More businesses may close if Nebraska rejects CARES Act tax changes

This week, senators on the Nebraska Legislature’s Revenue Committee met in Lincoln to discuss the impact of tax changes included in the federal CARES Act.

Many of the federal relief plan’s tax provisions are designed to help businesses increase their cash flow during the recession, including expanding the net operating loss (NOL), which will allow businesses suffering financial losses to amend past tax returns and receive immediate refunds on some of their taxes paid instead of having to wait to deduct those losses in future years.

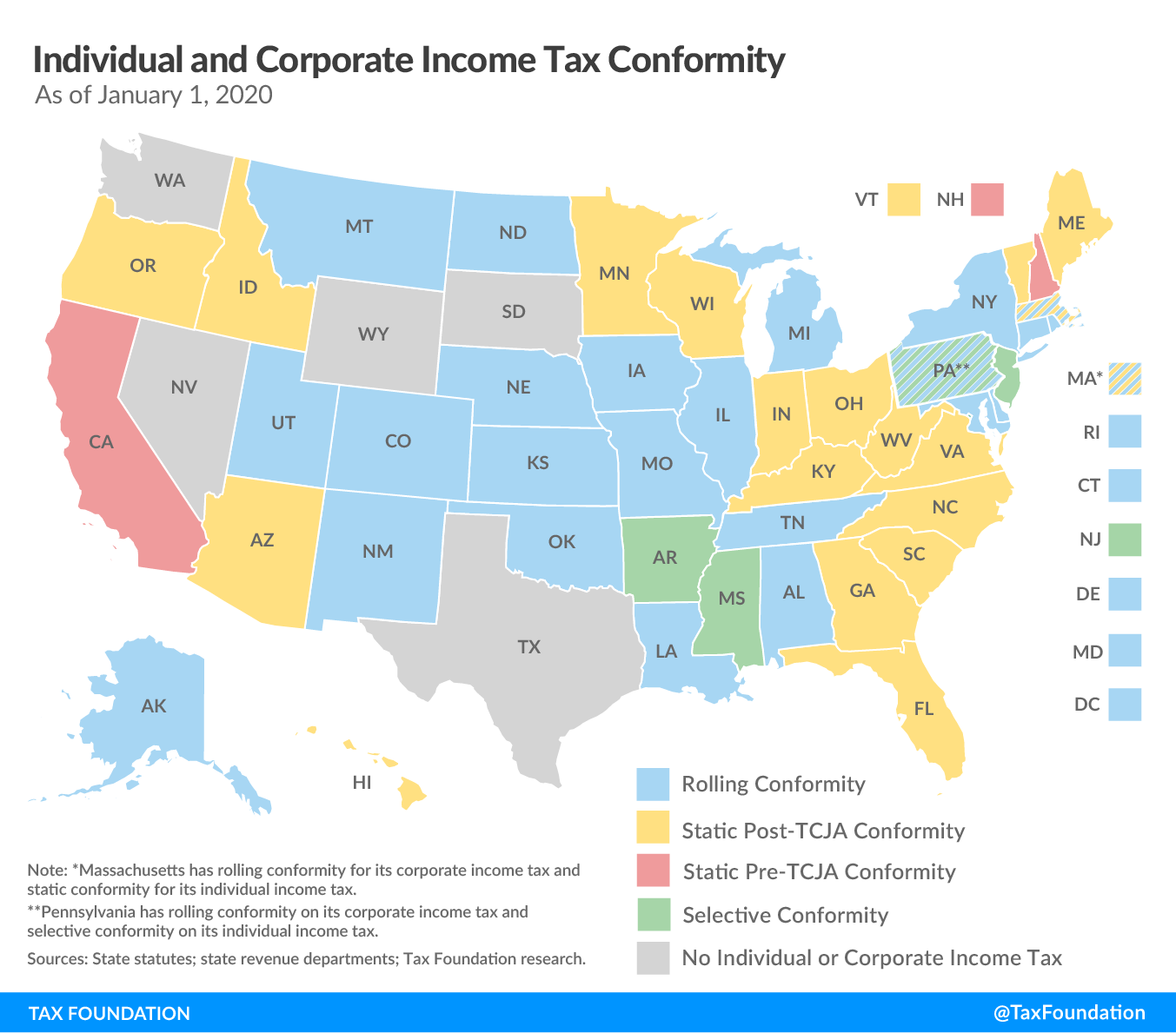

Nebraska is considered a rolling conformity state, which means the state automatically incorporates federal tax changes into its own tax code as they happen.

However, there have been discussions among some Nebraska state senators that the state should decide to decouple from the federal CARES Act tax changes. The CARES Act policy is projected to result in $250 million less in tax revenue to the state over the next three fiscal years.

For Nebraska to accept the CARES Act tax changes, no action is needed by the state. This is the same situation the state was in during 2018 when Nebraska conformed to the Tax Cuts and Jobs Act (TCJA)[i].

If the state were to decouple from the federal tax changes, though, it would put an additional burden on small businesses and agriculture producers that are already hurting, by subjecting them to a tax increase.

On Tuesday, the Department of Revenue discussed the details of conformity and anticipated revenue losses with the Legislature’s Revenue Committee.

It is important to note that the $250 million loss projected by the Department of Revenue is not additional money from the CARES Act that the state would forgo. The decision to decouple would only keep the state from reducing its current revenues, not increase its ability to fund more programs. To see the itemized breakdown of the fiscal impact, click HERE.

During a financial crisis, which is the result from the pandemic on our economy, it is important we prioritize the recovery. Conforming to the CARES Act tax relief provisions will benefit individuals, businesses, and farmers, especially those experiencing financial hardship.

Let’s look at a few examples of why conforming to the CARES Act is in the best interest for all Nebraskans.

According to the Small Business Administration’s Paycheck Protection Program (PPP), Nebraska has had 40,963 loans amounting to $3.4 billion. One of the CARES Act’s tax provisions is a forgiveness on tax liability for those who took the PPP loan, and some of these recipients include Nebraska farmers and other small businesses. However, it is unclear if these businesses would benefit from loan forgiveness if the state decided to decouple.

According to the Tax Foundation,

“… the state uses federal adjusted gross income (AGI) as a starting point for its own income tax calculations, including the exemption for forgiven PPP loans—unless the state expressly decouples…. it is possible that expressly decoupling from the exclusion could be read as adding that loan forgiveness income back into the tax base…”

In addition, there will be negative consequences from decoupling regarding tax complexity. If the state chooses to decouple, it will mean there will be a different AGI for Nebraskans on their federal return and state return, leading to more adjustments and difficulty with tax filing. This will result in higher compliance costs for businesses in the short term since tax preparers would have to learn a new system and the Department of Revenue would have to change some of its practices and regulations.

And possibly the most obvious issue is that the tax changes approved by the CARES Act were publicized in March, so people and businesses have already altered their behavior based upon a tax scenario all believed would be automatically accepted at the state level. For example, allowing the paying down of student debt is a useful employee retention tool, flexibility on retirement withdrawals is a good practice for individuals hurt during the pandemic, and allowing more charitable deductions is good for philanthropy and aids our communities in a time of crisis.

While there are other legislative priorities that lawmakers must address when they return to Lincoln in July, the economic recovery should not be seen as secondary to other unfinished legislation. Avoiding a tax increase and keeping Nebraska’s tax laws consistent with the federal law in the CARES Act helps preserve businesses and jobs, both in rural and urban areas, and supports economic growth as our state recovers from the pandemic.

[i] Nebraska did not decouple in 2018. Lawmakers offset the projected state tax increases from the TCJA by enacting LB1090.