Nebraska is in a relatively good revenue position compared with other states

Today is the new tax filing deadline in Nebraska. Today is also when the Department of Revenue released the state’s tax revenue figures for the month of June and for the last fiscal year (FY2019-2020). It is important to note that Nebraska’s phase 3 of directed health measures went into effect on June 22. So, the figures presented do not represent the most recent openings and their impact on our economy.

The revenue picture for the end of the fiscal year looks promising, coming in at 0.2% above the certified forecast. However, the tax with the biggest hit due to the pandemic is the corporate income tax posting a -11.5% variance from projected June figures. This tax is a very volatile tax, so with the uncertainty and the directed health measures causing many of Nebraska’s businesses to close, this is somewhat expected.

For the fiscal year, the individual income tax is showing a -6.8% variance from projections, which is more than likely from the delayed tax filing deadline. We will know with more certainty the impact from that once July numbers are released.

This data is released less than one week before the Nebraska Legislature comes back to finish the session that was postponed due to the pandemic. The remaining 17 days in the legislature will rely heavily on these revenue numbers as well as the revenue forecast scheduled for July 23. The legislature is expected to debate many bills that were left unfinished including property tax reform (LB1106) as well as business incentives (LB720).

A Platte Institute webinar with the Appropriations Committee Chair, Sen. John Stinner, discussed these numbers and what it would mean for the state’s budget. He said the 0.2% surplus above projections means the $10.6 million will be put into the state’s rainy-day fund. He believes when the forecast committee meets, they will revise the forecast downward due to the increased COVID-19 positive cases and the impact that is having on our economy. Agriculture is huge part of the state’s economy and the impact on that sector will be recognized by the state in the upcoming years in a noticeable way.

Other concerns for the state are maintaining government operations. Most state senators have been very good about spending restraint, but there are certain areas that must be addressed. Health care provider rates, Medicaid expansion, corrections and prisons, and fully funding the state’s cash reserve fund are all priorities.

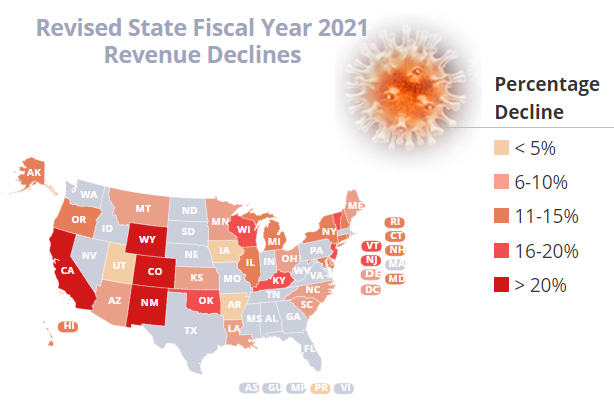

Overall, the revenue picture in Nebraska is positive. While our state is not posting the surplus that was expected earlier in the year, Nebraska has finished the fiscal year without a major budget shortfall. According to analysis from the National Conference of State Legislatures (NCSL), some states are expecting revenue declines above 20% in the next fiscal year (2020-2021). While Nebraska does not have a clear picture of what the future holds yet, we should be thankful that we have a responsible state legislature that does not overspend.