GILTI: What is it, and why does Nebraska need to focus on it?

GILTI stands for Global Intangible Low-Taxed Income. GILTI is a category of income that is earned abroad by U.S.-controlled foreign corporations and is subject to special treatment under the U.S. tax code, as well as states that levy a corporate income tax.

This special treatment of foreign earned income is intended to prevent erosion of the U.S. tax base by discouraging multinational companies from shifting their profits from easily moved assets, such as copyrights, trademarks, and patents, from the U.S. to other countries with tax rates below U.S. rates. Effectively, the calculation of GILTI is complex and is only levied on a portion of a U.S. controlled foreign corporation. To learn more about GILTI, click here.

Prior to the Tax Cuts and Jobs Act (TCJA) in 2017, the U.S. tax system incentivized U.S. multinationals to avoid paying U.S. taxes by artificially shifting income abroad. The TCJA aimed to remedy this situation by adopting a limited territorial treatment and reducing the overall corporate tax rate. Most states “conform” or adopt changes automatically to the U.S. federal tax code, which means after implementation of the TCJA, states now tax GILTI.

You might be asking yourself why we care about this in Nebraska. Well, historically most states, including Nebraska, have not taxed foreign income. They have instead treated it as a foreign dividend. Nebraska has always had a foreign dividend deduction. This is the same income, just a different name.

However, Nebraska is now taxing GILTI because the Nebraska Department of Revenue determined that GILTI should be included in Nebraska corporate tax returns instead of being treated as a foreign dividend.

Essentially, Nebraska has begun the collection of a tax the Legislature never authorized.

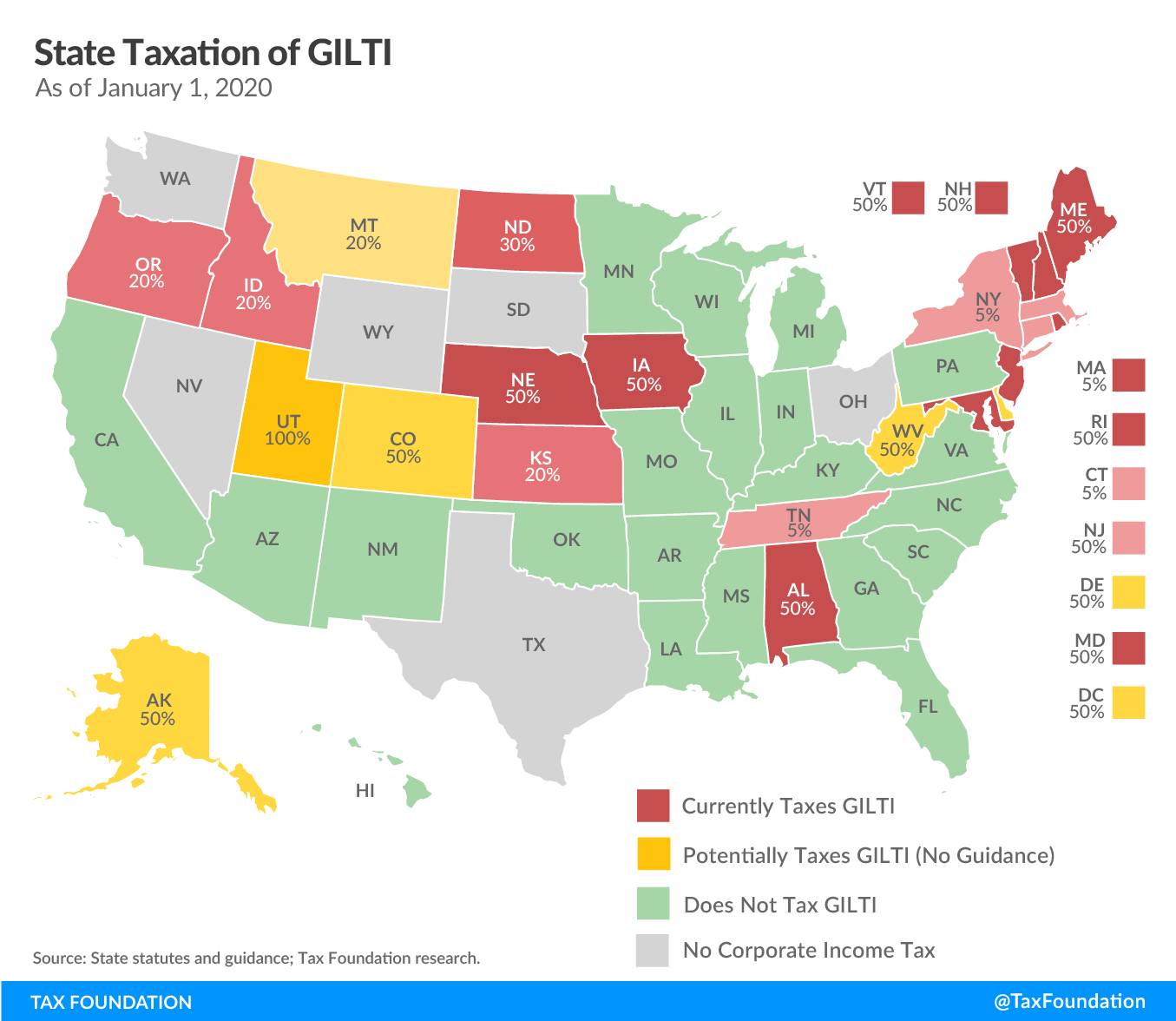

The changes imposed from the TCJA have led many states to make the decision to decouple or separate from the federal code. Nebraska has not decoupled yet and there has been a bill introduced this session, LB347, to do just that. Decoupling Nebraska from the TCJA provision on GILTI will clarify the treatment of this income should remain as it did prior to 2017. See the map of how states address GILTI below.

As a footnote – Utah and Alabama have decoupled in 2021 and now do not tax GILTI.

There was an identical bill filed in the last legislative session but did not get the required votes due to the pandemic.