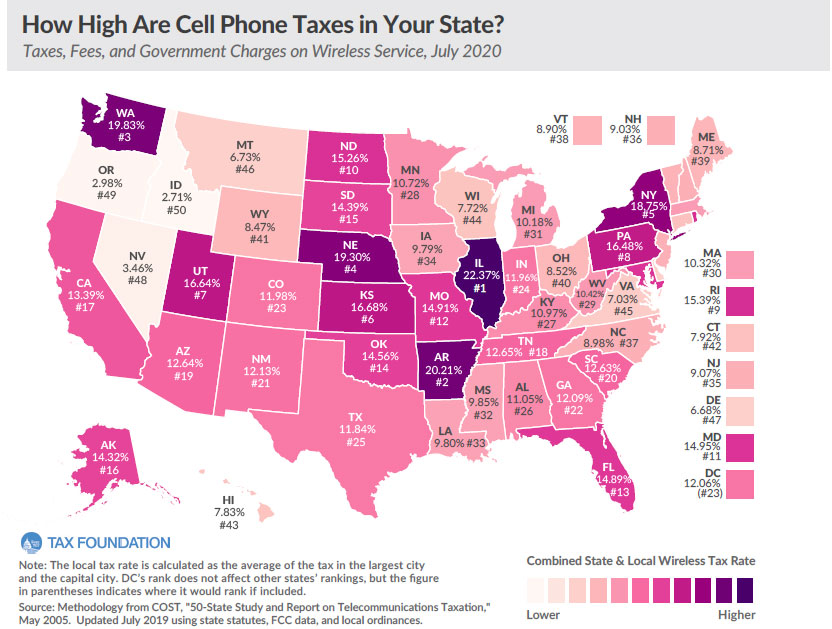

Nebraska has 4th highest wireless tax burden in the nation

According to a new report by the Tax Foundation, Nebraska has a combined federal, state, and local tax rate of 29.13% on wireless services. Most of the tax is at the state and local level, comprising 19.30% of the total tax.

For context, Illinois is the highest at 32.20% and Idaho is the lowest at 12.54%. The national average is 21.64%.

In addition to having the 4th highest tax rate, Nebraska is also ranked second highest in the nation for the disparity between the wireless tax rate and the general sales tax rate. This is a measure comparing the tax rates imposed on wireless services to the combined state and local sales tax rates in each state. Nebraska has a wireless tax that is 12.17% higher than its state and local sales tax rate.

In Omaha, Nebraska, the tax on a 4-line voice plan at $100 per month has an effective tax rate of 32%.

A single line voice plan costing $36.86 per month is subject to a 29.13% tax.

This tax is regressive and has a disproportionate impact on low-income taxpayers. At the end of 2019, according to the Centers for Disease Control and Prevention, about 67 percent of all low-income adults lived in wireless-only households and 58 percent of adults of all incomes lived in wireless-only households.

The tax also slows investment in wireless infrastructure at a time when we need wireless services for remote learning and work during the pandemic.

One would think these reasons are sufficient to reduce such a tax, but that idea was proposed before the Nebraska Legislature (LB550) and had strong opposition from the cities of Omaha and Lincoln, who didn’t want to lose the tax revenue.

The Platte Institute’s suggestion is to reduce the various components that make up Nebraska’s wireless tax to be more aligned with the national average. To remedy the transparency principle this tax violates, no municipality should be able to impose any tax or fee related to wireless and prepaid wireless services unless the tax has been approved by the voters within that municipality at a primary or general election.

To read more about this and other taxes in Nebraska, please visit our Legislative Issue Guide.