Trends in Nebraska State Spending

• Regardless of whether it is measured in nominal, per capita, or inflation-adjusted terms, state spending is increasing.

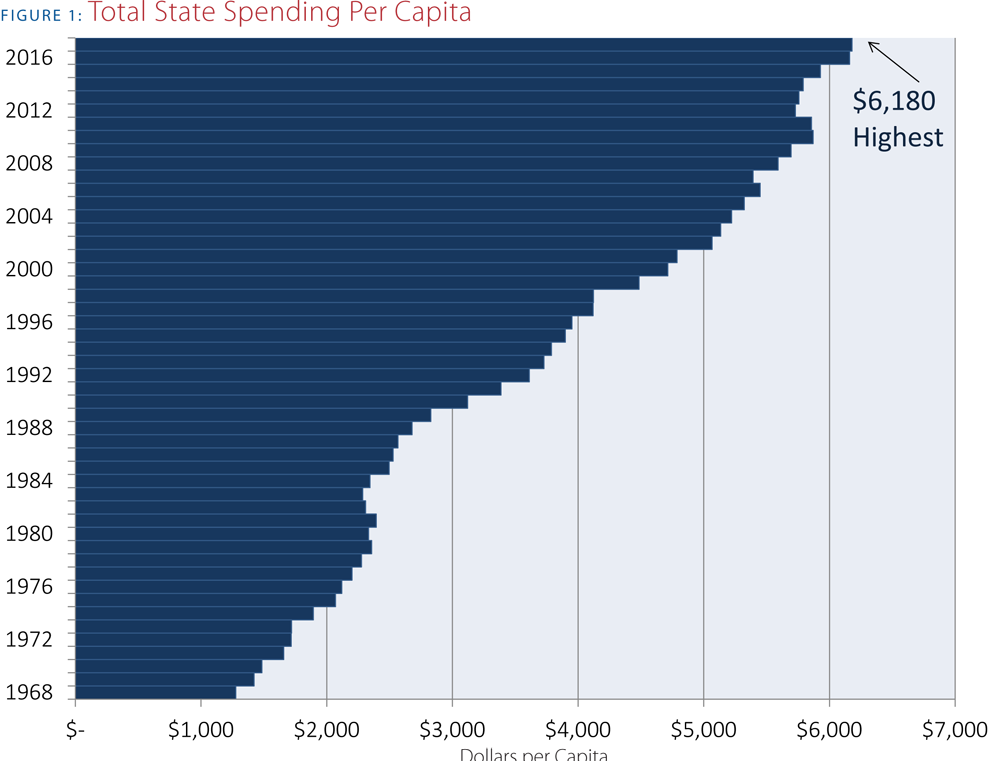

• Since 1968, inflation-adjusted per person total state spending has grown 384 percent while the state’s population has only grown 31 percent.

• Nebraska’s total state budget peaked in 2017, reaching more than $11.8 billion or $6,180 per capita.

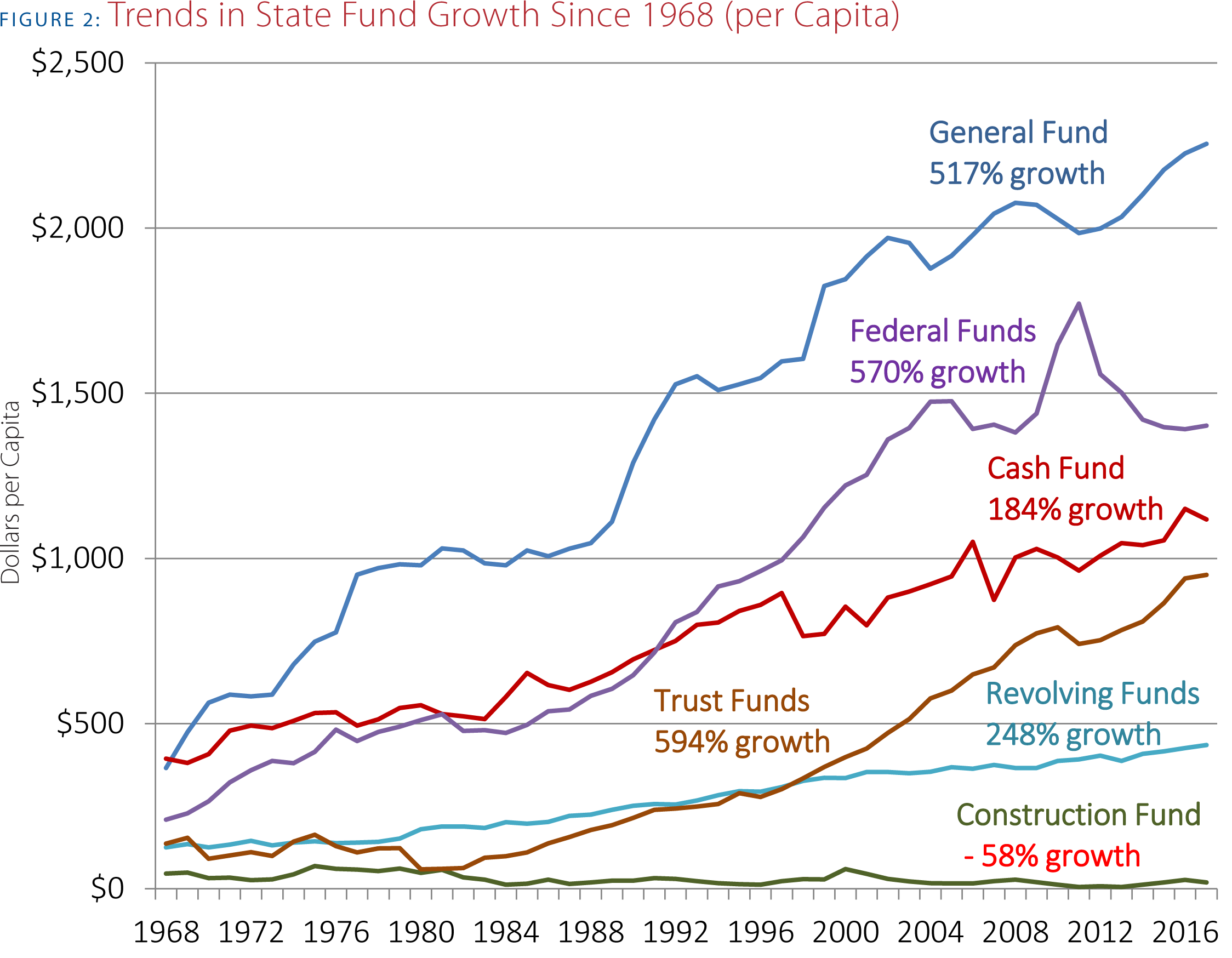

• General Fund spending has been steadily increasing since 2011, while federal funds have been slowly decreasing since hitting an all-time high in 2011. This means the state has filled the gap when federal funds are not received as promised, leading to more demand on state revenues.

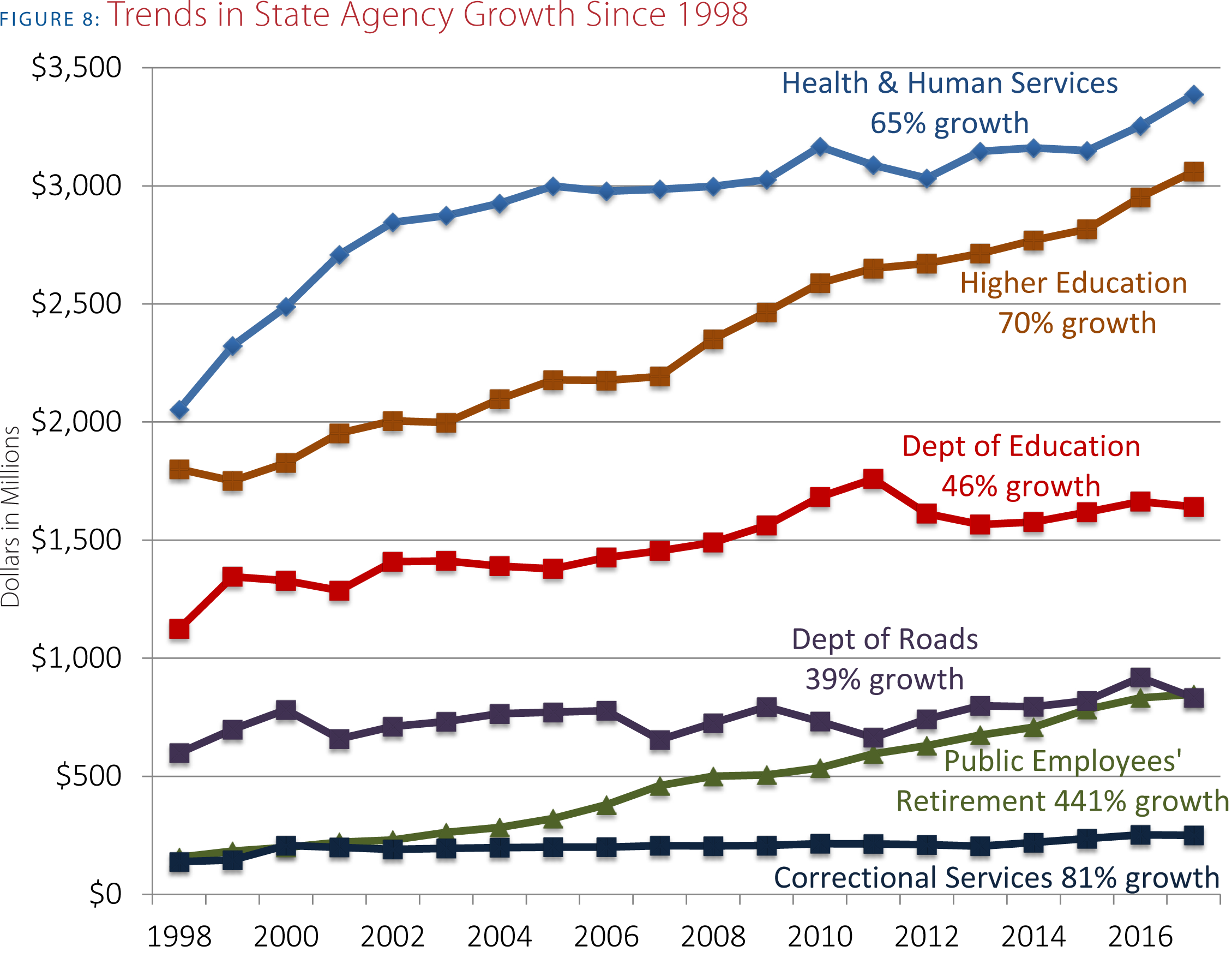

• Health and Human Services is the largest state agency expenditure in Nebraska’s total budget and has grown 65 percent in inflation-adjusted terms since 1998.

• Historically, spending on transportation and roads has been one of the largest expenditures in state government. Since 1998, the Public Employees’ Retirement System has grown 441 percent and now exceeds transportation spending.

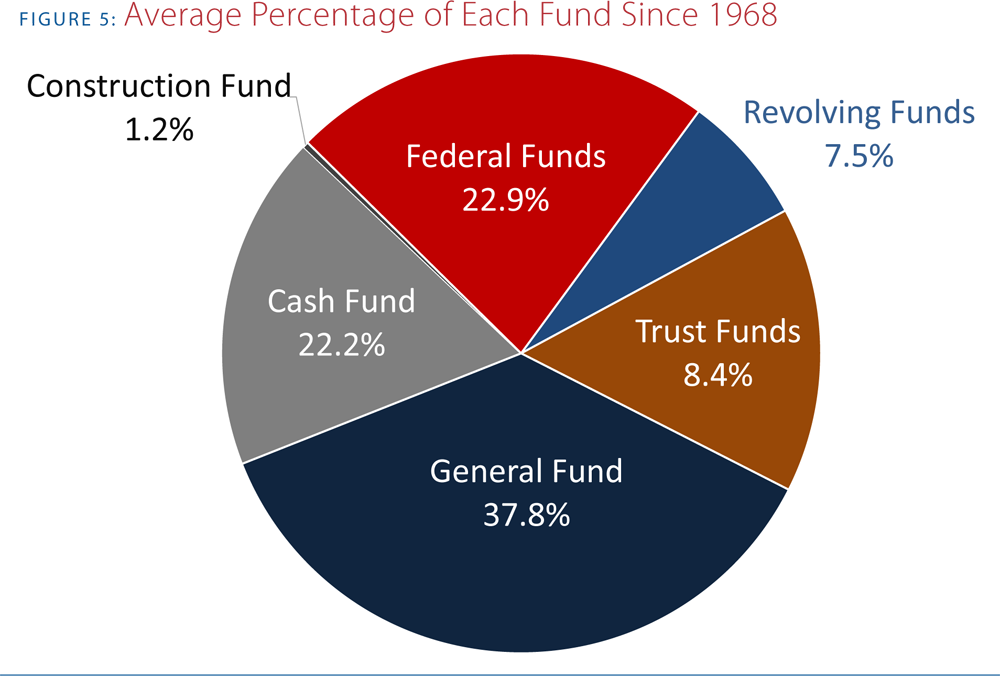

• Historically, the General Fund has only constituted 37.8 percent of total state spending, and all other spending has occurred outside the General Fund.

Every year, citizens, pundits, and elected officials in our state engage in spirited debates about Nebraska’s government spending. One viewpoint argues that spending continues to increase at an undesirable rate and, as a result, the state Legislature needs to decrease government spending and use taxpayer dollars more efficiently. The other perspective claims that the state needs to increase taxes and spending to provide essential services and investments for the state’s citizens. It is important to know how Nebraska arrived at its current level of spending and what has occurred over time.

Now is an important time to look at state spending trends because a 50-year milestone has been reached. The Revenue Act of 1967 (through a constitutional amendment) made significant changes to the state’s tax code, because the state was no longer allowed to levy ‘state’ property taxes, the state’s main revenue source at the time. The Legislature levied two new taxes in place of the ‘state’ property tax, a state sales tax and a state income tax. In addition to these new revenue sources, a portion of these revenues was designated to finance state aid programs, a practice that is still used today.

A certain amount is earmarked annually for aid to school districts and another amount is earmarked to be distributed to cities and counties to replace the revenue they lost from the elimination of the personal property tax on intangibles and household goods. While many things have changed over the years, the nuts and bolts of Nebraska’s spending and main revenue sources have been relatively constant since that major change in 1967.(1)

In order to make appropriate comparisons of Nebraska’s long-term government spending, the data needs to be adjusted for inflation(2) and stated in terms of per capita(3) expenditures. Adjusting for inflation provides an apples-to-apples measure of spending over time. The addition of population data allows researchers to adjust government spending to per person or “per capita” terms. Measuring spending at a per capita rate is needed because the population of the state is always changing, which has a direct effect on the demand for government services. Making these adjustments, it becomes apparent that state spending in Nebraska has increased significantly over the last 50 years. In fact, different data sets all show the same thing—spending in Nebraska is at record high levels.

Total State Budget

The total state budget encompasses all government expenditures in Nebraska each year.(4) The state uses several different types of funds across all areas of state government when funding programs and services. This includes the following funds(5):

• General Fund: The main fund for state government activities. When there is discussion about ‘balancing the budget,’ it relates to this fund.

• Cash Funds: This fund includes more than 250 individual cash funds across 70 different agencies. Money in this fund is generally used for the specific purpose for which the fund was created. The Department of Transportation (formerly the Department of Roads) is funded primarily through this category.

• Construction Fund: Accounts for the acquisition or construction of major capital facilities.

• Federal Funds: This fund is for all money received from the federal government either as grants, contracts, or matching funds.

• Revolving Funds: This fund is for transactions where one agency provides goods or services to another state agency.

• Trust Funds: Fund for assets held in a trustee capacity.

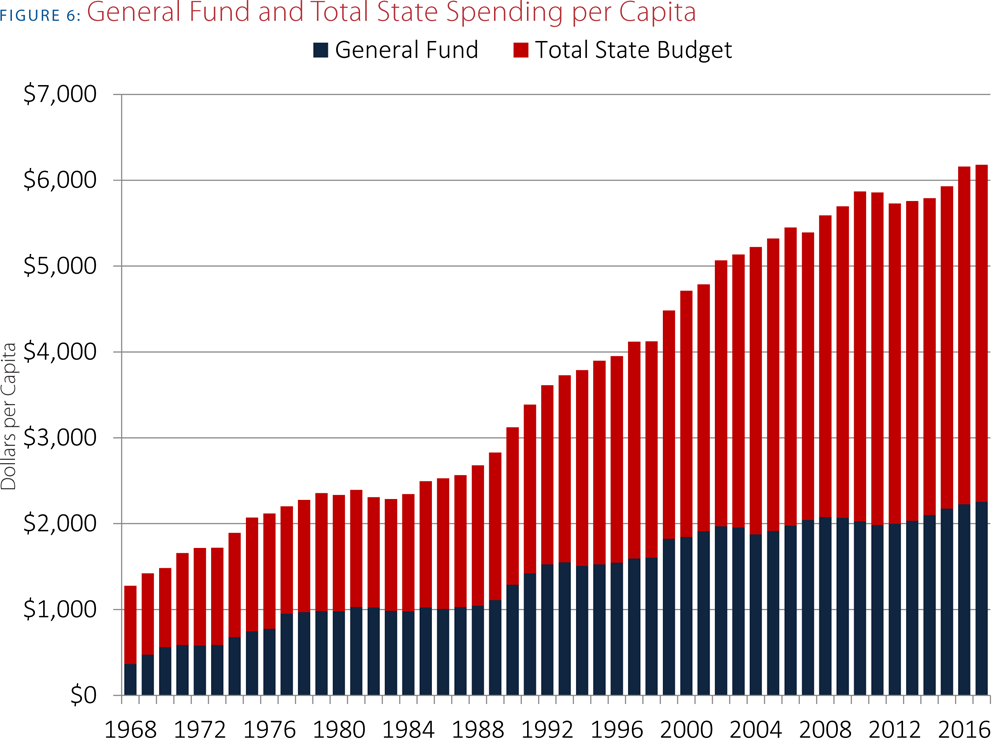

Since 1968, inflation-adjusted per person total state spending has grown 384 percent, while the state’s population has only grown 31 percent. The highest level of per capita spending was $6,180 in fiscal year 2017. Because it is adjusted for inflation and measured per capita, Figures 1, 2, and 3 gives the most accurate representation of the long-term growth in total state spending for Nebraska.

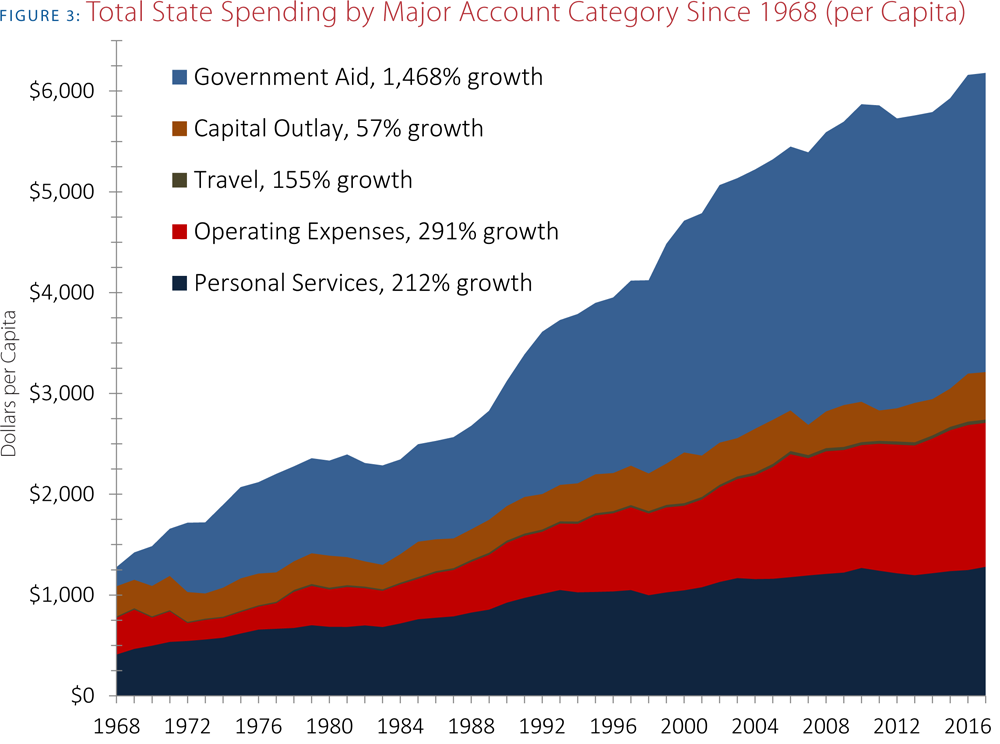

While Nebraska uses multiple different funds to account for state government, another way the state measures its financial situation is by specific categories or accounts. This measure is important because when the state changed the way it was funded with the Revenue Act of 1967, it also changed the way it spent tax dollars. The elimination of some local tax revenue resulted in the state spending state tax dollars at the local level to minimize the financial impact of those eliminated revenue sources. Over time, this policy has been expanded upon, as the state has tried to mitigate the high property tax burden at the local level and changed the way public education is financed.

Government Aid can be broken down into two main classifications because it is directed at two distinct groups, individuals and local governments. Aid to individuals are state funds that are spent for the direct benefit of an individual such as Medicaid, child welfare services and student scholarships, and aid to local governments is money sent to local governments that have the authority to levy a property tax such as cities, counties, K-12 schools, community colleges, natural resource districts, and educational service units.

The latter category includes programs such as state aid to schools (TEEOSA), special education, homestead exemption reimbursements and property tax relief through direct aid payments to local taxing entities. The largest of these expenditures is state aid to schools, amounting to over 50 percent of the amount spent in aid to local governments. The second largest expenditure is for property tax relief.(6)

Over the last 50 years, total state expenditures have grown 384 percent in an inflation-adjusted per capita measure. Government aid has grown at a much faster rate, amounting to a 1,468 percent growth increase and as a result, a cost of $2,967 per capita.

Personal Income

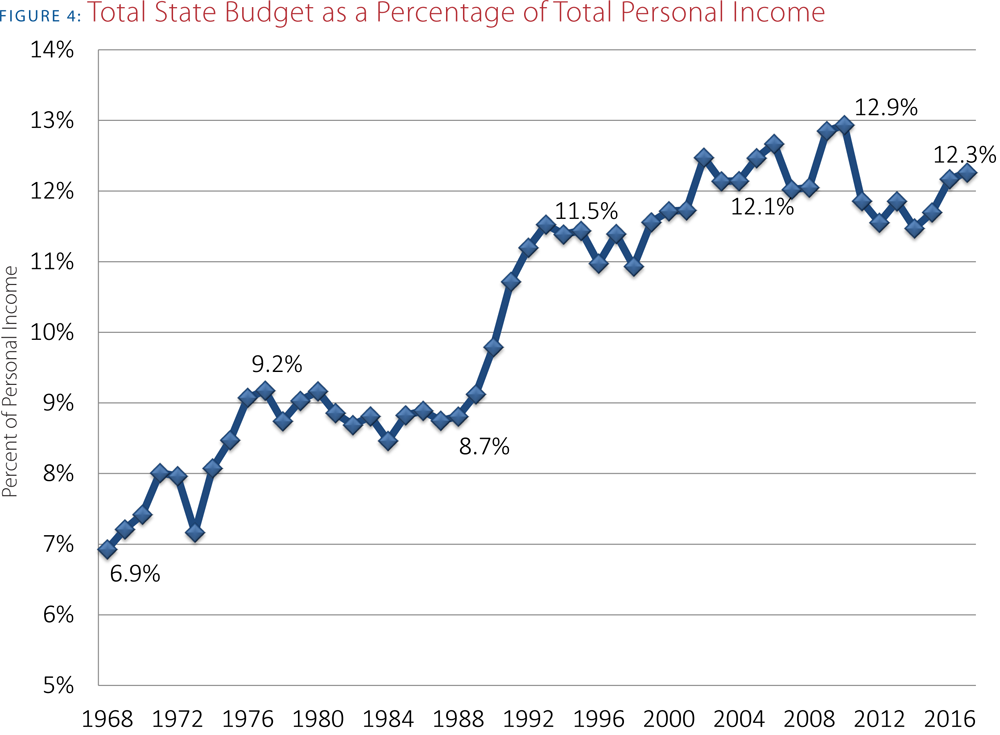

Another measure of government expenditure is the state’s spending as a share of personal income. In economic terms, personal income is the total amount of all income actually received by individuals or households during a specific period.

For state spending analyses, personal income levels tend to be good indicators of economic expansion and stagnation. Figure 4 depicts the total state budget as a percentage of Nebraska’s total personal income. For a state like Nebraska that has a significant portion of its economy tied to one major sector, agriculture, it is very important to see how state spending and personal income are tied together.

In the 1970s, the state saw a significant increase in spending as a percentage of personal income due to the strong export market farmers and ranchers experienced. Following the 1980 grain embargo against the Soviet Union, farm debt began to rise and commodity prices fell, causing a ripple effect across the state’s economy. During the 1980s, state spending as a share of personal income increased less than 1 percent and remained relatively constant. During the booming economic times of the 1990s, the total state budget averaged 11.1 percent of total personal income.

Since 2000, the state has weathered two nationwide recessions, with the most recent recession affecting personal income and employment the most. During the Great Recession, Nebraska was not affected as much as the rest of the country and the state continued to spend, hitting a record high of 12.9 percent of personal income in 2010. In recent years, Nebraska’s state spending relative to personal income has been within one percentage point of its all-time high. Spending trends show that Nebraska keeps state spending under control relative to personal income during bad economic times, but as economic productivity increases, so does state spending.

Transparency

Government budgets have a reputation for being difficult for the typical citizen to understand, and Nebraska’s is no exception. For many, the persistent growth in state spending is not easily visible because there is an undue focus on the General Fund, particularly in the media. During budget debates in Lincoln, the media typically reports the final General Fund appropriations to various state agencies and reports how much spending has increased as a percentage, but that is not the whole picture.

Almost all government agencies in Nebraska spend money from more than just one fund. For example, the Department of Agriculture spends a great deal of money from the General Fund, but also spends money from the Cash, Federal, and Revolving funds.(7) This means if the media reports the Department was to receive a cut in spending from the General Fund, more than likely the loss would be compensated for with expenditures from other funds, but the latter would not be explained in a brief newspaper reporting of the state’s spending.

While General Fund spending growth is significant, the growth in spending outside the General Fund amounts to more in per capita spending as illustrated in Figure 6. In 2017, per capita spending for the General Fund was $2,255 while per capita spending for every other fund in the state was $3,925. For a more complete picture of what the state is spending, Nebraskans should refocus their attention on total expenditures, not just the General Fund.

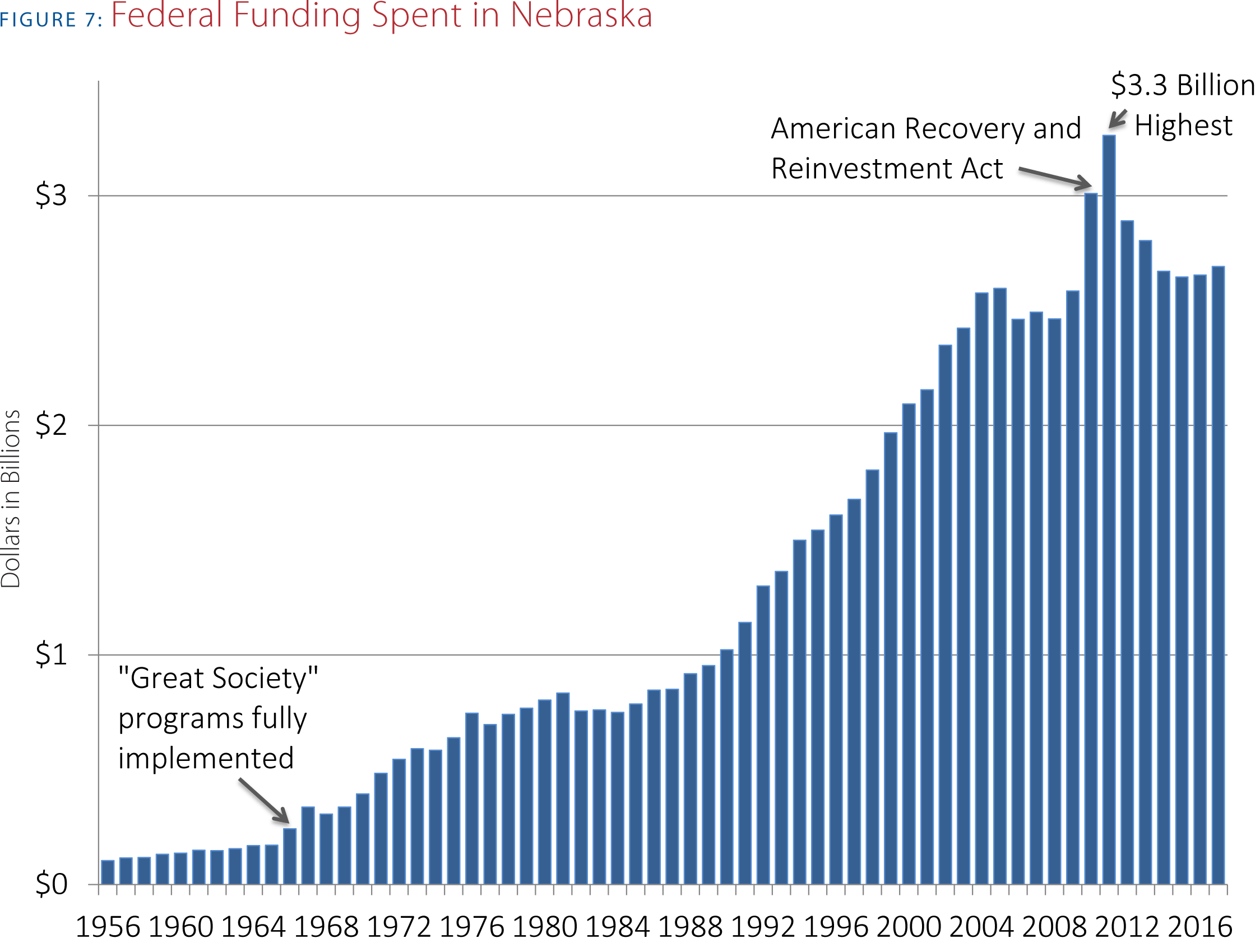

Another area of state spending that does not receive the proper level of discussion is the federal money spent by the state every year. Federal funds were a meager part of Nebraska’s spending in the late 1950s and early 1960s, but with the passage of the “Great Society” programs, federal funds jumped 44 percent in fiscal year 1966 to pay for the new welfare programs.

Nebraska’s reliance on federal funds has continued to grow over the last half a century, hitting an all-time high of $3.3 billion in 2010 and 2011 when the American Recovery and Reinvestment Act helped to boost federal funding to levels never before seen in the state. On an inflation-adjusted and per person basis, federal expenditures have increased in Nebraska by 570 percent since 1968. Today, federal funds amount to around 25 percent of the state’s total expenditures.

Nebraska has become increasingly dependent on federal funds, and if these funds were to be drastically reduced or stopped, the state would be unprepared to support the essential government services these funds provide for Nebraskans. Today, there are 34 agencies or programs in Nebraska that are funded with federal money. Six of these agencies have over 50 percent of their budget coming from the federal government.(8)

State government officials need to be wary of allowing such a large portion of the state’s expenditures to be dependent upon federal funding. As the federal government’s debt crisis continues, this money suffers from the same uncertainty that plagues all of Washington’s deficit spending.

State agency growth partially explains why the state budget as a whole is growing at a faster pace today than it did decades ago. Many people believe K-12 education to be the largest expenditure in state government, yet when looking at the whole state, it is clear that Health and Human Services is the largest expenditure in state government followed by higher education(9) and the state Department of Education.

An area of state government that has grown significantly over the last 20 years that has not received a lot of public attention is the Public Employees’ Retirement System, which grew at an inflation-adjusted amount of 441 percent. The state administers five mandatory plans: state, county, schools, judges, and patrol employees. Of these mandatory plans, school employees, judges, and the state patrol are defined benefit plans, which is the main driver of the high cost. State and county employees are cash balance or defined contribution plans.(10)

Conclusion

Multiple measures of state spending have shown clear trends of spending growth. For much of the 1970s and into the 1980s, spending was kept in check. Throughout the 1990s and for much of the 2000s, however, Nebraska’s total budget has grown significantly, with spending peaking in recent years. In 2009, lawmakers enacted the Taxpayer Transparency Act(11) which gave the public more access to the state budget, but it has not done anything to limit the amount of spending.

Many public policy experts will argue that state spending must increase as the state’s needs increase, which is normally tied to inflation and population increases. Since 1968, inflation-adjusted per person total state spending has grown 384 percent while the state’s population has only grown 31 percent. Total state spending, regardless of the source of the revenue, is a more complete measure of the extent to which state government diverts real resources—that is land, labor, and capital—away from the private sector. This is what economists call “crowding out,” and it leads to less economic growth and job creation.

Ultimately everyone, regardless of political ideology, wants to see Nebraska grow and prosper, but it is clear from the last 50 years that the state needs to reevaluate its impact on economic growth when spending increases are decided upon.

Endnotes

1. The state sales tax went into effect June 1, 1967. The personal income tax, corporate income tax and the food sales tax credit went into effect January 1, 1968.

2. All figures in 2010 dollars. U.S. Bureau of Economic Analysis, Gross Domestic Product: Implicit Price Deflator [GDPDEF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPDEF, May 23, 2018.

3. All population adjustments were done using U.S. Census Bureau’s population data.

4. Data for the total state budget came from the Annual Budgetary Reports, das.nebraska.gov/ accounting/financial_reports/annual_budget_ reports.html. Data prior to 1998 was collected with the help of Harlow A. Hyde of Deland, Florida. Assistance from the DAS Accounting Division personnel was used to verify accuracy of fiscal years 1968 through fiscal year 1973. For Fiscal Year 2005-06, Operating expenses include $145,811,368 paid by the State Treasurer to settle the radioactive waste site lawsuit.

5. These definitions came from various state budget publications including the Comprehensive Annual Financial Report, the Annual Budgetary Report, the State of Nebraska Biennial Budget, and statespending.nebraska.gov.

6. Percentages were calculated using total state tax dollars allocated to all local governments by category for fiscal year 2015-16. Payments to TEEOSA were 973,036,626 or 51 percent of the total and the property tax credit act was 204 million or 11 percent. This data was compiled by the State Chamber of Commerce and the Governor’s Policy Research Staff in April 2017.

7. State of Nebraska Annual Budgetary Report for the year ended June 30, 2017, Schedule of Budgeted and Actual Expenditures paid by program, Department of Agriculture page 13, http://das.nebraska.gov/ accounting/budrept/buddoc17.pdf.

8. State of Nebraska Annual Budgetary Report for the year ended June 30, 2017, Schedule of Budgeted and Actual Expenditures paid by program, http://das. nebraska.gov/accounting/budrept/buddoc17.pdf.

9. Higher education includes the expenditures for State Colleges, the University of Nebraska System, Coordinating Commission for Postsecondary Education, and the Coordinating Commission for Technical Community Colleges. All figures were adjusted for inflation.

10. Expenditures were taken from Nebraska Annual Budgetary Reports and adjusted for inflation using the St. Louis Fed GDP deflator. Information about the retirement plans was taken from https://npers. ne.gov/SelfService/public/aboutus/aboutus.jsp, accessed June 14, 2018.

11. Legislative Bill 16, approved by the governor May 29, 2009. “Section 1: The establishment of the web site provided for in section 84-602 and described in section 3 of this act shall be known and may be cited as the Taxpayer Transparency Act.”