Nebraska extends 2020 tax filing deadline: 3 reasons you might need more time

This week, the IRS announced that Tax Day is being pushed back to May 17 to give Americans more time to prepare and pay their federal taxes, and in a news conference, Gov. Pete Ricketts announced that the Nebraska Department of Revenue will follow suit.

The extension for filing and payment is for everyone except for those who file estimated tax payments in advance. Here are some reasons that this has become an irregular tax filing season, which might require more time for Nebraskans to get their tax situations squared away.

1) Remembering your 2020 Nebraska Property Tax Incentive credit.

Nebraska’s newest property tax relief program isn’t provided to taxpayers automatically. It must be claimed as an income tax credit by filing state income tax Form PTC along with your state tax return. On Form PTC, property taxpayers submit their land parcel number, along with the allowed amount of school-related real property tax they paid in 2020.

It’s possible to complete your state income tax return electronically for free on the Nebraska Department of Revenue website along with Form PTC. But many people using tax preparing services like Turbotax might miss the step of filing for the new tax credit. Here’s some info from Turbotax’s team to give you a head start on filing the form through that service.

2) A portion of your unemployment payments may be tax-free.

Under the new American Rescue Plan Act, Congress has set a threshold of $10,200 in unemployment benefits as exempt from income taxes for taxpayers making less than $150,000 annually, including their unemployment payments.

Because Nebraska calculates federally adjusted gross income as the basis for what is taxable at the state level, the governor has also confirmed that the $10,200 amount will be exempt at the state level in Nebraska.

If you were unemployed, that means you may be entitled to a federal or state refund if you had taxes withheld from your benefits. If you didn’t withhold taxes or received more than $10,200 in unemployment, your tax bill may still be lower than it would be otherwise.

3) Some Americans can still claim last year’s $1,200 and $600 Economic Impact Payments as a tax credit.

One reason the federal Economic Impact Payments, also known to many as the stimulus, is not considered taxable in most of the country is that the government sees it as a tax credit, delivered in advance.

However, not everyone who was eligible for the 2020 payments received them. Some people who were not eligible initially, like college students who became financially independent over the past year, may now be able to file their own 2020 tax return and claim the $1,200 and $600 payments as credits on their taxes.

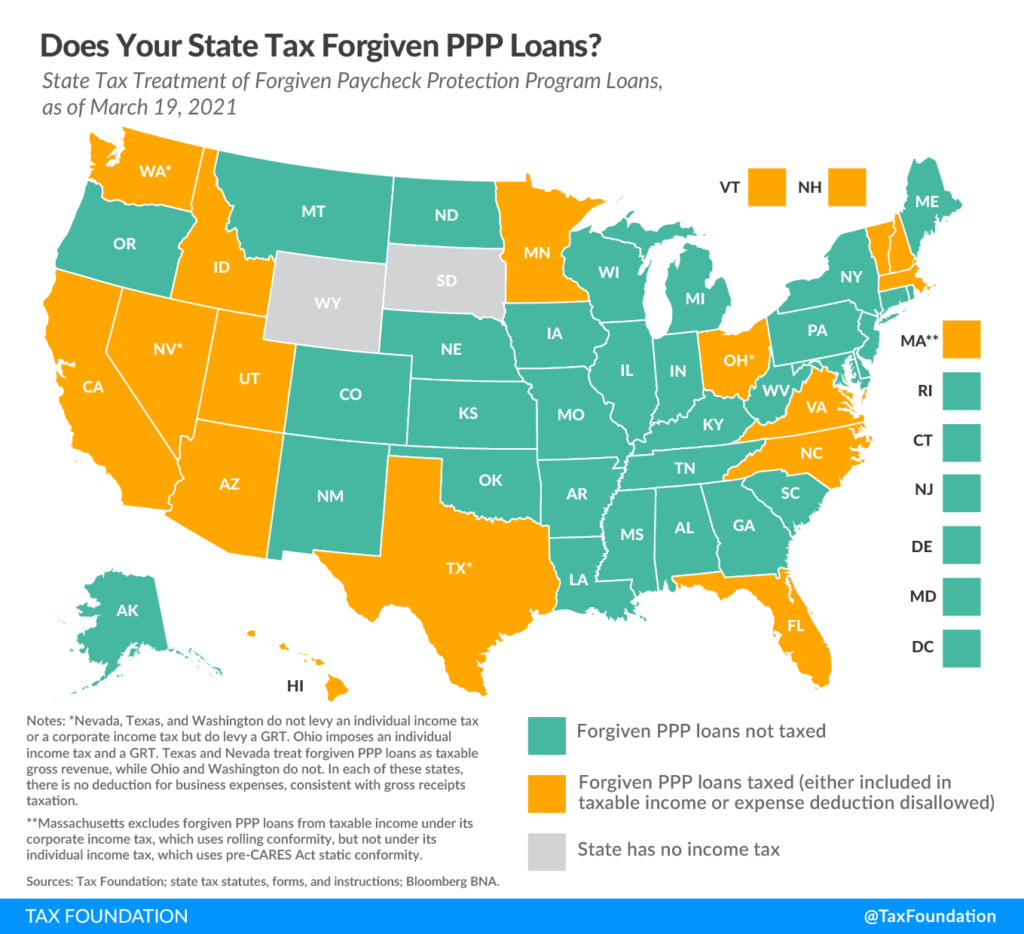

One thing that’s not a problem in Nebraska: taxing forgiven PPP loans.

In some states, small businesses that received an emergency loan through the Paycheck Protection Program may find that the loans they received from the federal government are considered taxable income, even if the loan was forgiven.

In Nebraska, that won’t be case. That was resolved last year when Nebraska conformed to the CARES Act’s emergency tax policies, making forgiven loans not taxable at either the federal or state level in Nebraska. Here’s a map and report on which states are making this a consideration for taxpayers on their 2020 tax filings.