Nebraska tax revenues for October 2021 show continued growth

Over the last few months, Nebraska’s tax revenues have been exceeding expectations, and now for the month of October they are meeting expectations. This doesn’t mean the state has slowed in its post-pandemic growth. Just a few weeks ago, the Nebraska Revenue Forecasting Board revised the state’s expected revenue forecast, increasing the total by $475 million.

This most recent General Fund report for October reflects that update and is the reason why the state is now meeting its expectations.

The forecasting board increased the Fiscal Year 2021-2022 revenue collections by the following amounts:

- Sales and Use Tax, increased by 3% ($57 million)

- Personal Income Tax, increased by 10% ($226 million)

- Corporate Income Tax, increased by 54% ($190 million)

- Miscellaneous Tax, increased by 1% ($2 million)

- Total, increased by 10% ($475 million)

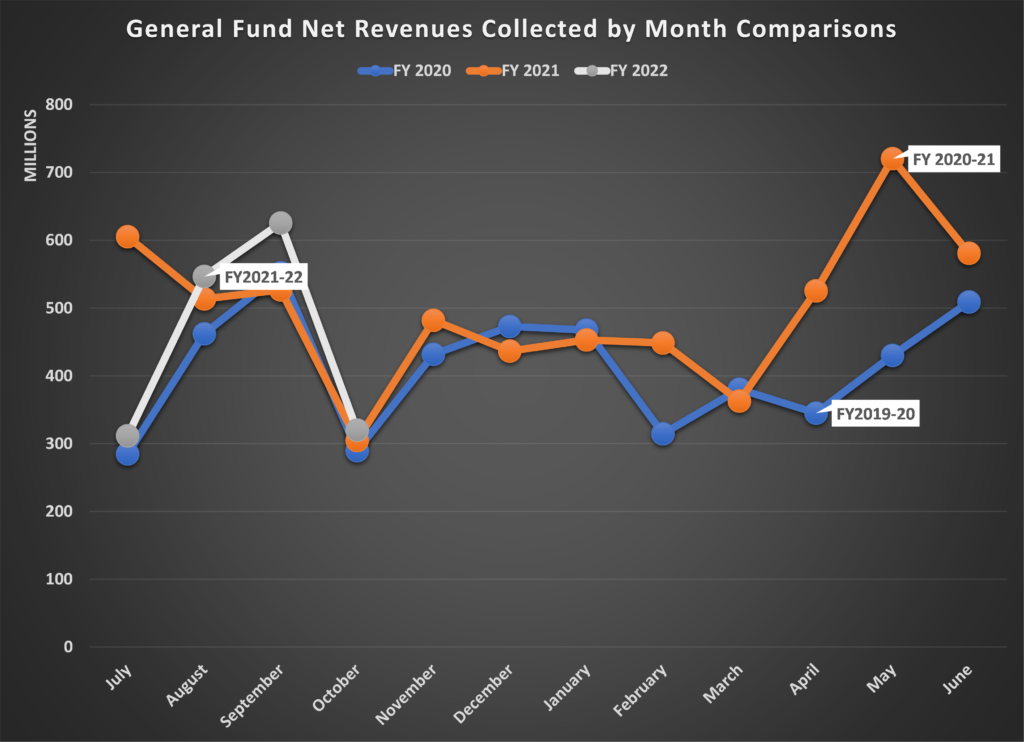

When looking at the state’s monthly revenue progress compared to the previous two fiscal years, it is evident the state is in a better position. Total net revenues from all major tax types, comparing October 2021 to October 2020, is up by 5%, or a little more than $15.2 million. Below is a chart showing the collections by month.

Overall, the October report from the Department of Revenue might seem misleading, since it looks like the state is only meeting expectations. However, it is important to remember that this expectation is an increase from where the state was last year and from expectations a mere 30 days ago.

Nebraska is still on the path to a strong economic recovery and there is ample money available to modernize our tax code.