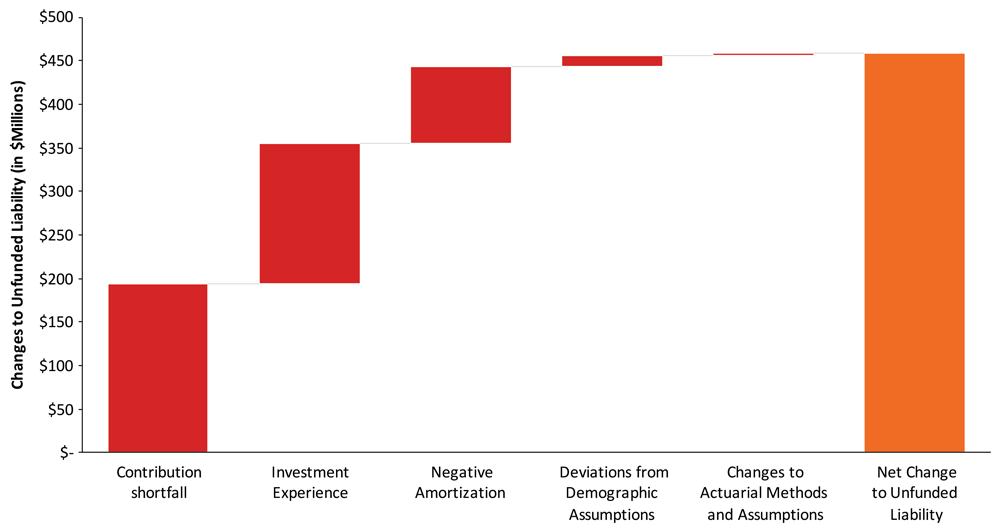

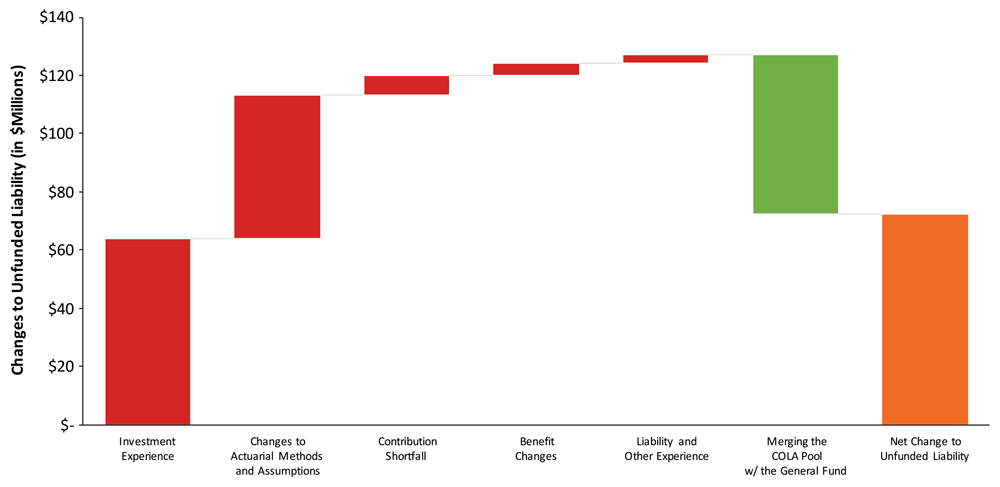

Recent changes in pension debt for Lincoln’s public safety plan can be seen in Figure 10. As evident in the chart, the primary sources of Lincoln’s PFPF increase in unfunded liability since 2009 are investment returns below expectations and changes to actuarial methods and assumptions. Contribution shortfalls, benefit changes, and liability and other experience changes are, relatively speaking, smaller contributors to pension debt. Again, the changes to actuarial calculations simply show previously underestimated preexisting liabilities.

Figure 10: The Causes of Lincoln PFPF Pension Debt (Actuarial Experience 2009-2019)

SOURCE: Pension Integrity Project analysis of Lincoln PFPF actuarial valuations. Data represents cumulative unfunded liability by gain/loss category.

SOURCE: Pension Integrity Project analysis of Lincoln PFPF actuarial valuations. Data represents cumulative unfunded liability by gain/loss category.

The positive change we see for PFPF is due to a reorganization in plan assets. In June of 2016, Lincoln PFPF merged an asset pool set aside to pay out “13th Checks”—a sort of cost-of-living adjustment (COLA)—with the pool of assets for normal retirement benefits. Since the early 1990s, PFPF paid out 13th Checks, but did not pre-fund the benefit with normal cost, instead paying for the COLAs by siphoning off a certain amount of investment returns in years with strong market returns. While the COLA pool merger did nominally improve the funded status of the plan, it nonetheless did not stop the drivers of pension debt.

Taken on the whole, there are three underlying root causes of unfunded liability growth in Nebraska’s municipal plans: employer contribution shortfalls, investment returns below expectations, and—not explicitly visible in the above illustrations—underpriced liabilities.

Compounding Costs: Why Pension Funding Shortfalls Should Be Paid as Quickly as Possible

When a pension fund fails to keep up with expected levels, the problem created by that gap worsens the longer a government takes to fix it. Like other retirement funds, pensions rely heavily on investment returns. If a pension fund’s assets are short, so too will be the annual returns generated on investments. That means that even if the plan achieves returns that meet expectations they can fall short in sufficiently growing the pool to match promises made to public servants. In short, holding pension debt for long periods of time generates significant and unnecessary costs to the government and taxpayer.

This lost opportunity for full investment returns acts very similarly to an interest on a debt. Every year that Lincoln and Omaha pension funds hold unfunded liabilities, they are taking on more unexpected costs that will eventually need to be paid. This phenomenon is most evident when annual interest on a plan’s debt is so high that it even exceeds the amount contributed for debt payments. This is what is called negative amortization, which has been a significant contributor to Omaha’s growth in unfunded liabilities. The challenges presented by interest on pension debt and negative amortization demonstrate why it is a poor policy to maintain high levels of debt over long periods, and why it is important to find ways to pay off any funding shortfalls as quickly as possible.

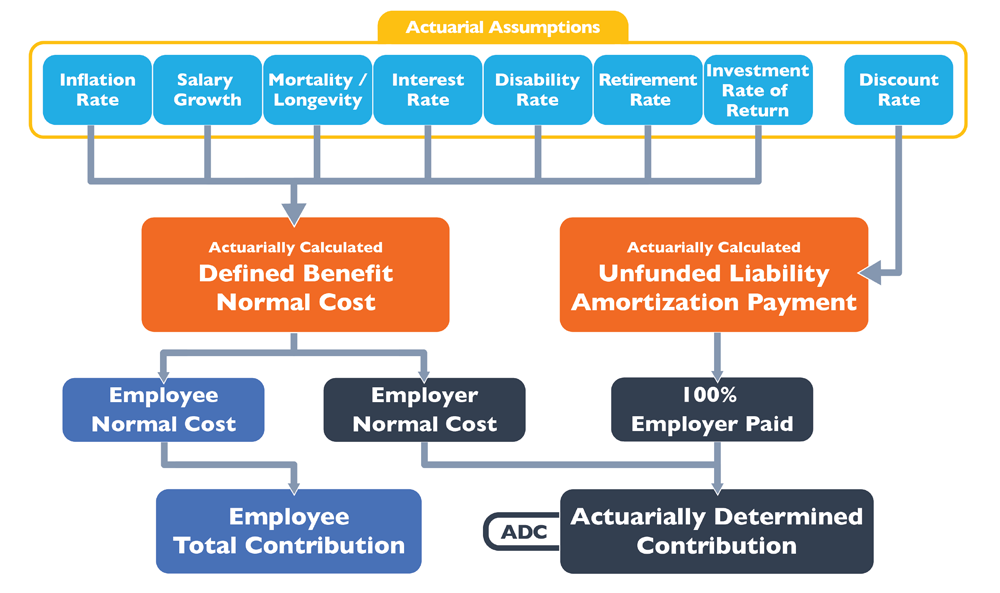

Figure 11: How a Pension Plan is Typically Funded

Challenge 1: Not Paying the Full Actuarially Determined Employer Contribution

Defined benefit pension plans are designed to be “pre-funded.” As pension benefits are earned, an amount equivalent to those earned benefits minus an expected investment return is paid into the pension fund. The necessary amount that should be contributed in a given year is called “normal cost,” with employees paying a share of this cost out of their paychecks and the city employers picking up the rest.

Whenever actuarial assumptions about the future turn out to be wrong (or if unpaid for benefits are increased) then a pension plan experiences an increase in unfunded liabilities, which require amortization payments from the city.

The combined total of the employer’s share of normal cost and whatever the necessary unfunded liability amortization payments are for a given year is known as the actuarially determined employer contribution (ADEC).2

Lincoln and Omaha have a history of not always contributing 100% of this actuarially calculated contribution rate. As shown in Figure 12, Omaha paid below the amount needed to avoid growth in pension debt in both systems for over a decade. For Lincoln, between 2003 and 2007 the plan contributed between 60% and 86% of the actuarially calculated rate.

Figure 12: Omaha’s Percentage of Actuarially Determined Contributions Actually Paid (1994-2018)

SOURCE: Pension Integrity Project analysis of Omaha PFRS and ERS valuation reports.

SOURCE: Pension Integrity Project analysis of Omaha PFRS and ERS valuation reports.

Since 2009, there has been steady improvement in the amount of required contributions paid in both cities. In Omaha this is due mainly to the aforementioned steps taken by the city to increase annual payments into the funds. The city’s efforts helped steer annual contributions to actuarially suggested levels by 2015 for PFRS and by 2016 for ERS, but these numbers are again trending down, leading again to underpayment over the last two years. Collectively, since 1994, the city has paid only 82% of the ADEC for PFRS’s, and 71% of ERS’s total ADEC. For Lincoln PFPF, contributions have improved since the crisis and the city took an important step by passing an ordinance to pay full ADEC.

Any time a government fails to fully pay the ADEC, it must make up those contributions at a later date as amortization payments. This shortfall is added to next year’s ADEC, and if the government chooses not to make the full payment again, the difference is added to the ADEC for the following year. Thus, failing to pay the ADEC creates a vicious cycle where choices to under contribute compound over time until it is impossible to pay the full ADEC because the required payments are too unaffordable for the city’s budget.

This cycle has been allowed to develop in Omaha because there is no law forcing the city pay the ADEC contribution rate. The Government Accounting Standards Board (GASB) does establish accounting rules that most states and cities voluntarily choose to follow, but GASB does not enforce payment of the ADEC or any other amount. Instead, the city establishes annual contributions by statute, which has proven to be slow to adjust to the funding needs of PFRS and ERS.

The past two decades have clearly demonstrated the shortcomings in waiting for city policymakers to make the necessary adjustments in statutory contributions, as Omaha’s pensions suffered from over a decade of payments well below the levels needed to maintain a path toward full funding. Now, the past two years suggest that this will continue to be a problem for Omaha’s two pension plans.

Challenge 2: Investment Returns Below Expectations

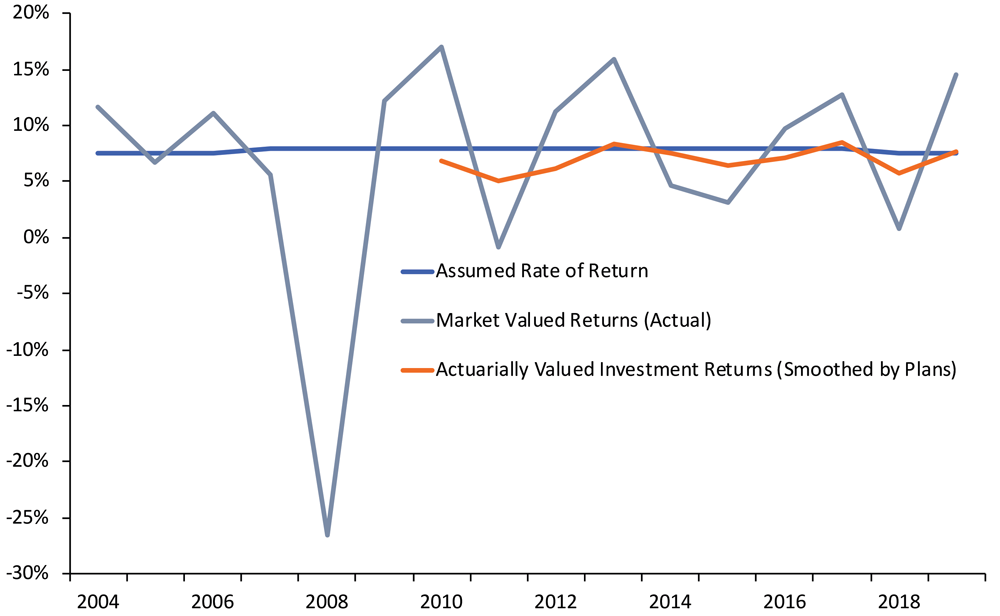

Until 2018, Omaha’s pension systems operated upon the assumption that they would be able to achieve long-term market returns of 8%. Both the PFRS and ERS experienced returns well below their 8% long-term assumed rates of return. As Figures 13 and 14 show, the long-term average annual returns for Omaha’s pension systems did not match their lofty expectations.

Figure 13: Omaha PFRS Investment Return History (2001-2018)

SOURCE: Pension Integrity Project analysis of Omaha PFRS valuation reports. The assumed return was lowered to 7.75% in 2018.

SOURCE: Pension Integrity Project analysis of Omaha PFRS valuation reports. The assumed return was lowered to 7.75% in 2018.

Figure 14: Omaha ERS Investment Return History (2004-2018)

SOURCE: Pension Integrity Project analysis of Omaha ERS valuation reports. The assumed return was lowered to 7.5% in 2018.

SOURCE: Pension Integrity Project analysis of Omaha ERS valuation reports. The assumed return was lowered to 7.5% in 2018.

Looking at the 15-year averages, returns were around 2% below the assumed 8% return. This type of underperformance resulted in an addition of $194.3 million to PFRS’ pension debt over the past two decades. Investment returns below expectations over that same period added $67.5 million to the unfunded liability of ERS.

Both plans eventually reduced their return assumptions in 2018, PFRS to 7.75% and ERS to 7.5%. These adjustments were moves in the right direction, but came far later than most other public pension plans around the country. As these assumptions now stand, they are still significantly more optimistic than the national average of 7.22%.3

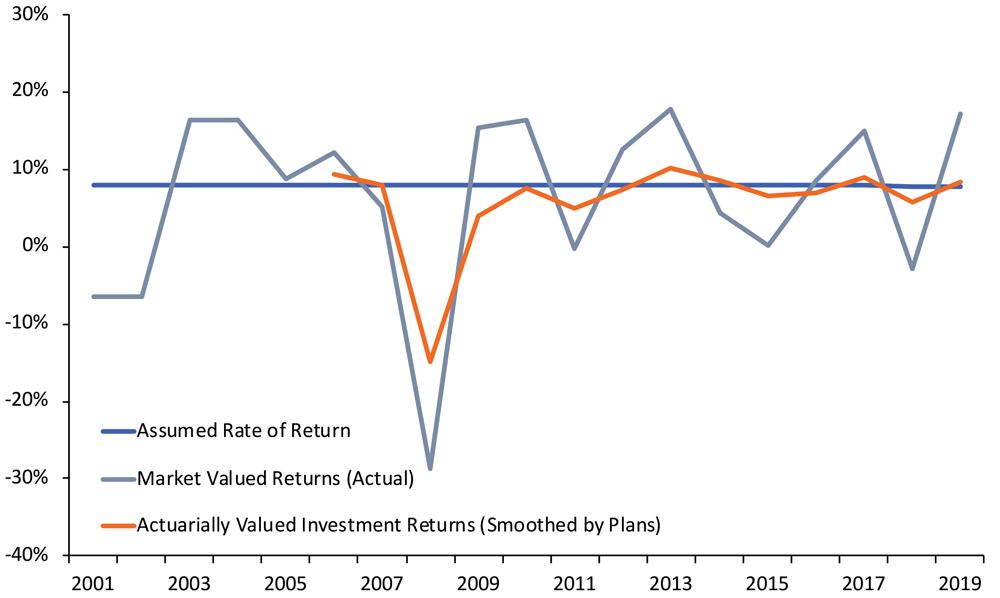

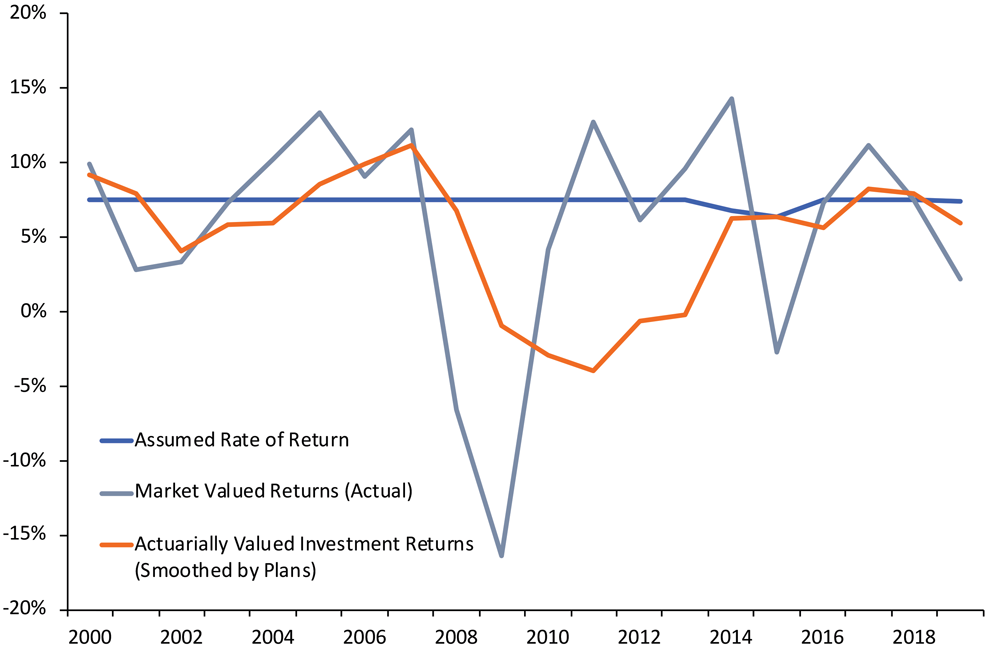

Lincoln PFPF operated for most of the last two decades with a market return assumption of 7.5%. There have been years where market returns on assets exceeded this assumption. Overall, however, this return assumption is too high. Over the past 20 years, market returns have averaged 5.6%. The last five years, averaged lower at 5.0%.

Figure 15: Lincoln PFPF Investment Return History (2000-2019)

SOURCE: Pension Integrity Project analysis of Omaha ERS valuation reports. The assumed return was lowered to 7.5% in 2018.

SOURCE: Pension Integrity Project analysis of Omaha ERS valuation reports. The assumed return was lowered to 7.5% in 2018.

Lincoln reduced the assumed rate of return from 7.5% in 2013 to 6.75% in 2014, and again to 6.4% in 2015. However, after the 13th Check merger, PFPF raised the assumed rate of return back to 7.5% before reducing it slightly to 7.45% in 2019. Based on both historical performance and forward-looking market conditions, Lincoln’s assumed rate of return is still too high.

Part of the reason for these losses was the negative investment experience of the financial crisis (2008-09) and dot-com bubble crash (2001-02). However, both plans saw strong periods of investment return growth in the housing bubble years, and even in some years since the financial crisis. Plus, long-term investment returns are supposed to account for significant cycles in the market.

The more substantial reason why returns didn’t match the city’s expectations is that there have been significant shifts in the way institutional investors are earning returns on their portfolios over the past two decades.

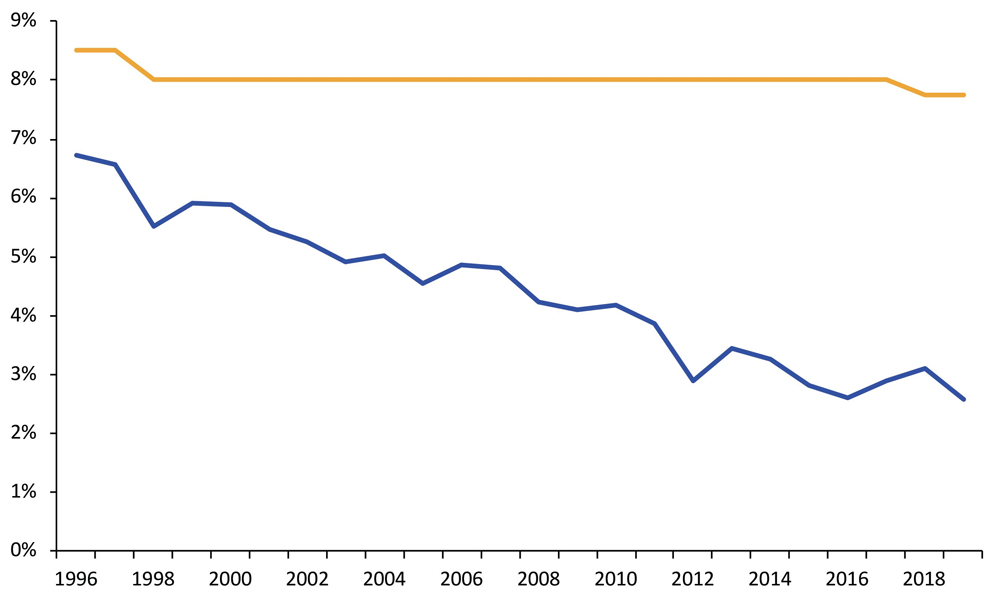

Current capital markets are not the same as those of the 1980s–2000s, as evidenced by massive declines in risk-free interest rates—usually represented by long-term Treasury yields—which have fallen by more than 50% since 2000. Over the past two decades, yields on 10-year Treasuries have averaged out to be roughly half of what they were during the decade prior to the 2007–08 financial crisis.4 These major shifts in what pension funds are able to gain in low-risk investments meant—and will continue to mean—that previous expectations on costs were based on overly-optimistic expectations.

This change in investment yield has forced pension plans across the country to do one of two things: either diversify portfolios with increased holdings of stocks and alternative investments, or reduce their assumed rates of return. Until 2018, Omaha’s pension systems pursued the former option, keeping their 8% assumed return constant since 1998 for PFRS and 2007 for ERS, while taking on more risk with the assets in their portfolios.

What exactly does this shift in asset allocation mean for the long-term rate of return performance for PFRS and ERS? First, it highlights the increasingly lower yields on safer fixed income — a pattern that is likely to persist into the future. Second, it means larger volatility of investment returns as the portfolio more consistently tracks market swings and consequently more volatile pension contribution rates. Third, it means that in order to reach for their lofty return assumptions—even after the recent adjustments—Omaha’s pension systems will have to maintain or add to the risk in the existing portfolio.

In this context, are the 7.45% to 7.75% assumed returns used by Omaha and Lincoln pension systems realistic and reasonable? For a traditional investment portfolio today, such as a 60%/40% mix of stocks and bonds, the answer is clearly no. Of course, the current portfolio is far from that traditional mix.

According to market prognosticators like BNY Melon and Blackrock, market trends today and expectations going forward are significantly different from long-term historic patterns, making long-term averages like 30-year returns a less meaningful guide than they would have been 10 years ago. Since retirement plans depend on the compounding investment gains of a fund, poor investment outcomes over the next decade could create significant funding shortfalls that even multiple decades back to previous highs—as experienced in the 1980s—would be able to overcome. For that reason, it is important that pensions focus in on what experts are forecasting for the next 10-20 years instead of looking back to what plans were able to achieve in terms of returns in the past.

In almost any context, past investment performance is no guarantee of future results, but particularly for pension plans like PFRS and ERS. The slow global growth, change in yields to fixed income, the short nature of the recent tech boom, and changing demographics as baby boomers retire are all contributing to a “new normal” for investment returns that suggests there is a significant likelihood that Omaha will continue underperforming their current assumed rates of return over the next few decades.

Challenge 3: Undervalued Liabilities

Unfortunately, even if investments were performing as expected over the long run, Omaha and Lincoln may still have seen unfunded liability amortization payments grow over the past few years. This is because the plan is undervaluing the amount of all promised future benefits in today’s dollars.

In order to determine the funded level of these plans, actuaries have to assign a value in present dollars to all of the expected pension checks that the systems will have to pay in the future. Because money today is worth more than the same amount of money in the future (e.g., the time value of money), it is necessary to “discount” future payments to determine how much a future stream of payments is worth in today’s money. Actuaries use a “discount rate” to put a value on future, promised pension benefits paid to each member over their lifetime, and this number is reported as the total pension liability (previously known as the actuarially accrued liability).

Selecting an appropriate discount rate is thus critical for properly calculating the value of liabilities, which is in turn necessary for knowing what the amount of unfunded liabilities is today, and subsequently setting up an appropriate amortization schedule. The higher the discount rate, the lower the value assigned to the total pension liability. So, if the discount rate is too high, liabilities will be undervalued, the recognized amount of unfunded liabilities on an accounting basis will be too low, and amortization payments will inherently be less than necessary to get a pension plan fully funded.

A properly calculated discount rate for valuing liabilities will reflect the risk in a plan’s liabilities, or the probability that the city defaults on its payments.5 However, Omaha’s pension plans use the assumed rate of return as a proxy for the discount rate (which is a standard practice for public defined benefit plans). The assumed return is a reflection of a pension plan’s portfolio of assets and thus, the risk in the plan’s investment assets. Using the assumed rate of return as the discount rate for plan liabilities is therefore economically unsound, as the likely performance of a portfolio and the probability of the city’s making pension benefit payments are two different things.

What discount rate should PFRS and ERS be using? It depends on how risky the liabilities are—i.e. what is the probability of Omaha defaulting on these “promised pension benefits.” If there is no risk for bankruptcy or benefits being cut, then the discount rate should reflect a ‘risk-free’ rate of return. A commonly cited proxy for a risk-free return is the yield on 30-year Treasury bonds, and this could serve as a baseline for thinking about how low the discount rate should be set. If there is some risk of city insolvency, then the discount rate for Omaha’s pension systems may want to reflect some risk premium.

Back in the 1980s, the yield on 30-year Treasury bonds averaged around 8%, suggesting a similar discount rate for the plan would be appropriate. But that number has been falling ever since. By 2001, the yield on 30-year Treasuries was about 5.5% and the discount rates for PFRS and ERS were 8% and 7.5% respectively. Thus, the discount rates used in Omaha at the turn of the century reflected a 250-200 basis point risk premium above a risk-free rate of return.

As shown in Figure 16, while the yield on 30-year Treasury bonds has continued to fall, the discount rates for Omaha PFRS have remained relatively flat.

Figure 16: Change in PFRS Discount Rate Compared to the “Risk-free Rate”

SOURCE: Pension Integrity Project analysis of Omaha PFRS valuation reports and Federal Reserve average annual 30-year treasury constant maturity rate.

SOURCE: Pension Integrity Project analysis of Omaha PFRS valuation reports and Federal Reserve average annual 30-year treasury constant maturity rate.

This means that as of today there is an implied risk premium of more than 500 basis points—suggesting Omaha is considerably likely to default on promised pension benefits. A similar pattern is evident in both the Omaha ERS and Lincoln PFPF discount rates. This suggests that these plans are more likely to default on promised pension benefit. However, at the same time, the benefit payments are guaranteed by the city with its taxing power and backed by numerous court rulings protecting pension benefits.6 Therefore, the risk that the city will not pay the pension benefits is quite low in reality and the discount rate used should thus be similarly low.

Understanding that the currently adopted discount rate is not an accurate reflection of the risks of the plans’ liabilities means the actuarially determined contribution rate does not reflect the true cost of funding the pension plan. Even Lincoln, which by ordinance has to pay 100% of ADEC, can underfund and may not save enough to pay promised benefits. This systematic, structural underfunding manifests in two ways. First, if reported unfunded liabilities are too low then amortization payments should be higher to ensure the pension debt is actually paid off. Second, the normal cost paid for each year of new benefits earned should be higher too.

A Two-Step Solution

Omaha and Lincoln have already taken some meaningful steps toward addressing their pension debt. Omaha has agreed with labor representatives to provide new civilian employees with a retirement plan that caps the growth of ERS liabilities. Lincoln has begun reform by passing a city ordinance to pay the full actuarially determined contribution rate.

Nonetheless, the pension reform effort underway in both cities will require additional steps to fully solve the problems. First, they must meaningfully curtail the growth of liabilities exposed to the same sorts of volatility and market risk that produced the current funding challenges. Second, the plans need to ensure a sustainable funding policy for existing liabilities, given the current funding gaps to close and the aggressively optimistic actuarial assumptions currently being used by Omaha PFRS, ERS, and Lincoln PFPF.

- Reining in Runaway Liabilities

Omaha ERS: Omaha’s policymakers already helped direct the Employees’ Retirement System to a position of reduced risk for further unexpected retirement liabilities in the future. They achieved this by creating a cash balance plan for all new hires, which will gradually reduce the city’s exposure to the risks of an unpredictable market while still providing a sufficient retirement benefit to future workers. Policymakers should now seek to formally codify this cash balance plan for ERS into law. If the new retirement plan is subject only to collective bargaining agreements, then it can be undone in a future agreement.

Omaha PFRS & Lincoln PFPF: Similarly, Omaha and Lincoln Police & Fire Funds should consider adopting a risk managed plan design for future hires into the city’s public safety pension plan that caps exposure to risk while also ensuring a meaningful retirement security benefit, or even choice of benefit options. In Omaha, a 2010 agreement between the city and labor representatives for police and fire did already make changes to the existing plan that led to a reduction in benefits and increase in employer contributions. However, these changes only addressed part of the unfunded liabilities at the time, so they effectively reduced worker benefits while still failing to address the long-term growth of pension debt and risk exposure.

An alternative, risk-managed plan design for future public safety employees could take many forms and even involve choices among different designs, such as a cash balance plan, a defined contribution retirement plan, a hybrid plan, or a new risk managed defined benefit plan tier for new employees that has built-in mechanisms to minimize risk and ensure benefits are accurately priced.

- Improving the Existing Funding Policy

At a fundamental level, defined benefit pension plans like Omaha PFRS, ERS, and Lincoln PFPF work when:

contributions + investment returns = benefit payments + expenses

Calculating the right amount of contributions depends on correctly estimating both investment returns and total promised benefit payments. The more aggressive the assumptions about investments and liability values, the more risk that the contribution rates will be wrong.

This reality holds true whether or not a defined benefit plan is open to new hires. For ERS, even though new hires are accruing benefits in the cash balance plan, if the investment return assumption for the defined benefit plan is wrong, then the contributions being paid into that system will not be enough to cover promised benefit payments in the future. For Omaha PFRS and Lincoln PFPF, the same risk exists–that investment return assumptions are too high—leading to chronic underfunding.

Municipal plans in Omaha and Lincoln should improve their funding policy by first adopting more conservative actuarial assumptions. The discount rate used to value existing liabilities should be lower than the status quo and based on a market-valuation of liabilities. The assumed rate of return used to price new benefits earned each year should reflect a less risky allocation of assets. Mortality and longevity estimates should reflect the most current actuarial tables. Inflation assumptions should favor conservative estimates about the future.

Funding policy could be further improved by shrinking the number of years used to amortize unfunded liabilities and requiring in the city charter that employer contributions to pension funds be among the first liabilities paid out as revenues are collected.

Conclusion

The growth of accrued liabilities with significant risk exposure is similar to an oil spill. The first step is always to make sure that the leak is capped. That is what capping the liabilities of Omaha and Lincoln would do. However, even once the leak has been contained, there is still a need to clean up what has been spilled. That is what the recommended funding policy improvements would accomplish.

The cash balance plan for Omaha ERS was a good first step toward improved solvency, but the existing liabilities of the defined benefit plan are still exposed to the risk of underperforming the existing assumed rate of return. These unfunded liabilities are like leaving toxic waste alone. Without cleaning it up, it will lead to more damage. Omaha and Lincoln’s police and fire plans face risks in both existing and accruing liabilities. Overall, Nebraska’s two largest cities have made progress in addressing pension issues in recent years, but—given the current status quo—unfunded liabilities are likely to continue growing and harming city finances.

Endnotes

- “Pension Changes Approved by City Workers,” Official Statement from the City of Omaha.

- Prior to 2015, the actuarial term for the combined normal cost and unfunded liability amortization payment was the “actuarially required contribution” (ARC). The Government Accounting Standards Board adopted new rules that were implemented as of 2015 that changed some methods of calculation and terminology. While subtle differences exist between the ARC and ADEC, for purposes of this level of analysis they are equivalent and interchangeable terms for the amount the employer is supposed to pay based on actuarial calculations.

- February 2020, “NASRA Issue Brief: Public Pension Plan Investment Return Assumptions,” National Association of State Retirement Administrators.

- Anil Niraula & Truong Bui (2020), “The ‘New Normal’ in Public Pension Investment Returns,” Reason Foundation.

- Truong Bui and Anthony Randazzo (2015), “Why Discount Rates Should Reflect Liabilities: Best Practices for Setting Public Sector Pension Fund Discount Rates,” Reason Foundation, Policy Brief 130.

- Alexander Volokh (2014), “Overprotecting Public Employee Pensions: The Contract Clause and the California Rule,” Reason Foundation.