How much do Nebraska-based companies pay in taxes and does it matter?

Nebraska is no stranger to business incentives. Starting in 1985 (LB273), Nebraska embarked on a long journey of business incentives in an attempt to lure companies to the Cornhusker State as well as promote job creation. Over the last 35 years there have been many central programs in the state’s history including the Employment and Investment Growth Act in 1987 (LB775), the Nebraska Advantage Act in 2005 (LB312), and the ImagiNE Nebraska Act in 2020 (LB1107), among many other smaller programs.

And while there have been many studies on these incentives and their effectiveness, or lack thereof, one thing is always asked by policymakers and elected officials – how does Nebraska compare with other states on its incentives and what are companies really paying in corporate tax?

The Tax Foundation has filled this void by publishing an apples-to-apples comparison of corporate tax costs in the 50 states. This is not a simple ranking or comparison of spending or taxes collected. This is a study that takes eight model firms—a corporate headquarters, a research and development facility, a technology center, a data center, a capital-intensive manufacturer, a labor-intensive manufacturer, a shared services center, and a distribution center—and used economic modeling tools to calculate each firm’s tax bill. The unique and most helpful aspect of this modeling exercise is that it was done twice for each firm in each state, once as a new firm that is eligible for all the business incentives, and again as a mature firm that is not eligible for these programs.

The title of their study, Location Matters, identifies some key issue areas surrounding business incentives. While the study is complex, here are some of the key themes or findings they drew from the modeling across all 50 states.

- Tax structure and tax bases matter as much as, or even more than, tax rates.

- Traditional corporate income taxes are only a small fraction of companies’ overall tax burden.

- Tax burdens are nonneutral both within and across firms and states.

- Incentives for new firms come at a cost for mature firms and those otherwise ineligible for incentives.

But how does this relate to Nebraska? Well, you always hear how Nebraska is a high tax state, but that is not necessarily the case for corporations. According to the findings on effective tax rates (the tax rates you actually pay after all the credits and deductions), Nebraska has an overall low tax burden for both mature and new firms, which ranks 8th and 9th nationwide, respectively.

“Taking both new and mature iterations into account, seven of the model firm iterations in our study experience a negative effective income tax rate and six experience a zero percent effective income tax rate, leaving only three firms with a positive income tax burden. This is largely attributable to the ImagiNE Nebraska Act incentives program—one of the most generous incentives programs in the country—which provides investment credits, jobs credits, and research and development (R&D) credits, as well as property and other tax abatements to qualifying firms. For many firms, these incentives more than offset the state’s high corporate income tax rate of 7.81 percent.”

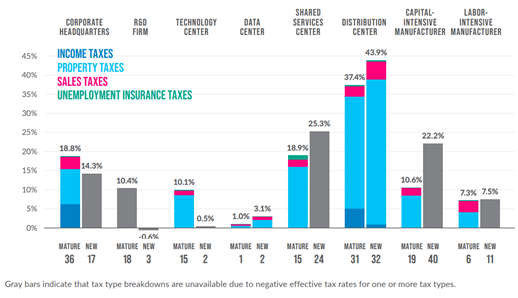

Mature data centers receive the lowest total effective tax rate nationwide for this type or company while new data centers are the second lowest. However, all firms are not so lucky. A mature research and development (R&D) facility has an effective tax rate of 10.4%, while a new R&D company will have a negative liability of -0.6%.

Another finding worth noting is that new capital-intensive manufacturing firm pay a high effective tax rate. Even though the state provides many income and unemployment insurance incentives, they do not offset the high property taxes that are levied on business equipment (tangible personal property tax) which yields these types of firms an effective tax rate of 22.2%, or the 40th highest in the nation.

Here are breakdowns of Nebraska’s effective tax rates by firm type.

For a more graphical representation, here you can see which types of firms receive the most benefits from Nebraska’s current incentive programs.

Overall, it is easy to see that Nebraska is extremely generous in its incentive programs. Is that because we have high taxes and we are overcompensating? Maybe it’s time our state leaders take a good hard look at who is paying and who isn’t. Also, let’s take a look at how much corporate income tax is collected and how much is spent every year in incentives – is the state a net winner or loser? These are all questions that should be brought up when quality economic research like this is released.

Another takeaway from this is that the property tax credits and relief programs are not working. The state is paying multiple times over for the burden of property taxes, while the rates remain extraordinarily high on a national scale. True property tax reform that fundamentally lowers the rate will not only save the state money in relief programs, but in incentive programs as well.