Don’t die in Nebraska: How the county inheritance tax works

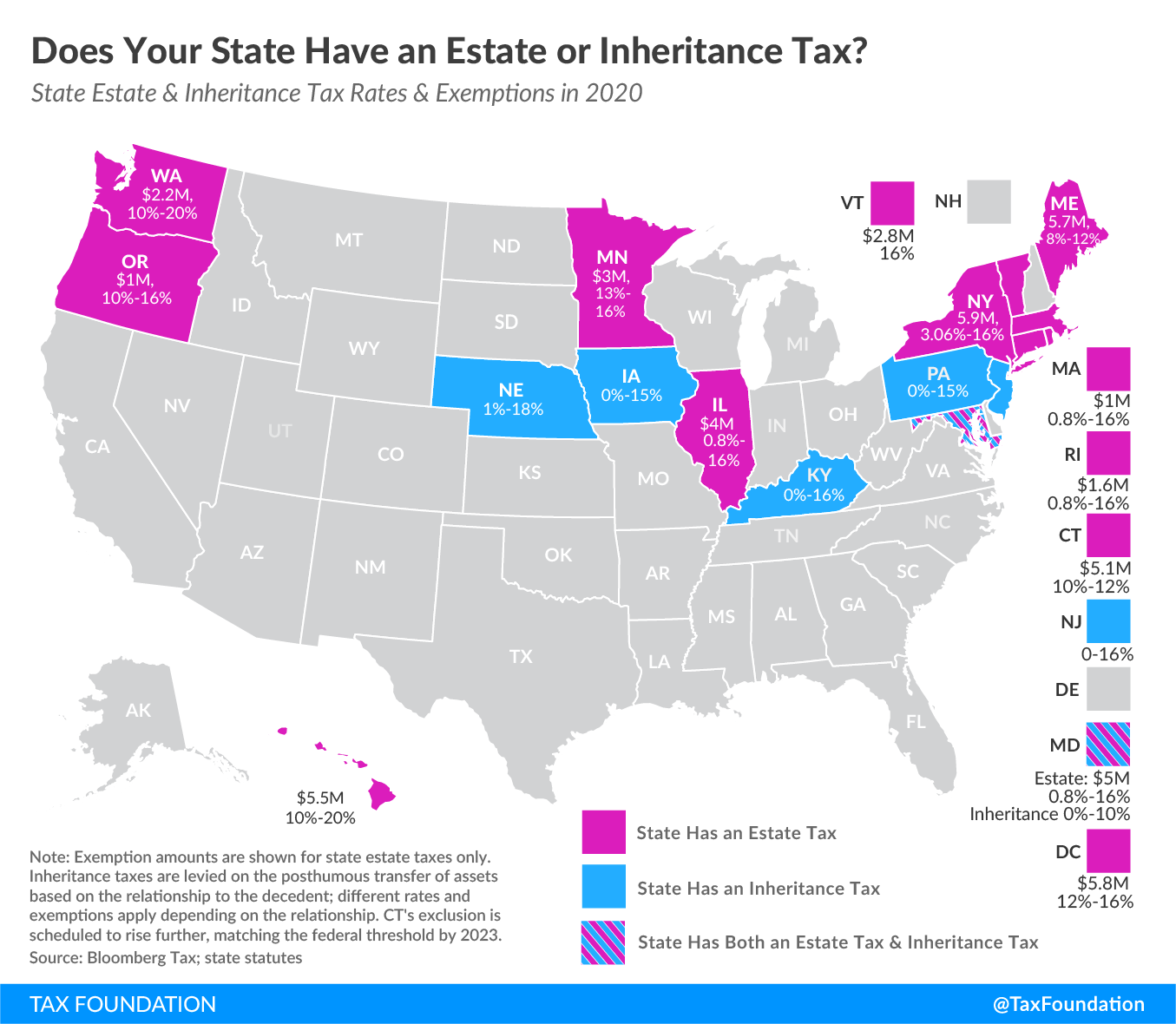

There are only six states in the nation that levy an inheritance tax, and Nebraska is one of them. In fact, Nebraska has the highest top rate at 18%.

According to a local law firm,

“When a person dies a resident of Nebraska or with property located in Nebraska, the Nebraska county inheritance tax will likely apply to the decedent’s property. To determine the applicability and amount of the Nebraska tax, the practitioner’s first step is to determine the relationship of the recipient to the decedent.”

In short, if a resident of Nebraska dies and their property goes to their spouse, no inheritance tax is due. If it goes to their parents, grandparents, siblings, children, or a lineal decedent (or their spouse) then the tax is applied to anything over $40,000 at a rate of 1%.

If it goes to an aunt, uncle, niece, nephew, or any lineal decedent of these people (or their spouse) then the tax applies to any property over $15,000 at a rate of 13%. For anyone else, the tax is applied to all property of more than $10,000 at a rate of 18%.

And in case you were wondering, the tax is imposed on the “fair market value” of the property, so that means as home valuations continue to rise in Nebraska, so does the “death tax” bill.

Here is an example of how this would play out:

David, a Nebraska resident, owns real estate worth $300,000, and bank account worth $500,000. He dies unmarried on January 1, 2008 and gives his property equally to his son Joe, his brother Brian, his nephew Bob, and his unrelated next-door neighbor Nick.

- Brian and Joe, as Class 1 beneficiaries, will pay a 1 percent tax on $160,000 less applicable deductions ($200,000 – $40,000 exemption). $1,600 tax bill

- Bob, a Class 2 beneficiary, will pay a 13 percent tax on $185,000 less applicable deductions ($200,000 – $15,000 exemption). $24,050 tax bill

- Finally, Nick, a Class 3 beneficiary, will pay an 18 percent tax on $190,000 less applicable deductions ($200,000 – 10,000 exemption). $34,200 tax bill

Maybe it is time Nebraska updates its tax code and eliminates (or at least reduces) its county inheritance tax. County governments cannot rely on this revenue source for funding regular expenditures, so when a taxable inheritance occurs, it is more like free money for them to spend wherever officials may feel they need it. And, since money subject to inheritance tax may have already been earned and taxed previously, applying a tax to the mere transfer of money can be a form of double taxation.

Already, 44 states get by without an inheritance tax. Nebraska can do the same.

Are you one of the 78% of Nebraskans who agree it’s time to lay the county inheritance tax to rest? Sign the petition to tell the Unicameral to eliminate this outdated and inequitable tax on Nebraska families.

Sign The Petition

End Nebraska's Inheritance Tax

Simply fill out the form below to sign the petition.

Learn More >