August general fund revenues exceed expectations

Nebraska August tax revenues have been reported by the Department of Revenue, and the result continues to be positive, as all tax types are posting above forecast figures.

For the month of August, net revenues were 9% above forecast, or in excess by $46 million. Personal income tax collections for the month posted double-digit percentages above forecast at 14.1%.

The more telling numbers, however, are the cumulative revenues for the fiscal year. This is what Nebraska state agencies and the Legislature will use when crafting their mid-biennium budget adjustments in preparation for the 2023 legislative session. For the fiscal year, revenues are 6.9% above the certified forecast, amounting to $55 million.

Here is the breakdown of the net increase by tax type:

- Sales and Use – 5.3% above ($18.9 million)

- Personal Income – 4.0% above ($16.1 million)

- Corporate Income – 126.8% above ($18.6 million)

- Miscellaneous – 6.1% above ($1.4 million)

However, comparing to a forecast can be somewhat misleading, and a more accurate picture of the state’s revenue position is to compare it to last year’s revenue collections. Compared to August of last year, the state is seeing a net 6.45% increase in collections for the month of August.

It is important to note for the cumulative fiscal year, the state is seeing a 23.3% less. This is due to the change in tax filing deadline because of the COVID-19 pandemic.

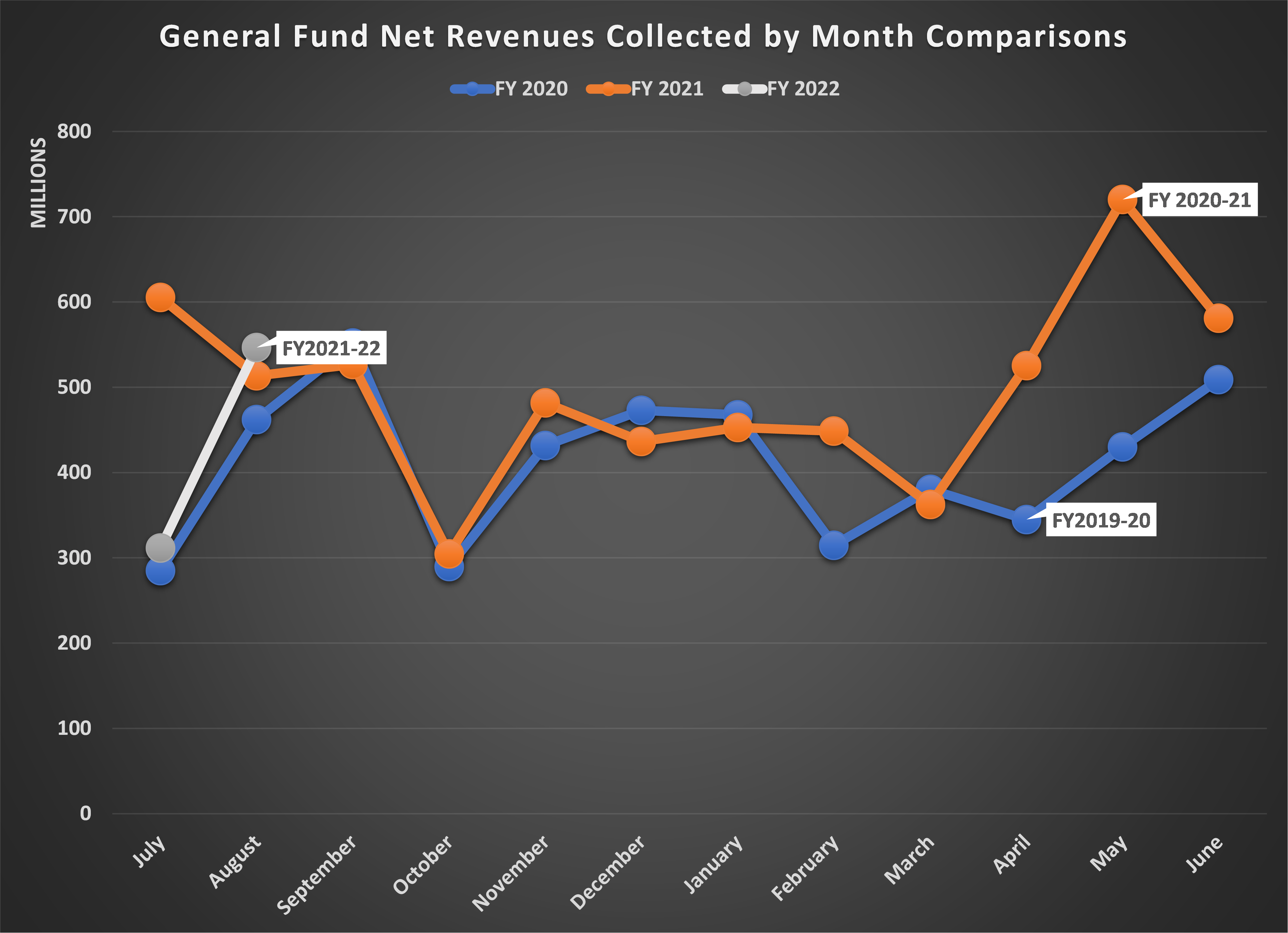

Because of this unique anomaly, I have included a chart that shows fiscal year 2019-2020 for additional context. The below chart shows the last two fiscal years along with the current fiscal year’s actual tax collections by month. This chart shows how July 2021 is an outlier and that the state is on par with what it should be collecting at this point in the fiscal year.