Build More Housing: Land Use Reform Opportunities for Nebraska’s Cities

Introduction

Across the U.S., local zoning ordinances limit the amount of housing that can be built within their jurisdictions and drive up costs for housing that is permitted. These regulations are particularly burdensome for low-income households.1 The effects of land use regulations on housing costs are largest in high-cost coastal regions, but the ubiquity of land use regulations drives up housing costs across the country.

Prior to the COVID-19 pandemic, Nebraska was experiencing fast-rising wages and one of the lowest unemployment rates in the country. But employers and new potential residents have faced a housing shortage standing in the way of new job opportunities.2 Because of Nebraska’s agricultural productivity, land is expensive, and opportunities for low-cost development in rural areas and the outskirts of its cities are limited.3

In order to address the problem of housing availability and costs within developed areas, state legislators passed a bill in 2020 requiring policymakers in Nebraska localities to create plans to improve conditions for housing availability and affordability.4 Under the law, policymakers in cities with at least 20,000 residents must submit affordable housing action plans, which will establish goals for land use regulations that permit missing middle construction—defined as duplexes, triplexes, fourplexes, cottage clusters, and townhouses—as well as housing that’s affordable to households making 80% of their county’s median income or less. Cities that fail to develop satisfactory affordable housing action plans will be required to permit missing middle housing across all of the zones where they currently permit single-family development.

Since the 1940s, the share of housing units that are attached single-family houses, duplexes, triplexes, or fourplexes has fallen from about 25% of the total housing stock to about 15%.5 Housing affordability advocates have identified these missing middle typologies as an important source of housing supply because they permit households to economize on land costs while maintaining the low construction costs of single-family housing.6

State policymakers have a role to play in setting limits on local zoning regulations that restrict housing supply and drive up costs.

The benefits of restricting development tend to be hyperlocal for people who would be affected by the traffic or parking of a new development. But the benefits of development are dispersed to homebuilders, people who would live in the new housing, and businesses who will be able to hire new workers. State policymakers have a broader view of both the costs and benefits of land use regulations relative to their local counterparts.

Housing affordability in Nebraska

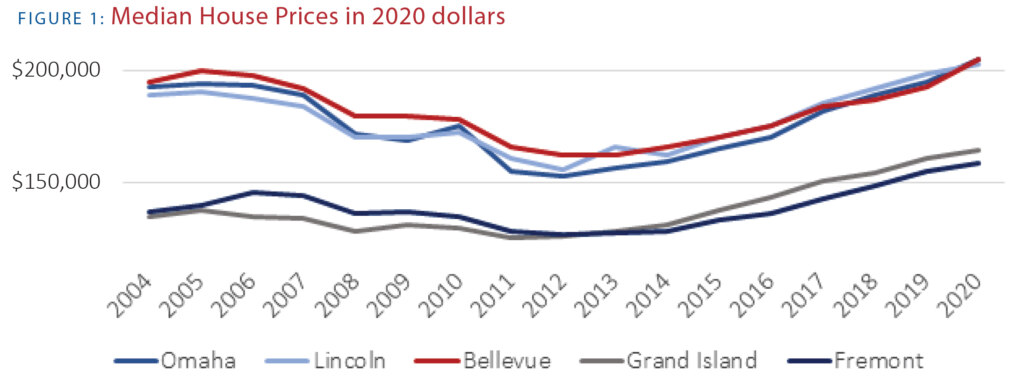

Nebraska is not suffering from the same housing supply and affordability problems that are plaguing the coastal states with notorious housing crises. Nonetheless, housing is getting more expensive in the Cornhusker State, and low-income Nebraskans are suffering the most. Across the state, median housing prices are now higher than they were prior to the 2007 housing crash. In Omaha, median real house prices have risen 6.6% from their 2004 level. Figure 1 charts inflation-adjusted median house prices in Nebraska’s five largest cities.

The real estate company Zillow also tracks median house prices for cities’ 5th to 35th percentile of house values. The median price of bottom-tier Omaha house prices has risen 7.3% over the same time period.

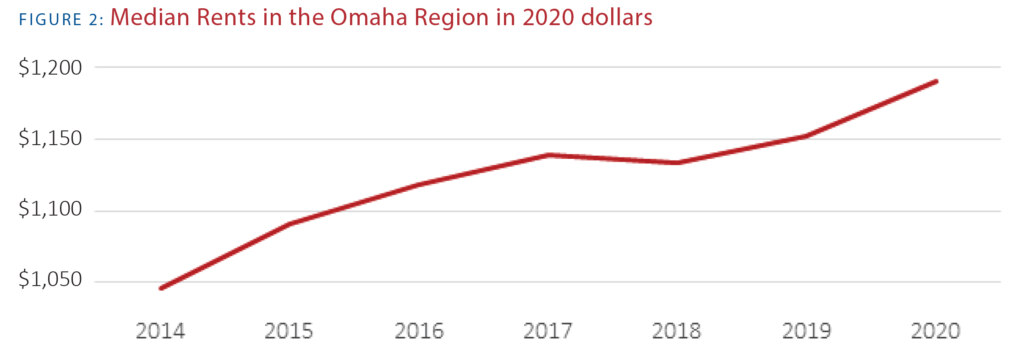

Rents in Omaha are rising too. Since 2014, when house prices were still recovering from their low in 2012, the median rates renters are paying (across both houses and apartments) have increased nearly 14%. Across the state, about one-quarter of low-income renters are housing cost burdened, meaning they spend more than 30% of their income on rent.7 Researchers have found that as people spend more than 30% of their income on housing costs, adverse outcomes rise, including their likelihood of homelessness.8

Housing supply in Nebraska

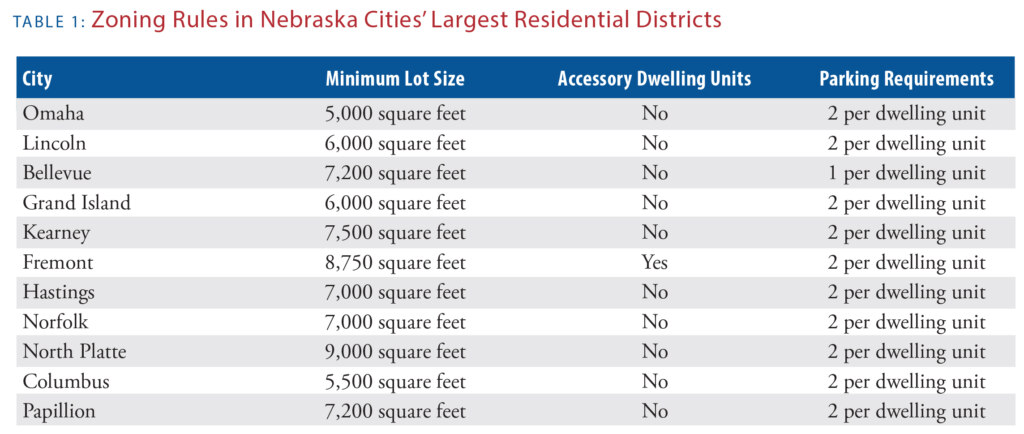

Nebraska cities currently restrict the amount and type of housing that can be built through their zoning ordinances, contributing to rising prices. Nebraska cities broadly restrict development in their largest residential districts, by land area, to exclusively detached, single-family development, generally the most expensive type of development. Further, minimum lot size requirements across Nebraska cities require each detached single-family house in their largest residential zones to sit on a large yard. When demand for housing increases, and land prices rise as a result, minimum lot size requirements cause housing to become more expensive, because households are prevented from sharing expensive land costs. If smaller lot sizes or missing middle housing types like duplexes, triplexes, or fourplexes were permitted, households would have the option of spending less on land. Table 1 below shows the minimum lot sizes in the largest zoning districts of Nebraska cities with 20,000 residents or more.

Some Nebraska cities permit housing typologies that are generally more cost-effective in their largest residential zoning districts. For example, in Papillion’s R-2 district, its largest residential zoning designation, duplexes are permitted in addition to attached or detached single-family homes. However, duplexes require 6,000 square feet of land per unit, nearly double the amount required for a single-family house. Similarly, townhouses require the same amount of land per unit as detached single-family houses, despite generally being smaller structures. This rule eliminates much of the cost-saving benefit of townhouses or duplexes relative to single-family houses by requiring households to spend nearly as much on land as they would for a detached single-family house. As a result, few are built.

Nebraska cities, like most U.S. jurisdictions, limit cost-effective multifamily developments to a small portion of their land. By limiting the amount of land that these affordable housing types can be built on, these policies effectively drive the cost of these types of housing up.

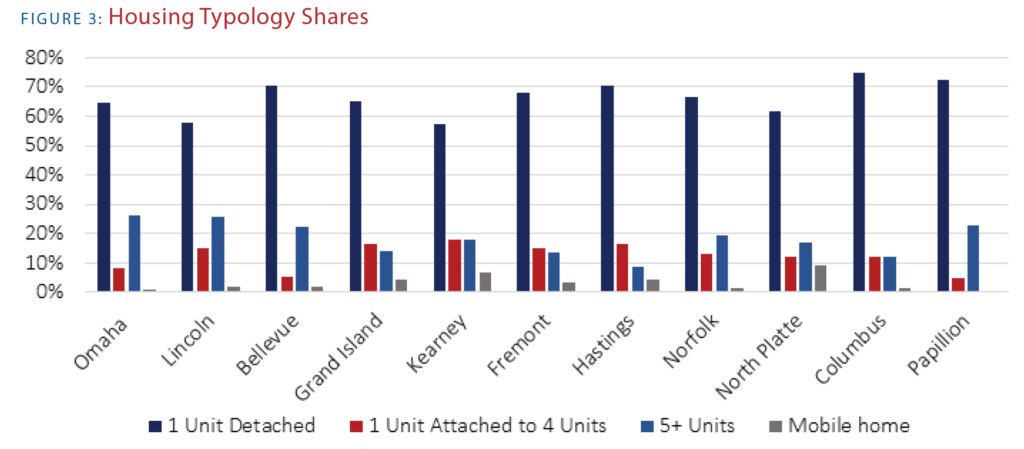

These restrictions are reflected in the housing stock across Nebraska’s cities. For all cities with at least 20,000 residents, detached single-family units make up more than half of total housing. Lower cost types of housing, including missing middle housing units (defined here as attached single unit housing to fourplexes, reflecting the data available from the U.S. Census Bureau), units in larger multifamily developments, and mobile homes, make up smaller shares.

Mobile homes make up fewer than 10% of housing units in all of these cities, but they are an important source of low-cost housing. State law requires localities to treat manufactured and stick-built housing equally, protecting the option for the lower-cost choice.9 However, local rules like minimum lot size requirements drive up the cost of all housing, regardless of how it’s built. Figure 3 shows the distribution of housing typologies in Nebraska cities.

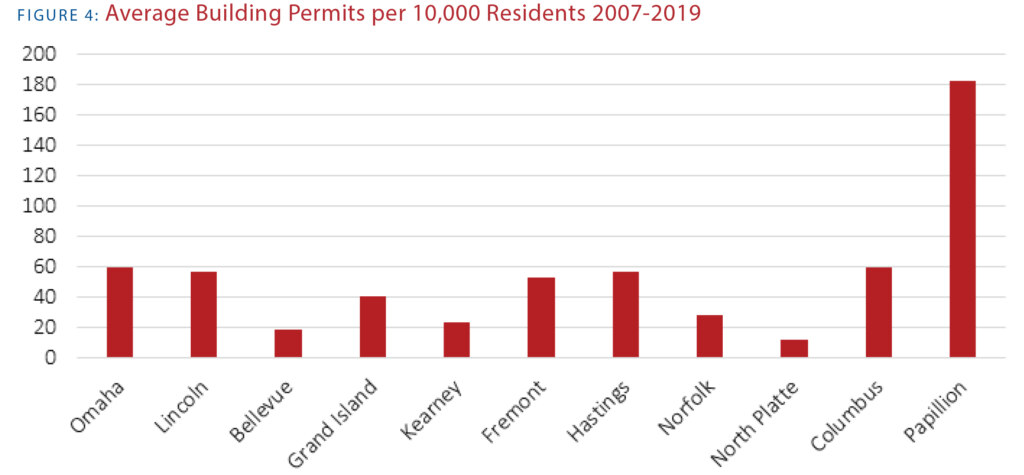

Across the country, the fastest growing localities tend to be suburban jurisdictions where greenfield development—new construction built on agricultural land or open space at a city’s outskirts—is relatively easy to build. Nebraska is no exception with Papillion permitting new housing at the fastest rate out of the state’s cities. Housing permitting is not just a function of local restrictions. It also reflects demand for housing because builders won’t request permits if buyers and renters aren’t willing to pay enough for new housing to make building it worthwhile. Omaha and Lincoln are permitting housing at rates similar to Washington, DC and Madison, WI, respectively. Figure 4 shows the average per capita rate of permitting housing units for Nebraska’s 11 largest cities.

Since the housing downturn, many parts of the country have seen an increase in multifamily permitting and a decline in single-family permitting. This is due in part to restrictions on mortgage lending adopted between 2008 and 201410. As homebuilders have faced fewer customers able to secure mortgages due to their income or credit scores, apartment building has become more attractive relative to single-family development. In Papillion, where the single-family permitting rate remains high, the median house price is also the highest of Nebraska cities at nearly $290,000. Homebuyers in Papillion are less affected by new federal mortgage regulations relative to buyers in lower-cost localities.

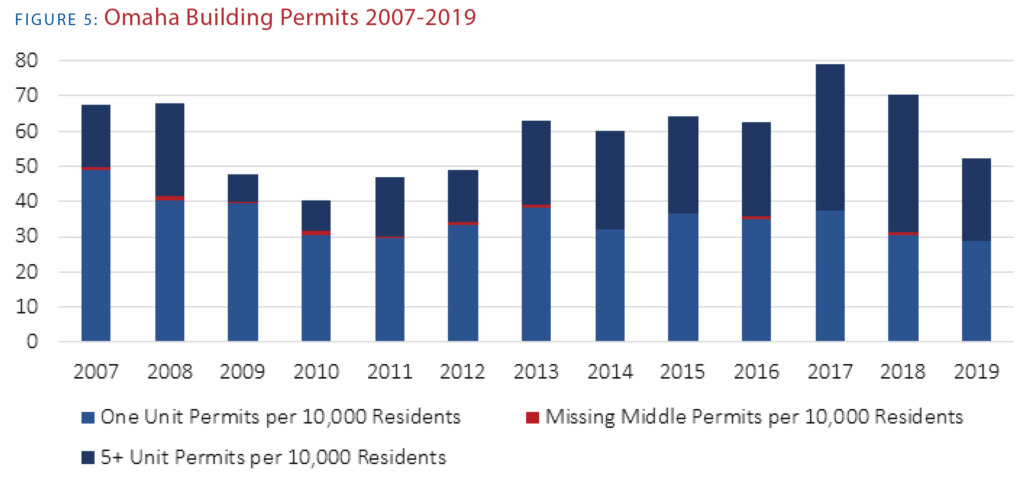

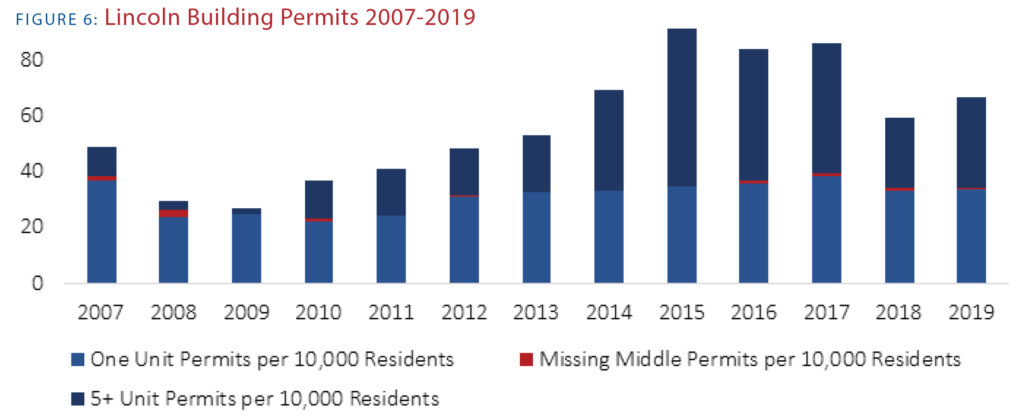

The apartment building boom has not extended to missing middle housing, however, likely due to land use restrictions. Building permits for housing in structures with two to four units has been almost non-existent since data for Nebraska cities became available in 2007. Figures 5 and 6 show building permits in Omaha and Lincoln by the type of permit issued.

Nebraska zoning reform opportunities

Nebraska’s cities likely won’t have much trouble complying with the state requirement to create plans that claim to support more missing middle construction and housing affordability for households earning less than median income. But details matter when it comes to which zoning reforms actually make small infill housing developments—projects that allow more people to live in areas that are already developed—feasible. For example, Papillion’s widespread two-family zoning may appear to facilitate duplex construction, but its minimum lot size requirements stand in the way of duplexes being an attractive opportunity for homebuilders since duplexes there are required to sit on lots much larger than single-family houses. Even rules on the books that have equal minimum lot size requirements for detached single-family houses and duplexes may not be enough to make duplex construction feasible if duplexes require a costly and uncertain review process.11

While LB866 won’t likely require localities to adopt reforms that support missing middle housing construction and improve availability of housing affordable to low-and moderate-income households, localities have many options to comply with the spirit of the law, by adopting meaningful reforms that support the construction of relatively low-cost housing, and improving economic opportunity in the process.

Accessory dwelling units

Accessory dwelling units (ADUs) are an attractive reform to support lower-cost housing construction for a few reasons. First, ADUs tend to be politically popular with homeowners relative to other reforms that increase allowable housing density. ADUs allow present homeowners to earn income from renters or to provide housing for a family member. AARP supports ADU construction because they can be an important source of retirement income for homeowners and because they can facilitate intergenerational housing that can be built to meet accessibility requirements.12 Second, ADUs tend to cost less than other housing alternatives. A basement apartment or backyard cottage can cost hundreds of dollars less per month than a typical one-bedroom apartment in a building in the same neighborhood. However, as Table 1 indicates, Fremont is the only one of Nebraska’s cities with 20,000 residents or more that permits ADUs.

Getting the details right to support ADU construction is particularly important because homeowners are not professional developers. The process to build an ADU must be simple and cost-effective for widespread construction. In California, state legislators have been working to make ADU construction feasible for homeowners since 1982. At first the state simply required that localities permit homeowners to build ADUs. But local policymakers that wanted to obstruct ADU construction responded by requiring large lot sizes for ADUs, onerous parking requirements, and high impact fees. It wasn’t until a state law passed in 2017 that ADU construction began taking off in some of California’s housing-starved jurisdictions, including Santa Clara, San Diego, and Los Angeles counties.13 The 2017 rule eliminated local policymaker discretion in permitting ADUs and limited parking and setback requirements for them.14

Permitting more units per lot

Outside of Nebraska, several recent reforms have changed single-family zoning to allow between two and four units per lot. In 2019, Minneapolis policymakers eliminated single-family zoning across the city, replacing it with triplex zoning that permits three units per lot. Similarly, Oregon state legislators preempted single-family zoning across much of the state, requiring local policymakers to permit two to four units per lot. Prior to zoning restrictions that banned them, duplexes, triplexes, and fourplexes were important sources of low- and middle-income housing.15 In part because loans insured by the Federal Housing Administration can be used to purchase buildings with one to four housing units, these missing middle structures can be attractive options for homeowners who want to live in one unit and rent the others.16

Further, missing middle structures like these can have affordability advantages relative to both single-family construction and large multifamily projects. Missing middle housing can cut land costs in half or more relative to a single-family house on the same lot. And relative to high-rise construction, missing middle construction can cost one-third less per square foot.17

The Bungalows on the Lake development at Prairie Queen in Papillion provides an example of new missing middle development in Nebraska. The project includes townhouses, fourplexes and larger “mansion apartments.” At the time of publication, units there range from $995 to $1,995, affordable to households earning the median income in Papillion.18 The Bungalows on the Lake features very high-end construction.19 Permitting fourplexes and small apartment buildings across Nebraska cities through a fast, simple approval process would permit more widespread, utilitarian missing middle construction that would be less-costly.

Reducing lot size requirements

While recent reforms have emphasized permitting more units per lot, reforms to minimum lot size requirements can have similar or larger effects in making new infill construction feasible. In 1998, Houston policymakers reduced the minimum lot size for land inside the I-610 loop from 5,000 square feet to functionally 1,400 square feet. This has permitted the construction of three townhouses where only a single-family house would have been permitted previously, resulting in tens of thousands of new townhouses.20

The Houston lot size reform is similar to Minneapolis’ triplex reform in concept, allowing three housing units to be built where only one was allowed previously. But siting and massing restrictions across much of Minneapolis mean that each unit in a triplex can only be about one-third of the square footage of a Houston townhouse. So far, permitting for new triplexes in Minneapolis has been disappointing, potentially because triplexes aren’t feasible to build in the size of structure that current rules permit.21

Additionally, townhouses come with the benefit of potential fee simple ownership, meaning the homeowner has complete ownership of the unit and land around it. Missing middle units can be and are sold as condos, but this introduces management challenges that single-family houses don’t have without the economies of scale that larger condo buildings offer.

Grand Island’s City Council recently approved a zoning change from a 6,000 square foot minimum lot size requirement down to 3,000 square feet in order to permit a proposed townhouse development in its Copper Creek subdivision.22 Councilmembers cited affordability concerns as a motivation for allowing development that’s less costly than detached single-family housing. Expanding townhouse zoning to permit townhouse development or redevelopment across large land areas in Nebraska cities would permit similar developments without the time consuming and costly approval process that this project went through.

Permitting lower cost multifamily construction

The high permitting rates of multifamily housing in Omaha and Lincoln show that multifamily housing is an important part of new housing supply in Nebraska cities, and policymakers in these cities aren’t standing in its way. Omaha has even permitted microapartments—small units of just a few hundred square feet—that provide tenants with a lower-cost option relative to more square footage in the same neighborhood. New housing construction improves affordability through a process known as filtering. When one household moves into a new unit, they generally free up a lower cost housing unit somewhere in the region. According to one study, 100 new market-rate apartment units free up 17-39 housing units in Census tracts with below median incomes.23 Making it feasible for new market-rate units to be less expensive ensures that this filtering process does more to improve region-wide affordability.

While multifamily construction is feasible in Omaha under current rules, zoning makes apartment and condo construction more expensive than it needs to be. The local zoning ordinance requires at least 1,000 square feet of land per unit, putting a limit on how much multifamily construction allows buyers or renters to economize on high-cost land by building up. Additionally, Omaha requires between one and two parking spaces per apartment unit. Dedicating land to a surface parking lot reduces the amount of housing that can be built on a site. Where land is expensive, multifamily developers generally provide parking in an above-ground or below-ground garage, which costs tens of thousands of dollars per spot, substantially increasing the cost of development. Without parking requirements, developers would still provide parking for multifamily residents who demand it, but likely fewer spots than these rules require.

Conclusion

State policymakers have passed legislation intended to address the scarcity of housing in Nebraska and requisite affordability challenges. Local policymakers have an opportunity to help address these challenges with reforms to policies that limit opportunities for missing middle housing construction and that drive up the costs of all types of housing. Permitting ADUs, allowing missing middle housing where only single-family is permitted today, reducing minimum lot size requirements, and allowing for less costly multifamily housing are all opportunities for Nebraska localities to comply with LB866 and improve housing affordability for their residents.

Local policymakers who want to carry out the intention of state policy to support more, lower-cost housing to be built should begin by identifying zoning rules that stand in the way of missing middle housing or make it more expensive to build. Omaha’s Neighborhood Business District zone provides a model that addresses many of the current barriers to missing middle housing discussed above, including units per lot and lot size requirements.24 It could be implemented in areas currently zoned for either lower density residential or commercial use across Nebraska cities.

Metrics on supply and affordability provide city officials with feedback on whether or not reforms are moving housing availability and affordability in the right directions. Paying attention to the direction which prices, rents, and permitting for low-cost units are moving gives policymakers timely feedback on whether or not they’ve reduced barriers to housing affordability.

Endnotes

1. Sanford Ikeda and Emily Hamilton, “How Land-Use Regulation Undermines Affordable Housing,” Mercatus

Research, Mercatus Center at George Mason University, Arlington, VA, November 2015.

2. Andrew Van Dam, “Why Nebraska has an amazing jobs market but nobody is moving there,” The Washington Post, June 6, 2018, https://www.washingtonpost.com/news/wonk/wp/2018/06/06/we-try-to-solve-the-great-nebraska-mobilehome-mystery/.

3. Ibid.

4. Nebraska Legislature, Legislative Bill 866, 2019-2020 session.

5. U.S. Census Bureau, Units per Structure, 1940 to 2010.

6. Daniel G. Parolek, Missing Middle Housing: Thinking Big and Building Small to Respond to Today’s Housing Crisis, Washington: Island Press (2020).

7. The National Low Income Housing Coalition, Housing Needs by State: Nebraska, https://nlihc.org/housing-needs-by-state/nebraska, accessed October 30, 2020.

8. Chris Glynn, Thomas H. Byrne, and Dennis P. Culhane, “Inflection points in community-level homeless rates,” http://files.zillowstatic.com/research/public/StaticFiles/Homelessness/Inflection_Points.pdf, access October 30, 2020.

9. Daniel R. Mendelker, “Zoning Barriers to Manufactured Housing,” The Urban Lawyer 48(2): 2016.

10. Scott Sumner and Kevin Erdmann, “Housing Policy, Monetary Policy, and the Great Recession.” Mercatus Research, Mercatus Center at George Mason University, Arlington, VA, August 2020, 48-53.

11. Palisades Park, NJ provides one successful example of two-family zoning that has resulted in extensive duplex

redevelopment. Originally, much of the borough was built as single-family development, but today the majority of housing units are part of two-family structures. An adjacent borough, Ridgefield Park, has similarly extensive two-family zoning and has seen almost no two-family construction, likely because Ridgefield Park requires a discretionary review process for duplexes rather than permitting them by-right.

12. AARP, “Accessory Dwelling Units Allow Homeowners to Choose Where They Age,” April 27, 2020, https://www.aarp.org/home-family/your-home/info-2020/accessory-dwellingunit.html, accessed October 30, 2020.

13. Karen Chapple et al., “ADUs in CA: A Revolution in Progress,” Center for Community Innovation, https://www.aducalifornia.org/wp-content/uploads/2020/10/ADU-Progress-in-California-Report-October-Version.pdf, 12.

14. Sarah Thomaz, “Investigating ADUs: Determinants of Location and Their Effects on Property Values,” Working

Paper, page 29, https://drive.google.com/file/d/1Tq_kYUTs4a0900LYfNeH1racLeRnwTB/view, accessed October 30, 2020.

15. New England’s triple deckers provide one example. See New England Historical Society, “The Rise, Fall and Rebirth of the Triple Decker,” https://www.newenglandhistoricalsociety.com/rise-fallrebirth-new-england-triple-decker/.

16. Department of Housing and Urban Development, “Mortgage Insurance for One to Four Family Homes Section 203(B), https://www.hud.gov/program_offices/housing/sfh/ins/203b–df.

17. International Code Council, “Building Valuation Data Archives,” https://www.iccsafe.org/products-and-services/i-codes/codedevelopment-process/building-valuation-data/, accessed October 30, 2020.

18. Bungalows on the Lake, Vacancies, https://www.bungalowsonthelake.com/vacancies, accessed October 30, 2020.

19. Robert Steuteville, “‘Missing middle’ neighborhood opens,” Congress for the New Urbanism, August 21, 2019, https://www.cnu.org/publicsquare/2019/08/21/%E2%80%98missingmiddle%E2%80%99-neighborhood-opens.

20. M. Nolan Gray and Adam A. Millsap, “Subdividing the Unzoned City: An Analysis of the Causes and Effects of Houston’s 1998 Subdivision Reform,” Journal of Planning Education and Research, July 2020.

21. Hannah Jones, “Triplex building permits requested in Minneapolis this year: 3,” City Pages, September 1, 2020.

22. Brandon Summer, “Zoning changed to allow livestock, private recreational areas,” The Grand Island Independent, September 23, 2020, https://theindependent.com/news/local/zoning-changedto-allow-livestock-private-rec-areas/article_15b3e136-fd58-11ea-91d5-334aa750bd72.html?utm_campaign=snd-autopilot&utm_

medium=social&utm_source=facebook_The_Grand_Island_Independent&fbclid=IwAR16XobO0CQIx3-kGvTSg_

k7F12OBA6NITogUeP6AQMtxdbwjFcycQirNVU.

23. Evan Mast, “The Effect of New Market-Rate Housing Construction on the Low-Income Housing Market,” Upjohn Institute working paper; 19-307, July 2019.

24. Will Greene, “Omaha Missing Middle Housing Campaign Plan,” Missing Middle Omaha, July 16, 2019.