Legislative Testimony for LB644: Truth in Taxation

Good morning, Chair Linehan and members of the Revenue Committee. I’m Sarah Curry, Policy Director at the Platte Institute and I am testifying in support of LB644.

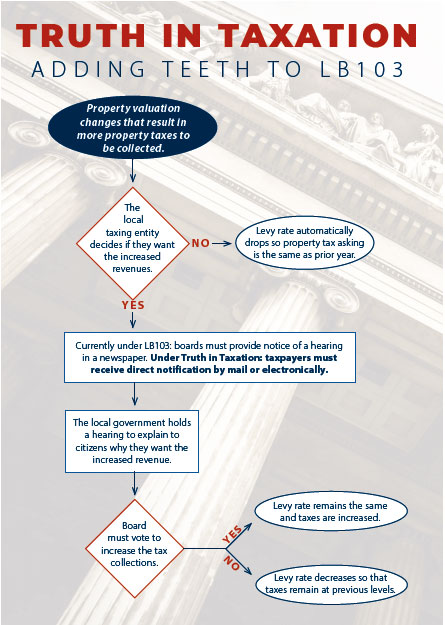

This bill is an extension of LB103, which the body unanimously enacted in 2019. In short, it “puts teeth” in Nebraska’s property tax hearing requirements by adopting a complete Truth in Taxation law. The current law requires that these hearings be posted in a newspaper for the dispersal of this information. However, most Nebraskans are not aware of the 2019 law and the hearings it requires.

We recently conducted a poll of Nebraskans and asked them:

“Are you aware that Nebraska law requires local governments to hold a public hearing before property taxes can be increased due to rising property valuations?”

The responses:

- 44% said YES

- 39% said NO

- 18% said UNSURE

After the 2019 law, we know that some political subdivisions initially thought they did not have to hold a hearing. We were able to follow-up with a few of the larger cities to confirm they did eventually hold hearings, but there is no mechanism to check if all taxing political subdivisions are complying with the law. That is why LB644 is needed, so taxpayers can hold their local taxing subdivisions accountable.

In this same poll, we asked Nebraskans:

“Would you support or oppose requiring local governments to inform taxpayers by mail about their opportunity to participate in a public hearing before property taxes can be increased due to rising property valuation?”

The responses:

- 52% said STRONGLY SUPPORT

- 25% said SOMEWHAT SUPPORT

- 6% said SOMEWHAT OPPOSE

- 4% said STRONGLY OPPOSE

- 13% said UNSURE

The responses show 77% in public support compared with only 10% in opposition. LB644 takes the Legislature’s previous transparency and accountability measure in LB103 and provides taxpayers with a stronger voice in how local property tax askings are set by providing the date, time, and location of a public meeting where proposed property tax increases will be heard. It allows more concerned Nebraskans to be included in the process of local control.

Utah is the model state for the taxpayer friendly Truth in Taxation law, yet numerous other states have also implemented a version of this law including Illinois, Minnesota, Texas, and Arizona. We want Nebraska to join this list.

Below I’ve included a flow chart of how LB644 would amend the current LB103 process.

Other sources on Truth in Taxation:

- Platte Institute Legislative Guide – Truth in Taxation

- Sanderford, Aaron. (July 31, 2019). Omaha World Herald, “No tax increase but a bigger property tax bill: What a new Nebraska law is doing to address issue”.

- Omaha World Herald Editorial Staff (August 2, 2019). “Editorial: New law makes local government in Nebraska more accountable to taxpayers”.